Opinion: How virtualization and open source are upending the entire telecom industry

Article below written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research

[Note that the IEEE Techblog content manager (since April 2009) does not agree with the theme of this article. We believe that the only really big customers of virtualization and open source hardware/software are the largest tier 1 telcos (like AT&T, Telefonica, etc) and the big cloud companies (like Amazon, Google, Microsoft, Facebook, Alibaba, Tencent, etc).

- One of the big problems with network virtualization is that you have a single point of failure (the server running virtual network functions) and also a much larger attack surface for cyber attacks.

- The biggest obstacles to using open source hardware and software are systems integration, multi-vendor interoperability and compatibility and tech support, especially related to failure isolation and recovery. Other issues with deploying open source include performance (vs purpose built hardware/firmware/software) and OPEX associated with integrating and maintaining hardware/software from multiple vendors.

However, we like to present different views and provide balanced coverage of telecom tech topics like open networking and open source hardware/software. So please enjoy the below article and comment in the Comment box below it.]

………………………………………………………………………………………………………………………………………………..

Posted by: Anasia D’mello. Article written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

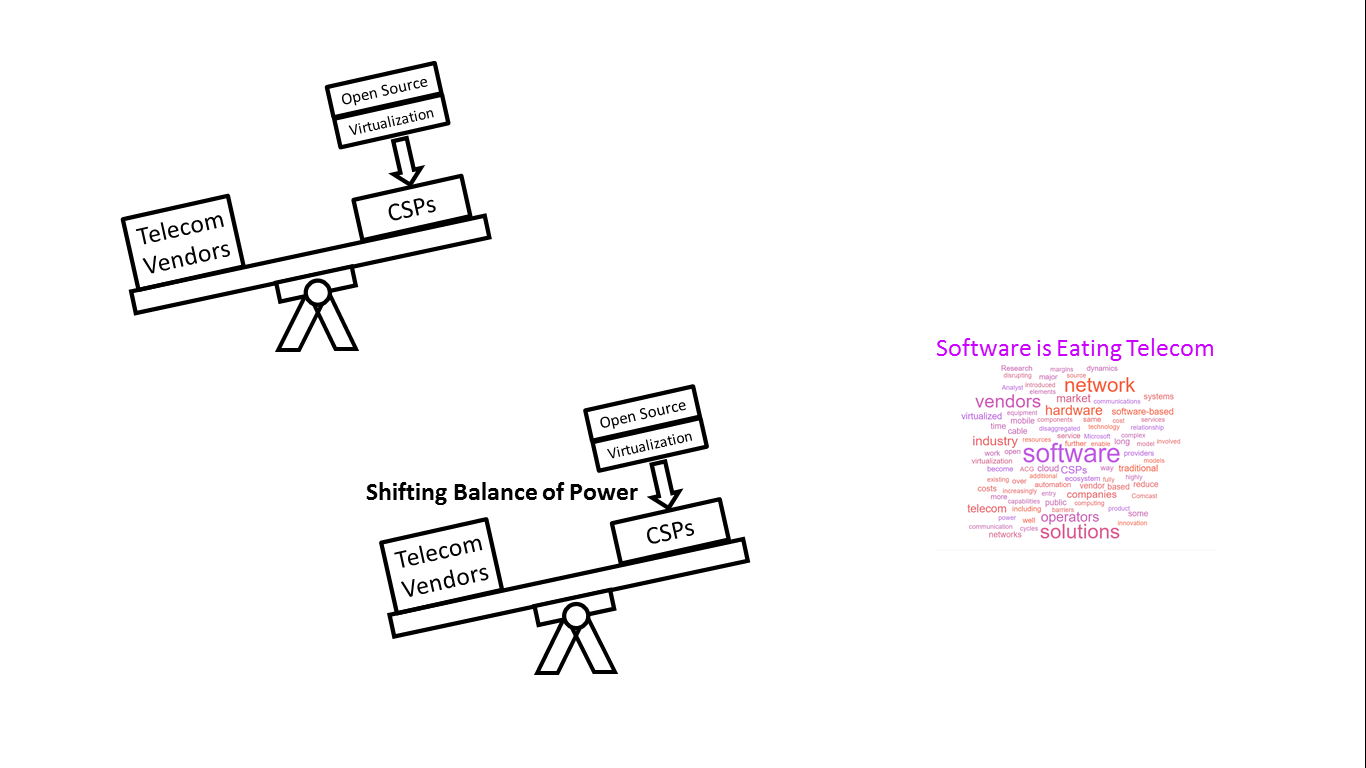

Until recently, network technology vendors to communication service providers (CSPs) had a well-established competitive market position with brand loyalty, long-standing customer relationships, and well entrenched proprietary solutions. However, an inexorable move to software-based (virtualised) solutions, combined with the increasing prevalence of open-source resources, is disrupting the market dynamics and will have profound implications for the industry structure.

Traditionally, telecom network technology vendors supplied bespoke solutions, typically consisting of hardware racks populated with purpose-built circuit boards that performed highly specialised tasks, complemented by highly customised software, with complex back office systems to manage these systems and the applications that run on them. These solutions were supplemented by extensive professional services resources, and typically involved regular software upgrades, and, less frequently hardware ones.

This, combined with the long cycles involved in introducing new solutions, or in upgrading existing ones due to long testing cycles, created a relatively closed ecosystem with high barriers to entry and high switching costs. It also drove costs up, as it increased the bargaining power of suppliers; it limited the number of competitors and stifled innovation because younger companies with fewer resources found it difficult to penetrate the ecosystem.

The disruptive nature of virtualization

The inexorable migration to software-based, virtualized solutions is disrupting this ecosystem, with profound long-term consequences. Increasingly, telecom operators are introducing virtualized software solutions in their operating environments. Their long-term goal is of a fully software-driven ecosystem with software-only network elements running on commodity off-the-shelf servers (COTS) or open source hardware, hosted in local offices, in distributed data centres or in a cloud-compute environment.

The software-based systems are not less complex, and the incumbent vendors are rushing to either port their existing solutions on COTS or redeveloping parts of those systems to become software based. It also allows new software vendors to enter the market without the long design, manufacturing, and logistics supply chains of traditional hardware.

At the same time, the CSP traditional development/deployment paradigm, which was largely based on the waterfall model and involved protracted cycles, is slowly making way to an agile framework, based on the Continuous Integration/Continuous Deployment model where incremental changes are introduced on an on-going basis, enabled by a microservices-based, modularised architecture.

This paradigm allows minimally viable products to be introduced and then rapidly enhanced, reducing the entrenched foothold of existing suppliers and opening the way for new entrants, further transforming the market dynamics.

By reducing the barriers to entry, virtualization is adding new vendors and new delivery mechanisms that bypass the traditional supply chains: New virtual network software companies, public cloud companies, and the network operators themselves.

- New virtual network software companies: New software-centric companies have entered the market over the last several years. Examples include Affirmed Networks, Altiostar and Parallel Wireless that offer a software-based mobile core solution, Etiya that provides a nearly fully virtualised mobile solution (running on an AWS public cloud infrastructure), and Metaswitch that offers a wide range of mobile and fixed network software-based network technologies. Other traditional software vendors to operators, such as HPE, are also entering the virtualised network equipment market.

- Public cloud companies: Cloud providers are increasingly tapping into the convergence of cloud and communication networks. Recently, Microsoft bought Affirmed Networks, which offers fully virtualized, cloud-native mobile network solutions for telecom operators. This acquisition will enable Microsoft to become a major telecom vendor in the mobile and nascent private 5G markets. In days past, communication service providers (CSP) used to build their own data centres, but virtualisation technologies enable cloud providers, such as Microsoft, to offer the same capabilities, mostly as services, on their public computing and storage infrastructure at much lower initial cost and with more flexibility.

- DIY: Some CSPs are hiring software developers in droves and are beginning to develop their own solutions. Not only that, but some operators are also transforming themselves into vendors, offering their solutions to their peer operators. A case in point is Comcast Corp. The company’s mantra has become “software eats the world.” Its newly opened Comcast Technology Center serves as “the dedicated home for our company’s growing workforce of more than 4,000 technologists, engineers and software architects.” Comcast has developed its Xfinity X1 entertainment service in-house; it is also syndicating it to cable operators, including Cox and Shaw and Rogers of Canada. At the same time, the company has developed a software-defined platform (ActiveCore) to power its business services, and it is not unfathomable that it would look to syndicate it at some point in the future.

Others CSPs are expanding their software capabilities for internal, and external, use. Reliance Jio’s parent company, Reliance Industries, bought Radisys, a US-based provider of open telecom solutions, while AT&T’s expansion of its software capabilities is well-known in the industry.

The role of open-source collaboration

Most operators do not have the capacity nor the ability to undertake massive development efforts, particularly because some of the solutions they need are highly complex. However, open-source hardware and software and disaggregated network elements go a long way to alleviate the need to undertake end to end developments.

Recent disaggregated network element (DNE) projects, some including open-source hardware and software, have been created by CSPs throughout the various telecom equipment domains, from radio backhaul to the core networks, optical access and transport equipment, and edge computing environments, among many others. DNEs are essentially public open source Lego-like building blocks that run on standard computing and storage hardware or programmable ASICs that standardise designs and that can be used to create solutions. They enable CSPs to select the best combination of commoditised hardware and specialised software components. DNEs are designed to reduce vendor lock-ins and further lower the barriers to entry for new vendors, increasing competition in sales and support.

The operator–vendor new relationship framework

New engagement models are emerging. The traditional supplier/customer relationship is making way to a cooperative engagement model, where the operator and the vendor work hand in hand on developing solutions. Furthermore, unlike traditional models where the vendor is paid upfront and is further compensated for on-going support, new frameworks are emerging where the vendor is compensated based on the success of the operator. One such arrangement was the Infinite Broadband Unlocked that Cisco introduced in 2018 where it charged cable operators based on broadband consumption over their networks, rather than upfront licenses. Such arrangements are facilitated by software-based solutions and are likely to become more prevalent over time, further disrupting market dynamics.

Toward the future

The commoditisation of the hardware components of the network will reduce the vendors’ margins and potentially reduce overall CSPs’ costs. However, the CSPs will have to bear the additional costs of testing multivendor arrangements, configuring, and managing the larger number of network components, as well as securing the entire network.

These additional costs will eat into the potential savings and are expected to require a hefty dose of automation. Such automation will come from vendors, systems integrators, as well as from additional open-source initiatives such as the ONAP program, the open-source version of the AT&T ECOMP home-grown system that seeks to provide real-time, policy-driven software automation of AT&T’s network management functions.

It is too early in the game to scope the full impact of this unfolding transformation. It is likely that it will increase the speed of innovation and improve the cost structure for operators. At the same time, intense competition may reduce vendors’ margins, decreasing their ability to invest in R&D. However, an increasingly symbiotic relationship between operators and vendors will improve industry dynamics, overall, as it will lead to better targeted solutions, more cost efficiency and improved customer experience.

Conclusion

Technological changes and industry realignment are enabling CSPs to gain greater market control and to reap larger efficiencies by replacing monolithic hardware and software solutions from major vendors with disaggregated networking elements with open-source software on commoditised, standardised hardware, and by adopting co-development models. This will reduce the pricing power of major vendors and compress their margins but may lead to greater innovation in the industry.

The authors are Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

Liliane Offredo-Zreik

Dr. Mark H Mortensen

About the authors

Liliane Offredo-Zreik ([email protected] @offredo) is a principal analyst with ACG Research. Her areas of coverage include the cable industry, SD-WAN, and communications service provider digital transformation. Prior to her analyst work, she held senior roles in major telecom and cable companies, including Verizon and Time Warner Cable (now Charter) as well as with industry vendors and has been an industry advisor in areas including marketing, strategy, product development and M&A due diligence.

Dr. Mark H Mortensen ([email protected] @DrMarkHM) is an acknowledged industry expert in communications software for the TMT sector, with over 40 years of experience in OSS and BSS specifications, network operations, software architecture, product marketing, and sales enablement. His work has spanned the gamut of technical work at Bell Labs, strategic product evolution at Telcordia, CMO positions at several software vendors, and as a research director at Analysys Mason. He is currently the Communications Software Principal Analyst at ACG Research focusing on network and business automation.

……………………………………………………………………………………………………………………………………………….

3 thoughts on “Opinion: How virtualization and open source are upending the entire telecom industry”

Comments are closed.

Alan comment on LinkedIN: Hi Bruce, Want to weigh in with your opinion on whether any but large tier 1 telcos are using network virtualization? Point/counter-point (for or against): Is virtualization and open source are upending the entire industry?

LinkedIn reply comment from VMWare VP Bruce Davie:

Hi Alan, nice to hear from you after so long. I pretty much agree with the headline of that article. In my experience NFV has at least reached pilot stage at most telcos (and well past it in many), not just the big ones, and that does generally imply network virtualisation as one of the ingredients. And of course SD-WAN is another technology (which has much in common with network virtualization) that is getting great traction with the telcos of all sizes.

https://www.linkedin.com/feed/update/urn:li:activity:6681375783535177730/?commentUrn=urn%3Ali%3Acomment%3A(activity%3A6681325572683010048%2C6681375681722634240)

I agree that Network Softwarization has introduced significant flexibility and improved time-to-market, however the following are main bottlenecks that need to be addressed by the industry:

1- opensource software such Openstack is not really open as each vendor or supplier will add customization on top of it and accordingly it is not easy to move a VNF from Openstack version of specific vendor to another.

2- The cost model is shifted from CAPEX to OPEX due to the above fact, while you are not paying Openstack license but you will pay annual support which may hit the license cost.

2- The OPEX associated with Softwarization is significantly higher than the monolithic HW/SW because CSP will consider OPEX for HW vendors including Compute, storage and backup, and virtualization SW such as Openstack and the VNF or the application SW plus automation and orcestration SW.

3- Instead of a single vendor delivers a complete platform, you will need SI and three to five vendors of the above products to deliver a single platform.

4- The same pain will be faced with public cloud providers as each provider is developing its own version of Openstack or containers platforms and accordingly vendor lock-in again and difficult migration from cloud to another.

5- The x86 HW is again a sort of vendor lock-in with mainly a single ODM supplies all vendors in the market.

6- With the current USA/China dispute, the above will be more challenging to be addressed.

Many thanks for your excellent and well documented comment! Please feel free to comment on other IEEE Techblog posts of interest. Type in the subject area of interest in the search bar (upper left of webpage) and you will get articles matching that search term. All best, Alan