Verizon is again top U.S. telco brand; AT&T falling behind T-Mobile

According to Brand Finance’s new rankings, Verizon recently widened its lead over AT&T as the world’s most valuable telecoms brand. The firm reported Verizon’s brand rose 8% in its rankings to a value of $68.9 billion.

For the second year in a row Verizon has claimed the title of the world’s most valuable telecoms brand following an 8% increase in brand value to US$68.9 billion. This brand value growth has not only propelled it back into the top 10 most valuable brands globally in the Brand Finance Global 500 2021 ranking, but has meant the brand has continued to widen the lead over second placed AT&T (brand value down 13% to US$51.4 billion). 15 further US brands feature in the Brand Finance Telecoms 150 2021 ranking, with a combined brand value of US$182.8 billion.

Two years since the beginning of Verizon’s business transformation program, Verizon 2.0 – focusing on the transformation of the network, the go-to-market, the brand, and the culture of the business – the brand continues to make leaps and bounds across the industry. The giant is widely recognized to have the best-in-class network and the widest coverage in the US, with the network’s usage surging during the pandemic, handling a staggering 800 million phone calls and 8 billion texts per day.

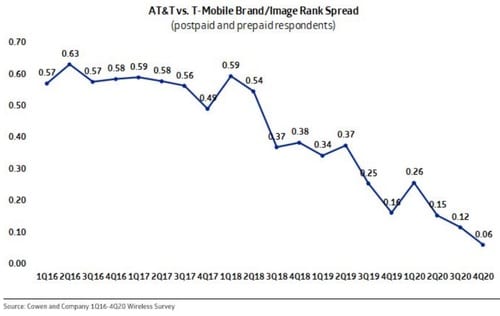

Meanwhile, Cowen and Company sees T-Mobile overtaking AT&T to be the second most popular telecom brand after Verizon. Cowen analysts conduct quarterly surveys of mobile customers, asking them to rank providers for “overall brand/image.”

In the 4th Quarter of 2020, the perceived difference between T-Mobile and AT&T was at its narrowest point since they started conducting their survey. As per the chart below, there was only a 0.06 difference between the two brands (we do not know how Cowen calculated the Rank Spread).

Cowen stated this brand perception issue will be an important to watch during 2021 because “network quality/coverage has historically been one of the main reasons for subscribers to leave their current wireless provider and likely a key driver of brand perception.”

The Cowen Telco Perceptions report (clients only) comes months after T-Mobile boasted that it surpassed AT&T in terms of total number of mobile phone customers.

Analyst Craig Moffett was shocked with AT&T’s $23.4 billion spent at the recently completed C-band auction. He wrote in a note to clients:

“At $23.4B, AT&T spent more than would have been expected a month ago, but expectations for their spend had been rising (notwithstanding the fact that they have only financed half of what they bought, and even that with only short-term debt), so the surprise may not be large there, either. But again, it’s a shock to see the number.”

“AT&T emerges from the auction with leverage of 4.1x EBITDA (assuming all debt financing). Can their dividend be sustained?”

AT&T bought 80 MHz of C-band spectrum in almost all of the top 50 U.S. markets.

How will they be able to finance the buildout of their 5G network to deploy that spectrum?

If you have an opinion on that, please post a comment in the box below this article. Thanks in advance!

References:

3 thoughts on “Verizon is again top U.S. telco brand; AT&T falling behind T-Mobile”

Comments are closed.

Will AT&T have to spin-off parts or all of Warner to finance the 5G build-out for the spectrum they acquired in the C-Band auction? If they keep this up, perhaps they will be back to a telecom company again.

Indeed, AT&T can’t finance the 5G network expansion using C-Band spectrum from organic growth. AT&T had a net loss of about 3,260,000 subscribers across its four pay-TV services (DIRECTV, AT&T U-verse, AT&T TV, and AT&T TV NOW) in 2020. The company also lost 5,000 broadband subs last year.

That means AT&T must sell/spin off assets or borrow even more. AT&T’s total debt increased from $123.5 billion in 2016 to $157.2 billion in 2020.

References:

https://techblog.comsoc.org/2021/03/06/top-u-s-broadband-providers-add-paytv-providers-lose-subscribers-in-2020/

https://www.nasdaq.com/articles/att-stock-will-continue-to-underperform-2021-03-05

“AT&T appears to be ceding the fight in wireless with a network plan that doesn’t even attempt to close the gap with T-Mobile and Verizon,” argued the financial analysts with New Street Research in a note to investors. “They must realize that ambitions of growing customers under these circumstances are wildly optimistic. They can’t have chosen this strategy; it must be a result of difficult choices amid scarce resources. The company is making the right investments in HBO and fiber; however, we wonder whether those resources might not be better spent on the [mobility] business that still accounts for well over half of their EBITDA [earnings before interest, taxes, depreciation, and amortization]. AT&T remains a collection of challenged assets in difficult markets with too much leverage and no easy path back to stability.”

In 5G, the analysts generally argued that AT&T now trails both Verizon and T-Mobile in terms of overall spectrum ownership, which could make it difficult for the operator to keep pace in pricing, network capacity and speed.

AT&T executives have acknowledged their situation but have argued the company will continue to aggressively pursue the kinds of expensive promotions – including free iPhones for new and existing customers – that AT&T began employing in the fourth quarter.

“We’re not here to just preserve a base of customers,” argued AT&T’s Jeff McElfresh, CEO of the company’s communications business, during the operator’s analyst event last week. “We’re No. 3 in the marketplace. We’ve got a great network. We’re going to continue to invest in that network, and you’ll see us continue to grow at least at our fair share, if not greater.”

But some analysts aren’t convinced. “Our sense is that … the value of those promotions will wane seasonally,” wrote the financial analysts at Sanford C. Bernstein & Co. in a recent note to investors.

Overall, the analysts at New Street Research argued that AT&T’s 5G positioning – that its services will be good enough – could eventually put the company on the same trajectory that it previously traveled in the early days of DSL.

“The debate around how-much-speed-is-enough is a tough one to resolve,” they wrote. “AT&T made the same argument about upgraded copper in their fixed broadband business, and it proved to be disastrously wrong. They have deployed fiber to 15 million homes over the last four years, and they are deploying fiber to another 15 million homes so that they can increase the speeds from 75Mbit/s to 1Gbit/s. It is reasonable to assume that the factor that drove share in fixed will do so in mobile too.”

https://www.lightreading.com/5g/some-analysts-sour-on-atandts-5g-prospects/d/d-id/768209?