AT&T Provides Update on Fiber Rollouts, 5G Expansion, and Financial Outlook

Here are the highlights of AT&T Investor Day Announcements:

3 million new fiber locations:

AT&T plans to deploy fiber-to-the-premises (FTTP) to another 3 million-plus residential and business locations across more than 90 metro areas in 2021, and is already sizing up plans to push that to an additional 4 million locations in 2022, Jeff McElfresh, CEO of AT&T Communications, said today during the company’s investor day event.

“The margin economics are attractive. These areas are adjacent to our current footprint, driving cost efficiencies in our build as well as our marketing and distribution efforts.”

McElfresh expects its fiber subscriber volumes increase in the second half of the year after the initial buildouts, but noted that he likes what AT&T is seeing in the early part of 2021. The company noted that about 70% of its gross broadband adds in fiber buildout areas are new AT&T customers.

“And if we keep up with that pace, our vision would be to have over half of our portfolio, or 50% of our network, covered by that fiber asset. As our integrated fiber plan improves the yield performance on that fiber it will further give us conviction on continuing that investment in the coming years.”

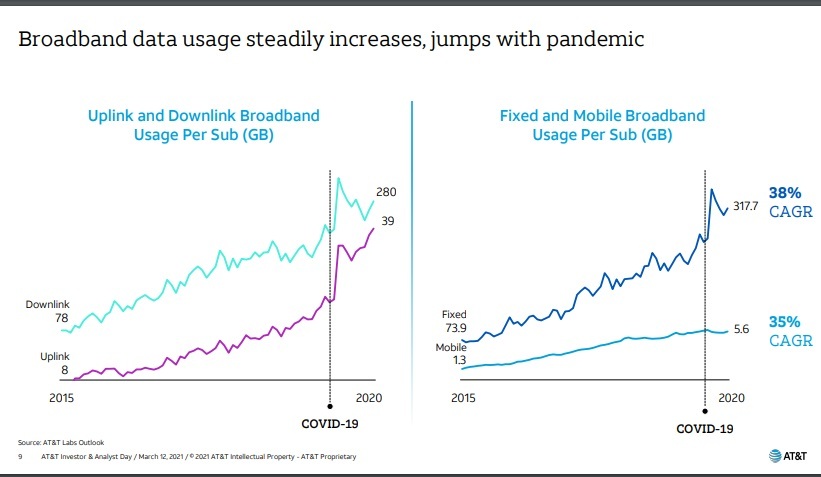

AT&T is also looking to broaden its reach of fiber amid rising data demand and network usage that has occurred during the pandemic, and isn’t expected to stop any time soon. That’s shown in the graph’s below:

References:

………………………………………………………………………………………………………………………………….

AT&T’s 5G Strategy:

AT&T’s 5G network now covers 230M Americans in 14,000 cities and towns and AT&T 5G+ is now available in parts of 38 cities in the U.S.

Note: AT&T may temporarily slow data speeds if the network is busy.

“Connectivity is at the heart of everything we do – 140 years and counting. From our fiber network backbone to the layers of wireless spectrum technology, we provide 5G network coverage that delivers the speeds, security and lower latency connections that customers and businesses need,” said Jeff McElfresh, CEO – AT&T Communications. “Over the past five years, AT&T has invested more capital in the U.S. than any other public company.”

Here is what the company said about its 5G Strategy:

AT&T has planned a balanced approach to 5G. Our strategy of deploying 5G in both sub-6 (5G) and mmWave (5G+) spectrum bands provides a great mix of speeds, latency and coverage for consumers and businesses. We rolled out nationwide 5G that now covers 230 million people, and offer 5G+ providing ultra-fast speeds to high-density areas where faster speeds can have huge impacts for our customers. So far, AT&T has deployed 5G+ nodes in parts of 38 cities across the U.S.

AT&T 5G is opening up some impressive opportunities for businesses and consumers and mid-band and mobile edge computing will help us go even further. There is an emerging multi-sided business model across 5G, edge computing and a variety of use cases from healthcare to gaming.

Our mobile edge computing plus 5G network will help satisfy the need for ultra-responsive networks and open up new possibilities for consumers and businesses. With our investments, we will take advantage of new technologies like spatial computing to enable applications across industries from manufacturing automation to watching immersive sports.

Reference: https://about.att.com/story/2021/5g_strategy.html

…………………………………………………………………………………………………………………………………

C-band spectrum deployment to begin in 2021:

- AT&T acquired 80 MHz of C-band spectrum in the FCC’s Spectrum Auction 107. The company plans to begin deploying the first 40 MHz of this spectrum by the end of 2021.

- AT&T expects to spend $6-8 billion in capex deploying C-band spectrum, with the vast majority of the spend occurring from 2022 to 2024. Expected C-band deployment costs are already included in the company’s 2021 capex guidance and in its leverage ratio target for 2024.

- AT&T expects to deliver 5G services over its new C-band spectrum licenses to 70 to 75 million people in 2022 and 100 million people in “early” 2023.

- Funding C-band spectrum: AT&T’s investment in C-band spectrum via Auction 107 totals $27.4 billion, including expected payments of $23 billion in 2021.

- To meet this commitment and other near-term priorities, in 2021 the company expects to have access to cash totaling at least $30 billion, including cash on hand at the end of 2020 of $9.7 billion, commercial paper issued in January 2021 of $6.1 billion and financing via a term loan credit agreement of $14.7 billion.

Jeff McElfresh, CEO of AT&T Communications, explained the operator’s focus on both 5G and fiber: “Our value proposition is to serve customers how they want to be served with enough bandwidth and capacity and speed, and we’ll let the technology service architecture meet that demand or that need.”

“When you get up into the midband segment of spectrum, while it offers us really wide bandwidth for speed and capacity, its coverage characteristics don’t penetrate [buildings and other locations] as effectively as the lowband does,” he said. “And so as we design our network and our offers in the market, you will see us densify our wireless network on the top of our investments in fiber.”

–>Yet McElfresh didn’t really address how AT&T Communications would overcome those challenges.

References:

https://about.att.com/story/2021/att_analyst_day.html

………………………………………………………………………………………………………………………………….

Financial Targets and Guidance:

- End-of-year 2021 debt ratio target of 3.0x. The company expects to end 2021 with a net debt-to-adjusted EBITDA ratio of about 3.0x,3 reflecting an anticipated increase in net debt of about $6 billion to fund the C-band spectrum purchase.

- 2024 debt ratio of 2.5x or lower. During 2024, AT&T expects to reach a net debt-to-adjusted EBITDA ratio of 2.5x or lower.3 To achieve this target, the company expects to use all cash flows after total dividends to pay down debt and will continue to look for opportunities to monetize non-strategic assets. The company also does not plan to repurchase shares during this period.

- 2021 guidance unchanged. AT&T’s 2021 financial guidance, announced in January 2021, is unchanged on a comparative basis. For the full year, the company continues to expect:

- Consolidated revenue growth in the 1% range

- Adjusted EPS to be stable with 20204,5

- Gross capital investment6 in the $21 billion range, with capital expenditures in the $18 billion range

- 2021 free cash flow7 in the $26 billion range, with a full-year total dividend payout ratio in the high 50’s% range

References:

https://about.att.com/story/2021/att_analyst_day.html

5 thoughts on “AT&T Provides Update on Fiber Rollouts, 5G Expansion, and Financial Outlook”

Comments are closed.

From analyst/colleague Craig Moffett note to clients on AT&T’s Wireless Strategy:

“What is AT&T’s value proposition? For whom will they be able to claim their network is the

best choice?

To be fair, AT&T has other stories to tell, and had devoted much of the Investor day webinar to HBO Max. And they appropriately took a bow for currently having a credible argument that, for some, their network is the best choice. Still, it was rather striking that they didn’t even try to make the case that theirs would be the best network in the era of 5G.”

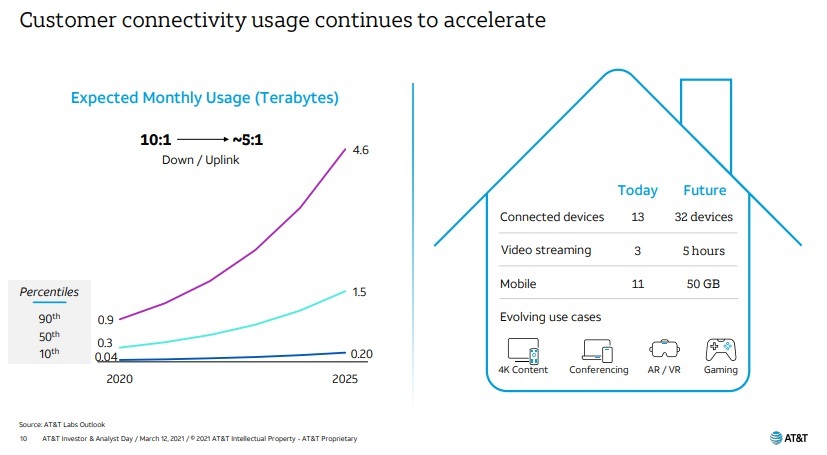

“AT&T dismissed the idea of fixed wireless…CEO John Stankey cited, conservatively, only a 10x delta in consumption between fixed and mobile, and even that was enough to persuade him that it would be unwise to pursue the opportunity.”

“AT&T Communications CEO Jeff McElfresh indicated that by 2025, they expect each wired home to support 32 connected devices and to consume a staggering 1.5 terabytes, with the heaviest users consuming three times that much.”

……………………………………………………………………………………….

Disclaimer: I, Craig Moffett, Senior Research Analyst at MoffettNathanson LLC, hereby certify that all of the views expressed in this Report accurately reflect my personal views about any and all of the subject securities or issuers and that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views of in this Report.

“AT&T appears to be ceding the fight in wireless with a network plan that doesn’t even attempt to close the gap with T-Mobile and Verizon,” argued the financial analysts with New Street Research in a note to investors. “They must realize that ambitions of growing customers under these circumstances are wildly optimistic. They can’t have chosen this strategy; it must be a result of difficult choices amid scarce resources. The company is making the right investments in HBO and fiber; however, we wonder whether those resources might not be better spent on the [mobility] business that still accounts for well over half of their EBITDA [earnings before interest, taxes, depreciation, and amortization]. AT&T remains a collection of challenged assets in difficult markets with too much leverage and no easy path back to stability.”

In 5G, the analysts generally argued that AT&T now trails both Verizon and T-Mobile in terms of overall spectrum ownership, which could make it difficult for the operator to keep pace in pricing, network capacity and speed.

AT&T executives have acknowledged their situation but have argued the company will continue to aggressively pursue the kinds of expensive promotions – including free iPhones for new and existing customers – that AT&T began employing in the fourth quarter.

“We’re not here to just preserve a base of customers,” argued AT&T’s Jeff McElfresh, CEO of the company’s communications business, during the operator’s analyst event last week. “We’re No. 3 in the marketplace. We’ve got a great network. We’re going to continue to invest in that network, and you’ll see us continue to grow at least at our fair share, if not greater.”

But some analysts aren’t convinced. “Our sense is that … the value of those promotions will wane seasonally,” wrote the financial analysts at Sanford C. Bernstein & Co. in a recent note to investors.

Overall, the analysts at New Street Research argued that AT&T’s 5G positioning – that its services will be good enough – could eventually put the company on the same trajectory that it previously traveled in the early days of DSL.

“The debate around how-much-speed-is-enough is a tough one to resolve,” they wrote. “AT&T made the same argument about upgraded copper in their fixed broadband business, and it proved to be disastrously wrong. They have deployed fiber to 15 million homes over the last four years, and they are deploying fiber to another 15 million homes so that they can increase the speeds from 75Mbit/s to 1Gbit/s. It is reasonable to assume that the factor that drove share in fixed will do so in mobile too.”

https://www.lightreading.com/5g/some-analysts-sour-on-atandts-5g-prospects/d/d-id/768209?

This article is filled with interesting statistics. Such as expecting thirty two connected devices per living situation. That’s an amazing adoption/proliferation rate of smart devices and other computers. Also, the notes on increasing bandwidth use are fascinating.

I am also impressed by AT&T’s push to connect more homes to the Internet. Too many people still live without broadband Internet access. So it’s refreshing to see the numbers AT&T is presenting.

At a recent investor day, AT&T discussed plans to build out FTTH services to more homes. AT&T plans to build out FTTH services to 3 million homes in 2021.

Starting in 2022, AT&T signaled that it could ramp up FTTH buildouts to 4 million homes annually. At that pace, AT&T’s FTTH services could reach 50% of its service footprint in a few years, Cowen analyst Gregory Williams said in a report to clients.

Williams said that “2021 is setting up to be a record year for FTTH builds.” He estimated telecom FTTH services currently reach about 37 million U.S. households, or roughly 29% of the market.

Williams said FTTH services could reach 68 million by 2025 if AT&T and the rural phone companies speed up deployment.

“If this were to occur, it would pose a formidable threat” to cable TV companies such as Charter Communications (CHTR), Comcast (CMCSA) and others, he said.

One reason rural phone companies are speeding up FTTH deployments is that Verizon Communications (VZ) and T-Mobile U.S. (TMUS) aim to provide fixed 5G wireless broadband services to homes. Like Verizon and T-Mobile, AT&T recently bought midband 5G radio spectrum in a government auction.

AT&T hasn’t committed to selling fixed 5G broadband services to homes. Instead, AT&T has targeted business customers with fixed 5G wireless broadband services. Also, it is deploying 5G mobile services for smartphone customers.

https://www.investors.com/news/technology/att-ftth-expansion-broadband-competition-cable-tv-companies/?refcode=TechReport-03262021-4-DA-2:03:2021:1Q:NewsLetter:Email:TechReport-03262021:na:na:na:na:26:13:4:DA:2

AT&T told the FCC it plans to begin adding open RAN-compliant equipment into its network “within the next year.”

That puts AT&T on roughly the same timeframe as Verizon. Verizon’s SVP Adam Koeppe told Light Reading earlier this year that the operator’s 5G hardware vendors – Ericsson, Samsung and Nokia – will begin supplying open RAN-compliant equipment starting later this year. And he expects that the bulk of their equipment shipments to Verizon will comply with open RAN specifications by next year.

AT&T told the FCC it expects to implement similar changes into its own network.

“The challenge for an operator shifting to any open network architecture, including but not limited to O-RAN, will be maintaining network reliability, integrity and performance for customers during the transition,” the operator wrote in a filing. “For our part, AT&T serves multiple customer groups, with varied and often complex, service requirements. As we introduce O-RAN into our network, our goal will be maintaining the same high level of performance at scale. We are actively working in this direction.”

https://www.lightreading.com/open-ran/atandt-to-launch-open-ran-by-next-year/d/d-id/769199?

AT&T to FCC: Promoting the Deployment of 5G Open Radio ) Access Networks – GN Docket No. 21-63

https://ecfsapi.fcc.gov/file/1042871504579/AT%26T%20Comments%20to%20FCC%20NOI%20(04.28.21).pdf