Month: May 2018

GSMA: NB-IoT and LTE-M deployments gaining market traction; Sequans combo module & NB-IoT silicon

NB-IoT and LTE-M Deployments:

A total of 48 commercial narrowband IoT (NB-IoT) and LTE-category M (LTE-M) have been launched worldwide as of the end of April, according to the GSMA. Statistics from GSMA show that 13 mobile operators have deployed mobile IoT solutions, including all of China’s big three wireless network operators – China Mobile, China Telecom and China Unicom.

South Korea’s KT, LG Uplus, Singapore’s M1, Australia’s Telstra, Sri Lanka’s Dialog Axiata and Mobitel, Taiwan’s Far EasTone and Chunghwa Telecom, Japan’s KDDI, Thailand’s True Corp and Vodafone Group have also adopted the technology.

NB-IoT deployments are currently a lot more common than LTE-M, although some operators including Singtel and Australia’s Telstra have deployed both technologies. AT&T, Verizon, and Sprint have all announced LTE-M. T-Mobile has only announced support for NB-IoT.

Note that both NB-IoT and LTE-M operate over licensed spectrum, which is much more reliable than unlicensed spectrum used in Sigfox and LoRa. Those latter two LPWANs are much more widely deployed then NB-IoT and LTE-M combined.

……………………………………………………………………………………………………………………………

Sequans Combo Module:

During an IoT World panel session on Tuesday May 15th, France chip design house Sequans Communications announced that both Verizon and AT&T would be selling their combined NB-IoT/LTE-M module for $7.50. Verizon has certified Sequans” Monarch SiP (system-in-package) LTE-M/NB-IoT connectivity solution. This module integrates Sequans’ Monarch LTE baseband platform with an RF front-end module in the world’s smallest form factor. Monarch SiP was introduced in late February and is now listed on Verizon’s Open Development website as an approved module. Complete details are available here.

……………………………………………………………………………………………………………..

NB-IoT Silicon:

In a recent blog post, Nick Hunn claimed there are 13 companies (now 17) that have announced NB-IoT chips.

If you count up real NB-IoT deployments, it’s still early days. There are probably fewer than 10 million chips deployed. That’s the figure from Huawei, who is certainly leading the field. How many of those are actually connected and sending data back is questionable – the last year has largely been an exercise in getting things to work and spinning the PR. Nevertheless, Huawei is predicting that by the end of 2018 the number of chip shipments will reach 150 million, which, given the focus on NB-IoT within China, may well happen. The big question is what will happen in the rest of the world. To understand that, it’s interesting to look at the different companies which will be producing silicon.

The thirteen companies I’m aware of (please let me know if you know of any others) are HiSilicon (part of Huawei), Sanechips (a division of ZTE), RDA, Mediatek, Altair (owned by Sony), Sequans, Nordic Semiconductor, Goodix, Riot Micro, Qualcomm and Nesslab, along with ARM and ASTRI/CEVA. ARM and the ASTRI / CEVA partnership are IP vendors, but appear to be at a state where they are already behind some of the offerings, so are worth including, as if anyone plans to ship in volume, they’re an obvious destination. ARM is further differentiating itself by offering a wider-ranging IoT service including device management and aspects of provisioning. I need to apologise for missing GCT, which brings it up to fourteen. And since writing this I’ve been made aware of a further three – Pinecone Electronics (who have Xiaomi as an investor and appear to be building on ASTRI’s IP), Extra Dimensions Technology – a Beijing startup and Eigencomm – a Shanghai startup. That further highlights the China centric concentration and reflects the amount of Government support being put in to make China the leader in IoT. So we have a sweet seventeen, with probably more to come.

………………………………………………………………………………………………………………………….

Image courtesy of GSMA

………………………………………………………………………………………………………………………….

GSMA says the technologies will coexist with other 5G components. Also, that 3GPP is working to allow LTE-M and NB-IoT to be placed directly in a 5G new radio frequency band, and is investigating options for the 5G core network to support LTE-M and NB-IoT radio access networks.

Sigfox launches Sens’It Discovery; Network used for Gas Tank Monitoring in Mexico via IoTnet & Levelgas

At the IoT World conference, May 15th, global IoT network operator Sigfox unveiled its Sens’It Discovery solution. It combines a sensor-packed device (thermometer, hygrometer, light meter, accelerometer, magnetometer and a reed switch), the sensit.io application (for Web browsers and mobile) to remotely control the device, and 1 year of network connectivity to Sigfox’s IoT Cloud. Sigfox hopes that Sens’it becomes one more way for users to experiment with IoT projects and/or produce insightful data to be analyzed.

The new Sens’It device and Sigfox connectivity service will be available in the 45 countries where Sigfox currently operates. Priced at around $75, Sens’it also comes with a software development kit (SDK) for developers to start building a wide range of IoT applications from home appliances, vending machines, smart metering, asset tracking, supply chain management, logistics and even waste management.

Developers can turn the device into a development kit, create their own firmware, and fully re-configure the device thanks to a dedicated Software Development Kit (SDK) available on www.sensit.io. They will be able to:

- Get direct access to the device data on the Sigfox Cloud and create new application integrations.

- Build custom embedded applications to completely change the device behaviour and adapt sensors’ logic to create new uses and solutions.

- For hardware engineers, Sens’it Device Sources are available for download, to be re-used in other device projects.

“With Sens’it, our goal is to demystify IoT and accelerate its adoption by showing how easy anyone, from consumers to developers, can connect anything to the Internet,” says Cédric Giorgi, the director of experience design at Sigfox. “Just attach the device to your door, a bicycle or anything really, and you will start receiving feeds of real-time data coming from the device, via the Sigfox Cloud, on your phone, through email, SMS or push notifications. It’s that easy.”

…………………………………………………………………………………………………………………………………………..

Backgrounder:

Sigfox, which has raised almost $300 million in venture capital, operates a low-power, low data rate communications network to send tiny packets of information using 2G – like radio technologies. The idea is to allow large volumes of connected devices to send small amounts of data without needing much battery power and at a very low cost. That enables massive numbers of devices to be deployed over long periods of time without having to replace the batteries.

Today, large scale IoT applications are mostly deployed over 2 competitive low-power, wide-area (LPWA) IoT network: The one built by Sigfox and its telecom operators partners, and the other, LoraWAN, pushed by chip supplier Semtech through the LoRa Alliance. We compared and contrasted those two LPWANs in this article.

Sigfox devices have better power efficiency (longer battery life) and resistance to jamming and interferences. And unlike Semtech, which is the only one making the radio for LoRa, Sigfox offers its technology license-free, making their money on network services and not on the device itself.

The SigFox network covers 45 countries, which means that a Sigfox device will work seamlessly anywhere wherever it operates in the world.

……………………………………………………………………………………………………………………………………………………………….

For additional information about Sens’it please visit: https://www.sensit.io/

References:

https://www.sigfox.com/en/news/sigfox-launches-sensit-discovery

…………………………………………………………………………………………………………………………………………………..

In a superb tag team presentation late Thursday afternoon, a Mexican MVNO and device maker provided a real life case study: How LPWAN is Helping Levelgas Uberize Gas Tank Monitoring. Daniel Guevara – CEO, IoTnet Mexico – aka WND Group (the Sigfox MVNO) and Pedro Gabay Villafaña – Founder of Edison Effect were the presenters.

IotNet is the exclusive network operator for Sigfox in Mexico and will initially focus on utility applications, such as remote metering for water, gas and residential electricity. The company is owned by the shareholders of NXTVIEW, a company that is deploying the first metering-as-a-service that exists in the Mexican energy market. They worked closely with Edison Effect which makes the Levelgas product for measuring the level of gas in tanks. Collectively, the two companies provide a complete end to end solution for gas companies throughout Mexico.

IoTnet provides CONNECTIVITY for the INTERNET OF THINGS in all of MEXICO:

LOW CONSUMPTION

Optimized communication for low power consumption devices.

LOW COST

Low cost subscription, with easy integration technology and open protocol.

LONG-RANGE

The IoT global network with a coverage of 1.7 million km.

TRUSTWORTHY

The SigFox network is built on strong security mechanisms.

Levelgas is revolutionizing the management of stationary gas tanks in homes. Its solution integrates a device that is quickly placed directly in the tank and sends information (via Sigfox) to a mobile application where the user can check the gas level, calculate refills, verify the supply of the tank in real time , buy gas remotely and transparently, and know their consumption habits.

For the gas companies, Levelgas becomes a commercial partner with a unique advantage: generating data. This data becomes essential when it is translated into a deep knowledge of the market for better marketing strategies, the optimization of routes based on real demand, and a logistical efficiency that results in important savings.

More in a future IEEE Techblog article………………………………

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Why end-to-end network slicing will be important for 5G:

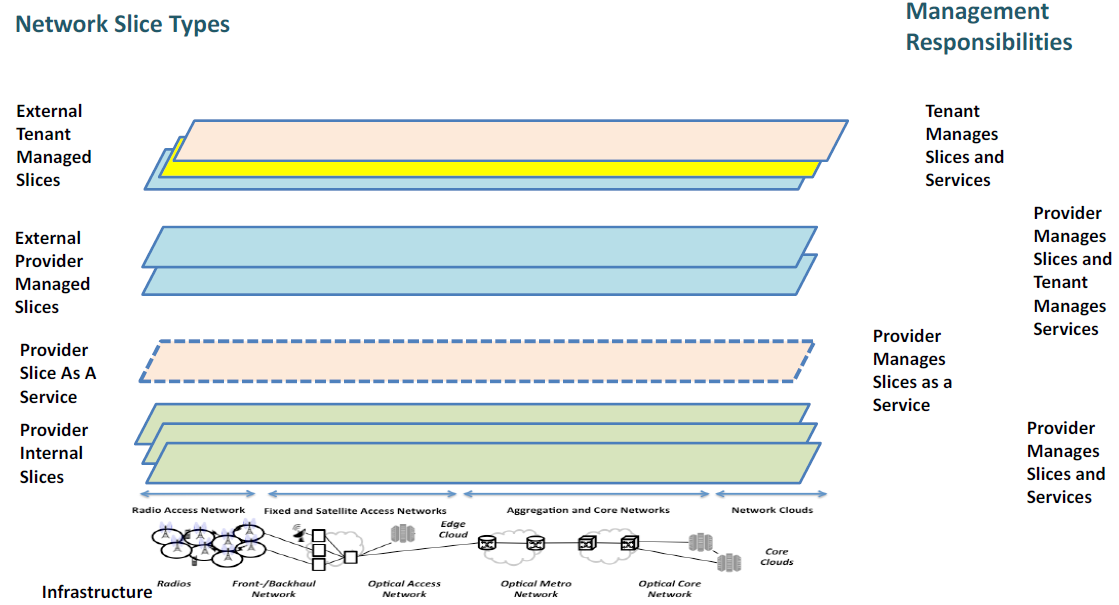

In network slicing of a 5G network, the intent is to take infrastructure resources from the spectrum, antennas and all of the backend network and equipment and use it to create multiple sub-networks with different properties. Each sub-network slices the resources from the physical network, end to end, to create its own independent, no-compromise network for its preferred applications.

One slice type is specifically targeted for ultra-low latency and high reliability (like self-driving vehicles) (URRLC), another slice type is specifically targeted for devices that don’t have large batteries (like sensors) (MMTC) and need efficiency and yet another slice type is targeted at ultra-high speed (eMBB) as required for 4K or immersive 3d video. While the initial standards work calls for only three slice types, the architectures are flexible for future slice types.

Since it would be far too expensive to allocate a complete end-to-end network to each type of slice, the network infrastructure that supports 5G (and likely 4G) will employ sharing techniques (virtualization and cloud), which allow for multiple slice types to co-exist without having too many multiples of the resources.

…………………………………………………………………………………………………………………………………………………………………………………………..

In 2017, ITU–T Study Group 13 (SG13) created a Focus Group with a mandate to research the areas that needed standardization for the non-radio aspects of 5G. The harmonious operation through software control, referred to as “softwarization” of all of the components of the 5G network, was one of the many subjects studied by the Focus Group, and which is now being more formally considered by SG13. Many of the areas requiring control are not uniquely wireless components but are also involved in service providers’ other end-to-end-businesses. For example, the cloud and transport networks which interconnect them will require new agile control to ensure that the packet, non-packet interconnections and compute, meet the Quality-of-Service (QoS) demands of that slice. The success of 5G lies in entire ecosystems 5G slicing technology, to be truly successful, will need entire ecosystems to come together to solve and standardize their end-to-end applications.

Read more here and here. ITU-T SG13 Working Party 1 Questions on Non Radio Aspects of IMT 2020 Networks & Systems:

| WP1/13 | IMT-2020 Networks & Systems |

| Q6/13 | Quality of service (QoS) aspects including IMT-2020 networks |

| Q20/13 | IMT-2020: Network requirements and functional architecture |

| Q21/13 | Network softwarization including software-defined networking, network slicing and orchestration |

| Q22/13 | Upcoming network technologies for IMT-2020 and Future Networks |

| Q23/13 | Fixed-Mobile Convergence including IMT-2020 |

……………………………………………………………………………………………………………………………………………………………………………………………..

Selected IEEE ComSoc Papers on 5G Network Slicing:

Efficient and Secure Service-oriented Authentication Supporting Network Slicing for 5G-enabled IoT

by Jianbing Ni, Student Member, IEEE, Xiaodong Lin, Fellow, IEEE, Xuemin (Sherman) Shen, Fellow, IEEE (edited by Alan J Weissberger)

To be published in a future issue of IEEE Journal on Selected Areas in Communications sometime in 2018

Abstract

“5G” network is considered as a key enabler in meeting continuously increasing demands for future Internet of Things (IoT) services which will connect numerous devices. Those IoT demands include high data rate and very low network latency. To satisfy these demands, network slicing and FOG computing have been envisioned as promising solutions in service-oriented 5G architecture. However, security paradigms enabling authentication and confidentiality of 5G communications for IoT services remain elusive, but indispensable. In this paper, we propose an efficient and secure service oriented authentication framework supporting network slicing and fog computing for 5G-enabled IoT services.

Specifically, users may efficiently establish connections over a 5G core network and anonymously access IoT services under their delegation through proper network slices of 5G infrastructure. The particular 5G service might be selected by FOG nodes based on the slice/service types of accessing services. The privacy preserving slice selection mechanism is introduced to preserve both configured slice types and accessing service types of users. In addition, session keys are negotiated among users, local fogs and IoT servers to guarantee secure access of service data in fog cache and remote servers with low latency. We evaluate the performance of the proposed framework through simulations to demonstrate its efficiency and feasibility under 5G infrastructure.

From the Introduction:

How to enhance security and privacy protection for IoT services powered by 5G is the focus of this paper. To secure 5G-enabled IoT services, a national demand is to design efficient service-oriented authentication protocols for numerous users with the severe demands of different IoT services. To preserve user privacy, it is critical to hide users’ identities during service authentication. Thus, the challenge is to support anonymous service-oriented authentication with scalability of handing a large number of authentication requests. Furthermore, after users’ identities are well protected, it is still possible for local fog nodes to identify users through some side-channel information, such as users’ accessing services, which results in unwelcome advertisements for users.

……………………………………………………………………………………………………………………………………………………………………………………………………………

Network slicing for 5G systems: A review from an architecture and standardization perspective

by Riccardo Trivisonno; Xueli An; Qing Wei

Published in: Standards for Communications and Networking (CSCN), 2017 IEEE Conference in Helsinki, Finland, 18-20 Sept. 2017.

Abstract:

The problem statement originated back in 2015, at the time 5G use cases were analyzed ([1]), when it emerged 4G network architecture did not suit with the diversity of requirements derived from 5G use cases. 4G architecture was considered “not flexible and scalable enough to efficiently support a wider range of business needed when each has its own specific set of performance, scalability and availability requirements”. Additionally, it was argued that a future-proof 5G system should have been conceived allowing efficient introduction of new network services. From this simple and clear starting point, the concept of Network Slicing for 5G was introduced. According to NGMN, the network slicing concept consisted of 3 layers: Service Instance Layer, Network Slice Instance (NSI) Layer, and Resource layer. As described in [1], “the Service Instance Layer represents the services which are to be supported. Each service is represented by a Service Instance.” Also, [1] stated “a Service Instance can either represent an operator service or a 3rd party provided service”. Furthermore, NGMN assumed a network operator would use a Network Slice Blueprint to create an NSI. An NSI provides the network characteristics which are required by a Service Instance. An NSI may also be shared across multiple Service Instances provided by the network operator. An NSI was defined as “ a set of network functions, and resources to run these network functions, forming a complete instantiated logical network to meet certain network characteristics required by the Service Instance (s) ”. Network Slice Blueprint was defined as a complete description of the structure, configuration and the plans/work flows for how to instantiate and control the NSI during its life cycle. A Network Slice Blueprint enables the instantiation of a Network Slice and describes required physical and logical resources. NGMN definitions are sound and complete but, being written from network operator’s standpoint, they focus on the end service perspective and they fail to distinguish among domains they apply to. In particular, it is straightforward the Network Slice Blueprint definition includes system architecture, network lifecycle/management and resource/infrastructure aspects.

The implicit wide scope of such definitions and the appeal the slicing concept was gaining in the R&D community triggered a number of initiatives aiming at extending and clarifying the concepts in all possible concerned domains (see e.g. [2] for SDN related aspects, or [3] for protocols ecosystem issues). The bottom line is: to further progress in the definition of the technologies required to bring Network Slicing into real systems, it is essential to focus on a narrower scope.

The scope of this paper is restricted to 5G end to end System Architecture aspects (i.e. Access and Core networks), leaving aside network management, transport network, network and data centres infrastructure issues. The purpose of this paper is to examine the 4G legacy on Network Slicing (where related early concepts can be found), to review the current status of 5G system standardization in this respect, and to highlight the critical open points which will require significant effort before 5G standardization completes.

The paper is organized as follows: Sec II looks back to 4G systems, analysing early solutions which can be considered precursors of Network Slicing. Sec III presents an in-depth review of latest achievements from 3GPP WGs, which cast the actual foundations over which 5GS will be built. Sec IV highlights the key open issues on which research and standardization will further devote significant effort. Finally, Sec V concludes the paper.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Network Slicing for 5G: Challenges and Opportunities

by Xin Li; Mohammed Samaka; H. Anthony Chan; Deval Bhamare; Lav Gupta; Chengcheng Guo; Raj Jain

Published in: IEEE Internet Computing (Volume: 21, Issue: 5, 2017)

Abstract:

Traditional mobile communication networks employ the one-size-fits-all approach to providing services to mobile devices, regardless of the communication requirements of vertical services. This design philosophy can’t offer differentiated services. Hence, it’s necessary for the research community to explore new techniques to address the challenges associated with supporting vertical industries in 5G networks.

Software-defined networking (SDN) and network functions virtualization (NFV) have been proposed as key technologies to build softwarized, virtualized, and cloudified 5G systems in recent years. SDN2 decouples network control and data forwarding. Network control functions can run as applications independently in the logically centralized controllers. NFV3 decouples specific network functions from dedicated and expensive hardware platforms to general-purpose commodity hardware. Network operators can implement a variety of virtual network functions (VNFs) over the standard commodity servers. In addition, Mobile Edge Computing (MEC)4 as a key emerging technology in 5G is expected to serve low-latency communication that’s one of the use cases in future 5G. It moves computing, storage, and networking resources from remote public clouds closer to the edge of the network. Thus, mobile clients can request virtual resources within the access network and experience low end-to-end delay.

The concept of network slicing 5 has been proposed to address the diversified service requirements in 5G under the background of the aforementioned technologies. Network slicing is an end-to-end logical network provisioned with a set of isolated virtual resources on the shared physical infrastructure. These logical networks are provided as different services to fulfill users’ varying communication requirements. Network slicing provides a network-as-a-service (NaaS) model, flexibly allocating and reallocating resources according to dynamic demands, such that it can customize network slices for diverse and complex 5G communication scenarios.

Network slicing will be the fundamental feature of 5G networks. Slice-based 5G has the following significant advantages when compared with traditional networks:

- Network slicing can provide logical networks with better performance than one-size-fits-all networks.

- A network slice can scale up or down as service requirements and the number of users change.

- Network slices can isolate the network resources of one service from the others; the configurations among various slices don’t affect each other. Therefore, the reliability and security of each slice can be enhanced.

- Finally, a network slice is customized according to service requirements, which can optimize the allocation and use of physical network resources.

With this in mind, next we discuss some details on network slicing for 5G networks and explore why 5G needs network slicing, as well as how to implement network slicing in 5G. For others’ work on network slicing for 5G, see the related subhead below.

Network Slicing in 5G

Fifth-generation networks need to integrate multiple services with various performance requirements — such as high throughput, low latency, high reliability, high mobility, and high security — into a single physical network infrastructure, and provide each service with a customized logical network (that is, network slicing). The Third-Generation Partnership Project (3GPP) has identified network slicing as one of the key technologies to achieve the aforementioned goals in future 5G networks. Some 3GPP work items have the features of network slicing: for example, the dedicated core (DÉCOR) feature supports the operator to deploy multiple dedicated core networks by sharing a common Public Land Mobile Network (PLMN). An exhaustive description about how the next-generation wireless system will support network slicing is provided elsewhere.6

Network slicing refers to partitioning of one physical network into multiple virtual networks, each architected and optimized for a specific application/service. Specifically speaking, a network slice is a virtual network that’s created on top of a physical network in such a way that it gives the illusion to the slice tenant of operating its own dedicated physical network. A network slice is a self-contained network with its own virtual resources, topology, traffIC flow, and provisioning rules. There might be various network slices to meet the specific communication needs of different users in the future mobile network systems. For example, a massive industrial IoT slice might need a light 5G core, with no handover but a large number of connections. On the other hand, a mobile broadband slice might need a high-capacity core, full feature mobility, and low latency. Slices are logically isolated, but resources can be shared among them. Figure 1 illustrates the network slicing concept.

Figure 1.Conceptual illustration of network slicing. NFV stands for Network Function Virtualization, RAN stands for radio access network, and SDN stands for software-defined networking.

………………………………………………………………………………………………………………………………………………………………………

Related Work on Network Slicing for 5G

Network slicing makes use of the concept known as network virtualization. Network virtualization enables flexible and dynamic network management to address the problem of network ossification by allowing multiple heterogeneous and service-specific virtual networks to share a single substrate network.

In addition, the emerging technologies software-defined networking (SDN) and network functions virtualization (NFV) are considered as the necessary tools to implement network slicing. The following work summarizes use of SDN and NFV to implement 5G network slicing.

Csaba Simon and colleagues1 propose a flexible 5G network architecture to support the coexistence of heterogeneous services and to quickly create services. The authors propose to use SDN and NFV in the architecture to realize the sharing of resources by different services and orchestrating resources automatically. The concept of resource slicing is similar to network slicing in the proposed architecture. Resource slices, which include virtual resources and virtual network functions, are tailored on-demand according to service categories, namely slice as a service (SlaaS).

Manuel Peuster and colleagues designed an NFV-based platform called Multi Datacenter service ChaIN Emulator (MeDICINE) for network services.2 It allows management and orchestration (MANO) system to deploy virtual network resources for network services in a multi-domain infrastructure. The design and implementation of this platform show that NFV plays an important role in realizing network slicing.

Navid Nikaein and colleagues3 proposed a novel slice-based 5G architecture based on SDN, NFV, and cloud computing. They designed the elements required to implement network slicing and present a validation prototype. The concept of a network store in this work can achieve dynamic 5G network slicing. The authors discuss building a multitenant and multiservice end-to-end 5G mobile network architecture using SDN, NFV, and network slicing in the 5G NORMA project.4

Mobile operators, hardware manufacturers and open source communities are also actively studying the ways to implement 5G network slicing. Ericsson and NTT DOCOMO successfully showed a dynamic 5G network slicing proof of concept on 9 June 2016.5 Ericsson6 discussed the decomposition schemes of radio access network (RAN) functions that can support network slicing. The schemes provide a meaningful guidance for implementing flexible and resilient RAN slices.

Very recently, Huawei (with other three enterprises) released a network slicing white paper.7 They discussed several key technologies, such as network management system and security to achieve service-guaranteed network slicing, which will be helpful for network industries.

It’s worth noting that the Open Network Automation Platform (ONAP), established in February 2017, is working on a cloud-centric and SDN/NFV-based network platform, which might lay the groundwork for the implementation of 5G network slicing. Also, currently, the Wireless World Research Forum (WWRF) is launching a working group for 5G network slicing.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………

Network Slicing for 5G with SDN/NFV: Concepts, Architectures, and Challenges

by Jose Ordonez-Lucena; Pablo Ameigeiras; Diego Lopez; Juan J. Ramos-Munoz; Javier Lorca; Jesus Folgueira

Published in: IEEE Communications Magazine ( Volume: 55, Issue: 5, May 2017 )

Abstract:

Ericsson: Network Slicing can be a piece of cake

Network slicing in essence means that connectivity becomes differentiated, enabling you to provide innovative business models and demonstrate additional value.

Ericsson has a complete solution for network slicing, with all the key components in place. Available now, it will let you get started with network slicing, and elevate your offerings above mobile broadband.

This paper looks at the practicalities of network slicing and automation, how to support a multitude of new use cases, and how to simplify operations with services which are quick to provision, replicate, scale, upgrade and delete. The paper also considers the business support and monetization aspects required to generate revenue using this technology, and concludes with an example of network slicing collaborative work with a leading network operator.

Verizon Updates its “5G” Plans; Announces ThingSpace Platform for IoT Developers

Verizon “5G” (totally proprietary for both fixed and mobile access):

Verizon will launch its mobile “5G” service roughly six months after the introduction of its fixed “5G” offering, which the telecom has set for several cities later this year, CEO Lowell McAdam told the Seattle Times. Separately, Verizon named Amazon Web Services (AWS) as its preferred public cloud provider and will transfer its production databases and business apps to AWS.

Verizon’s fixed “5G” services are intended to compete with broadband wired internet services by sending high frequency signals from a nearby cell site to receivers either outside or inside users’ homes or offices. Fiber optics is used for backhaul from the cell site to the ISP’s point of presence.

Verizon has been partnering with Samsung and others to test “5G” in homes, or “fixed 5G,” in several U.S. cities. It plans to launch the service to customers in four cities, including Sacramento and Los Angeles California, before the end of this year.

………………………………………………………………………………………………………………………………………………

NOTE: Again, this is not really 5G but instead is Verizon’s proprietary spec for broadband fixed wireless which is NOT being considered by ITU-R for IMT2020. The specification was conducted within Verizon’s 5G Technology Forum (V5GTF), a group that includes Cisco, Ericsson, Intel, LG, Nokia, Qualcomm and Samsung. V5GTF will be used for Verizon’s 28GHz and 39GHz fixed wireless access trials and deployments.

From the ITU-T Focus Group report on IMT 2020 Deliverables:

The use cases expected in IMT-2020 are categorized into three representative services: enhanced mobile broadband service, ultra-reliable and low-latency communications, and massive machine type communications. The other services are placed in-between those three service characteristics.

- Enhanced mobile broadband services are to allow users to experience high-speed and high-quality multimedia services, e.g., virtual reality, augmented reality, 4K/8K Ultra-High Definition video, and even hologram services, at any time and any place.

- Ultra-reliable and low-latency communications are to enable delay sensitive and mission critical services such as tactile Internet which requires less than a millisecond end-to-end delay, remote control of medical and industrial robots, and vehicle-to-everything (V2X) communications.

- The massive machine type communications is to support connections and communications among massive amounts of Internet of Things (IoT) devices.

………………………………………………………………………………………………………………………………………………

“We bought 36 million miles of fiber so we can have big pipes feeding the cells. We will have hundreds of megahertz of bandwidth to deliver the whole suite of services of 5G,” McAdam said.

“We’ll have 1,000 cell sites up and operating on the global standard,” McAdam said on CNBC cable network.

Separately, Samsung acknowledged that the FCC certified the company’s indoor 5G home router (for fixed broadband access), following a VentureBeat report about the action. Samsung confirmed the router is designed for Verizon’s 28 GHz fixed wireless deployment.

For comparison, AT&T said in February that Atlanta, Dallas and Waco, Tex. would be the first of 12 cities to receive its “5G” mobile service, while Sprint is bringing its 5G services to Kansas City, Phoenix and New York City (the millennium capital of the world).

Mobile 5G is designed for portable devices like smartphones, tablets, and virtual reality/game players. That market — giving customers access to ultrafast speeds even on the go — is where T-Mobile has been investing its resources. T-Mobile CEO John Legere has criticized Verizon and other competitors in the past for focusing on the fixed service rather than mobile.

………………………………………………………………………………………………………………………………………………………..

ThingSpace Platform for IoT Developers:

On the eve of IoT World in Santa Clara, CA. Verizon has launched ThingSpace Ready for IoT developers looking to accelerate the creation, test time and speed to bring innovative IoT ideas and ultimately, products to market. ThingSpace Ready is a new program that is part of Verizon’s successful ThingSpace platform, which has more than 20 million connected devices on the platform. Designed to simplify the IoT on-ramp for businesses and OEMs, ThingSpace Ready will provide the most cost-effective and time-efficient design and implementation experience possible – all while connected to Verizon’s award-winning network. The program provides developers more affordable cellular modules and new, lower priced IoT SIM and hardware design house partnerships.

ThingSpace Ready builds on Verizon’s leading platform and connectivity services for IoT – in 2017 Verizon was first to market with its nationwide commercial 4G LTE CATM1 network spanning 2.57 million square miles, the first nationwide low-power, wide-area LTE network designed specifically for IoT. As of April 2018, ThingSpace supports connectivity in over 200 countries & territories via global agreements. Now, through carefully curated module, SIM, and design house partnerships, a ThingSpace SDK integrated on modules and incentives when devices are activated on Verizon’s leading network, device development has never been simpler.

“We’ve been a leader in the industry around IoT platform and connectivity services with the successful launch of ThingSpace in 2015, and the first nationwide CATM1 network for IoT in 2017. Now, we’re building on those tools with key partnerships and services to help make it easier and more affordable than ever to develop and launch cellular-enabled IoT solutions in the marketplace” said Steve Szabo, head of global IoT products and solutions at Verizon. “We’ve created a one-stop-shop for IoT and are providing access like never before,” he added.

This new program is the latest advancement in Verizon’s growing IoT toolkit. Verizon’s ThingSpace press release is here.

Smart Cities Week Silicon Valley: Lots of Progress in Many Areas

Introduction:

Smart Cities Week Silicon Valley was held May 7-9, 2018 at the Santa Clara Convention Center. In addition to highlighting the many new technologies deployed, practicalities such as financing, procurement, stakeholder engagement and program management were also discussed. For example, projects become a much easier sell if an agency can find alternative funding methods. Panelists outlined five of those methods: Monetizing infrastructure, Revenue sharing, Monetizing data, Fees and fare collection, Cost savings.

This article presents just a few highlights of this outstanding conference which should be a must attend for city officials everywhere.

………………………………………………………………………………………………………………………………………………………………….

Summary of Selected Sessions:

May 7th Workshop: Industry Exchange: Smart City Technology and Planning Standards; Moderator: Zack Huhn – Founder, Venture Smarter

Standards and guidance documents play a critical role in describing good practice and clearly set out what needs to be done to comply with specified outcomes. They help in the planning, design, manufacturing, procurement and management processes to ensure goods and services supplied are fit for purpose. This workshop discussed the emerging IEEE standard on developing a technology and process framework for planning a smart city.

IEEE PROJECT 2784 – Guide for the Technology and Process Framework for Planning a Smart City

This guide will provide a framework that outlines technologies and the processes for planning the evolution of a smart city. Smart Cities and related solutions require technology standards and a cohesive process planning framework for the use of the internet of things to ensure interoperable, agile, and scalable solutions that are able to be implemented and maintained in a sustainable manner. This framework provides a methodology for municipalities and technology integrators to use as a tool to plan for innovative and technology solutions for smart cities.

Approval Date: 28-Sep-2017 PAR Expiration Date: 31-Dec-2021 Status: PAR for a New IEEE Standard 1.1 Project Number: P2784 1.2 Type of Document: Guide

“We have been working to create agile, secure, interoperable and financially sustainable technology standards and planning guidelines for municipal leaders to support the vision of building smart cities and connected communities – regardless of socioeconomic or geographical barriers.” — ZACK HUHN

–>Much more in a forthcoming article about this IEEE Smart Cities Standards Project.

…………………………………………………………………………………………………………………

May 8th Panel Session- Transportation Investments: the Building Blocks for Tomorrow’s City

Transportation officials addressed the progress city, regional and state agencies are making towards planning for the future of mobility through investments in transportation infrastructure. With objectives such as increasing transportation options, enhancing the quality of life and improving sustainability, practitioners will address how planning, coordination with other departments to bring a range of services, creative financing and public-private partnerships that modern mobility possible.

Moderator

Jason Goldman – Vice President, ITSA

Speakers

Roger Millar – Secretary, Washington State Department of Transportation

Stefano Landi – Global Sales, Business Development & Partnerships, Verizon

Dan McElhinney – District 4 Chief Deputy District Director, CalTrans

Some characteristics and attributes of smart cities are: intelligent lighting and energy, smart traffic management, traffic data collection, driver aware parking, public safety, and intersection control through safety analytics.

Verizon is partnering with cities to provide connectivity solutions including small cells, fiber backhaul, 4G/5G/WiFi, and NB-IoT.

CALTRANS District 4 (SF Bay Area) is trying to control traffic congestion by ramp metering which is key element of the state’s Transportation Management System (TMS). They are also working on Smart Corridors like Contra Costa I-80.

CALTRANS/CHP goal is to clear major highway accidents withing <=90 minutes of occurrence. That objective was achieved in 75% of such incidents in Fiscal Year 2015/2016 (the latest year for which figures were available).

Somewhat surprisingly, CALTRANS is putting in a lot more fiber optic communications near roads and highways- mainly because of its reliability and future proof bandwidth capacity.

A vision of the CALTRANS Intelligent Transportation System is depicted in the following figure:

Image courtesy of CALTRANS

……………………………………………………………………………………………………………………………………………..

Future Ready — Growing an Innovation Ecosystem in your Community — Learn from Experienced Practitioners:

Through governance, regulation and investment, the public sector can create an environment in which innovation occurs. Cities, counties, states and other units offer access to technology and data, set policies that support startups through simplified regulations and licensing, and host incubators and accelerators. In this session, you will hear from practitioners from the San Diego region, the state of California and an Australian NGO about their efforts to create a climate of innovation and entrepreneurship.

Moderator

Emma Hendry – CEO, Hendry

Speakers

Marty Turock – Strategic Projects Consultant, Clean Tech San Diego

Erik Stokes – Manager, Energy Deployment and Market Facilitation Office California Energy Commission

Johanna Pittman – Program Director, CityConnect

It seems like the city of San Diego has made tremendous progress in intelligent clean tech and micro-grids, which may have replaced the “smart grid” so many experts were talking about several years ago.

Meanwhile, the California Energy Commission established BlueTechValley as part of a major $60 million initiative Commission launched about 18 months ago to really try to create a state-wide ecosystem to support clean energy entrepreneurship across the state.

“As part of this initiative, we created four regional innovation clusters to manage a network of incubator-type services that can encourage clean tech entrepreneurs in the region and really try to help make what can be a very tough road towards commercialization a little bit easier,” Erik Stokes said.

“BlueTechValley and their partners were selected to be the Central Valley cluster. A big reason for that was their strength and expertise in the food and agricultural sector,” he explained. One of the focus areas of the incubator is to find areas in farming to save costs and minimize greenhouse gases. “We really want to focus on those technologies that can help both reduce water use, as well as energy use,” Stokes added.

In a private chat, Erike opined that a lot of the “smart grid” platform vendors had migrated their offerings to data analytics for energy consumption and prediction of future usage trends.

Future Ready Cities — The Robust Mobile Network and Why You Need it Now:

Cities depend on mobile networks for day-to-day operations and delivery of citizen services, and this dependence is growing rapidly. In this session, mobile operators and local government officials will address the critical role of IoT applications for not only transportation, public safety and sustainability, but also for stimulating entrepreneurship, innovation and economic growth.

Speakers

David Witkowski – Executive Director of Civic Technologies, Joint Venture Silicon Valley

Peter Murray – Executive Director, Dense Networks

Rebecca Hunter – External Affairs, Corporate Development & Strategy, Crown Castle

Geoff Arnold – CTO, Verizon Smart Communities

Dolan Beckel – Smart City Lead, City of San Jose

……………………………………………………………………………………….

Closing Quotes:

“We need to be talking about smart regions, not smart cities” -Joy Bonaguro, Chief Data Officer, City of San Francisco.

“Most cities measure performance and miss the boat on measuring effectiveness. You can quantify subjective well-being and should” – Shanna Draheim, Michigan Municipal League Policy Director.

“The idea that we have to disrupt to move forward has poisoned our thinking. We should not discount incremental steps toward a solution. We should ask ourselves – what are the small changes we can make that over time lead to significant outcomes?” – Deb Socia, Executive Director of Next Century Cities – a public interest initiative helping cities that want fast, affordable, reliable broadband.

“The first-ever Smart Cities Readiness Hub at Smart Cities Week Silicon Valley paired cities that are starting their efforts with those who have already blazed a trail — and all gained useful insights.” – Smart Cities Council. Watch the video here.

…………………………………………………………………………………………………

About Smart Cities Council:

The Smart Cities Council, envisions a world where digital technology and intelligent design are harnessed to create smart, sustainable cities with high-quality living and high-quality jobs. A leader in smart cities education, the Council is comprised of more than 120 partners and advisors who have generated US$2.7 trillion in annual revenue and contributed to more than 11,000 smart cities projects.

…………………………………………………………………………………………………

Addendum: Smart Cities Market:

Global Smart Cities industry was valued at approximately $343 billion in 2016 and is anticipated to grow at a rate of more than 24.4% from 2017-2025 according to Research for Markets. The increasing demands for integrated security, safety systems improving public safety and the rising demand for system integrators are the key drivers for this market. Recent technological advancements in smart cities can also be included as a key driver.

Some of the important manufacturers involved in the Smart Cities market are Hewlett Packard Enterprise, Ericsson, General Electronics, Delphi, IBM Co., CISCO Systems Inc., Schneider Electric SE, and Accenture Plc. Those companies are investing in smart grid technologies. A major part of this is going into upgrading the outdated energy infrastructure with new and advanced infrastructure. Acquisitions and effective mergers are some of the strategies adopted by the key manufacturers.

NTT DoCoMo achieves 28GHz wireless data transmission in ultrahigh mobility environment

NTT DoCoMo says it has achieved what is believed to be the world’s first successful 28 GHz wireless data transmission between a 5G base station and a 5G mobile station in 5G field trials using a car moving at 305 KMH or about 189 MPH. The trials were conducted last month at the Japan Automobile Research Institute (JARI) using 700 megahertz of spectrum. They also included live wireless relay of 4K high-frame rate video via uplink from a 5G mobile station moving at 200 km/h, according to DoCoMo.

The speeds in the field trials are designed to be similar to speeds of high-speed railways, so it’s understandable the operator wants to make sure it works, including handoffs, at these kinds of speeds.

Working with NEC and Nippon Telegraph and Telephone Corporation (NTT), DoCoMo said the trials also achieved what are believed to be the world’s first successful 1.1 Gbps ultrahigh-speed data transmission via downlink to a 5G mobile station moving at 293 km/h. It also conducted a fast handover during communication between 5G base stations and a 5G mobile station moving at 290 KMH.

DoCoMo noted that the “world’s first” achievements are according to DoCoMo research as of April 23, 2018. Japan’s largest wireless network operator and its partners used beamforming and beam tracking to address propagation challenges in the 28 GHz band. The 5G base stations used massive-element antenna (96 elements, up to two beams), and the mobile station had massive-element antenna (64 elements, up to two beams). Sony Business Solutions provided a 4K camera for high-frame rate video, and DoCoMo’s own Dandelion racing manager provided a trial car and operated the car on the test course.

…………………………………………………………………………………………………………………………………………………………..

DoCoMo’s 5G R&D objectives and “Phantom Cell” architecture:

NTT DOCOMO’s 5G related research and development will enable a wide range of capabilities such as super high data rate communications of over 10Gbps, lower latency, and simultaneous connection of a large number of terminals in order to support the future spread of M2M communications and internet of things (IoT), etc.

DOCOMO is advocating the concept of Phantom Cell architecture, which consists of a combination of a small cell using a higher frequency band and broader bandwidth and a macro cell using a conventional lower frequency band. For 5G, DOCOMO is making research and development efforts with a focus on the development of technologies that enable efficient transmission in higher frequency bands such as the beamforming technology leveraging a large array of antenna elements (Massive MIMO) as well as technologies for efficient transmission in lower frequency bands.

Toward the goal of 5G service rollout, various mobile communication technologies and schemes need to be tested, including low-latency transmission methods that meet the needs of M2M and other various applications. To this end, DOCOMO is conducting experimental trials in collaboration with world-leading vendors to confirm the feasibility of a wide range of mobile communication technologies, centering on the concepts that DOCOMO advocates.

…………………………………………………………………………………………………………………………………………………………..

DoCoMo is preparing to show off its 5G technology for the Olympics in 2020. Intel revealed earlier this year that it is collaborating with DoCoMo to develop 5G applications, like 360-degree 8K-video streams for highly immersive watching of the games.

Sports viewing: Choosing any of video streams from numerous small cameras in the venue, you can enjoy vivid, powerful images from the players’ viewpoints over an omni-directional three dimensional screen.

…………………………………………………………………………………………………………………………………………………………………

Earlier this year, DoCoMo completed a trial with Huawei and Tobu Railway at Tokyo Skytree Town, the commercial center in the Sumida District of Tokyo that is the home of the iconic 634-meter high television broadcasting tower and landmark. The trial focused on delivering consistent 5G system performance for enhanced mobile broadband (eMBB) applications within the complex, and was used to research radio propagation characteristics and other technical conditions for the 28 GHz band and other candidate spectrum within congested environments.

References:

https://www.nttdocomo.co.jp/english/info/media_center/pr/2018/0509_00.html

https://www.nttdocomo.co.jp/english/corporate/technology/rd/tech/5g/

https://www.nttdocomo.co.jp/english/corporate/technology/rd/tech/5g/5g_trial/index.html

Apple asks FCC for “light touch” as it explores 95GHz to 3,000GHz wireless options

Executive Summary:

Apple has written to the Federal Communications Commission (FCC) asking the agency to leave certain frequencies unlicensed or shared as it tests 95 GHz to 3,000 GHz wireless technology. A major part of this “5G” testing is working on millimeter wave radio spectrum, which was traditionally reserved for larger devices, such as radars, satellites and airport security scanners. One year ago, we wrote that Apple would be testing millimeter wave technology in controlled facilities in Cupertino and Milpitas, California. This is a follow up to that blog post

…………………………………………………………………………………………………………

NOTE that millimeter wave spectrum has yet to be added to the IMT 2020 permitted frequencies. Here’s the current status and future direction for IMT 2020 and “5G” spectrum:

The World Radiocommunication Conference 2015 (WRC-15) paved the way for the future development of IMT on higher frequency bands by identifying several frequencies for study within the 24.25-86 GHz range for possible identification for IMT under Agenda Item 1.13 of WRC-19 (see below).

The 24.25-27.5 and 37-43.5 GHz bands are prioritized within the ongoing ITU-R work in preparation for WRC-19 agenda item 1.13. All geographical regions and countries are recommended to support the identification of these two bands for IMT during WRC-19 and should aim to harmonise technical conditions for use of these frequencies in 5G.

The frequency band of 27.5-29.5 GHz, though not included in the WRC-19 Agenda Item 1.13, is being considered for “5G” in the USA, South Korea and Japan, according to Huawei.

The first solid list of IMT 2020 frequencies will be set at the WRC-19 – World Radio Conference meeting- 28 October to 22 November 2019 in Sharm El Sheikh, Egypt.

To date, the most definitive document approved by ITU-R for IMT 2020 has been: Minimum requirements related to technical performance for IMT-2020 radio interface(s)

…………………………………………………………………………………………………………..

Backgrounder:

Until recently, consumer products did not use millimeter wave radio spectrum, which the FCC allocated to large devices such as satellites, radars, and airport security scanners. Over time, however, technology companies found that the millimeter wave spectrum could be used to radically improve mobile devices’ data speeds.

Starting this year, “5G” fixed broadband access products (which have nothing to do with the forthcoming IMT 2020 standard for real “5G”) will begin to use radios operating in the 24GHz to 29GHz range, radically increasing data bandwidth over short distances. Non-cellular wireless technologies such as next-generation Wi-Fi or Bluetooth could conceivably occupy other frequencies.

Details:

In a recent letter to the FCC, Apple requested the agency to leave substantial portions of the ultra-high-frequency radio spectrum unlicensed or shared — a so called “light touch” to “5G” regulation. That suggests the iPhone king is already considering potential applications of 95GHz to 3,000GHz wireless technology,

The Apple-FCC letter is focused on even higher-frequency spectrum. Specifically, the company says that the commission needs to avoid making the mistakes of prematurely or narrowly licensing radio frequencies above 95GHz, as researchers are already looking at 120GHz to 260GHz and 275GHz to 450GHz ranges for “high-speed, short range” purposes. The concern is that the FCC will sell licenses to small stripes of spectrum now, then have to claw them back later once technology companies determine their best uses — a situation that just played out with 5G millimeter wave licenses, with billions of dollars in consequences.

“Apple supports the Commission’s proposal for experimental licensing in the bands above 95 GHz and believes that adopting this flexible model will help to spur innovation in the band,” the company said in a May 2 letter, signed by Mark Neumann, a senior engineer at Apple.

“As the band is still largely greenfield, this is a rare opportunity to allow for freedom of exploration that does not exist in other bands and advantage should be taken,” Apple continued.

Apple told the FCC it favored a “light regulatory touch” that would leave a greater share of the spectrum unlicensed, and open for anyone to use. Apple’s comments were in response to the FCC’s request seeking comments on how to regulate the high-bandwidth wireless spectrum, often referred to as “super high” spectrum. Apple believes that the current approach to regulation is too far in favor of established, licensed technologies, instead of emerging uses that a company like Apple might be interested in.

Apple offered the FCC two key suggestions to prepare for next-generation wireless technologies. First, it says the FCC should “increase the fraction of the spectrum that it opens to unlicensed spectrum” (including licensed-unlicensed spectrum sharing), rather than heavily preferring licensed technologies, as is the case today. Second, it suggests that the FCC increase the size of unlicensed bands beyond the “too narrow” 1GHz to 7GHz currently proposed, permitting more space for upcoming devices to aggregate spectrum for massive bandwidth. “Very wide bandwidth operations” would call for “20 gigahertz or more to function optimally,” Apple notes, and could have benefits for “environmental protection, human safety, and manufacturing.”

What is this spectrum good for?

Currently, the frequencies that Apple is commenting on are unused — or “greenfield,” as Apple puts it. But that doesn’t mean that there aren’t many different scientists and industry researchers who are starting to come up with ideas for those frequencies. The big advantage to millimeter wave is that it can achieve very high data rates, with much more bandwidth than current cellular networks.

“As Apple says in its filing no one really knows what’s going to happen with that very high spectrum. But since something will someday it’s time to create a mechanism to use it. Maybe not Apple’s preferred unlicensed mechanism,” wireless consultant Steve Crowley told Business Insider in an email. “Regulation takes time, the standardization process takes time, product development takes time. It doesn’t hurt to take the first step.”

The FCC took that first step earlier this year, by filing a notice inviting comment on its proposed rules, which is what Apple responded to. “Now, I realize that some are skeptical that this spectrum can be used productively,” said FCC Chairman Ajit Pai in a statement earlier this year. “But the skeptics have been proven wrong before,” Pai added.

The more spectrum that remains unlicensed, the more likely it is that Apple can experiment in those radio frequencies and build them into its future products. The spectrum used by cellular networks is licensed, for example, but Wi-Fi uses unlicensed spectrum, which enabled Apple to use it in innovative ways, such as for wireless speakers and network syncing.

The FCC also makes money by auctioning licenses to specific bands of spectrum. And if FCC declares that a new slice of spectrum is unlicensed, that means Apple can access it for free. The question remains what it could be used for. One possibility is to use those frequencies for infrastructure to enable “5G” or for fixed broadband access.

“I’d expect first uses of bands 95 GHz and above to be used for 5G small cell backhaul — interconnecting the millimeter wave cells connecting handsets, and fixed users, below 95 GHz,” Crowley told Business Insider. “Currently, bands under study (by whom?) include the so-called W-band (92-114 GHz) and D-band (130-175 GHz),” Crowley added.

Apple’s interest in millimeter wave:

Apple devices currently use Intel and Qualcomm modem chip sets to connect to cellular networks. The referenced FCC filing is only the latest sign that Apple is currently experimenting with millimeter wave technologies, which are expected to be a big part of “5G” networks, even if not used for mobile broadband access (see opinions above and below).

Apple has been testing millimeter wave technology in Cupertino, California since last May on the 28 GHz and 39 GHz, bands that are lower than the ultra-high spectrum Apple commented on. Earlier this year, Apple applied to make both of its Cupertino, CA headquarters into “innovation zones” which would enable it to run tests more easily without regulatory headaches and applications.

Apple devices access spectrum in numerous licensed and unlicensed frequency bands. For example, iPhones use spectrum ranging from 13 megahertz (contactless payments via Apple Pay) to 5 gigahertz (802.11ac Wi-Fi with MIMO) and support more than 18 different LTE bands,” according to the Apple application, which was also signed by Neumann, the senior Apple engineer.

Last month, Apple pulled a job listing off of its site for a “mmWave IC design engineer,” which suggested it planned to build chips to work on 5G networks. Currently, Apple buys its modems from Qualcomm and Intel.

Experts have said that millimeter wave “might wind up being a kind of middle mile technology, connecting small cells which in turn connect to our phones or big ticket items like buses and home modem.” Also, “This could be could be part of a wider system that Apple are working on in order to be able to serve more different devices perhaps expanding their own router system with millimeter wave.”

Apple CEO Tim Cook has said that Apple wants to own all of its core technologies— and that likely includes the modem chips that connect Apple devices to networks like those operated by Verizon and AT&T. But even if that’s not part of Apple’s plans, the company clearly wants to understand these extremely high frequencies well.

………………………………………………………………………………………………………

Opinion of Venture Beat:

It’s unlikely that Apple will actually use spectrum in the 95GHz to 3,000GHz range for consumer products anytime soon, but the fact that it’s even considering the future of next-generation and next-next-generation wireless right now is quite interesting — a hint that its planning horizon is closer to a decade or two than a year or two ahead of current trends.

Qualcomm president Cristiano Amon announces that 19 manufacturers and 18 carriers will be using Snapdragon X50 modems to roll out 5G devices to customers in 2019. Image Credit: Jeremy Horwitz/VentureBeat

Reference:

Alan’s comment:

To its credit, Apple is one of very few technology companies to have made no public commitments regarding impending 5G technology. Perhaps they will wait till all the hype, spin and nonsense fades into the background.

GM and Toyota back DSRC to link connected cars to “smart” traffic lights; Ford, BMW, other auto makers favor “5G”

by Chester Dawson

Excitement around “5G” is eclipsing the prospects for a competing technology that General Motors Co. and Toyota Motor Corp. are backing, potentially giving rivals a leg-up in the race to debut vehicles with state-of-the-art internet connectivity.

The U.S. government has invested hundreds of millions of dollars in Wi-Fi-based technology known as DSRC (dedicated short-range communications)[1], that allows cars to link to “smart” traffic lights designed to smooth congestion and provide warnings about accidents or poor weather conditions ahead.

Note 1. DSRC (Dedicated Short Range Communications) is a two-way short- to- medium-range wireless communications capability that permits very high data transmission critical in communications-based active safety applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

GM and Toyota strongly support DSRC technology. But Ford Motor Co., BMW AG and other auto makers are pressing the Trump administration to allow them to leapfrog that system by fast-tracking fifth-generation cellular broadband in automobiles. “5G” will transmits data at up to 10 times the speed of current broadband and improves reliability by potentially shrinking a self-driving car’s ability to stop to one inch, from one yard with today’s network.

The showdown between the Wi-Fi-based and 4G or 5G cellular-based standards for connected cars echoes winner-take-all format wars in other industries, and is a sign of how software is emerging as a new battleground for auto makers. The stakes are high as U.S. motor-vehicle deaths have risen in recent years. Car makers say vehicle-to-vehicle communication will ease congestion and improve safety.

Speeding up adoption of new technology is a priority for an industry that has lagged behind mobile-phone makers when it comes to connecting devices to the internet. The global market for connected cars is forecast to grow nearly threefold by 2022 with more than 125 million new internet-connected cars shipped over that five-year period, according to Counterpoint Research.

Current broadband, known as 4G, has enabled Wi-Fi hot spots and streaming, allowing passengers to surf the internet or watch videos in cars. The next wave of cellular technology will usher in new entertainment and safety features, enabling cars to access cameras on other vehicles that could alert them to accidents, obstacles and driving conditions.

Ultimately, drivers might even be able to order a Starbucks drink from their dashboard or take a nap while artificial intelligence operates the vehicle. Companies like BMW say faster data transmission through next-generation broadband is critical to accelerating this push.

“We are on a broader scale pushing the telecommunication companies to roll out 5G as quickly as they can,” said BMW management board member Peter Schwarzenbauer.

GM and Toyota, meanwhile, have models already equipped with DSRC, and are urging the Trump administration to support a 2016 proposal that would require auto makers to start phasing it into new cars as of 2021. The Transportation Department has yet to make a final ruling on that Obama-era proposal, even as auto makers are already well into the design phase of 2021 model year vehicles.

“Getting the rest of the industry to follow has been tough sledding,” said Steve Schwinke, director of GM’s advanced development and connected services.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

One issue with the technology backed by GM and Toyota is cost. Telecom companies plan to pay for upgraded cell towers and roadside antennas for 5G to service their existing networks. To fully deploy DSRC, billions of dollars in government-funded infrastructure is required, according to a U.S. Transportation Department estimate.

That short-range technology also would add about $300 to the price of a vehicle for dedicated equipment, the National Highway Traffic Safety Administration estimates. Most new vehicles come installed with cellular modems, so there would be little additional cost to drivers for 5G.

GM and Toyota alone account for about one-third of the new cars sold in the U.S., and roughly 20% of the vehicles sold world-wide. Toyota has delivered more than 100,000 cars equipped with DRSC in Japan and will offer it on most of its lineup in the U.S. by the mid-2020s in addition to cellular modems.

GM and Toyota see their Wi-Fi-based technology as a bridge to 5G, which has yet to be fully tested in vehicles and may take years to be fully deployed.

Critics say the government shouldn’t force car makers to use older Wi-Fi-based technology some say is out of sync with fast-evolving cellular broadband. Last month, Audi and Ford demonstrated cellular-based safety technology called C-V2X in what they said was the world’s first application of it using vehicles from different manufacturers.

“You will have, for the first time, cars speaking together and it’s important for them to speak the same language,” said Christoph Voigt, head of R&D connectivity for Audi. As chairman of 5GAA, a trade group supporting automotive 5G, Mr. Voigt petitioned federal regulators to avoid “directly or indirectly pick[ing] technology winners and losers” because he is confident 5G will become the de facto standard on its own merits.

Even as Volkswagen AG is aligning its premium Audi brand with 5G in the U.S. and China, it is hedging its bets by deploying a version of DSRC on VW branded vehicles in Europe starting next year. A representative for VW said the German auto maker currently has no plans to introduce that technology to its lineup in the U.S. market.

The Trump administration, pointing to the expected proliferation of 5G, this year blocked the takeover of U.S. chip maker Qualcomm Inc. by Singapore-based Broadcom Ltd. on national-security grounds. Qualcomm is negotiating chip supply contracts with at least half a dozen auto makers for coming models.

Industry experts say 5G smartphones will debut next year and the first cars with 5G modems will appear as soon as 2020. That is about twice as fast as the transition for current 4G technology, which was introduced for smartphones in 2011 but didn’t show up in cars until GMintegrated it into its latest version of OnStar remote communications in 2014.

“There is going to be 5G in every single next-generation car design,” said Nakul Duggal, the head of Qualcomm’s automotive business.

Write to Chester Dawson at [email protected]

References:

https://www.wsj.com/articles/auto-makers-at-odds-over-talking-car-standards-1525608000

https://www.its.dot.gov/factsheets/pdf/JPO-034_DSRC.pdf

https://www.its.dot.gov/factsheets/dsrc_factsheet.htm

https://en.wikipedia.org/wiki/Dedicated_short-range_communications

IHS Markit: $3.5 Billion to be spent on Carrier Wi-Fi equipment between 2018 and 2022

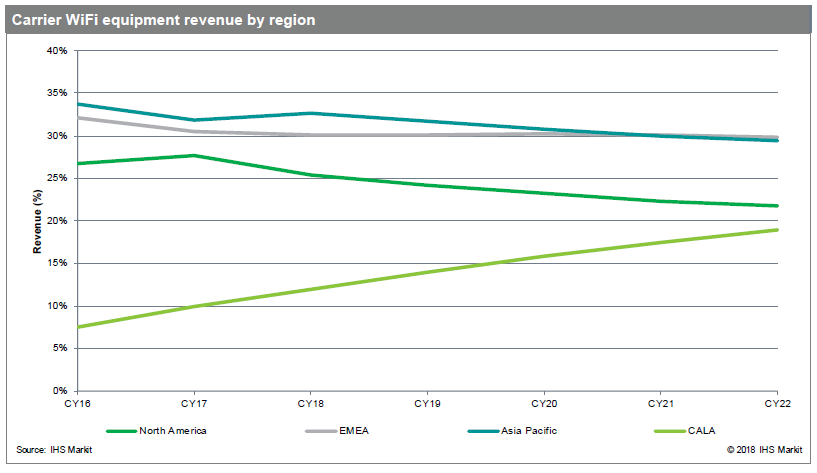

by Richard Webb, IHS Markit

The carrier Wi-Fi equipment market continued to grow in 2017, driven by ongoing broadband demand and a strong role within 5G era. Revenue reached $626 million for the full-year 2017, increasing 1.3 percent from the prior year.

By 2022, the market is forecast to hit $725 million — a cumulative size of over $3.5 billion from 2018 to 2022 — based on two strong segments: standalone Wi-Fi access points (predominantly deployed by fixed-line operators and wireless ISPs) and dual mode Wi-Fi/cellular access points (deployed by mobile operators).

“The arrival of the 5G era will gradually transform network architectures, but the requirements for network density mean that Wi-Fi will continue to play a strong support role for mobile broadband end-users and for newer applications such as the Internet of Things and smart city,” said Richard Webb, director of research and analysis for service provider technology at IHS Markit. “We expect an uptick in carrier Wi-Fi investments through 2020, aligned with 5G network development.”

All regions are seeing strong demand for carrier Wi-Fi, demonstrating evidence of proliferation in developing countries in addition to developed markets where mobile data growth is well documented. However, the scale of requests for proposals (RFPs) from mobile operators in Asia Pacific — in particular China and Indonesia currently, with India likely to add to the groundswell closer to 2022 — means the region will be the strongest driver of growth, although all regions see continuous growth through this period.

More carrier Wi-Fi market highlights

- Dual mode 3G/Wi-Fi equipment revenue totaled just $17 million in 2017, a decline of 66.4 percent from the prior year

- Meanwhile, subscriber identity module (SIM)–based Wi-Fi access points are experiencing solid adoption growth (+21.6 percent in 2017 from 2016), driven by the desire to have closer integration between Wi-Fi and the mobile network

- Network functions virtualization (NFV) has strong potential benefits for fixed and mobile operators alike, such as opex and capex efficiencies, service flexibility and creation, reduced power usage and new service environments, including data analytics and location-based services

Carrier WiFi Equipment Market Tracker – H2 2017

This report tracks Wi-Fi equipment deployed by operators in public spaces for wireless internet access. It provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for Wi-Fi hotspot controllers and carrier Wi-Fi access points.

Reference:

……………………………………………………………………………………………………………………………………………………………………………………….

In a separate report, Markets & Markets forecasts the Wi-Fi Market to be worth $15.60 Billion by 2022:

The rapid adoption of Wi-Fi technology is expected to make North America the largest region in market.

North America consists of developed economies, the US and Canada. In this region, Wi-Fi solutions and services are gaining traction within the businesses. The region’s strong financial position also enables it to invest heavily in the Wi-Fi technology. These advantages have provided North American organizations a competitive edge in the market. Moreover, the region has the presence of several major Wi-Fi vendors. Therefore, there is strong competition among the players. The number of enterprises adopting Wi-Fi solutions and services is quite high in North America as compared to the other regions.

The major vendors offering Wi-Fi solutions and services across the globe include Cisco (US), Aruba (US), Ruckus Wireless (US), Juniper Networks (US), Ericsson (Sweden), Panasonic (Japan), Huawei (China), Alcatel-Lucent Enterprise (France), Netgear (US), Aerohive Networks (US), and Riverbed Technology (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships, and collaborations, to enhance their position in the Wi-Fi market.

T-Mobile, Sprint Combo Bypasses Dish; With spectrum plus linear and OTT subscribers, satellite provider was seen as a logical partner

By Michael Farrell of Multichannel News

The announced merger of T-Mobile and Sprint, the third- and fourth-largest wireless carriers in the nation, answers many of the scale questions that have dogged the two companies over the past several years. But in creating a carrier with about 100 million customers and valued at a combined $146 billion, the deal bypasses what many had considered to be T-Mobile’s more perfect match: Dish Network.

With a large swath of wireless spectrum, 11 million satellite TV subscribers and 2.2 million customers for its over-the-top video service Sling TV, Dish was seen by many to be a logical target for T-Mobile. Combining the No. 3 wireless carrier, which has obvious video aspirations through its January purchase of Layer3 TV, with Dish would in many minds have created a strong competitor in the ongoing wireless-OTT-traditional video wars.

Investors apparently believed so too. Shares in Dish fell 3% ($1.19 each) to $33.55 per share on April 30, the first trading day after T-Mobile and Sprint announced their deal. The stock has continued to slip in subsequent trading, closing at $33.09 on May 3.

Video Plans ‘Ratchet Up’

On a conference call to discuss first-quarter results shortly after the Sprint deal was announced, T-Mobile chief financial officer Braxton Carter said the transaction “ratchets up” the wireless provider’s video plans by allowing the combined company to provide customers with an IPTV service via wireline and wireless broadband.

“So T-Mobile’s in the position as a new T-Mobile to be able to offer a quad play, if that’s what the market wants,” Carter said on the call.

The combined company will be controlled by T-Mobile management: CEO John Legere will continue that role in the new entity, as will T-Mobile chief operating officer Mike Sievert. T-Mobile parent Deutsche Telekom will own 42% of the combined company, with Sprint parent Softbank owning 27% and the remaining 31% held by the public. The deal is expected to close in the first half of next year.

This is the two companies’ third time on the merger dance floor together. They scrapped talks in 2014 over regulatory concerns and in 2017 over control issues. While the two have managed to work out their control issues, some analysts are skeptical that the current deal will sail easily through the regulatory process.

BTIG telecom analyst Walt Piecyk gave the merger a less than 40% chance of passing regulatory muster, primarily because he didn’t believe the deal, which will reduce the number of wireless competitors to three from four, will pass the antitrust smell test.

“It doesn’t look like a competitive market right now, and that’s what the regulator may focus on,” Piecyk told CNBC.

Columbia Law professor Tim Wu wrote an op-ed piece for The New York Times urging regulators to block the deal, adding that having four separate competitors has been most beneficial to wireless customers, leading to free unlimited data plans and lower prices. Transforming the wireless business into a “triopoly” like the airline business will only serve to raise prices and lower service.

“Competition has actually worked the way economists say it is supposed to, forcing firms to improve quality or face elimination,” Wu wrote in the Times. “But it takes competitors to compete, which is where blocking mergers comes in.”

Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak has said in research notes over the past year that pairing Dish and T-Mobile would “immediately vault the most disruptive U.S. wireless player into the leading U.S. spectrum position,” and at worst would force rival wireless company Verizon Communications to pay more for the satellite asset. For now, though, it looks like Dish will remain on its own. Other scenarios see the satellite company being acquired either by another wireless service provider, like Verizon, or even by the new T-Mobile. The latter scenario wouldn’t take place for at least another year. Dish has struggled over the past several quarters as the satellite business has dwindled. In the fourth quarter the company lost more than 100,000 satellite-TV subscribers and added 160,000 Sling TV customers.

Dish Misses Out on Buildout Relief

For Dish, a purchase by a wireless carrier would mean relief from its obligation to build its own wireless network. As a result of its success in bidding on spectrum in several of the government’s wireless auctions, Dish faces a March 2020 deadline to build out wireless service in 70% of the market territories it won.

Dish chair Charlie Ergen has said the company will spend about $1 billion on that initial phase, which will be more geared toward IoT services.

For T-Mobile, a Dish purchase would give it an instant video base through the satellite-TV offering, programming contracts with cable networks and the largest OTT service in the country, Sling TV.

But not all analysts believe that a T-Mobile-Dish deal is more palpable. In a research note in November, after T-Mobile and Sprint ended merger talks, MoffettNathanson principal and senior analyst Craig Moffett wrote that he never saw any synergies in combining those companies, other than as a source of additional spectrum.

The argument that the dissolution of the merger was bad news for Dish is equally compelling in that, if Dish does build its wireless network, it would become the fifth player in an already-crowded market, he added.

“However bad one might have imagined the ROI (Return on Investment) for network building, it has to be worse if the industry is more fragmented than expected,” Moffett wrote in November.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dish’s Spectrum Yet to be Deployed: