TIP OpenRAN project: New 5G Private Networks and ROMA subgroups

The Telecom Infra Project (TIP), one of several industry consortiums creating specifications for open radio access networks (Open RAN), recently announced a new 5G Private Networks subgroup.

Editor’s Note:

We don’t know whether the TIP OpenRAN project or the O-RAN Alliance has (and will have) more industry influence and impact. In addition, there are many splinter partnerships forming; many of them led by Rakuten Mobile. What’s mind boggling is that none of the groups have liaison agreements with either ITU-R WP5D (responsible for all IMT standards, including 4G and 5G) or 3GPP (the prime spec writing organization for mobile networks).

……………………………………………………………………………………

5G Private Networks contribute to improve the quality of experience for 5G connectivity, including better coverage and capacity through on-premise radio equipment, the ability to support low latency and high bandwidth service requirements through edge compute & routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

For network operators, 5G Private Networks also create the opportunity to implement new network management and operational models, enabling full automation of the operation of the enterprise network while improving end customer application experience.

However, to fully capture the benefits of 5G Private Networks, a different approach is required, because traditional network architectures, focused on large scale deployments and operations don’t have the right economics or the operational flexibility to efficiently deliver on the emerging needs of enterprise customers.

The 5G Private Networks Solution Group will develop a new approach to manage and operate 5G Private Networks, based on a cloud-native architecture, and making use of a new class of software management tools, based on the paradigms currently used for the cloud, but adapted to deliver the requirements of a telecom network environment. Telefónica will test the solution in their local TIP Community Lab in Madrid and then move to field trials in Málaga (Spain).

Juan Carlos Garcia, SVP Technology Innovation & Ecosystem, Telefónica, and TIP Board Director said: “This new solution group will enable operators to address the exciting opportunities that 5G is creating in the enterprise segment, both through valuable features for our customers and more efficient network operations. The TIP community is the perfect environment for this innovation, as it will allow us to leverage multiple current project groups (Open Core Networks, OpenRAN) to deliver an end-to-end Minimum Viable Product that we will then test in Telefonica’s TIP Community Lab.”

In particular, the new Solutions Group will leverage previous work contributed to TIP’s OpenRAN Project Group, on a first version of a CI/CD platform that applies traditional IT methodologies to automate integration, testing and deployment of OpenRAN software.

Ihab Tarazi, CTO and SVP, Networking and Solutions, Dell Technologies and TIP Board Director, said: “For open networks to deliver their benefits, the telecom industry needs an abstraction layer that helps integrate different components into end-to-end solutions. New software management tools based on the ones currently used for the cloud can address this need, and this Solution Group is a timely initiative for the industry to collaborate on making this happen.”

Caroline Chan, VP and GM Network Business Incubation Division, Intel and TIP Board Director, said: “Through the recently launched solution groups, TIP is expanding its scope to include the validation of interoperability between different elements across the whole network, and insights and recommendations about how to operate them. The new 5G Private Networks Solution Group is a strong example of this approach. With dedicated local private high-performance network connectivity as a key emerging deployment model for 5G and edge buildout, this group can help foster important ecosystem collaboration.”

As a result, this new solution group will help drive:

- Improved network economics, through the use of commoditized hardware and open source software, and more efficient and flexible network operations and automation, enabled by the adoption of cloud-native technologies.

- Dedicated local high-performance 5G connectivity and edge computing infrastructure, appealing to multiple B2B & B2B2C verticals.

- Better network security and performance.

Telefónica is one of the five European telcos that announced that they will work together on open RANs for mobile networks. The others are Deutsche Telekom, Orange, TIM and Vodafone. A memorandum of understanding (MOU) for that grouping commits the five to the O-RAN Alliance, which has 27 network operator members from AT&T to Vodafone, and to “other industry initiatives, such as the Telecom Infra Project, that contribute to the development of open RAN and that aim to create a healthy and competitive open RAN ecosystem and advance R&D efforts.”

……………………………………………………………………………………………………………….

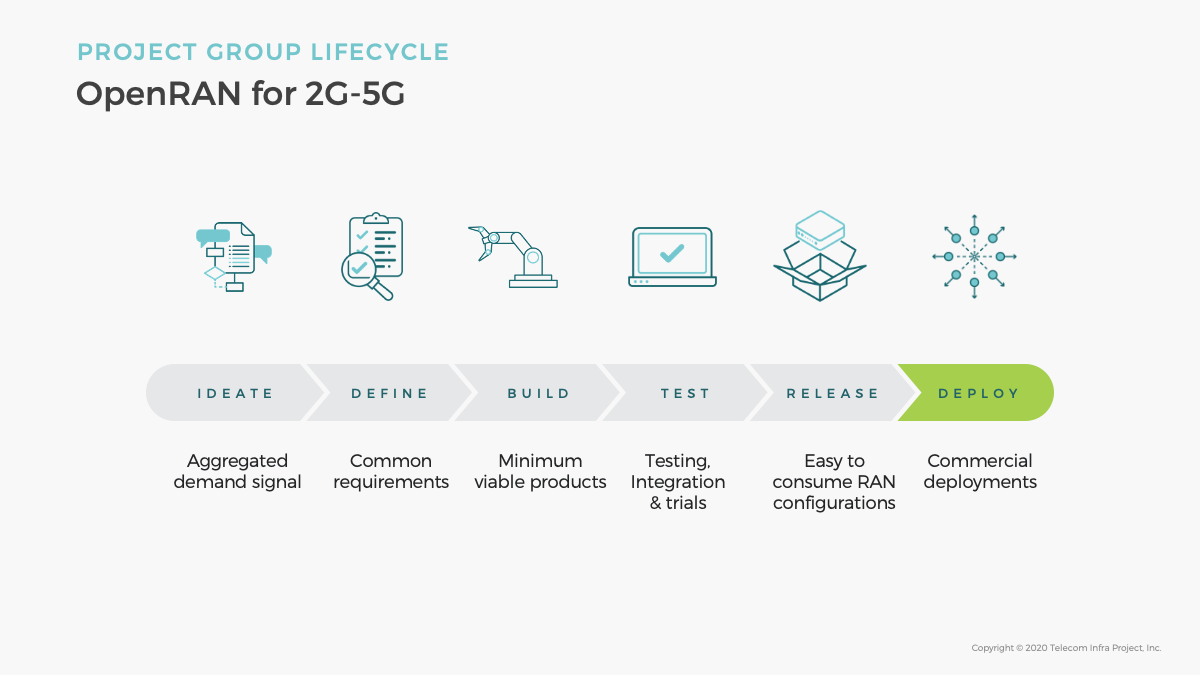

Separately, the charter of the new OpenRAN Orchestration and Management Automation (ROMA) subgroup was approved by the OpenRAN PG. ROMA focuses on aggregating and harmonizing mobile network operators requirements on Open RAN orchestration and lifecycle management automation, fostering ecosystem partners to develop products and solutions that meet ROMA requirements.

The goal of ROMA is to:

· Develop a common set of use cases for OpenRAN lifecycle management automation and orchestration that are agreed across multiple MNO and OpenRAN ecosystem members

· Develop Technical Requirements on products and solutions that support the identified use cases, including interfaces and data models

· Facilitate product and solution development through lab testing, field trials, participating TIP Plugfest and badging on TIP exchange etc.

· Support large scale OpenRAN deployment with lifecycle management automation, including Continuous Integration and Continuous Deployment (CI/CD) frameworks and tool sets.

It will bring better coverage and capacity through on-premise radio equipment, says TIP, and the ability to support low latency and high bandwidth service requirements through edge compute and routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

……………………………………………………………………

About the Telecom Infra Project:

The Telecom Infra Project (TIP) is a global community of companies and organizations that are driving infrastructure solutions to advance global connectivity. Half of the world’s population is still not connected to the internet, and for those who are, connectivity is often insufficient. This limits access to the multitude of consumer and commercial benefits provided by the internet, thereby impacting GDP growth globally. However, a lack of flexibility in the current solutions – exacerbated by a limited choice in technology providers – makes it challenging for operators to efficiently build and upgrade networks.

Founded in 2016, TIP is a community of diverse participants that includes hundreds of companies – from service providers and technology partners, to systems integrators and other connectivity stakeholders. We are working together to develop, test and deploy open, disaggregated, and standards-based solutions that deliver the high-quality connectivity that the world needs – now and in the decades to come.

Find out more: www.telecominfraproject.com

References:

Learn more and join the new 5G Private Networks Solution Group here.

https://telecominfraproject.com/tip-launches-5g-private-networks-solution-group/

2 thoughts on “TIP OpenRAN project: New 5G Private Networks and ROMA subgroups”

Comments are closed.

Many talk about OpenRAN but few dare to ask the critical questions which concern mobile operators

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s report “Debunking 25 Myths of OpenRAN” examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

Strand Consult is an independent research company with 25 years industry experience in the mobile telecom industry with over 170 mobile operators globally as clients. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world.

We at Strand Consult has nothing against OpenRAN. However we want to create the transparency at the O-RAN Alliance, and some of its members have pushed back. Indeed Strand Consult’s transparency concerns are shared by policymakers in the EU and US, notably the House of Representatives Foreign Affairs Committee.

Strand Consult has studied OpenRAN and produced many reports and research notes on the topic. Strand Consult first identified that there are at least 44 Chinese firms participating in the OpenRan Alliance, debunking the assertion that OpenRAN would be free of Chinese influence. Strand Consult has also posited that Huawei is influencing OpenRAN indirectly through its largest customer China Mobile, which is a founding member of the O-RAN Alliance. However inspiring companies like Mavenir, Parallell Wireless, and Altiostar may be to storytellers, they are bit players. Most of the contributions to OpenRAN specifications come from old established technology providers and China Mobile.

Strand Consult’s goal is to create objectivity and transparency about the actors promoting OpenRAN so that mobile operators, investors and others stakeholders can make informed decisions. Strand Consult finds it telling that OpenRAN proponents have not wanted to answer its critical questions addressing financial, economic, technical, and practical points about the technology. This is particularly evident at many OpenRAN webinars over the last 18 months when Strand Consult posts its questions publicly in the chat and the moderator ignores the questions, or Strand Consult’s emailed questions to the event organizer are ignored.

In an effort to lift the level of policy discussion, Strand Consult offers a comprehensive review of the official public documents promoting deployment of 5G Open Radio Access Networks (OpenRAN). These include the set of industrial, think tank, advocacy, and academic papers and reports as well as official proceedings by regulators and authorities in the United States and European Union. Official inquiries on OpenRAN have been undertaken by the Federal Communications Commission (FCC), the National Telecommunications and Information Administration (NTIA), and the DG Connect at European Union.

These inquiries have a variety of goals. One objective of these inquiries is to explore resilience in the network infrastructure market. Another is to promote alternative suppliers to Chinese providers Huawei and ZTE. Yet another is to explore and develop industrial policy and promote domestic companies.

Strand Consult believes that such processes and subsequent reports are important. Telecommunications regulatory authorities are tasked with providing policymakers with objective information for decision making as well as cost benefit and other analyses.

In the report “Debunking 25 Myths of OpenRAN”, Strand Consult investigates the quality of the literature describing OpenRAN. It categorizes the 25 myths into 6 categories: security, competition, innovation, engineering, economics, and public policy. Among the OpenRAN reports, articles, and investigations, there is little information which can be classified as empirical, scientific, or peer-reviewed. Outside of a few exceptions, most materials are marketing/advocacy promoted by OpenRAN proponents or news/press releases/opinion pieces. The key shortcomings of the OpenRAN discussion include

Lack of objectivity and/or empirical support

Preconceived notions, assumptions, and assertions about the economics of infrastructure, competition, and innovation

Little to no discussion of the infrastructure value chain beyond the large infrastructure equipment providers

Ignorance or failure to disclose that OpenRAN is not a technical standard. The O-RAN Alliance develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) like the 3GPP.

Ignorance or failure to disclose that OpenRAN only supports 4G and 5G and therefore it is not a 1:1 commercial alternative for 5G networks. Moreover OpenRAN does not support 2G and 3G, the prevailing network generation in many developing countries, and yet OpenRAN is reported as a solution for developing countries.

Ignorance or failure to disclose that 182 commercial 5G networks have been launched globally. These are classic RAN installations that support 2, 3, 4 and 5G in one base station. There is only 1 commercial OpenRAN installation, Rakuten in Japan.

Ignorance or failure to disclose how small expectations are for the OpenRAN install base by 2025 and 2030 compared to the entire market. This is likely just 1 percent in 2025 and under 3 percent in 2030.

Ignorance or failure to disclose the role of Chinese vendors in OpenRAN ecosystem and their leading role in OpenRAN governance and specification setting

The report “Debunking 25 Myths of OpenRAN” takes a critical view of the claims made about OpenRAN, including the claim that OpenRAN will stimulate the 5G service market. Strand Consult doesn’t believe OpenRAN will stimulate the 5G service market. We understand which services there will be in the core network and which in the cloud. They key problem for OpenRAN community is that they can’t explain which services are based on RAN that require OpenRAN on a cell site to be implemented. And the OpenRAN community cannot tell us who will develop these OpenRAN-based services, who will sell them, what business models underlie these services, whether they will address corporate or consumer market. And they cannot tell us about whether these services only be available on the few mobile sites where the operators have implemented OpenRAN, e.g. outside the big cites.

The report “Debunking 25 Myths of OpenRAN” will provide the objectivity and transparency needed by decision makers. This is the sort of information and analysis which is not available in most mainstream outlets. At the end of the day, mobile operators’ job is to deliver a great network experience to their customers. OpenRAN proponents have not succeeded to communicate, let alone demonstrate, specifically or empirically the difference they will make to mobile operators’ bottom line in a world where 182 commercial 5G networks on classic RAN have been launched.

For more than 25 years, Strand Consult has debunked the many myths of mobile industry hype. With its new and free report “Debunking 25 Myths of OpenRAN”, Strand Consult provides valuable information to mobile operators, investors and other mobile industry stakeholders.

Contact Strand Consult today to get your free copy of the report “Debunking 25 Myths of OpenRAN”

https://strandconsult.dk/debunking-25-myths-of-openran/

IEEE ComSoc and SCU will host a virtual panel session on Private 4G/5G and OpenRAN. We have confirmed participants from Nokia, Mavenir, Intel, and EdgeQ + analyst firm StrandConsult. If you’re interested in attending this FREE event (to be scheduled in late Feb) please email me: [email protected] & I will put you on the email invitation list.