GSA: More 5G SA devices, but commercial 5G SA deployments lag

Findings from the latest GSA report on the 5G standalone (SA) ecosystem include:

- 1,764 announced devices with claimed support for 5G SA, up 43.7% from 1,227 at the end of 2022.

- Devices with support for 5G SA account for 68.1% of all 5G devices, as of the end of March 2024, up from 43.3% in December 2019.

- 97 modems or mobile processors/platform chipsets state support for 5G SA, 93 of which are understood to be commercially available.

………………………………………………………………………..

Other Estimates of deployed 5G SA core networks:

According to a recent LinkedIn post by Kaneshwaran Govindasamy, at least 49 network 29 have launched or deployed public 5 , one of which has only soft-launched their 5G SA networks.

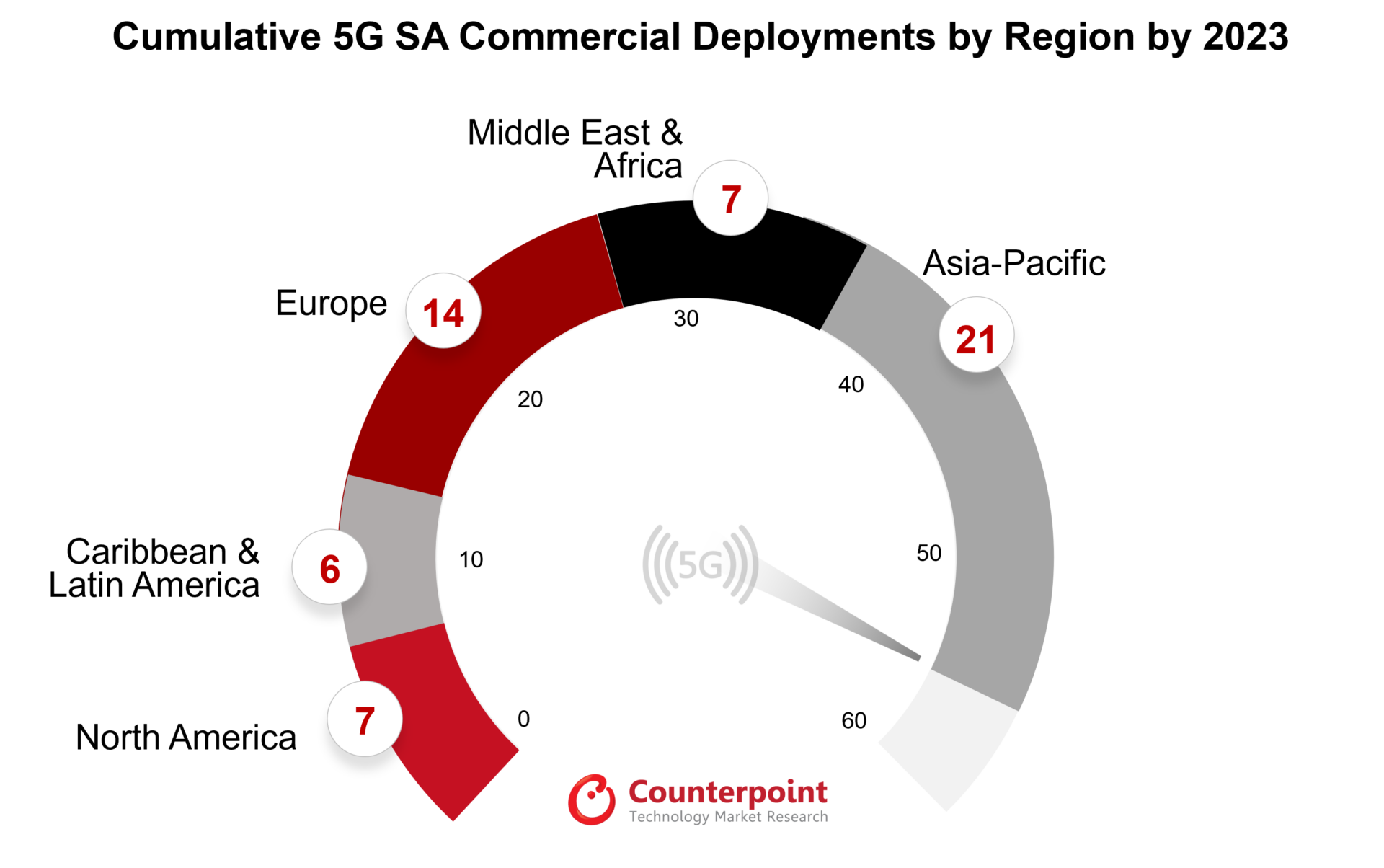

A February 2024 report from Counterpoint Research in February 2024 states that only 55 operators have commercially implemented 5G SA, with many more in testing and trial stages.

As of January 2024, Dell’Oro Group has identified 50 5G SA enhanced Mobile BroadBand (eMMB) networks that have been deployed worldwide. Dell’Oro Group’s Research Director, Dave Bolan, stated that the build-out of 5G SA networks is slower than expected, and that the number of new 5G SA networks deployed in 2023 (12) was lower than in 2022 (18). However, Bolan predicts that 2024 will see more 5G SA launches than 2022, and that 5G SA launches will occur in almost all global markets except Africa.

……………………………………………………………………………………………………

It should be noted that there is only one 5G SA network deployed in the U.S. from T-Mobile. AT&T and Verizon have promised 5G SA for years but it’s not commercially deployed by either operator at this time.

5G SA networks support higher-density device deployments and improved network performance. Without a 5G SA network, there are no 3GPP defined 5G features available, such as 5G Security, Network Slicing, MEC, etc.

References:

GSA 5G SA Core Network Update Report – Technology Blog

Building and Operating a Cloud Native 5G SA Core Network

Mobile Core Market Stagnant Due to Lack of 5G Standalone Deployments, According to Dell’Oro Group

https://www.ericsson.com/en/5g/5g-sa

2 thoughts on “GSA: More 5G SA devices, but commercial 5G SA deployments lag”

Comments are closed.

Moving to open, software-driven, cloud-native architectures represents a massive change from traditional telco networks and operations. 5G SA’s disaggregated, distributed architecture transforms telco networks from largely predictable, appliance-based infrastructures to a dizzying assortment of virtualized and containerized software elements that constantly change.

This transition is essential to make telco networks as agile and adaptable as other modern cloud environments, but it was always going to take some time. Now, service providers worldwide are beginning to go live with these new environments, and they’re seeing impressive results. Operators deploying 5G Core (5GC) report 72 percent power savings, 20 percent latency improvements, and 60 percent faster service deployments. Those are huge improvements, and they’re only just the start.

https://www.telecomramblings.com/2024/06/the-5g-standalone-revolution-has-officially-begun/

Phil Harvey, Light Reading:

According to a recent report by Dell’Oro, the number of 5G SA networks commercially deployed by mobile network operators remains the same as at the end of 2023: around 50 5G SA networks.

Research firm Omdia estimates that 54 5G SA networks have been deployed so far, with both firms agreeing that there hasn’t been much growth over the last year.

Both firms agree that roughly one in six 5G networks are standalone. Omdia said 17% of service providers that deployed a 5G RAN have also deployed the 5G core. “The 5G SA market drives market growth, and only about 15% of the 5G networks (5G SA + 5G NSA) are 5G SA,” wrote Dave Bolan, research director at Dell’Oro Group, in an email to Light Reading.

“Without the 5G core, CSPs cannot benefit from network slicing or low-latency use cases, both of which are required for new revenue-generating use cases,” wrote Omdia’s Roberto Kompany, a principal analyst in the firm’s Service Provider Networks team.

Slow growth in the mobile core

The Dell’Oro data showed a 10% decline in the five-year revenue forecast for mobile core networks, indicating that service provider adoption of 5G SA networks is sluggish. The market is growing, but the new core network pieces aren’t deployed in a vacuum.

Mobile core and other 5G network equipment spending has been underwhelming for several quarters, and the big vendors are shedding staff to keep costs down. In the last year, Nokia has cut about 6,000 jobs, around 7% of its total workforce.

Omdia’s Kompany recently wrote that the top four core network vendors (Ericsson, Huawei, Nokia and ZTE) together captured nearly 70% of the 5G core market share last year. Omdia lists the 5G core components (network functions) as packet core, policy and charging; subscriber data management; routing and selection; and, finally, automation, orchestration and analytics.

The compounded annual growth rate (from 2023 to 2028) for mobile core networks is positive and is estimated to be between 5% and 10%, wrote Bolan. “Unfortunately, the 5G Core growth rate is insufficient to offset the negative growth rate for the 4G Evolved Packet Core (EPC), estimated to be between -15% and -20%, bringing the mobile core market average growth rate below 0%,” Bolan wrote.

5G SA is challenging for network operators. Deploying a cloud-native infrastructure in the mobile core can help telcos operate their networks in a way that’s more similar to hyperscalers. However, the architecture is relatively new and very complex. Non-standalone 5G (5G NSA), which hooks a 5G radio access network (RAN) to a 4G core, is less expensive and more straightforward.

“There’s a lot they must get right – RAN build out, telco cloud, and the 5G core itself – before they can offer SA to paying customers,” said Heavy Reading’s Senior Principal Analyst, Mobile Networks, Gabriel Brown.

“The other big factor is the rate at which subscribers/devices are added to the new 5G core once it does launch,” Brown added. “Even though some big operators are live with SA already, they don’t necessarily have many devices on the new core yet.”

In the US, T-Mobile and US Cellular have already launched 5G SA, and EchoStar is still building out its 5G SA network for its Boost Mobile customers. AT&T and Verizon have also discussed their plans to move to 5G SA.

“The customer migration strategy from 5G NSA to 5G SA is really the key swing factor,” Heavy Reading’s Brown said. “Generally, operators are being cautious because the risk of service disruption is high, and they judge it better to get it right than be fast. They want to offer something better with SA, so quality and reliability are critical.”

“In Europe, France and Italy have been behind due to the spectrum limitations,” said Dell’Oro’s Bolan. “Time will tell if the MNOs will choose 5G SA or 5G NSA. Unfortunately, most MNOs select 5G NSA, which has the lowest cost and is the most straightforward way to meet the capacity requirements for more subscribers’ bandwidth. Once an MNO selects the 5G NSA route, it may be years before they switch to 5G SA.”

To Brown’s earlier point, there’s a lot of background work happening but there’s no telling when it will show up in the numbers with new 5G SA network launches. New use cases and 5G capabilities are always just around the corner as technologies mature, standards advance and telcos get comfortable with the new reality of a 5G core, the use of new spectrum bands and devices and customer expectations. Overall market growth, as Dell’Oro’s numbers suggest, may take a while as the operators taking the 5G SA plunge get used to their new services at scale.

https://www.lightreading.com/mobile-core/why-5g-mobile-core-forecasts-keep-slipping