Carrier Ethernet Market up Strongly in 3Q14; What’s it Used for & What Role will SDN Play?

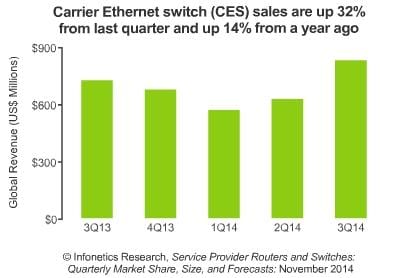

Infonetics Research released vendor market share and analysis from its 3rd quarter 2014 (3Q14) Service Provider Routers and Switches report. Author & Infonetics co-founder Michael Howard writes that Carrier Ethernet Switches had a terrific quarter and year:

“…Carrier Ethernet switches (CES) had an unprecedented quarter, with global revenue up 32% from the previous quarter and up 14% from a year ago, driven by ZTE in China and Cisco in North America. Fundamental changes are on the horizon as the market transitions from hardware-driven to software-driven, but no doubt routers must be fitted with higher-capacity blades to accommodate growing traffic, and there is intensifying focus on content delivery networks (CDNs) and smart traffic management across routes to make routers and optical gear cooperate more closely.”

“The ‘SDN hesitation’ we first identified four quarters ago remains in effect, slowing router spending in the third quarter of 2014 as carriers remain cautious about investing in equipment and software that might need to be replaced in the future,” Howard added.

3Q14 CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

. Combined, service provider routers and switches-including IP edge and core routers and carrier Ethernet switches-totaled $3.7 billion worldwide in 3Q14, down 3% from the previous quarter

. All regions except CALA (Caribbean and Latin America) were down sequentially in 3Q14

. However, the market is up 3% from the year-ago 3rd quarter, reflecting the long-term slow growth trend Infonetics has been tracking

. Infonetics expects the global carrier router and switch market to slowly grow to $17 billion by 2018, a five year (2013-2018) compound annual growth rate of just over 3%

. Looking at rolling 4-quarter router market share, Huawei increased its share the most of any vendor (+4.6 points) from 3Q12 to 3Q14, as edge and core router revenue stayed

relatively flat

ROUTER/SWITCH REPORT SYNOPSIS:

Infonetics’ quarterly service provider router and switch report provides worldwide, regional, China, and Japan market share, market size, forecasts through 2018, analysis, and trends for IP edge and core routers and carrier Ethernet switches. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Coriant, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, UTStarcom, ZTE, others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

What is Carrier Ethernet used for?

We’ve asked this question many times and the answer seems to be “something other than a Carrier Ethernet service.” For example, it’s the “last mile” or last few meters access to triple play service offerings that include IP TV. AT&T’s U-verse is a good example of that. It’s also used to access IP-MPLS VPNs which may terminate at a company’s or cloud service providers point of presence.

XO Communications Chief Operating Officer Don MacNeil said at MEF14 (see below) that networks increasingly will consist of Carrier Ethernet connections feeding into an MPLS core. That matches an observation from Bob O’Brien, vice president of network and OG&M solutions for the Americas for global network operator Orange, who noted that customers’ preferred method of accessing the company’s MPLS offerings is via Carrier Ethernet. That’s in contrast to Carrier Ethernet as a private line, virtual private line, or private LAN over WAN service.

Role for SDN?

Rob Tompkins believes that SDN will boost Carrier Ethernet Services. He wrote that SDN will change carrier Ethernet and its services in three significant ways:

- Cost: A key objective for both SDN and carrier Ethernet is to reduce overall costs. SDN has the potential to lower operational expenditures through increased network automation and network optimization. This will also reduce capital expenditures. Carrier Ethernet is proven to significantly reduce network costs and in many cases reduce solution complexity. Coupling SDN with carrier Ethernet to reduce costs just makes sense.

- Control: SDN leverages a logically centralized control model to enable deterministic, dynamic, on-demand services that comply with strong service-level agreements. Carrier Ethernet, when coupled with SDN, provides an agile and flexible network for network virtualization and dynamic bandwidth services.

- Ubiquity: Ethernet has become a ubiquitous networking technology. It dominates the marketplace as the interface for IP networking, whether in its wired forms or as Wi-Fi. It does not rely on Layer 1 or optical technologies to carry it over fiber, but can be used over any of today’s optical technologies to gain enhanced distance, even trans-Pacific submarine links. SDN’s tight coupling with Ethernet strongly positions carrier Ethernet coupled with SDN to be critical in next-generation service and content provider networks. Currently, the Optical Transport working group of the Open Networking Foundation (ONF) is working on standards that will allow SDN controllers to manage or direct optical networks.

At last week’s MEF14 conference in Washington, DC:

- Rob Rockell, vice president of regional engineering for Comcast Business, noted that software defined networking (SDN) is reversing the common wisdom often followed by network operators to “distribute what you can and centralize what you must.” That assumes the version of SDN implemented uses a centralized controller which computes paths (i.e. Control plane) for many packet/frame forwarding engines (Data planes).

- The U.S. Defense Information Systems Agency sees SDN as a way of simplifying its network which in turn is viewed as a means of making the network more secure by “reducing the attack surface,” commented Cindy Moran, director of the Network Services Directorate for the agency. Plans also include “collapsing” 1,000 peering points to a smaller number and establishing different procedures for exchanging traffic that is internal and external to the DoDI.

- Tata Communications Vice President of Managed Network Services James Walker sees customers increasingly seeking deterministic connectivity between data centers.

- Craig Drinkhall, CTO for Lumos Networks, said it a priority to co-locate in as many data centers as possible so that they will be well positioned to provide connectivity to cloud providers located in those data centers.

- Colt has made substantial progress in implementing a vision shared by many other network operators – givingcustomers the ability to turn up network bandwidth at the same time they turn up a cloud service or virtual machine. Colt calls that capability Dedicated Cloud Access, noted Matthias Hain, director of data services for Colt Technology

- Large companies that are customers of Lumos Networks also are seeking that capability – they want to use a “best of breed” approach to cloud services, which means they want that capability for multiple cloud providers. In order for that to happen, the customers are looking for Lumos to allow some back office functions to be triggered by other back office systems. The question then, he said, is whether to let business systems run network systems, which is “very scary to the network people” or whether to let the network systems run the business systems, which is “very scary” to the IT people.

- What Lumos’ Drinkhall described was a theme that came up repeatedly at GEN14: in order to meet the vision of a nimble network that so many companies seem to share, network operators will need to open their operations support and business support systems not only to other internal systems but also to customer and those of other network operators. It remains to be seen if that will actually happen. The NOC is the heart and soul of a network operator’s services and the info therein has never been made directly available to outsiders.