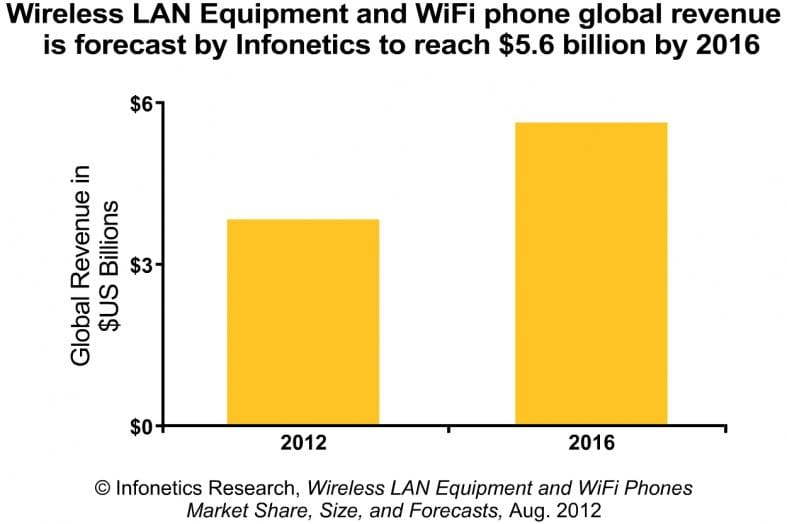

Strong Growth in WiFi LAN equipment and WiFi phone sales as total market nears $1B!

Infonetics Research released excerpts from its 2nd quarter 2012 (2Q12) Wireless LAN Equipment and WiFi Phones vendor market share and forecast report, which tracks 802.11 a/b/g, 802.11n, and 802.11ac access points (APs), wireless LAN (WLAN) controllers, and WiFi phones for the enterprise. That total market approached $1B in 2Q2012!

WIRELESS LAN MARKET HIGHLIGHTS:

•Global wireless LAN equipment and WiFi phone sales grew 16% sequentially in 2Q12, to $993 million, driven by strong demand in North America and the education and retail verticals

•WLAN equipment revenue in EMEA (Europe, the Middle East, and Africa) is up by more than 1/3 year-over-year

•Revenue for outdoor access points rose 45% from the year-ago 2nd quarter due to increasing deployments of WiFi by service providers

•Cisco, the perennial leader in the wireless LAN equipment market, gained about 4 market share points year-over-year in 2Q12; Aruba again took the #2 spot; HP leapfrogged Motorola to take 3rd

•Vocera widened its lead over Polycom and Cisco in the race for enterprise WiFi phone market share in 2Q12

ANALYST NOTE:

“Wireless LAN has had a very good run over the last couple of years, even outperforming wired LAN, and the WLAN market is now approaching the $1-billion-per-quarter mark,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research. “The world is going wireless, and users expect fast, always-on connectivity no matter where they are. Enterprises need to keep pace with ever-increasing bandwidth demands, and next-gen WLAN gear based on fast 802.11n and soon 802.11ac technologies gives them a reason to upgrade.”

REPORT SYNOPSIS:

Infonetics’ quarterly Wireless LAN Equipment and WiFi Phones report provides worldwide and regional market size, vendor market share, forecasts, and analysis for interactive, independent, and outdoor access points (802.11 a/b/g, 802.11n, and 802.11ac), wireless LAN controllers, and enterprise single-mode WiFi phones. Companies tracked include Alcatel-Lucent, Aruba, Brocade, Cisco, D-Link, Enterasys, Extreme, Juniper, LG Ericsson, Meru, Motorola, NETGEAR, Polycom, HP, Ruckus, SMC, Vocera, Xirrus, and others.

TO BUY INFONETICS REPORTS, CONTACT SALES:

- N. America (West), Asia, Latin America: Larry Howard, [email protected], +1-408-583-3335

- N. America (East), Texas, Midwest: Scott Coyne, [email protected], +1-408-583-3395

- Europe, Middle East, Africa: George Stojsavljevic, [email protected], +44-755-488-1623

- Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Dell’Oro Group, another market research firm specializing in networking and telecommunications industries reports that Wireless LAN (WLAN) revenue grew 16% year-over-year in 2Q2012, driven in part by a 26% year-over-year increase in the Enterprise WLAN segment. Dell’Oro states that nine WLAN vendors had record revenue quarters, marking it a very strong quarter for the industry. Cisco Systems maintained the majority revenue market share in the Enterprise WLAN market, followed by Aruba Networks and Hewlett Packard. In the SOHO market, Netgear retained the number one revenue rank, followed by Cisco Systems. In the Service Provider WiFi market, Hewlett Packard, Ruckus

Wireless and Cisco Systems were within 0.2 percent revenue share points of each other in a near dead heat for top vendor ranking, according to Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report provides complete, in-depth coverage of the Service Provider, Enterprise, and SOHO markets with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11g, 802.11a/g, 802.11n and 802.11ac.

“There are many exciting changes underway in the Wireless LAN industry now. We have a new generation of technology shipping, 802.11ac; a new customer group emerging, Service Providers; and new architectures being brought to market, cloud services and virtualized software,” stated Chris DePuy, Analyst of Wireless LAN research at Dell’Oro Group. “In addition, enterprises now consider Wireless LAN infrastructure systems to be just as important as their wired Ethernet systems, which is driving a need for combined management systems for wired and wireless access at the edge of the enterprise,” continued DePuy.

http://finance.yahoo.com/news/wireless-lan-market-sales-16-130000763.html