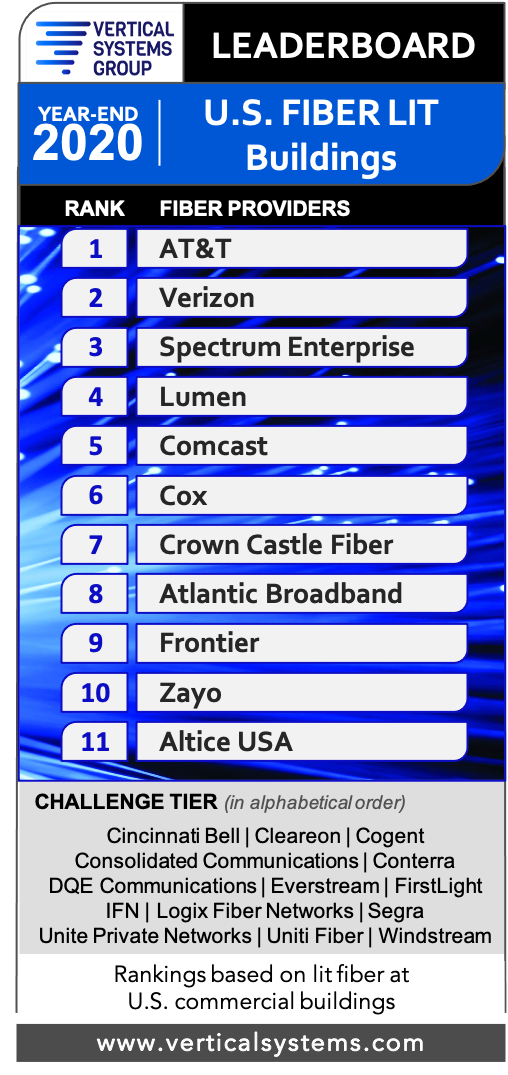

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

Vertical Systems Group’s 2020 U.S. Fiber Lit Buildings LEADERBOARD results are as follows (in rank order by number of on-net fiber lit buildings): AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast, Cox, Crown Castle Fiber, Atlantic Broadband, Frontier, Zayo and Altice USA. These eleven retail and wholesale fiber providers qualify for this benchmark with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2020.

Additionally, fourteen companies qualify for the 2020 Challenge Tier as follows (in alphabetical order): Cincinnati Bell, Cleareon, Cogent, Consolidated Communications, Conterra, DQE Communications, Everstream, FirstLight, IFN, Logix Fiber Networks, Segra, Unite Private Networks, Uniti Fiber and Windstream. These fiber providers each qualify for the 2020 Challenge Tier with between 2,000 and 14,999 U.S. fiber lit commercial buildings.

“The base of fiber lit buildings in the U.S. expanded in 2020, although the pace of new installations was hampered by the pandemic. Challenges for fiber providers ranged from impeded installations due to commercial building closures and business shutdowns to supply chain disruptions,” said Rosemary Cochran, principal of Vertical Systems Group. “As the economy rebounds in 2021, fiber providers have opportunities to monetize the millions of small and medium U.S. commercial buildings without fiber, as well as larger multi-tenant buildings with only a single fiber provider. However it remains uncertain how changes in U.S. regulatory policies and federal funding could alter fiber investments and deployment plans in the next several years.”

2020 Fiber Provider Research Highlights:

- AT&T retains the top rank on the U.S. Fiber Lit Buildings LEADERBOARD for the fifth consecutive year.

- The threshold for a rank position on the 2020 Fiber LEADERBOARD is 15,000 fiber lit buildings, up from 10,000 buildings previously.

- Atlantic Broadband advanced to eighth position on the LEADERBOARD, up from eleventh in the previous year.

- Windstream and Consolidated Communications move into the Challenge Tier from the LEADERBOARD.

- Vertical Systems Group’s 2020 U.S. fiber research analysis for five building sizes shows that fiber availability varies significantly based on number of employees. The Fiber 20+ segment, which covers four building sizes with twenty or more employees, has a 69.2% fiber lit availability rate. This compares to 14.1% availability for the Fiber <20 segment, which covers buildings with fewer than twenty employees.

Market Players include all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings. The 2020 Market Players tier includes more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): ACD.net, Armstrong Business Solutions, C Spire, Centracom, CTS Telecom, Douglas Fast Net, EnTouch Business, ExteNet Systems, Fatbeam, FiberLight, Fusion Connect, Google Fiber, GTT, Hunter Communications, LS Networks, Mediacom Business, MetroNet Business, Midco Business, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Syringa, TDS Telecom, TPX Communications, U.S. Signal, Veracity, Wave Broadband, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

One thought on “VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020”

Comments are closed.

Google Fiber is included in VSG “Market Players”tier- all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings.

Google Fiber says it’s here to stay, even as competitors point out its exits elsewhere

When Google Fiber announced earlier this year that it would be exiting the Louisville, Ky., market, people were quick to wonder whether this might mean other markets, such as the Triangle, could be next. Google’s parent company has not expanded across the country as fast as some thought it would, only operating in around a dozen communities.

And now Google Fiber’s competitors in the Triangle — one of the best-connected areas in the country — are trying to take advantage of any doubt that might exist around the stability of the service. Spectrum, one of several companies offering high-speed internet connections in the Triangle, sent a letter to some Google Fiber customers recently warning them: “Google is canceling Internet service in Louisville. Don’t wait to be the next city.”

The warning is followed by a deal Spectrum would offer Google Fiber customers to switch over. Joe Mancini, head of sales for Google Fiber’s Triangle operations, called the letter a “scare tactic,” adding that despite what happens in Louisville, Google Fiber is here to stay in the Triangle.