Month: May 2018

Cloud services to reach $374 billion in 2022; Integration of AI & ML into enterprise business apps to drive growth

by IHS Markit analysts Clifford Grossner, PhD and Devan Adams

Executive Summary:

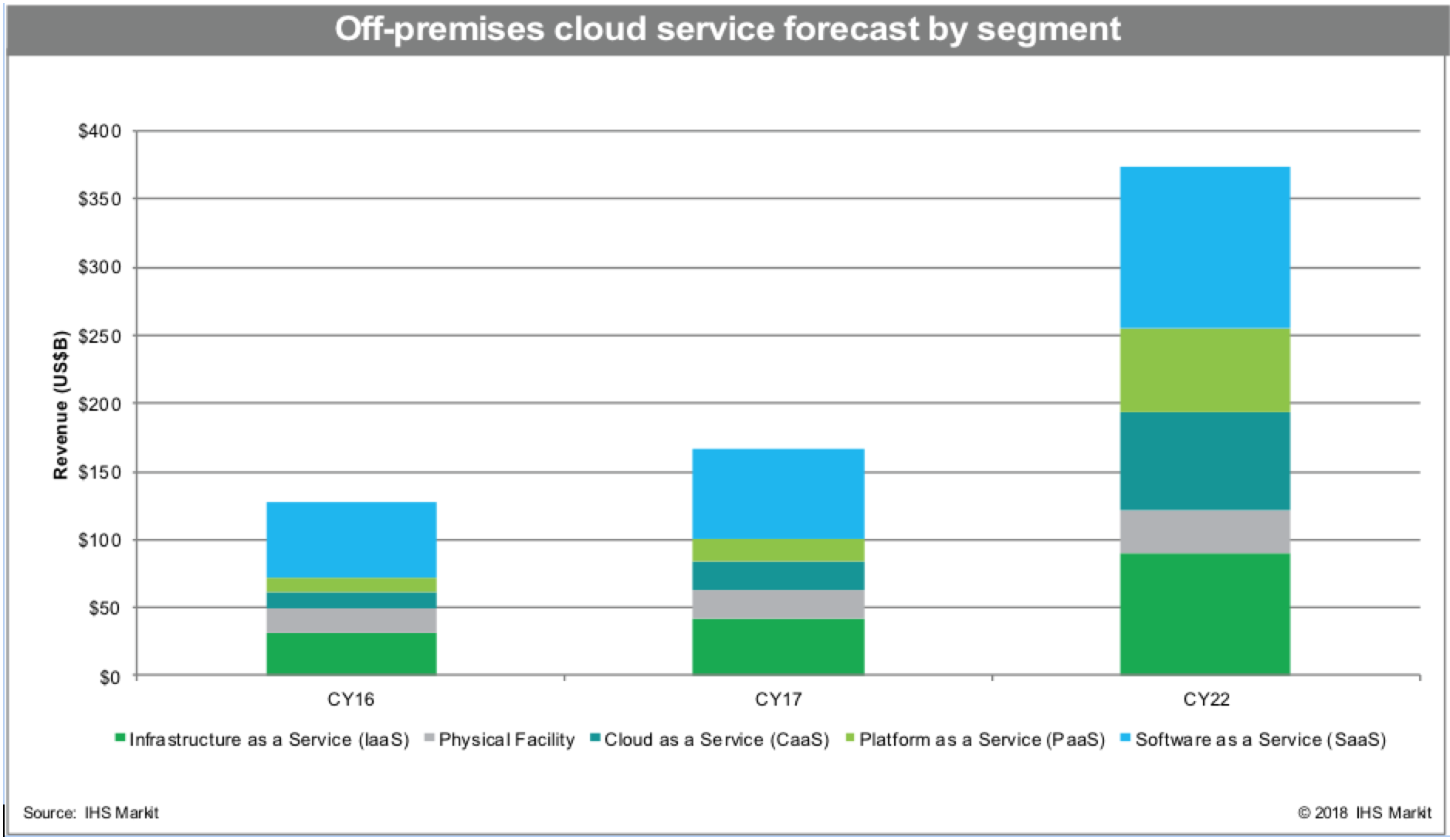

To grow market share, many cloud service providers (CSPs) are introducing specialized compute instances, which target data-intensive workloads and ease the integration of artificial intelligence (AI) and machine learning (ML) into enterprise business applications as a strategy to capture market share. This type of activity is expanding the high-growth cloud-as-a-service (CaaS) and platform-as-a-service (PaaS) segments. The off-premises cloud service market is expected to reach $374 billion in 2022, at a five-year compound annual growth rate (CAGR) of 17.7 percent.

Innovative service offerings by CSPs are multiplying, including the introduction of blockchain technology in PaaS service offers. They are also introducing new services focused on enterprise verticals, including the following: healthcare, to aid diagnosis; energy, for oil and gas exploration; financial services, for transaction monitoring; and supply chain efficiencies in retail and government, for smart city infrastructure. These services package expert domain knowledge acquired by CSPs and make it available to enterprises.

“Amazon made a smart move when it integrated Alexa into Amazon Web Services business applications — and by launching several machine learning services, further expanding its breadth of intelligent solutions,” said Clifford Grossner, Ph.D., senior research director and advisor, cloud and data center research practice, IHS Markit. “Google and Cisco also upped their AI and ML game, targeting hybrid cloud deployments with a collaboration aimed at running these tasks, both on-premises and from Google Cloud.”

As certain market segments mature, consolidation continues for two reasons: buying competitors for access to their client base and expanding service portfolios. Some recent notable mergers and acquisitions include the following: Equinix announced its intention to buy Infomart Dallas, GTT Communications is planning to acquire Interoute, INAP acquired SingleHop, Google agreed to acquire Xively and Microsoft agreed to acquire Avere Systems.

The types of partnerships CSPs are striking evolved from partnerships with enterprise software vendors, as a way to gain a foothold in on-premises data centers, to establishing relationships between providers for cross selling. Some recent noteworthy partnerships include the following: SAP and Microsoft announced a partnership to integrate SAP’s S/4HANA ERP suite with MS Azure; China Unicom plans to expand its reach across various industry verticals, by partnering with YonYou; British Telecom partnered with IBM, to extend its BT Cloud Connect Direct multi-cloud platform; and Salesforce also partnered with IBM, to enhanced its go-to-market strategy.

Highlights:

- The CaaS category is expected to grow 56 percent in 2018, with a five-year CAGR of 29 percent; PaaS will grow 55 percent, with a five-year CAGR of 31 percent.

- North America, the birthplace of off-premises cloud services, will remain the lead market through 2022, delivering approximately 53 percent of all global off-premises cloud service revenue.

- IBM continued to lead the market for software-as-a-service (SaaS) in 2017, with 18 percent of revenue; Amazon led infrastructure-of-a-service (IaaS), with 41 percent of revenue; Microsoft topped the list for PaaS, with 26 percent of revenue; Microsoft’s lead in CaaS continued, with 21 percent revenue; and Equinix led the physical facility market, with 15 percent of revenue.

Research Synopsis:

The biannual IHS Markit Cloud Services for IT Infrastructure and Applications market research report tracks public or private network delivered services offered by a third party (cloud service provider or telco); cloud brokering is not tracked. The research service provides worldwide and regional market size, cloud service provider (CSP) market share, forecasts through 2022, analysis and trends. CSPs tracked include Amazon, Alibaba, Baidu, IBM, Microsoft, Salesforce, Google, Oracle, SAP, China Telecom, Equinix, Digital Realty, Deutsche Telekom Tencent, China Unicom and others.

U.S. Commerce Secretary Talks Up 5G Implying T-Mobile/Sprint Merger Would Accelerate 5G Deployments in U.S.

The Trump administration is placing a high priority on building 5G mobile networks, Commerce Secretary Wilbur Ross told CNBC in a discussion of T-Mobile’s proposed merger with Sprint. According to a CNBC provided transcript of the interview, Ross said:

“You never know who is really ahead or behind (in 5G) until it is truly perfected. Nobody has 5G totally perfected yet. I think the pitch that Sprint and T-Mobile are making is an interesting one that their merger would propel Verizon and AT&T into more active pursuit of 5G. Whoever pursues it, whoever does it, we’re very much in support of 5G. We need it. We need it for defense purposes. We need it for commercial purposes. We (the U.S.) really need to be the player in 5G.”

A video of the interview can be watched here.

……………………………………………………………………………………………………………………………………………………………………………………….

The Federal Communications Commission (FCC) said in February it planned new auctions of high-band spectrum starting later this year to speed the launch of next-generation 5G networks. Carriers have spent billions of dollars acquiring spectrum and are beginning to develop and test 5G networks, which are expected to be at least 100 times faster than current 4G networks and cut latency, or delays, to less than one-thousandth of a second from one-hundredth of a second in 4G, the FCC has said.

Policymakers and mobile phone companies have said the next generation of wireless signals needs to be much faster and far more responsive to allow advanced technologies like virtual surgery or controlling machines remotely. T-Mobile Chief Executive John Legere met with two FCC commissioners in Washington on Tuesday to discuss the merits of the deal.

………………………………………………………………………………………………………………………………………………………………………………………..

Sprint is beginning to train its employees on what to say regarding the merger.

A memo has leaked out, courtesy of XDA-Developers, that shows the talking points that Sprint wants its customers to focus on. According to the document, Sprint employees are supposed to say that the company is very excited that the two companies have agreed to merge. And add that “this is terrific news for customers.” As well as assuring customers that the new T-Mobile will have “a faster, more reliable network at lower prices and with better value.” Which is basically what Sprint and T-Mobile said on Sunday and on Monday during their press tour with different news sites and TV networks.

Columnist Alexander Maxham wrote: “It is definitely important for Sprint to begin training its employees on what to say to customers regarding this merger, as there are bound to be a ton of questions regarding the merger in the coming weeks and months. T-Mobile is likely also training its employees on what to say about the merger – and many of the talking points are likely very similar if not exactly the same. Though T-Mobile’s memo has not leaked just yet. The two companies believe that merging together, they’ll be able to provide the best 5G network in the US, and also be able to better compete with AT&T and Verizon, both of which are more than twice the size of T-Mobile, and almost three times the size of Sprint.”