Month: February 2013

Informa: Public Access Small Cell Market to Hit US$16 Billion in 2016!

Urban and rural small cells will account for 73% of all small cell revenues, according to Informa Telecoms & Media latest quarterly small-cell market status report for the Small Cell Forum. The report highlights that public access small cells are gaining clear market traction and will dominate small cell revenues for the foreseeable future.

Informa Telecoms & Media’s report predicts that the installed base of small cells is set to grow from almost 11 million units today to 92 million units in 2016 – an eight-fold increase – with a total market value of over $22bn. Public access models will dominate revenues in 2016 with a market value of $16.2bn, 73 per cent of the overall small cell market total the research found. This is despite accounting for only four per cent of small cell units deployed.

The research also found that the 9.6 million femtocells in operation today make up 56 per cent of all base stations globally – outnumbering macrocells for the first time. Femtocells will continue to outnumber all other types of cell with 85 per cent of the total base station market in 2016 and constitute 12 per cent of overall small cell market revenues, according to the report.

“Public access small cells in busy urban areas are set to be one of the defining mobile network trends in the coming years. While operators won’t be deploying them in the same numbers as femtocells, they are arguably their best tool for bringing massive extra capacity to their mobile networks. As this research shows, the vendors who succeed in this space are going to win the lion’s share of small cell revenues. All eyes will be on the deployments taking place in the coming months in order to establish best practice for the many more that will follow over the next few years,” said the report’s author, Dimitris Mavrakis, principal analyst at Informa Telecoms & Media.

“The mobile network is undergoing the biggest and most rapid change in its history due to small cells – they now account for 63 per cent of all base stations globally. This revolution may have started in the home with femtocells but in 2013 we’re going to see it spill into the streets, shopping centres and enterprises,” added Gordon Mansfield, the Small Cell Forum’s chairman.

For more info, please go to:

Infonetics 2012 review & 2013 forecasts for PON, FTTH, DSL Aggregation + Cable Broadband markets

Market research firm Infonetics Research released vendor market share and preliminary analysis from its 4th quarter 2012 (4Q12) PON, FTTH, and DSL Aggregation Equipment and Subscribers report. (Full report will be published March 4th).

BROADBAND AGGREGATION MARKET HIGHLIGHTS:

. Global sales of broadband aggregation equipment (DSL, PON, Ethernet FTTH) fell 6% in 4Q12, to $1.56 billion, as a result of declines in spending on DSL equipment in EMEA and EPON gear in Asia

. For the full year 2012, worldwide spending on broadband aggregation equipment was down 10% to

$6.65 billion, with DSL equipment taking the largest hit, plunging 26%!

. Meanwhile, the 2.5G GPON equipment segment is up 30% in 2012, led by China, where a dramatic swing in technology choice by China Telecom and China Unicom is shifting investment from EPON to GPON for FTTH deployments

. VDSL port shipments grew by almost a quarter in 2012, reaching 23 million worldwide, as Belgacom, KPN, British Telecom, France Telecom, Deutsche Telekom, Turk Telecom, and Telekom Austria deploy VDSL2 to keep pace with cable DOCSIS 3.0 rollouts

. In 2012 in the overall broadband aggregation market, perennial leader Huawei lost some revenue share to its top competitors, and Alcatel-Lucent pulled ahead of ZTE for 2nd place

. The top 3 overall vendors also lead the growing 2.5G GPON equipment market, with Dasan Networks rounding out the #4 spot

ANALYST NOTE:

2012 was a challenging year for fixed broadband equipment, with DSL taking the biggest hit as China continues its transition to FTTH,” notes Jeff Heynen, directing analyst for broadband access and pay TV at Infonetics Research. “But despite the difficult road for DSL, VDSL remains a real bright spot, expanding among operators in Western Europe, North America and Latin America. Vectoring solutions and a long-term path to G.Fast are driving sustained interest in VDSL2.”

Heynen adds: “Meanwhile, GPON equipment had an outstanding year, with China again contributing the most revenue and EMEA and Latin America providing pockets of strength.”

REPORT SYNOPSIS:

Infonetics’ quarterly broadband aggregation report provides worldwide and regional market size, vendor market share,

forecasts, analysis, and trends for 1.25G, 2.5G, and 10G EPON, 2.5G and 10G GPON, FTTH, FTTB, PON, and DSL aggregation equipment. The report also tracks FTTH, FTTB+LAN, and DSL subscribers. Companies tracked include ADTRAN, Alcatel-Lucent, Calix, Dasan, ECI Telecom, Fiberhome, Fujitsu, Genexis, Hitachi, Huawei, Iskratel, Mitsubishi, Motorola, NEC, OF Networks, PacketFront, Sumitomo, Tellabs, Ubiquoss, Zhone, ZTE, ZyXEL, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

http://www.infonetics.com/pr/2013/4Q12-PON-FTTH-and-DSL-Aggregation-Market-Highlights.asp

Infonetics is very positive about the cable broadband market in 2013 after a difficult 2012. “Though 2012 was a down year for cable broadband, the stage is set for a strong 2013,” notes Jeff Heynen, directing analyst for broadband access and pay TV at Infonetics Research. “Cable operators worldwide have a number of bandwidth-hungry applications on tap that will drive CMTS and edge QAM channel growth throughout the year, including DOCSIS 3.0, multiscreen services via the deployment of new video gateways, and carrier WiFi services. We’re expecting CMTS and edge QAM revenue to grow more than 20% in 2013,” he wrote.

CMTS AND EDGE QAM MARKET HIGHLIGHTS:

. For the full year 2012, CMTS (cable modem termination system) and edge QAM (quadrature amplitude modulation) equipment revenue decreased 15%, to $1.39 billion

. Declining ASPs and channel shipments edged the global CMTS and edge QAM market down for the 3rd consecutive quarter in 4Q12, as revenue fell 1% sequentially, to $284 million

. North America bucked the global trend, notching a 7% increase in CMTS and edge QAM revenue in 4Q12 from 3Q12

. Cisco held onto its perennial #1 CMTS revenue market share position in 4Q12, though #2 ARRIS, the leader in channel shipments, grew its share by 6 percentage points

. In the edge QAM segment, Cisco edged out Harmonic to claim the top spot for the 1st time ever in 4Q12; even so, Harmonic closed out 2012 as the edge QAM leader

http://www.infonetics.com/pr/2013/4Q12-CMTS-and-Edge-QAM-Market-Highlights.asp

A related article on Infonetics Service Provider Router/Switch Market is at:

Infonetics views on mobile infrastructure are at:

AT&T Exec Sees Shifting Cloud Challenges and Opportunities

AT&T is now taking a range of offerings to the cloud — infrastructure, virtual private networks, storage, platforms — based on what businesses of all stripes have been asking for from network providers.

Chris Costello of AT&T Cloud Services discussed what the company is doing in cloud computing services in this recent interview. “AT&T has been in the hosting business for more than 15 years, and so it was only a natural extension for us to get into the cloud services business to evolve with customers’ changing business demands and technology needs,” she said. Ms. Costello also stated:

“We have cloud services in several areas. The first is our AT&T Synaptic Compute as a Service. This is a hybrid cloud that allows VMware clients to extend their private clouds into AT&T’s network-based cloud using a virtual private network. And it melds the security and performance of VPNs with the economics and flexibility of a public cloud. So the service is optimized for VMware’s more than 350,000 clients.

If you look at customers who have internal clouds today or private data centers, they like the control, the security, and the leverage that they have, but they really want the best of both worlds. There are certain workloads where they want to burst into a service provider’s cloud.

We give them that flexibility, agility and control, where they can simply point and click, using free downloadable tools from VMware, to instantly turn up workloads into AT&T’s cloud.

Another capability that we have in this space is AT&T Platform as a Service. This is targeted primarily to independent software vendors (ISVs), IT leaders, and line-of-business managers. It allows customers to choose from 50 pre-built applications, instantly mobilize those applications, and run them in AT&T’s cloud, all without having to write a single line of code.

So we’re really starting to get into more of the informal buyers, those line-of-business managers, and IT managers who don’t have the budget to build it all themselves, or don’t have the budget to buy expensive software licenses for certain application environments.

Examples of some of the applications that we support with our platform as a service (PaaS) are things like salesforce automation, quote and proposal tools, and budget management tools.

The third key category of AT&T’s Cloud Services is in the storage space. We have our AT&T Synaptic Storage as a Service, and this gives customers control over storage, distribution, and retrieval of their data, on the go, using any web-enabled device. In a little bit, I can get into some detail on use cases of how customers are using our cloud services.”

Read more at: http://www.ecommercetimes.com/story/77329.html

Siemens to Accelerate Exit from NSN; "Liquid Applications" in NSN Base Stations

The Financial Times reports that Siemens will speed up efforts to exit or cut its 50 percent stake in NSN- its telecom

equipment joint venture with Finnish phone maker Nokia. Siemens and Nokia will be free to take action regarding their stake in Nokia Siemens Networks (NSN) in April when a six-year shareholder agreement expires, following which Siemens would look to cut its stake in the venture to below 20 percent, the FT said, citing a person close to Siemens.

Siemens, whose products include trains, medical scanners and wind turbines, has long made clear its desire to get out of the European telecoms sector which has been hit by price erosion and competition from Asian entrants such as Huawei. Nokia and Siemens have been looking to exit the joint venture through a buy-out or public offering, and analysts expect a decision in the next few months.

NSN has shown signs of a turnaround in recent quarters, helped by a massive restructuring drive last year that cut around 20,500 out of 74,000 jobs.

The FT said that “In a second step, NSN could take over Alcatel-Lucent, the struggling Franco-American telecoms equipment company, and then form two companies; one in mobile broadband and another in IP and optical networks.

“These private equity guys could pull that off. That would probably be a very rewarding outcome and real industrial logic,” the source said.

Analysts have applied an enterprise value for NSN of up to €10bn but the person close to Siemens said the true number might only be only around half that amount.”

http://www.ft.com/intl/cms/s/0/1f1fbc5c-7d0b-11e2-adb6-00144feabdc0.html

At Mobile World Congress, NSN announced plans to embed IBM WebSphere application servers into its base stations. The radio and services networks have always been separate, but NSN is making a case to merge them.

NSN unveiled a new mobile services architecture, called Liquid Applications, designed to push a host of applications – ranging from video to location-based services and mobile gaming – to the furthest edge of the cellular network.

Mobile applications and radio infrastructure have always been walled off from one another – applications just barrel ahead onto their radio on-ramps oblivious to the highway traffic conditions ahead. What NSN proposes to do with Liquid Apps is to make those disparate portions of the network work in unison.http://gigaom.com/2013/02/25/nokia-siemens-makes-mobile-apps-and-cellular-networks-play-nice/

Optical network market poised for growth in 2013, especially in EMEA region

1. Market research firm Infonetics Research just released vendor market share and preliminary analysis from its 4th quarter 2012 (4Q12) and year-end Optical Network Hardware report. The full report will be published Feb. 27th.

OPTICAL NETWORK MARKET HIGHLIGHTS :

. The global optical network hardware market rose 2% in 4Q12 from 3Q12, but was down 13% from the year-ago 4thQ

. For the full year 2012, total optical equipment spending was down 10% worldwide

. The SONET/SDH optical segment fared much worse, essentially dealt a death blow in 2012 as global legacy capex fell 30%

. After posting its lowest-ever optical revenue results a quarter ago, Alcatel-Lucent bounced back in 4Q12, up 29% on the tide of the EMEA capex surge; still, ALU’s WDM revenue is down from a year ago

. Ciena’s optical revenue was down sequentially and year-over-year, but grew shipments of its 40G and 100G equipment and is ramping production of a new single-carrier 100G solution

. Infinera had another strong quarter, thanks to a surge in sales of its new DTN-X OTN switching platform

“After ending 2012 on a flat note, things are looking up for the optical market in 2013,” notes Andrew Schmitt, principal analyst for optical at Infonetics Research. “Our conversations with equipment providers continue to trend positive, particularly in North America where 100G spending is about to ramp. The general consensus remains that an optical cycle for equipment in the core is emerging, what we call the ‘optical reboot.'”

“Meanwhile, there are positive rumbles in the EMEA region, where 2012 ended with a spending flourish and carriers are cutting dividends to plow capital into general capex,” Schmitt adds. “And we are looking forward to our visits with carriers in Beijing this spring to get a good read on the year, but the preliminary indication is it will be a huge year for 100G. China is about half of the global 40G WDM market, and 2013 will be the peak year for 40G worldwide.”

In an earlier report, Mr Schmitt was quite positive about the OTN Switching market. Andrew wrote, “Though OTN switching currently makes up only a small portion of the overall OTN market and deployments have been centered mostly in China, we anticipate breakout growth for this segment as operators in EMEA and North America adopt integrated WDM+OTN switching as part of the roll out of 100G coherent technology in regional and core networks. We’re forecasting the OTN switching segment to grow at a 5-year compound annual growth rate of 28% from 2012 to 2016.”

OPTICAL HARDWARE REPORT SYNOPSIS:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, analysis, forecasts, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/ POS ports, and WDM ports. Companies tracked include Adtran, ADVA, Alcatel-Lucent, Ciena, Cisco, ECI Telecom, Ericsson, Fujitsu, Huawei, Infinera, NEC, Nokia Siemens Networks, Tellabs, Transmode, Tyco Telecom, ZTE, and others. To buy the report, contact Infonetics:

http://www.infonetics.com/contact.asp

2. TechNavio’s report, the Optical Network Hardware Market in the EMEA Region 2011-2015, has been prepared based on an in-depth market analysis with inputs from industry experts. The report focuses on the EMEA region; it also covers the Optical Network Hardware market landscape and its growth prospects in the coming years. The report also includes a discussion of the key vendors operating in this market.

TechNavio’s analysts forecast the Optical Network Hardware market in the EMEA region to grow at a CAGR of 2.93 percent over the period 2011-2015. One of the key factors contributing to this market growth is the increased bandwidth requirements. The Optical Network Hardware market in the EMEA region has also been witnessing strong growth prospects in Central and Eastern Europe. However, the high initial investment could pose a challenge to the growth of this market.

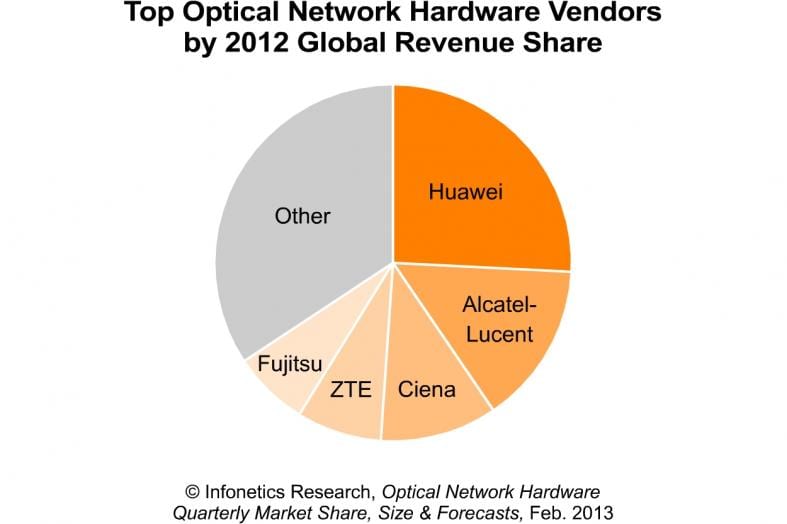

The key vendors dominating the optical network hardware space are Alcatel-Lucent, Ciena Corp., Huawei Technologies Co. Ltd., and ZTE Corp. The other vendors mentioned in the report are Fujitsu Ltd., Cisco Systems Inc., Ericsson Inc., NEC Corp., Nokia Siemens Networks, and Tellabs Inc.

To buy this report: http://www.researchmoz.us/optical-network-hardware-market-in-the-emea-region-2011-2015-report.html

3. 100G OPTICS WEBINAR:

Join Infonetics analyst Andrew Schmitt, Cisco, Cyan and Oclaro on March 5 for 100G Optics: Why Operators Are Upgrading Now, a free live webinar examining coherent 100G deployment activity to date and solutions for adding 100G to the network. Learn more or register at:

http://w.on24.com/r.htm?e=564650&s=1&k=D516668CBFFF7CD6D45545BA350F0373

Alcatel-Lucent Posts Q4 Loss; CEO Forced Out Under Pressure

Alcatel-Lucent reported Q4 loss of 1.37 billion Euros, or 60 Euro cents a share, reflecting a 1.41 billion Euro asset impairment charge. Operating income was 66 million Euros. Revenues were up 13.8% sequentially to 4.1 bilion Euros, but down 1.3% from the year ago quarter.

While North American sales improved to 1.6 billion Euros from 1.41 billion a year ago, European revenue fell to 1.1 billion Euros from 1.28 billion, and Asia-Pacific fell to 714 million Euros from 775 million.

Ben Verwaayen, CEO Alcatel-Lucent, commented: “Our fourth quarter reflects the early progress of The

Performance Program announced last July. We announced clear choices on where we would operate, how we

would operate and where we would differentiate.”

“We have seen progress on all these choices, and close 2012 ahead on our cost reduction plans. We have

addressed half of the previously margin-diluting Managed Services contracts, and show continued and strong

growth in IP and Next Generation Wireless. We can see a clear statement of customer confidence through

growth in both our order book and backlog.”

The WSJ reports: Alcatel Chief Is Out as Turnaround Stalls

“The CEO’s departure comes at a turbulent time for the equipment maker. More than six years after France’s Alcatel merged with U.S.-based Lucent Technologies to create a telecom-equipment giant, the company is discovering that it can’t keep up in the global tech race. It is smaller by revenue than most of its competitors. But it competes in more lines of business than almost all of them. It has racked up billions of euros of red ink for its efforts.

Under Mr. Verwaayen’s leadership, Alcatel-Lucent has pinned hopes on leading the market for next-generation networks. But when France’s two largest cellphone operators launched the first next-generation wireless networks in the Paris area last week, they weren’t using Alcatel-Lucent’s gear.

Instead, they went with competitors who had figured out how to bundle the new network alongside existing ones all in the same small transmitter—something Alcatel-Lucent couldn’t easily match. The Paris-based company was outflanked in its back yard.

On Thursday, Alcatel-Lucent posted a €1.37 billion ($1.85 billion) loss in the fourth quarter, dragged down by an impairment charge largely on the declining value of its businesses making wireless network equipment and optical-network gear. It had full-year cash burn of €679 million—its seventh consecutive year of negative free cash flow.

The company has responded to its losses with a €2 billion loan package to buy time for a restructuring that aims to shed unprofitable products and exit underperforming contracts, especially in the troubled European market. The result is that a company with century-old roots in Europe will be doing less business there.

Alcatel-Lucent’s strategy for years has been to be an end-to-end supplier for the biggest telecommunications companies in the world. It supplies everything from the submarine cables that wire together continents to the software that phone companies use to calculate and send out phone bills every month. It can plan new wireless networks, make the equipment and then be the outsourcing company to maintain the whole thing.

But Alcatel-Lucent has struggled to turn a consistent profit across its businesses. Europe has been a particular problem. Amid a struggling economy, phone companies have been slow to upgrade networks. Alcatel-Lucent revenue in Western Europe was down 19% through the third quarter of 2012, according to company filings, and its wireless division, where the company has been losing bidding for European contracts, was off 23%.

Few companies—apart from China’s massive Huawei Technologies, which had nearly 50% more revenue than Alcatel-Lucent in 2011—compete on such a wide playing field. Sweden’s even-larger Ericsson focuses more on networks, services and software for mobile operators. When it comes to Internet routing and switching, Alcatel-Lucent competes instead against Cisco Systems Inc. CSCO -0.67%and Juniper Networks Inc. JNPR -0.71%In next-generation optical networks dubbed 100G, its rivals include companies like Huawei and Ciena Corp. CIEN +0.41%

That breadth has stretched a research budget that is already trailing bigger competitors. Ericsson spent 47% more on research in the first nine months of 2012 than Alcatel-Lucent. Huawei began outpacing Alcatel-Lucent in absolute research spending in 2011, even though Huawei’s China-based engineers cost much less.

Alcatel-Lucent officials say their situation means they simply have to be smarter than competitors about where they place their technology bets. “It’s not a matter of size,” Alcatel-Lucent’s Mr. Verwaayen said in an interview in November. “It’s a matter of choices that we make.”

Alcatel-Lucent is the offspring of two giants. France’s Alcatel descends from a French industrial behemoth that developed bullet trains. Lucent was the equipment arm for the original AT&T T -0.68%and includes Bell Labs, which helped invent the laser and the idea of a cellular network. In 1986, the two units were Nos. 1 and 2 in the global telecommunications-equipment market, accounting for a 49% combined market share.”

http://online.wsj.com/article/SB10001424127887324906004578287852518071498.html?mod=djemalertTECH

Eric Beaudet, an analyst at Natixis, a bank in Paris, said that Mr. Verwaayen had lost credibility among investors after promising a succession of restructuring plans that had failed to bring it to sustainable profit. In 2010, Alcatel-Lucent posted a net loss of €292 million. The next year, the company had a €1.1 billion net profit. For 2012, the company reported a full-year loss of €1.1 billion.

“With the C.E.O. having lost credibility, we believe that this move will be appreciated, even though a replacement has not yet been named,” Mr. Beaudet wrote in a note to investors. “We believe that the market should react positively to this announcement with Mr. Verwaayen having lost some of his credibility with the numerous successive restructuring plans.”

In a statement, Mr. Verwaayen said the company needed new leadership.

“Alcatel-Lucent has been an enormous part of my life,” Mr. Verwaayen said. “It was therefore a difficult decision to not seek a further term, but it was clear to me that now is an appropriate moment for the board to seek fresh leadership to take the company forward.”

Under his tenure, Alcatel-Lucent developed a unified set of network products, eliminating redundant French and American gear, and focused efforts around wireless broadband technologies as it fought larger rivals like Ericsson of Sweden and Huawei of China.

“Mr. Verwaayen had done as much as he could with the assets he had,” said Martin Nilsson, an analyst at Handelsbanken in Stockholm. “But when he came in, things were pretty bad there, and a lot of ground had been lost.”

Lucent, Mr. Nilsson said, had been reduced to making “legacy” wireline products for AT&T and other American operators, a once-lucrative business whose profitability had diminished following deregulation of the U.S. telecommunications industry in the 1980’s.

Alcatel had a similar symbiotic relationship with the French government, supplying most of the core equipment and land lines to France Télécom, or to public entities like Thales.

But Mr. Verwaayen’s austerity cure, which he successfully applied as chief executive of the former British telecom monopoly BT from 2001 to 2008, has not brought the same results at Alcatel-Lucent.

Mr. Camus, the Alcatel-Lucent chairman, credited Mr. Verwaayen for leading the company out of a difficult transition following its merger.

http://www.nytimes.com/2013/02/08/technology/ben-verwaayen-alcatel-lucent-chief-resigns.html?_r=0

AT&T U-Verse Live TV now called Mobile TV & has Enhanced Picture Quality

AT&T has changed the name of its wireless video service from AT&T U-Verse Live TV to Mobile TV, saying in a blog post that it has also improved the picture quality of the $10 monthly service, introduced $5 add-on programming packages and made it available on most of its smartphones via 3G, 4G and Wi-Fi networks. Subscribers can view a number of live TV channels by downloading a streaming and on-demand TV application.

Rob Hyatt, AT&T’s Executive Director of Marketing Management, posted on the company’s Consumer blog page that the newly renamed service was intended to be your “on-the-go source for entertainment and information whether you’re traveling near or far and is accessible through Wi-Fi and AT&T’s 3G & 4G LTE networks.” It is available on most of the AT&T smartphones and will cost $9.99 per month.

http://blogs.att.net/consumerblog/blogger/a7787219

In addition to the accessibility on most of its smartphones, AT&T says it is now offering “enhanced picture quality” when viewed on its 4G LTE network. This implies that AT&T will broaden coverage of its 4G-LTE network as they promised last fall.

http://viodi.com/2012/11/08/at-bring-fiber-to-commercial-buildings-cover-99-of-us-with-lte/

Mobile TV subscribers will also have their Mobile TV subscription merged with their main account so it’s streamlined billing. The new Mobile TV service enables users to easily watch channels like ESPN Mobile, Disney, FOX News, ABC Mobile, and more right from their portable device using a streaming and on-demand television app.

AT&T is offering add-on packages for Mobile TV for $4.99. Its Urban Zone Pack features programming from BET while its Playground TV Pack is more for kids, and lastly Hispanics can get specialized programming with its Paquete en Espanol movil.

This isn’t the first time AT&T has offered a “mobile TV” service. The carrier, along with Verizon Wireless, offered Qualcomm’s MediaFLO broadcast mobile TV service until Qualcomm decided to shut the network down in 2011.

References:

http://www.engadget.com/2013/02/04/att-mobile-tv-10-per-month/

Oracle Buys Acme Packet for $2.1 Billion to Provide Converged Systems Solution

Oracle has agreed to acquire Acme Packet, a provider of Session Border Control technology, for $2.1 billion. Acme Packet allows service providers to deliver voice, data and unified communications services and applications across IP networks. More than 1,900 service providers and enterprises, including 89 of the world’s top 100 communications companies, are Acme Packet customers. The transaction is expected to close in the first half of this year.

Oracle President Mark Hurd called the proposed acquisition of Acme Packet another important piece in the company’s overall strategy to deliver integrated products that address critical customer requirements in key industries.

“The addition of Acme Packet to Oracle’s leading communications portfolio will enable service providers and enterprises to deliver innovative solutions that will change the way we interact, conduct commerce, deliver healthcare, secure our homes, and much more,” Hurd said.

By integrating Acme Packet technology, Oracle expects to accelerate the migration to all-IP networks by making it possible for service providers to offer secure, reliable communications from any device, across any network. With more high speed communications interfaces, companies are moving to deliver hardware stacks that consist of servers, storage and networking from a single vendor.

“The communications industry is undergoing a dramatic shift as users become more connected and dependent on mobile applications and devices,” said Bhaskar Gorti, senior vice president and general manager of Oracle Communications. “Service providers and enterprises need a comprehensive communications solution that will enable them to more effectively engage with their customers.”

Charles King, principal analyst at Pund-IT, said there were three issues to explore: how Acme Packet’s solutions stack up against Oracle’s competition; how the acquisition will affect Oracle’s longstanding relationships with Cisco and Juniper; and how customers will ultimately respond.

“In the past, we’ve seen some resistance, specifically among enterprises that have a fairly large investment in Cisco hardware. They want to stick with the hardware that they know and understand,” King said. “Adding yet one more network player to the mix may have questionable value for some of those customers.”

http://www.newsfactor.com/news/Oracle-Buys-Acme-Packet-for–2-1B/story.xhtml?story_id=010000R4XH36&full_skip=1

From Acme Packet CEO to Acme Packet Customers and Partners

On February 4, 2013, we announced that we have signed an agreement to be acquired by Oracle. The proposed transaction is subject to stockholder approval, certain regulatory approvals, and customary closing conditions and is expected to close in the first half of 2013. Until the deal closes, each company will continue to operate independently, and will operate its business as usual.

Today is a significant milestone for Acme Packet. We are excited to join forces with Oracle because we believe that together we can rapidly accelerate the transformation to all-IP communications networks across the globe. The combination of our session border control and other solutions with Oracle’s powerful Communications portfolio will enable service providers to uniquely differentiate and monetize next-generation services, and help enterprises benefit from more effective user engagement and improved employee productivity. This combination will also provide our partners with an expanded portfolio of world-class solutions to help them create even greater value for their customers.

Oracle plans to make Acme Packet a core offering in its Oracle Communications portfolio to enable customers to more rapidly innovate while simplifying their IT and network infrastructures. This means our customers can expect to continue to receive the expertise, vision and passion that they have come to expect from us today — and our efforts will be supported by the global reach, investment and infrastructure of Oracle.

Acme Packet’s management team and employees are expected to join Oracle’s Communications Global Business Unit, and continue their focus on building the industry’s best session delivery solutions. We expect that joining Oracle will provide significant benefits for both our customer and partner communities.

Thank you for your continued support and for being part of the Acme Packet community.

Best regards,

Andy Ory

CEO, Acme Packet