Arthur D Little: 10 countries provide >= 95% FTTH coverage; Gigabit Fiber driving take-up of new apps and services

Gigabit broadband can be delivered using cable DOCSIS, fiber or other 5G-based technologies. This ADL report focuses on the rollout, take-up and services delivered with fiber -based gigabit broadband networks. ADL especially considers the developments made in fiber take-up and gigabit services enabled by fiber. See the previous edition of this study, “Race to gigabit fiber: Telecom incumbents pick up pace”4 for further details on which markets are taking the lead on fiber rollout and the deployment models used for it.

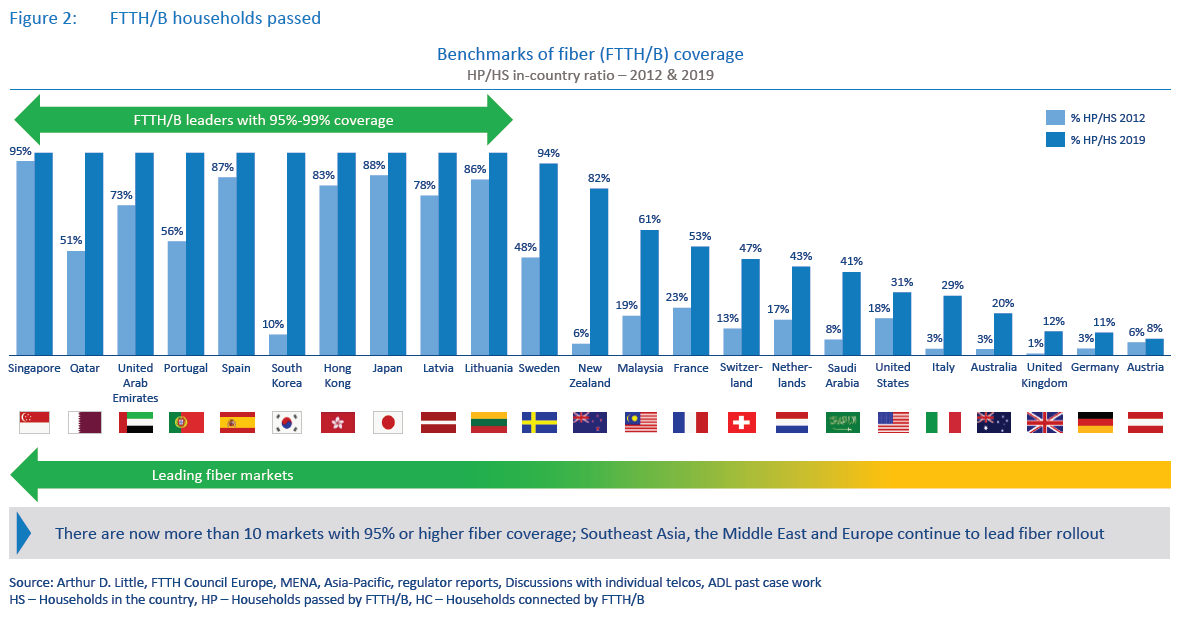

Non-telecom entities such as energy companies, railway operators and local municipalities are also entering the market, with large fiber rollout plans in fiber-lagging countries such as Italy, Germany and Austria, to bridge the gigabit broadband gap.With 5G deployment models crystallizing, operators are also considering 5G-based technologies to complement high-cost,

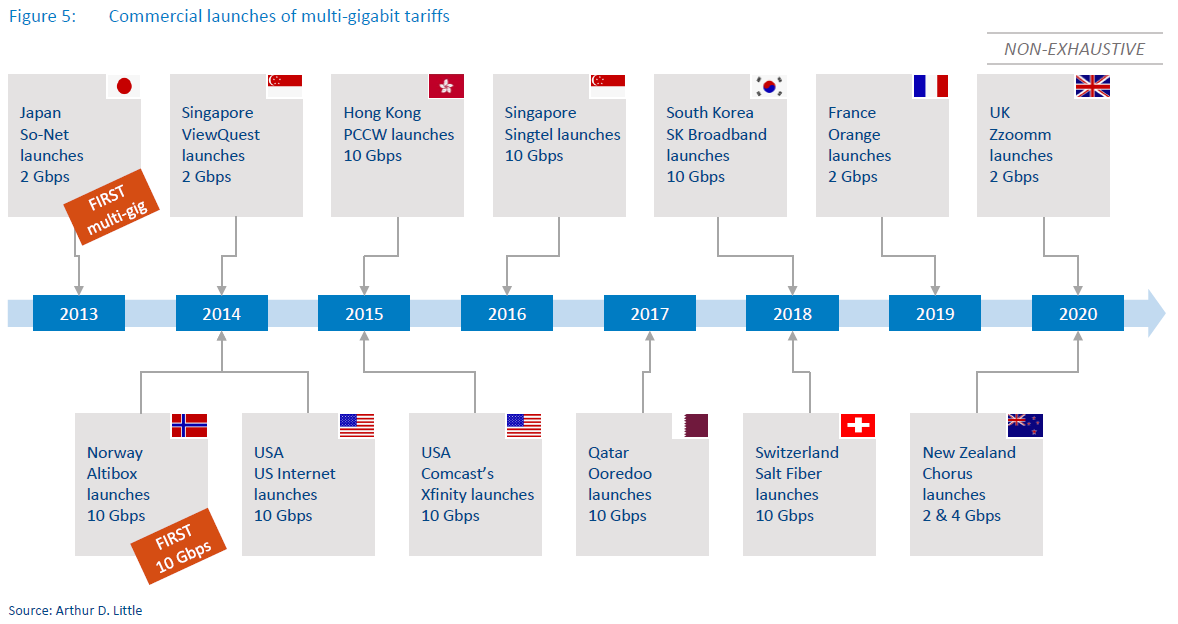

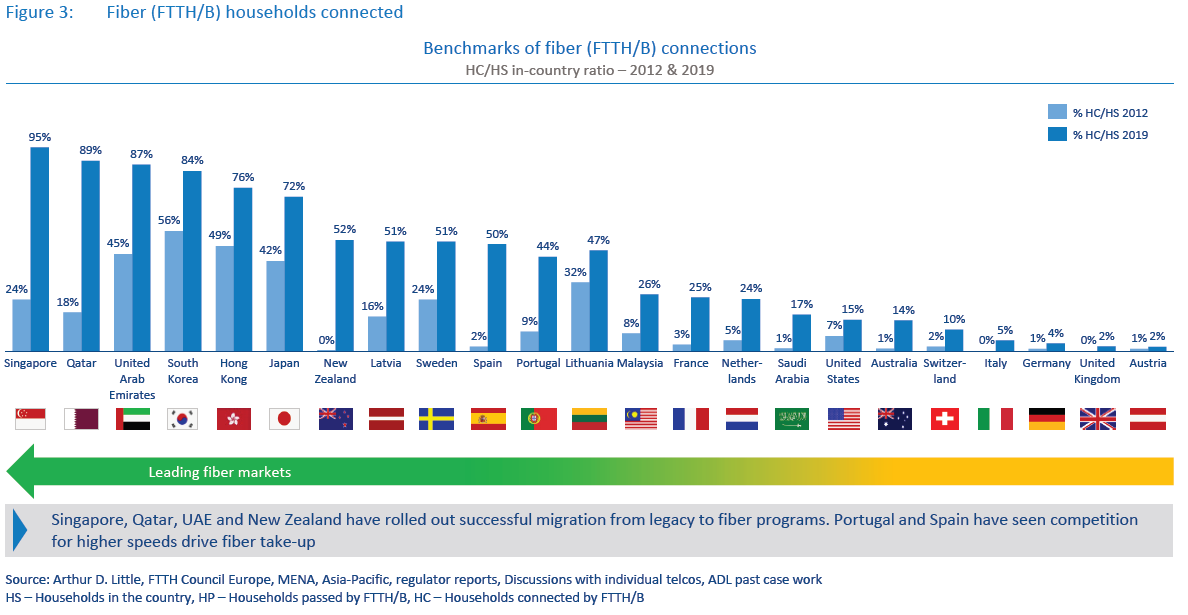

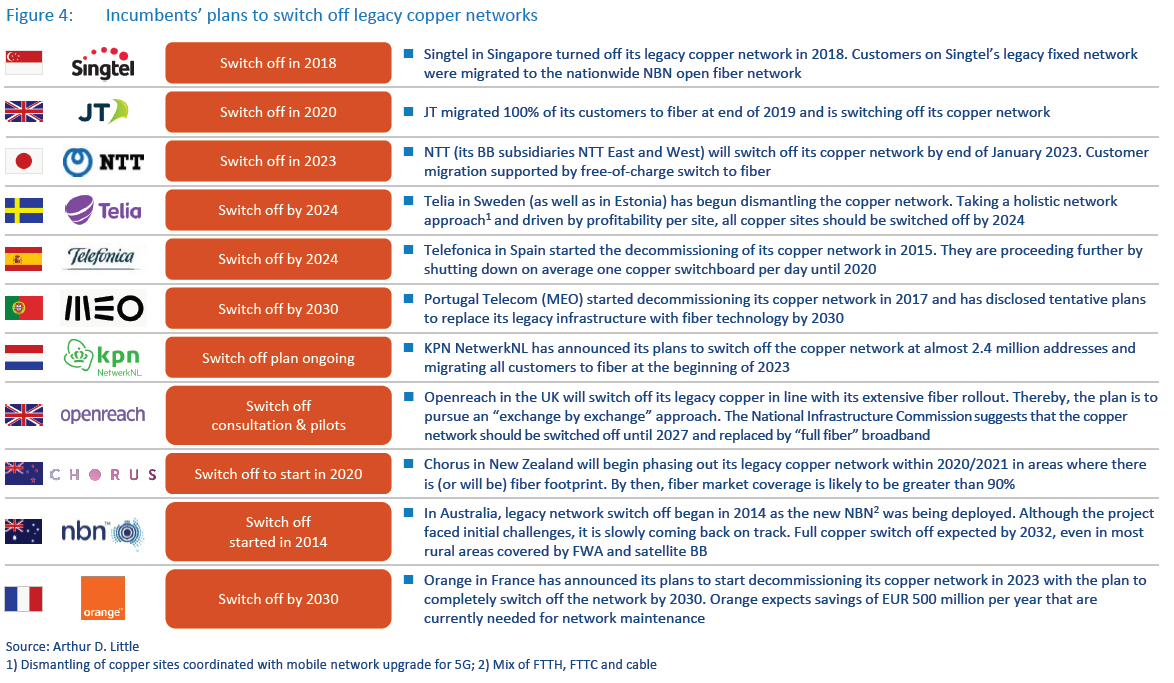

last-mile fiber access, especially in rural areas.While there were big improvements in fiber rollout from 2012 to 2017, take-up was still lagging behind, even though several markets invested large amounts of capex into nationwide fiber. However, we now see take-up rapidly improving, driven by both effective migration of legacy customers to fiber and competition driving demand for higher-speed broadband adoption at home.As the fiber coverage and take-up rates continue to grow, incumbents are increasingly announcing plans to switch off and dismantle their legacy copper networks. Singtel in Singapore turned off its copper network in 2018 and migrated its copper and cable subscribers to fiber, allowing the incumbent Singtel and cable company StarHub to switch off their copper and cable networks. Another example is JT Global in Jersey, which already migrated its entire fixed broadband customer base to fiber and will switch off the copper infrastructure in 2020. Operators in at least three other countries plan to completely migrate their customer base to fiber in the next four to five years (see Figure 4 below).

However, before decommissioning their legacy networks, telcos will need to overcome regulatory and other obstacles, such as providing an alternative to existing regulatory wholesale products and replacing some copper-specific B2B use cases with other technologies. With legacy network switch off, incumbents hope to achieve cost efficiencies especially in network operations. In recent projects, we estimate that fiber networks have up to a 15x lower fault rate and use up to 85 percent less energy compared to legacy copper-based networks.

Fiber is undoubtedly an advanced fixed broadband technology that can efficiently deliver multi-gigabit speeds to a large volume of customers in real-life conditions, especially in dense urban areas. Offering 1 Gbps plans has become the norm in the leading Asian fiber markets such as Singapore, Japan, South Korea and Hong Kong, opening the way for multi-gigabit tariffs.

It has been more than five years since the first 10 Gbps plans were initially introduced in the US, Singapore, Hong Kong and Norway (see Figure 5. below). As of September 2020, we are not aware of any faster commercially available plan for the residential segment. Availability of multi-gigabit plans is still limited to a handful of markets and approximately 10-15 ISPs. However, just in the first half of 2020, there have been at least three ISPs that launched multi-gigabit offers: Zzoomm in the UK, Orange in France and Chorus in New Zealand.

Incumbent operator led deployments continue to play the leading role in fiber deployment today. However, we believe the importance of open access fiber providers will gain in significance, especially in important markets such as Italy, Germany, UK and Saudi Arabia, among others. Large-scale investment by non-telco entities such as energy companies and infrastructure funds, among others, will continue to expand fiber coverage in these markets. (For further details on open access fiber developments, please refer to our other report on this topic.)

An increasing number of incumbents acknowledge the inevitability of switching off and dismantling their legacy copper networks as fiber coverage becomes ubiquitous, while the cost economics of maintaining a fiber network are far superior to maintaining a legacy fixed network. Initiatives for legacy network switch off have been announced in multiple markets, and we expect to see results in larger markets such as Spain, France or Sweden soon. We also see regulators opening up to the idea that fiber-based solutions can eventually replace regulated legacy network–based products, giving a further impetus to open access fiber rollout in some regions.

Gigabit tariffs have become commonplace in developed fiber markets (mostly in Asia) and are increasingly being offered to customers worldwide. However, multi-gigabit speeds are still available only in a handful of markets. Salt in Switzerland is an example of a provider that uses its aggressively priced multigigabit offer to differentiate and disrupt the fiber market and not only as a marketing tool. We expect that, with new fiber rollouts and increasing competition on the broadband markets, the number of multi-gigabit offerings will continue to grow.

Note: This report, “The race to gigabit fiber,” is the 2020 update to Arthur D. Little’s Global FTTH study, published in 2010, 2013, 2016 and 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………..