IHS Markit: Telecom Revenue +1.1%; CAPEX -1.8% in 2017

Despite unabated exponential growth in network usage, global telecom revenue is on track to grow just 1.1 percent in 2017 over the prior year, according to a new report [1] by business information provider IHS Markit.

Global economic growth prospects, meanwhile, are looking up. IHS Markit macroeconomic indicators point to moderate global economic growth of 3.2 percent for 2017, up from 2.5 percent in 2016, and world real gross domestic product (GDP) is projected to increase 3.2 percent in 2018 and 3.1 percent in 2019.

“Although the telecom sector has been resilient, revenue growth in developed and developing economies has slowed dramatically due to saturation and fierce competition,” said Stéphane Téral, executive director of research and analysis and advisor at IHS Markit. “At this point, every region is showing revenue growth in the low single digits when not declining, and there is no direct positive correlation between slow economic expansion and anemic telecom revenue growth or decline as seen year after year in Europe, for instance.”

China alone is tamping down global telecom capex in 2017:

IHS Markit forecasts a 1.8 percent year-over-year decline in global telecom capital expenditures (capex) in 2017, mainly a result of a 13 percent year-over-year falloff in Chinese telecom capex. Asia Pacific outspends every other region in the world on telecom equipment.

“Call it precision investment, strategically focused investment or tactical investment, but all three of China’s service providers — China Mobile, China Unicom and China Telecom — scaled back their 2017 spending plans, and the end result is another double-digit drop in China’s telecom capex bucket, with mobile infrastructure hit the hardest,” Téral said. “Bringing down capital intensity to reasonable levels of 15 to 20 percent is the chief goal of these operators.”

The virtualization trend:

A transformation is underway in service provider networks, epitomized by software-defined networking (SDN) and network functions virtualization (NFV), which involve the automation of processes such as customer interaction, as well as the addition of more telemetry and analytics with feedback loops into network operations, operations and business support systems, and service assurance.

“Many service providers have deployed new architectural options — including content delivery networks, distributed broadband network gateways, distributed mini data centers in smart central offices, and video optimization,” said Michael Howard, executive director of research and analysis for carrier networks at IHS Markit. “Nearly all operators are madly learning how to use SDN and NFV, and the growing deployments today bring us to declare 2017 as The Year of SDN and NFV.”

Data is the new oil, and AI is the engine:

Big data is becoming more manageable, and operators are leveraging subscriber and network intelligence to support the automation and optimization of their networks using SDN, NFV and initial forays into using analytics, including artificial intelligence (AI) and machine learning (ML).

“Forward-thinking operators are experimenting with how to use anonymized subscriber data and analytics to create targeted services and broker this information to third parties such as retailers and internet content providers like Google,” Téral said. “No matter their size, market or current level of digitization, service providers need to rethink their roles in the new age of information and reset the strategies needed to capitalize on this opportunity.”

……………………………………………………………………………………………….

Note 1. The Telecom Trends & Drivers Market Report is published twice annually by IHS-Markit to provide analysis of global and regional market trends and conditions affecting service providers, subscribers, and the global economy. These roughly 40- page reports assess the state of the telecom industry, telling the story of what’s going on now and what we expect in the near and long term, illustrated with charts, graphs, tables, and written analysis. These critical analysis reports are a foundation piece for all market forecasts.

The reports include top takeaways on the economic health of the global telecom/datacom space; regional and global trends, drivers, and analysis for the service provider network sector in the context of the overall economy; financial analysis of the world’s top 10 service providers (revenue growth, capital intensities, free cash flow, debt level); regional enterprise and carrier spending trends; top-level service provider and subscriber forecasts; macroeconomic drivers; and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The reports are informed by all of IHS Technology research, from market share and forecasts to surveys with telecom service providers and small, medium, and large businesses.

……………………………………………………………………………………………………………….

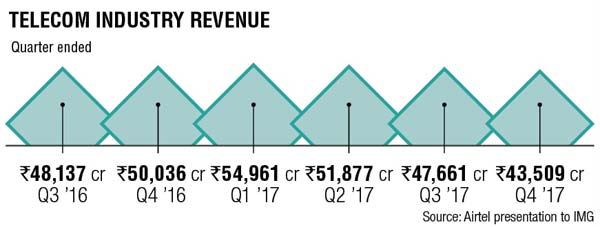

The chart below from Bharti Airtel (India’s largest telecom company) shows that telecom industry revenue has declined in 2017 Q2, Q3, and Q4 with only Q1 showing positive growth.

…………………………………………………………………………………………………………………..

Optical Network Equipment Vendors:

In a service provider survey report on Optical Networking and equipment vendors, IHS-Markit found Ciena, Huawei and Nokia as the three most popular optical networking equipment vendors. The report also highlighted Data Center Interconnection (DCI) is a huge growth opportunity.

IHS-Markit predicts DCI will be a significant driver for the optical equipment market, surging from 19 percent of overall equipment sales at mid-2017 to nearly 30 percent by 2021.

Ciena was deemed the top DCI vendor by 39 percent of those surveyed by IHS-Markit. Cisco, Coriant, and Infinera each garnered 36 percent of the votes.Last year Ciena reportedly won a DCI deal from rival ADVA Optical, which had a negative impact on ADVA’s operational results.

Ciena also topped the list of top (optical) transport software-defined networking (SDN) vendors, with 46 percent of those surveyed citing the company as a leader in the segment. Adams noted that while this market was still in its early days, Ciena’s continued integration of its Blue Planet software platform with its optical equipment products was driving differentiation in the market.

Cisco attracted the second most votes in terms of transport SDN leadership, followed by Nokia and Infinera.