C band auction

Who will be the big bidders at upcoming FCC C-band and AWS auctions?

Under new chairman Brendan Carr, the U.S. Federal Communications Commission (FCC) plans to open up more C-band (3.98-4.2 GHz) spectrum for 5G, recalling a golden age of spectrum awards that brought in tens of billions of dollars. The first C-band auction, which drew to a close in early 2021, brought in a staggering US$94 billion. Verizon made headlines by shelling out $52.9 billion at the auction, including incentive payments and clearing costs, so naturally there is talk of whether it will look to repeat its performance in the next C-band sale. But until we have more information it’s all just speculation. “In 2020, the FCC conducted the most successful auction in history when it released 280 megahertz of mid-band spectrum in the C-band for 5G,” Carr wrote, in a blog post.

At its upcoming February 25, 2025 Open Commission Meeting, the FCC (among other things) will:

- Enhancing National Security Though the Auctioning of Spectrum Licenses

The Commission will consider a Notice of Proposed Rulemaking that would update 10 year-old AWS-3 service-specific competitive bidding rules to bring those rules in line with current practice as the first step in fulfilling the Commission’s statutory obligation to initiate an auction of licenses for the AWS-3 spectrum in the Commission’s inventory by June 23, 2026, under the Spectrum and Secure Technology and Innovation Act. (GN Docket Nos. 25-70, 25-71, 13-185) - Exploring New Uses for Mid-Band Spectrum in the Upper C-band

The Commission will consider a Notice of Inquiry exploring whether, and if so how, we could free up additional mid-band spectrum for new services in the Upper C-band to meet projected spectrum demand, spur economic growth, and advance American security interests. (GN Docket No. 25-59)

CTIA – the U.S. wireless industry’s primary trade group – quickly cheered the news: “We applaud Chairman Carr for his swift action in exploring how best to make the upper C-band available for 5G wireless commercial use,” CTIA CEO Meredith Attwell Baker said in a statement. However, Carr didn’t specifically say whether that C-band 2.0 auction would be for 5G. “We will vote on a notice of inquiry that asks whether the commission should open up additional portions of the C-band (3.98-4.2 GHz) for more intensive use. We want to hear your views,” Carr wrote.

Elon Musk’s SpaceX and the major U.S. 5G telcos (AT&T, Verizon, T-Mobile) have expressed interest in upper C-band spectrum. SpaceX said in January that the FCC should develop “a modernized sharing framework” for the upper C-band, presumably so that it could be used by both satellite operators (like SpaceX) and terrestrial operators (like AT&T, Verizon and T-Mobile).

“Establishing a modernized sharing framework for the upper C-band that welcomes multiple new entrants is essential to solidify American leadership in 6G, which will interweave terrestrial and satellite networks into a seamless consumer experience,” SpaceX wrote. Politico noted that FCC’s Carr – has been developing ties to Musk.

“While the outcome is far from certain, we give an edge to the wireless interests,” wrote Blair Levin, a policy adviser to New Street Research and a former high-level FCC official, in a recent note to investors. “In this administration it appears that ‘whatever Elon wants, Elon gets.’ So, it is difficult to have conviction on the outcome.” Indeed, there are plenty of ways for the FCC to handle the upper C-band situation. Levin wrote, “There are multiple compromises available, such as allocating some to exclusive and some to satellite sharing or getting back more spectrum from the current users,” he wrote.

Other industry watchers are unsure about SpaceX vs wireless industry C-band spectrum bidding:

- “It’s unclear whether SpaceX could overcome the wireless lobby’s desire for more terrestrial spectrum,” analyst Tim Farrar, with TMF Associates, told Light Reading.

- “The upper C-band is an enormous opportunity to unleash additional spectrum for mobile 5G, for LEO [low-Earth orbit] satellite direct-to-device connectivity, or for a combination of both,” Michael Calabrese told Light Reading. Calabrese is director of the Wireless Future Project, which is part of New America’s Open Technology Institute think tank. Calabrese said that FCC Chairman Brendan Carr “is wise to open a notice of inquiry to explore what form of repurposing or sharing will best promote innovation and the connectivity needs of the future. The one certainty is that the 220 megahertz in C-band that was not repurposed five years ago should be a priority for reallocation to a higher and better use today.”

–>The previous C-band sale may have been the peak of wireless network operator spectrum spending, but we could see the big players pony up a significant amount of cash again in the next year or so at FCC auctions.

……………………………………………………………………………………………………………………………………………………………………………………………………………………

Mr. Carr also talked about an upcoming AWS-3 frequency auction, indicating that it is on track to take place by mid-2026 as required by law. In one of his first official statements as the new chairman of the FCC, Carr said he plans to auction AWS-3 spectrum before the end of next year. He added that the commission would consider holding another auction of C-band spectrum.

“This month, we will vote to kickstart the process for reauctioning a large number of AWS-3 spectrum licenses that have sat in inventory for years. This auction will be a win-win. It brings new spectrum into play for commercial use. And the proceeds from this auction will also cover the costs of the national security initiative known as “rip and replace”—an effort that is removing untrustworthy technology, like Huawei and ZTE gear, from networks. Specifically, our AWS-3 notice of proposed rulemaking will ensure that the Commission is on track to meet its statutory obligation to complete this auction by June 23, 2026.’

Those auctions will help pay for Rip and Replace (mostly Huawei network equipment) from U.S. telco networks. The Rip and Replace program was created in 2020 to remove Chinese components from U.S. wireless communications systems. The Rip and Replace fund needs an additional $3B in order to finish its mission.

AT&T is the most likely to spend big on the AWS-3 spectrum sale, given that it has less mid-band spectrum than its rivals, and CEO John Stankey has already expressed interest in the airwaves.

References:

https://www.telecoms.com/spectrum/new-fcc-chair-looks-to-repeat-c-band-mega-auction

https://broadbandbreakfast.com/fcc-to-vote-on-aws-auction-inquiry-into-upper-c-band-2/

https://www.lightreading.com/5g/could-elon-grab-some-of-5g-s-spectrum-

https://www.lightreading.com/5g/carr-hands-a-spectrum-gift-to-5g-industry

https://www.ctia.org/news/ctia-statement-on-chairman-carrs-announcement-on-upper-c-band

https://www.fcc.gov/February2025

Eric Schmidt: FCC C-Band Auction Dooms U.S. 5G Future

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

FCC Chairman Pai Reviews 5G FAST plan and importance of the C-Band (3.7 GHz to 4.2 GHz) auction

4 U.S. Mobile Operators offer C-band FCC proposal to address aircraft interference

FCC Auction 108 (2.5 GHz) ends with total proceeds << than expected; T-Mobile expected to be #1 spectrum buyer

FCC launches new 5G mid-band wireless spectrum auction (FCC Auction 108)

Bloomberg: 5G in the U.S. Has Been a $100 Billion Box Office Bomb

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

Verizon says it has approximtely 222 million people covered with its mid-band C-band network, [1.] a figure the company hopes to increase to 250 million by the end of next year. “C-band is a game change for our business,” CEO Hans Vestberg said on the telco’s 3rd quarter earnings call. “Our network is winning.”

Note 1. C-band sits between the two Wi-Fi bands, which are at 2.4GHz and 5GHz. It’s slightly above and very similar to the 2.6GHz band that Clearwire and then Sprint used for 4G starting in 2007, and which T-Mobile currently uses for mid-band 5G. And it adjoins CBRS, a band from 3.55 to 3.7GHz that’s currently being deployed for 4G. ITU-R divided C-band into three chunks, referred to as band n77, band n78, and band n79.

……………………………………………………………………………………………………………………………

Verizon officials said the company is using the capacity in its mid-band 5G network to pursue opportunities like fixed wireless access (FWA) and private wireless networks. “We see demand for the product continuing to grow,” Vestberg said of Verizon’s private wireless network offerings. He added that Verizon is working to transition its private wireless customers from pilots to commercial deployments. He also said the company is growing its ecosystem of suppliers for that business.

…………………………………………………………………………………………………………………………

T-Mobile announced Tuesday it now covers 300 million people with its 2.5GHz mid-band network, reaching that goal three months earlier than the company had planned. T-Mobile’s overall 5G footprint has expanded as well, now covering more than 330 million people or 98% of the population.

“We have been leaders in the 5G era from the start, deploying the largest, fastest, most awarded and most advanced 5G network in the country faster than anyone else,” said Ulf Ewaldsson, President of Technology at T-Mobile. “While the other guys are playing catch-up, finally beginning to build out their mid-band 5G networks, we are maintaining our lead and will continue offering customers the best network – paired with the best value – for years to come.”

“T-Mobile’s turnaround story is incredible, going from network underdog a decade ago to the undeniable network leader today,” said Anshel Sag, Principal Analyst at Moor Insights and Strategy. “T-Mobile has not only built out a robust 5G network with unmatched coverage and capacity, but the Un-carrier is also leading the way in rolling out new capabilities that will unlock the true promise of 5G.”

………………………………………………………………………………………………………………………..

Last week, AT&T said it ended the third quarter covering 190 million subscribers for its mid-band 5G network, and said it remains on track to cover 200 million by the end of the year. On the telco’s 3-2023 earnings call, CEO John Stankey said, “we continue to enhance the largest wireless network in North America and expand the nation’s most reliable 5G network. It’s no surprise that when you combine our high-value customer growth and rising revenues per user, we continue to grow profits in our wireless business.”

Regarding FWA, Stankey touted the company’s Internet Air offering. “We have no issues selling Internet Air into the business segment. It’s a really attractive thing for us to do. It’s a really helpful product on a number of different fronts. It meets a particular need.

……………………………………………………………………………………………………..

References:

https://www.lightreading.com/private-networks/verizon-jumps-too-as-mobility-biz-surprises-in-q3

https://www.pcmag.com/news/what-is-c-band

https://www.fool.com/earnings/call-transcripts/2023/10/19/att-t-q3-2023-earnings-call-transcript/

https://www.att.com/internet/internet-air/

4 U.S. Mobile Operators offer C-band FCC proposal to address aircraft interference

Four major U.S. mobile operators have agreed to a series of undertakings designed to address concerns over airline safety and to allow them to use their C-band spectrum to its full extent.

“These voluntary commitments will support full-power deployments across C-Band, and are crafted to minimize the operational impact on our C-Band operations,” says the letter to the FCC, signed by senior executives at AT&T, Verizon, T-Mobile US and UScellular.

“As C-Band licensees, we will abide by the attached voluntary commitments. These voluntary commitments will support full-power deployments across C-Band, and are crafted to minimize the operational impact on our C-Band operations. In agreeing to these commitments, we reserve any and all rights and privileges conferred by our lawfully held spectrum licenses issued by the FCC.”

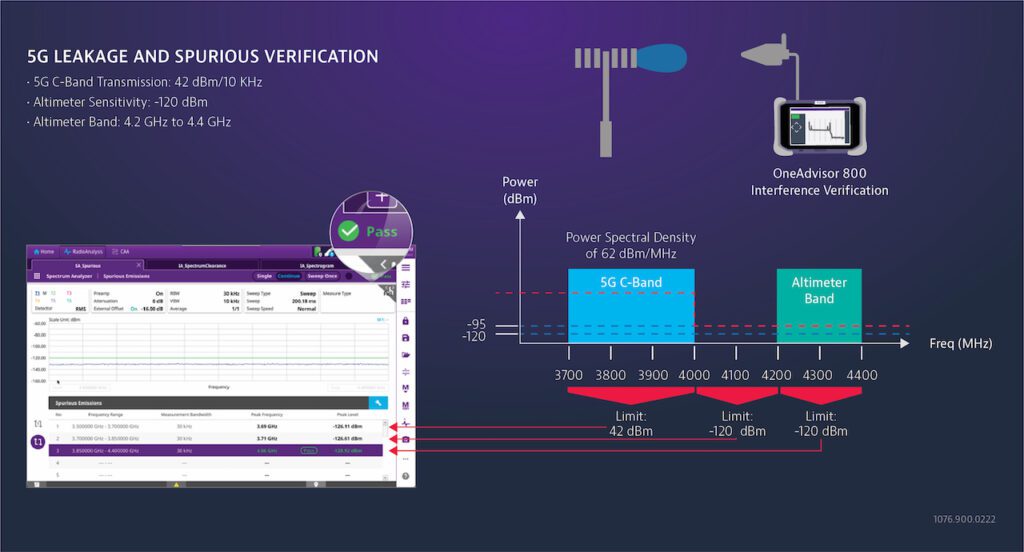

US mobile operators have been at odds with the airline industry for some time, the latter having strongly objected to the rollout of C-band spectrum for 5G services, fearing interference with the altimeters used by aircraft.

As the operators note in their letter, the FCC adopted licensing and technical rules to ensure the safe coexistence between C-band spectrum – that’s 3.7 GHz-3.98 GHz – and radio altimeters at 4.2 GHz-4.4 GHz; as the telcos put it, “more than 220 megahertz away.” The mobile industry has always insisted that the rules in place were sufficient, but nonetheless made several short-term moves to appease the Federal Aviation Administration.

At the end of 2021 AT&T and Verizon grudgingly offered to reduce power at 5G sites, particularly near airports and heliports, for six months, then later committed to deferring 5G rollout near airports altogether. Last summer the pair agreed to delay 5G rollout using C-band spectrum around US airports for another year to give the airlines time to upgrade their altimeters.

This latest missive to the FCC essentially reinforces that glide path into the full usage of C-band spectrum.

Reuters shared a comment from Verizon that these latest commitments will allow it to fully use its C-band frequencies for 5G “by the previously agreed to deadline of July 1.”

“Despite the sufficiency of the FCC rules, subsequent collaborative engagement across affected industries and with the FCC and Federal Aviation Administration has resulted in the development of the attached voluntary commitments relevant to this coexistence,” the mobile operators said.

Officials from the FCC did not immediately comment, according to Reuters. The Federal Aviation Administration (FAA) told the publication that it continues to “work closely to ensure a safe co-existence in the US 5G C-band environment.”

A representative from Airlines for America, a trade group representing US airlines including American, Delta and United, offered this statement on the new proposal: “We appreciate the collaboration among stakeholders, including the federal government and will continue to work our common goal of ensuring the aviation system remains the safest mode of transportation in the world. While our industry strongly supports 5G deployment, safety is—and always will be—the top priority of US airlines. A4A member carriers are working diligently to ensure fleets are equipped with compliant radio altimeters, but global supply chains continue to lag behind current demand and any government deadline must consider this reality.”

Arguably the most important thing now is that the operators can get the most out of the C-band spectrum they paid so much for just over two years ago. Lest we forget, the final tally came in at $81 billion, with an additional $15 billion on top in clearing costs – to shift the satellite players away from the band, that is. Verizon was famously the biggest spender by some margin, accounting for $53 billion at the auction itself.

Little wonder then that the operators are so keen to declare ‘case closed’ on the interference issue and to crack on with using that spectrum properly.

References:

https://www.fcc.gov/ecfs/document/1033142661477/1

https://telecoms.com/521048/us-telcos-solve-c-band-airline-interference-issue/

FAA NPRM: Aviation Industry Altimeter Upgrades to Thwart C-Band Interference

FAA order to avoid interfering with 5G C-Band services; RootMetrics touts coverage vs performance advantages for 5G

AT&T, Verizon Propose C Band Power Limits to Address FAA 5G Air Safety concerns

FAA NPRM: Aviation Industry Altimeter Upgrades to Thwart C-Band Interference

The Federal Aviation Administration (FAA) is giving the aviation industry more time to update legacy radio altimeters that could potentially be impacted by terrestrial 5G operations in C-Band spectrum.

In a notice of proposed rulemaking (to be published January 11, 2023), the FAA said that it remains concerned about the impacts of the C-Band operations on flights, including triggering false warnings from flight systems—particularly as more 5G is deployed across the entire band, and with more than 20 additional operators expected to start operating in the band later this year. This new Notice of Proposed Rulemaking (NPRM) lays out a timeline for retrofits by February 2024.

SUMMARY: The FAA proposes to supersede Airworthiness Directive 2021-23-12, which applies to all transport and commuter category airplanes equipped with a radio (also known as radar) altimeter. AD 2021-23-12 requires revising the limitations section of the existing airplane/aircraft flight manual to incorporate limitations prohibiting certain operations requiring radio altimeter data when in the presence of 5G C-Band interference as identified by Notices to Air Missions.

Since the FAA issued AD 2021-23-12, the FAA determined that additional limitations are needed due to the continued deployment of new 5G C-Band base stations whose signals are expected to cover most of the contiguous United States at transmission frequencies between 3.7-3.98 GHz. This proposed AD would require revising the limitations section of the existing airplane/aircraft flight manual to incorporate limitations prohibiting certain operations requiring radio altimeter data, due to the presence of 5G C-Band interference.

This proposed AD would also require modifying certain airplanes to allow safe operations in the United States 5G CBand radio frequency environment. The FAA is issuing this AD to address the unsafe condition on these products.

Originally, the agency had targeted a phased approach that required operators of regional aircraft with the most susceptible altimeters to retrofit them with filters by the end of 2022. AT&T and Verizon, meanwhile, had agreed to delay 5G C-band deployments near airports until July 2023, at which time air carriers were expected to have completed all the retrofits to mitigate possible 5G C-band spectrum interference.

Concerns about the impacts of 5G in C-Band to radio altimeters delayed the initial deployment of C-Band spectrum by AT&T and Verizon roughly a year ago. The worry is that the old altimeters, even though they operate in a completely different spectrum range, were not designed to filter out strong terrestrial cellular signals, leading to out-of-band interference. That interference could lead to the radars not being able to accurately gauge an aircraft’s height-above-ground, which could lead to aircraft crashes—particularly in fog or other situations where pilots would not be able to visually confirm whether height information was correct. As a result, Verizon and AT&T voluntarily agreed to operational tweaks near certain airports, including 5G transmission at reduced power levels, or tilt adjustments to cell sites to direct energy away from protected areas.

The FAA said that it has been able to review data from “dozens of alternative method of compliance (AMOC) requests, demonstrating that these radio altimeters can be relied upon to perform their intended function when operating beyond a certain protection radius around 5G C-Band transmitters.” The agency said that its first related actions on C-Band protection were based on conservative estimates of impacts, and that it initially sought to protect against interference during take-offs and landings within a two-nautical-mile circle around the ends of runways.

“After some time and an improved understanding of the C-Band signals and their effects on specific radio altimeters, the FAA was able to reduce the protected area around the ends of runways,” the agency said int he NPRM—first, by defining a rectangular protected airspace, then shifting that to a trapezoidal protection zone that allowed for expanded neighboring 5G signals. “The FAA is now able to assess the 5G C-Band transmissions’ impact to aviation operations in a specific area, taking into account the particularities of the signal and the airport environment. This assessment process is the Signal in Space (SiS) analysis. It includes a 3-dimensional model for the runway safety zone and considers base station heights and terrain around the airport,” the FAA said.

The FAA said that since it began soliciting reports of potential C-Band interference impacts, it received more than 420 reports of radio altimeter anomalies happening within the areas of known 5G C-band deployments. Most of those—about 315—were ultimately determined to have other causes and resolved through normal operational safety procedures, the agency said. But, it added, “for roughly 100 of the anomaly reports occurring within NOTAM areas, the FAA has excluded other potential causes for the anomaly, but could not rule out 5G C-Band interference as the potential source of the radio altimeter anomalies.”

Those 100 incidents included “erroneous Terrain Awareness and Warning System (TAWS) warnings, erroneous Traffic Collision Avoidance System (TCAS) warnings, erroneous landing gear warnings, and the erroneous display of radio altimeter data. … The FAA is concerned that to the extent 5G C-Band operations contributed to such events, the effects will occur more frequently as telecommunication companies continue to deploy 5G C-Band services throughout the country.”

“The radio altimeter modifications that would not require a substantial system redesign, allowing aircraft operators to readily replace radio altimeters or install filters that allowed the aircraft to operate safely in a mitigated 5G environment,” the agency said, adding that some altimeters will also be able to demonstration that level of performance without any modification. The FAA estimated that the modifications would affect about 7,993 aircraft registered in the U.S.

References:

https://public-inspection.federalregister.gov/2023-00420.pdf

FAA order to avoid interfering with 5G C-Band services; RootMetrics touts coverage vs performance advantages for 5G

AT&T, Verizon Propose C Band Power Limits to Address FAA 5G Air Safety concerns

Verizon boost 5G Ultra Wideband capacity and availability with C-band spectrum

Highlights:

- Verizon has started deploying with 100 MHz of C-band spectrum in many markets across the US – a significant increase from the 60 MHz it has deployed in 5G markets to date.

- In the recent trial, using 100 MHz of C-band spectrum, engineers were able to reach 1.4 Gbps peak download speeds near active cell sites and 500 Mbps further away from the towers.

- As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHZ across the nation.

Verizon said it started deploying nearly double the amount of C-band spectrum on its 5G network in order to boost capacity. A recent trial with 100 MHz carriers of the C band delivered peak download speeds of 1.4 Gbps near active cell sites and 500 Mbps further away from the towers.

Since it started the roll-out of the C band earlier this year, Verizon has been using blocks of 60 MHz. After recent successful trials of 100 MHz carriers, Verizon has started deploying the larger capacity in many markets across the US, the company announced. In addition to higher speeds and greater capacity for mobile customers, the extra spectrum is expected to support more 5G home broadband and business internet services for customers.

“This increase from using 60MHz to 100 MHz of C-band – which we will ultimately have available in many markets across the US – allows us to support more network traffic, deliver even better performance to our customers and add new products and services on top of the mobile and fixed wireless access solutions we provide today,” said Kyle Malady, EVP and President, Global Networks and Technology. “Reaching new levels of innovation and digital transformation in our society requires a fundamental transformation of the networks our world runs on. The continued evolution of our network is paving the way for this tremendous growth.”

In the recent trial, using 100 MHz of C-band spectrum, engineers were able to reach 1.4 Gbps peak download speeds near active cell sites and 500 Mbps further away from the towers. This additional spectrum is being made available to customers in certain markets several months earlier than projected due to agreements with satellite providers to clear C-Band spectrum (which was originally scheduled to be cleared in December 2023). With the start of commercial deployment with 100 MHz of C-band, customers now have access to more spectrum than ever before. And there is still much runway ahead. As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHz of C Band spectrum across the nation.

This additional spectrum is being made available to customers in certain markets several months earlier than projected due to agreements with satellite providers to clear the C-band spectrum. It was originally scheduled to be cleared only in December 2023. As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHz of C Band spectrum across the nation.

References:

https://www.telecompaper.com/news/verizon-boost-5g-capacity-with-extra-c-band-spectrum–1431401

https://www.verizon.com/about/news/verizon-provide-5g-ultra-wideband-service-more-cities-year

Verizon faces tough times as 5G fails to generate a decent ROI

In 2021, Verizon spent more than $50 billion at FCC auctions to acquire mid-band C-band spectrum licenses for 5G. Along with AT&T, it negotiated a high-profile battle with the U.S. airline industry and FAA to put those spectrum licenses into commercial operations at the beginning of this year.

Verizon launched a C-band 5G network covering 130 million people – almost half of the U.S. population- in the 1st quarter of 2022. By the end of the first quarter, around 40% of Verizon‘s customers owned 5G gadgets capable of accessing the network, and it’s already carrying almost a third of all of Verizon‘s data traffic where it is available.

According to results from network-monitoring company Ookla, Verizon‘s 5G download speeds doubled via to its C-band network launch. However, the effort has been costly. Verizon‘s quarterly capital expenses (capex) spiked during the first quarter thanks to the $1.5 billion it spent during the period on the network equipment necessary to put its C-band licenses into action. That figure doesn’t include the extra money Verizon spent on its massive marketing campaign, which included $1,000 handset subsidies and a $1,000 switcher credit, during the quarter to promote the new network.

What does Verizon have to show for all its mid-band 5G investments? So very much as Moody wrote in a report skeptical on 5G monetization.

In the 1st quarter of 2022, Verizon lost 36,000 postpaid phone customers. While that’s certainly an improvement over the operator’s quarterly performance from a year ago, and also better than some financial analyst expectations, it stands in stark contrast to the 691,000 new postpaid phone customers AT&T netted during the period. AT&T, for its part, has delayed slightly its own big mid-band 5G network buildout until next year.

Moreover, Verizon executives acknowledged that the company saw a slowdown in new customers signing up for Verizon service starting in February and accelerating into March, just as the operator’s C-band marketing campaign ramped up.

David Barden, a financial analyst with Bank of America Merrill Lynch, called out the situation during Verizon‘s quarterly conference call on Friday. “There was a time when Verizon had the best network and could charge the highest prices. And on these calls we would talk about margins and obtainable market share,” he said. “You guys are now [market] share donors. And we’re celebrating how many 5G phones we have and how much C-band we’re deploying, but it’s not obvious that that’s translating into something tangible that investors can celebrate in terms of financial reward. So can we talk a little about that?”

Verizon‘s management team, including CEO Hans Vestberg, argued that “our focus over time is to grow this business.”

“We’re going to compete well,” Vestberg said, adding that “we see more excitement in the market where we offer C-band.”

“This is going to pay off big time in 5-10 years,” he said of Verizon‘s broad 5G investments.

However, he also conceded that Verizon could suffer from inflationary pressures on its labor and energy costs. And, like AT&T CEO John Stankey, he said Verizon may consider raising service prices as a result.

Verizon has lowered their 2022 guidance to the low end of their previous range on every key metric, and they cut their forecast for service and other revenue growth to flat (from +1.0-1.5% previously). The company warned that it now expects its full-year 2022 financial results to come in at the low end of its previously announced guidance. Nonetheless, “we remain well positioned to achieve our long-term growth targets,” Vestberg said.

Analysts don’t seem to agree with Vestberg’s optimism:

“Verizon is growing neither its subscriber base nor its ARPU [average revenue per user]. At a time of rising inflationary pressures, pricing power is nowhere to be found,” wrote the colleague Craig Moffett at MoffettNathanson in a note to clients following the release of Verizon‘s first-quarter results. “And on the unit side, Verizon is already losing share. Unless something changes for 5G revenues that still seem rather intangible (IoT, MEC [multiaccess edge computing], or private networks), the growth runway for Verizon would appear rather weak.”

“There are areas for concern outside of the Wireless segment. Again like AT&T, their Wireline segment is a drag on growth that is only getting worse (their results in Business Wireline, in particular, were – like AT&T’s yesterday – shockingly weak). That puts even more of an onus on the Wireless unit to grow.”

“Things aren’t likely to get easier. Consolidated operating revenue (as reported) of $33.6B was 0.3% below consensus of $33.7B. With such anemic growth, the inflation backdrop is a troubling one. Costs will rise faster than revenues.”

Moffett sees “no easy answers” for Verizon. It could “bow to the pressure” and increase promotions, but he noted that this would further constrain average revenue per user growth for both Verizon and the broader industry. The company could stay disciplined with its pricing and promotional strategies, but doing so would risk further subscriber losses at a time when Verizon’s network advantage over rivals is in jeopardy. “In summary, the path forward remains a challenging one,” Craig concluded.

Financial analysts with New Street Research wrote: “We do remain concerned about Verizon‘s longer-term prospects in wireless, fueled by T-Mobile‘s lead over Verizon on deploying upper mid-band [spectrum] and big lead on total holdings in mid-band spectrum. Verizon management’s aspirations for strong service revenue growth driven by rising ARPU and growing subscribers also still seem way too optimistic in the face of rising competition from a challenger [T-Mobile] with a similar (if not soon-to-be better) network offering priced at a steep discount.”

The New Street analysts also acknowledged that there are widespread expectations that overall growth in the U.S. wireless industry will start to slow sometime this year and that Verizon could be the first 5G operator to suffer from that trend that may eventually affect all of the market’s players.

References:

https://www.lightreading.com/5g/is-verizons-big-5g-gamble-falling-apart/d/d-id/776998?

FAA order to avoid interfering with 5G C-Band services; RootMetrics touts coverage vs performance advantages for 5G

The FCC’s C-Band spectrum (between 3.7 GHz and 4.2 GHz) auction earlier this year raised a staggering gross total of $81.17 billion [1.], smashing the previous auction record of $44 billion raised in the AWS-3 auction that ran in 2014-2015 and raised nearly $45 billion. The mid-band spectrum acquired by AT&T, Verizon, and T-Mobile, could mark a fundamental shift to the 5G landscape in the U.S.

Note 1. Verizon spent a jaw dropping $45B at the C-Band auction, AT&T invested about $23B, while T-Mobile spent $9B to augment its already substantial mid-band holdings.

However, there is a huge controversy over use of that band by wireless telcos. The FAA and aviation industry groups say the new 5G service could interfere with radar or radio altimeters, gauges that measure the distance between aircraft and the ground. Information from those aviation devices feeds a number of cockpit safety systems used to land planes, avoid crashes and prevent midair collisions.

Today, the FAA warned that interference from planned use of 5G wireless spectrum posed an air safety risk and could result in flight diversions.

FAA outlined flight restrictions that will take effect on January 5, 2022 when new 5G C-Band services make their debut, even as regulators work with telecom and aerospace companies to avoid U.S. air traffic disruptions. The FAA order would restrict pilots from operating automatic landing and other cockpit systems commonly used in poor weather, to avoid possible interference from 5G in the spectrum range known as the C-band.

The airports that would face potential disruptions will be identified in future notices, according to the FAA order, known as an airworthiness directive. Regulators and technical experts have been working to address concerns about potential safety risks to resolve a long-running dispute between the aviation and telecom industries.

“The FAA plans to use data provided by telecommunications providers to determine which airports within the United States have or will have C-band base stations or other devices that could potentially impact airplane systems,” the agency’s order said.

Data pertaining to 5G signals’ power levels and location are expected to help air-safety regulators limit disruptions, current and former government officials have said. Aviation industry groups have warned of potentially “debilitating impacts” from such flight restrictions, saying in a Nov. 18 letter to the FCC: “Air cargo and commercial air travel will likely cease at night and in any weather where the pilot cannot see the runway.”

- The FAA said it was coordinating with the Federal Communications Commission and wireless companies and has made progress “toward safely implementing the 5G expansion.”

- The FCC said it looks forward to further guidance from the FAA that takes into account a recently proposed solution from telecom companies.

The FAA said the new 5G service could interfere with gauges that measure the distance between aircraft and the ground.

PHOTO: RANDALL HILL/REUTERS

…………………………………………………………………………………………………………………………………………………………………………………………….

AT&T and Verizon previously agreed to delay by a month their activation of the fifth-generation wireless service, which provides faster broadband speeds for a range of mobile devices. The 5G C-Band services had previously been due to go live Dec. 5, but the companies agreed to hold off because of the FAA’s aviation safety concerns.

On November 24th, AT&T and Verizon offered to limit the signal power of certain 5G base stations as an additional safeguard. On Monday, a representative from the Aerospace Industries Association told the FCC in a letter the carriers’ proposed limits were “inadequate and far too narrow” to address flight safety concerns.

The U.S. telecom industry has maintained that the new 5G service doesn’t pose a safety threat to aircraft, pointing to other countries’ experience with similar wireless services.

- A Verizon spokesman said today that “there is no evidence that 5G operations using C-band spectrum pose any risk to aviation safety, as the real-world experience in dozens of countries already using this spectrum for 5G confirms.” The person added it was confident the FAA ultimately will conclude C-Band 5G use “poses no risk to air safety.” Verizon says it’s on track to reach 100 million Americans with the new service in the first quarter of 2022 and was confident the FAA’s further analysis will find C-band service “poses no risk to air safety.”

- An AT&T spokeswoman said today that the carrier recognizes the “paramount importance of air safety, and our use of the C-band spectrum will not undermine that imperative.”

In its order, the FAA said it determined that “no information has been presented that shows radio altimeters are not susceptible to interference” by the new 5G service. The FAA’s order said it affected an estimated 6,834 U.S.-registered airliners and other aircraft. A similar FAA order, also issued Tuesday, affects an estimated 1,828 helicopters.

The FAA also warned that interference from planned use of 5G wireless spectrum posed an air safety risk and could result in flight diversions. Another FAA directive on Tuesday said the “unsafe condition” posed by the planned use required immediate action before the Jan. 5 deployment “because radio altimeter anomalies that are undetected by the aircraft automation or pilot, particularly close to the ground … could lead to loss of continued safe flight and landing.”

The FCC said it “continues to make progress working with the FAA and private entities to advance the safe and swift deployment of 5G networks … We look forward to updated guidance from the FAA in the coming weeks that reflects these developments.”

…………………………………………………………………………………………………………………………………………………………………..

| Carrier | Low-band | C-Band/mmWave | Smartphone icon |

|---|---|---|---|

| AT&T | Nationwide 5G | 5G+ | 5G+ |

| T-Mobile | Extended Range 5G | Ultra Capacity 5G | 5G UC |

| Verizon | 5G Nationwide | Ultra Wideband 5G | 5G UW |

As the table shows, the carriers’ branding strategies combine mid-band (including C-band) and mmWave into one moniker, which is a logical choice as both mid-band and mmWave 5G can deliver much faster speeds than the low-band 5G networks that carriers currently use to provide nationwide 5G service. In simple terms, when users see those icons on their phones, they should also see faster speeds.

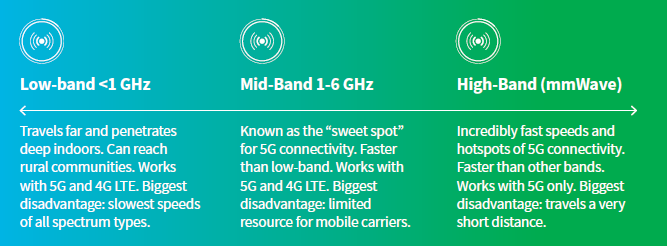

Here’s a look at the three frequency bands being used for 5G services:

Andersen says, “mid-band spectrum can give users a level of 5G service that other types of spectrum can’t: a combination of broad coverage plus excellent speeds, rather than just one or the other, which is the case with low-band (broad coverage but slower speeds) or mmWave (super-fast speeds but small coverage areas).”

Looking ahead to when C-Band might become the dominant spectrum for 5G, Andersen wrote (emphasis added):

C-Band has always been a few years away from becoming the dominant flavor of 5G in the US, and its rollout has been delayed for a bit as the FAA analyzes any possible effects the spectrum could have on aviation. That said, the good news for AT&T and Verizon users is that both carriers will soon begin C-Band deployments, as they pledged to minimize power output from C-Band base stations, especially those close to airports.

The bottom line is that while C-Band will likely be available in some cities in early-to-mid 2022, before it can be rolled out on a broad scale, wireless carriers will need to add new towers, install new hardware and software, and update existing network infrastructure in cities across the country.

All of that takes time, so users likely won’t see a major boost in 5G performance from the C-Band auction for another year or two. But given the results we’ve already recorded on mid-band 5G in the US and other countries, the performance gains C-Band can offer could very well be worth the wait.

We’re looking forward to testing C-Band as rollouts begin and seeing its impact on the end-user 5G experience. In the meantime, keep checking back with RootMetrics for more 5G and mobile performance insights.

AT&T, Verizon Propose C Band Power Limits to Address FAA 5G Air Safety concerns

AT&T and Verizon said today that they would limit some of their 5G wireless services for six months while federal regulators review the signals’ effect on aircraft sensors, an effort to defuse a conflict about C band interference that has roiled both industries.

The cellphone carriers detailed the proposed limits Wednesday in a letter to the Federal Communications Commission (FCC). The companies said they would lower the signals’ cell-tower power levels nationwide and impose stricter power caps near airports and helipads, according to a copy reviewed by The Wall Street Journal. This comes after, both companies agreed to push back their 5G C band rollouts by an additional month to January 5, 2022 after the FAA issued a Nov. 2 bulletin warning that action may be needed to address the potential interference caused by the 5G deployment.

“While we remain confident that 5G poses no risk to air safety, we are also sensitive to the Federal Aviation Administration‘s desire for additional analysis of this issue,” the companies said in the letter to FCC Chairwoman Jessica Rosenworcel.

“Wireless carriers, including AT&T and Verizon, paid over $80 billion for C-band spectrum—and have committed to pay another $15 billion to satellite users for early access to those licenses—and made those investments in reliance on a set of technical ground rules that were expressly found by the FCC to protect other spectrum users.”

AT&T and Verizon said they had committed for six months to take “additional steps to minimize energy coming from 5G base stations – both nationwide and to an even greater degree around public airports and heliports,” and said that should address altimeter concerns.

Wireless industry officials have held frequent talks with FCC and FAA experts to discuss the interference claims and potential fixes, according to people familiar with the matter. An FCC spokesman said the agreed-upon limits “represent one of the most comprehensive efforts in the world to safeguard aviation technologies” and the agency will work with the FAA “so that 5G networks deploy both safely and swiftly.” Wireless groups argue that there have been no C-Band aviation safety issues in other countries using the spectrum.

Earlier this month, the Federal Aviation Administration (FAA) warned it could restrict U.S. airspace in bad weather if the networks were turned on as planned in December. The FAA warning came in the thick of cellphone carriers’ network upgrade projects. A spokesman for the FAA called the proposal “an important and encouraging step, and we are committed to continued constructive dialogue with all of the stakeholders.” The FAA believes that aviation and 5G service in the band telecom companies have planned to use can safely coexist, he said.

AT&T and Verizon said they would temporarily lower cell-tower power levels for their 5G wireless services nationwide.

Photo Credit: GEORGE FREY/AGENCE FRANCE-PRESSE/GETTY IMAGES

Wireless industry executives don’t expect the temporary limits to seriously impair the bandwidth they provide customers because networks already direct signals away from planes and airport tarmacs, according to another person familiar with the matter.

Still, the voluntary limits are a rare step for wireless companies that place a high value on the spectrum licenses they hold. U.S. carriers spent $81 billion to buy licenses for the 5G airwaves in question, known as the C-band, and spent $15 billion more to prepare them for service this winter.

The carriers earlier this month delayed their rollout plans until early January after FAA leaders raised concerns about the planned 5G service. Air-safety officials worried the new transmissions could confuse some radar altimeters, which aircraft use to measure their distance from the ground.

At an industry event last week, FAA Administrator Steve Dickson said conducting flights in a safe manner and tapping spectrum for 5G services can both occur. He said the question was how to “tailor both what we’re doing in aviation so that it dovetails with the use of this particular spectrum.” Mr. Dickson said another focus is the use of the spectrum in other parts of the world and how it differs compared with the U.S. “That’s what the discussions are that we’re having with the telecoms right now.”

U.S. wireless companies send 5G signals over lower frequencies than the altimeters, but air-safety officials worried that some especially sensitive sensors could still pick up cell-tower transmissions. Regulators in Canada and France have also imposed some temporary 5G limits.

The carriers’ letter said the mitigation measures would provide more time for technical analysis “without waiver of our legal rights associated with our substantial investments in these licenses.”

C-band limits are most relevant to AT&T and Verizon, which paid premiums to grab licenses for the new signals ready for use in December 2021. The companies still plan to launch their service, subject to the new limits, in January 2022. The proposed limits would extend to July 6, 2022 “unless credible evidence exists that real world interference would occur if the mitigations were relaxed.”

Rival carrier T-Mobile US Inc. is less vulnerable to delay because it spent a smaller amount for licenses that are eligible for use in December 2023. It also controls a swath of licenses suitable for 5G that aren’t subject to air-safety claims.

It’s not yet clear whether the proposal will be accepted by the FAA, which has warned pilots of the possibility that “interference from 5G transmitters and other technology could cause certain safety equipment to malfunction, requiring them to take mitigating action that could affect flight operations.” After July 6th, both carriers say they’ll set everything back to normal “unless credible evidence exists that real-world interference would occur if the mitigations were relaxed.”

“Our use of this spectrum will dramatically expand the reach and capabilities of the nation’s next-generation 5G networks, advancing US leadership, and bringing enormous benefits to consumers and the US economy,” Verizon and AT&T claimed in their joint letter sent to the FCC.

The federal agencies and the companies they oversee are meanwhile stuck in what New Street Research analyst Blair Levin called “a deep state game of chicken” guided by each regulator’s particular interest, with no clear path towards resolution.

References:

https://www.wsj.com/articles/at-t-verizon-propose-5g-limits-to-break-air-safety-standoff-11637778722

Analysis: FCC’s C band auction impact on U.S. wireless telcos

AT&T Provides Update on Fiber Rollouts, 5G Expansion, and Financial Outlook

Here are the highlights of AT&T Investor Day Announcements:

3 million new fiber locations:

AT&T plans to deploy fiber-to-the-premises (FTTP) to another 3 million-plus residential and business locations across more than 90 metro areas in 2021, and is already sizing up plans to push that to an additional 4 million locations in 2022, Jeff McElfresh, CEO of AT&T Communications, said today during the company’s investor day event.

“The margin economics are attractive. These areas are adjacent to our current footprint, driving cost efficiencies in our build as well as our marketing and distribution efforts.”

McElfresh expects its fiber subscriber volumes increase in the second half of the year after the initial buildouts, but noted that he likes what AT&T is seeing in the early part of 2021. The company noted that about 70% of its gross broadband adds in fiber buildout areas are new AT&T customers.

“And if we keep up with that pace, our vision would be to have over half of our portfolio, or 50% of our network, covered by that fiber asset. As our integrated fiber plan improves the yield performance on that fiber it will further give us conviction on continuing that investment in the coming years.”

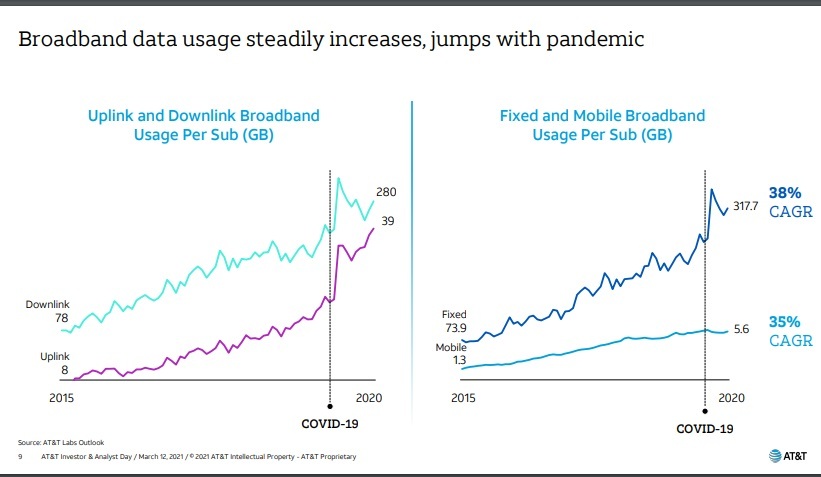

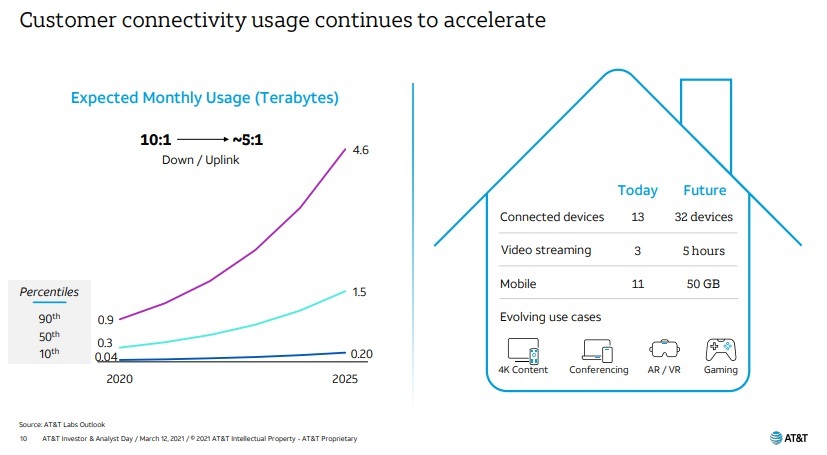

AT&T is also looking to broaden its reach of fiber amid rising data demand and network usage that has occurred during the pandemic, and isn’t expected to stop any time soon. That’s shown in the graph’s below:

References:

………………………………………………………………………………………………………………………………….

AT&T’s 5G Strategy:

AT&T’s 5G network now covers 230M Americans in 14,000 cities and towns and AT&T 5G+ is now available in parts of 38 cities in the U.S.

Note: AT&T may temporarily slow data speeds if the network is busy.

“Connectivity is at the heart of everything we do – 140 years and counting. From our fiber network backbone to the layers of wireless spectrum technology, we provide 5G network coverage that delivers the speeds, security and lower latency connections that customers and businesses need,” said Jeff McElfresh, CEO – AT&T Communications. “Over the past five years, AT&T has invested more capital in the U.S. than any other public company.”

Here is what the company said about its 5G Strategy:

AT&T has planned a balanced approach to 5G. Our strategy of deploying 5G in both sub-6 (5G) and mmWave (5G+) spectrum bands provides a great mix of speeds, latency and coverage for consumers and businesses. We rolled out nationwide 5G that now covers 230 million people, and offer 5G+ providing ultra-fast speeds to high-density areas where faster speeds can have huge impacts for our customers. So far, AT&T has deployed 5G+ nodes in parts of 38 cities across the U.S.

AT&T 5G is opening up some impressive opportunities for businesses and consumers and mid-band and mobile edge computing will help us go even further. There is an emerging multi-sided business model across 5G, edge computing and a variety of use cases from healthcare to gaming.

Our mobile edge computing plus 5G network will help satisfy the need for ultra-responsive networks and open up new possibilities for consumers and businesses. With our investments, we will take advantage of new technologies like spatial computing to enable applications across industries from manufacturing automation to watching immersive sports.

Reference: https://about.att.com/story/2021/5g_strategy.html

…………………………………………………………………………………………………………………………………

C-band spectrum deployment to begin in 2021:

- AT&T acquired 80 MHz of C-band spectrum in the FCC’s Spectrum Auction 107. The company plans to begin deploying the first 40 MHz of this spectrum by the end of 2021.

- AT&T expects to spend $6-8 billion in capex deploying C-band spectrum, with the vast majority of the spend occurring from 2022 to 2024. Expected C-band deployment costs are already included in the company’s 2021 capex guidance and in its leverage ratio target for 2024.

- AT&T expects to deliver 5G services over its new C-band spectrum licenses to 70 to 75 million people in 2022 and 100 million people in “early” 2023.

- Funding C-band spectrum: AT&T’s investment in C-band spectrum via Auction 107 totals $27.4 billion, including expected payments of $23 billion in 2021.

- To meet this commitment and other near-term priorities, in 2021 the company expects to have access to cash totaling at least $30 billion, including cash on hand at the end of 2020 of $9.7 billion, commercial paper issued in January 2021 of $6.1 billion and financing via a term loan credit agreement of $14.7 billion.

Jeff McElfresh, CEO of AT&T Communications, explained the operator’s focus on both 5G and fiber: “Our value proposition is to serve customers how they want to be served with enough bandwidth and capacity and speed, and we’ll let the technology service architecture meet that demand or that need.”

“When you get up into the midband segment of spectrum, while it offers us really wide bandwidth for speed and capacity, its coverage characteristics don’t penetrate [buildings and other locations] as effectively as the lowband does,” he said. “And so as we design our network and our offers in the market, you will see us densify our wireless network on the top of our investments in fiber.”

–>Yet McElfresh didn’t really address how AT&T Communications would overcome those challenges.

References:

https://about.att.com/story/2021/att_analyst_day.html

………………………………………………………………………………………………………………………………….

Financial Targets and Guidance:

- End-of-year 2021 debt ratio target of 3.0x. The company expects to end 2021 with a net debt-to-adjusted EBITDA ratio of about 3.0x,3 reflecting an anticipated increase in net debt of about $6 billion to fund the C-band spectrum purchase.

- 2024 debt ratio of 2.5x or lower. During 2024, AT&T expects to reach a net debt-to-adjusted EBITDA ratio of 2.5x or lower.3 To achieve this target, the company expects to use all cash flows after total dividends to pay down debt and will continue to look for opportunities to monetize non-strategic assets. The company also does not plan to repurchase shares during this period.

- 2021 guidance unchanged. AT&T’s 2021 financial guidance, announced in January 2021, is unchanged on a comparative basis. For the full year, the company continues to expect:

- Consolidated revenue growth in the 1% range

- Adjusted EPS to be stable with 20204,5

- Gross capital investment6 in the $21 billion range, with capital expenditures in the $18 billion range

- 2021 free cash flow7 in the $26 billion range, with a full-year total dividend payout ratio in the high 50’s% range

References:

https://about.att.com/story/2021/att_analyst_day.html

Verizon Outlines Plans for C-Band and mmWave 5G, Business Internet and MEC

C-Band auction results:

Verizon has outlined its plans to expand 5G network coverage using the spectrum it acquired in the recent C-band auction. The company pledged to cover 100 million Americans with its new C-band 5G network—which it will brand as “ultra wideband”—by next March

Verizon succeeded in more than doubling its existing mid-band spectrum holdings by adding an average of 161 MHz of C-Band nationwide for $52.9 billion including incentive payments and clearing costs.

Verizon won between 140 and 200 megahertz of C-Band spectrum in every available market. Specifically, Verizon:

- Secured a minimum 140 megahertz of total spectrum in the contiguous United States and an average of 161 megahertz nationwide; that’s bandwidth in every available market, 406 markets in all.

- Secured a consistent 60 megahertz of early clearing spectrum in the initial 46 markets – this is the swath of spectrum targeted for clearing by the end of 2021, home to more than half of the U.S. population.

- Secured up to 200 megahertz in 158 mostly rural markets covering nearly 40 million people. This will further enhance Verizon’s broadband solution portfolio for rural America.

The auction results represent a 120 percent increase in Verizon’s spectrum holdings in sub-6 gigahertz bands. The quality of this spectrum and Verizon’s depth of licensed holdings represent the premier asset in the industry. In addition, C-Band is a widely used spectrum band throughout the world and will allow for roaming opportunities and economies of scale. The spectrum bands Verizon won are contiguous, which will streamline deployment of this spectrum across the mainland United States.

At an analysts meeting on Wednesday evening, the company said the improved services will help it accelerate wireless network service revenue growth. Verizon expects growth of at least 2 percent this year, 3 percent in 2022 and 2023 and 4 percent or more in 2024. It’s committed an extra $10 billion in capex over the next three years to support the additional 5G network roll-out. Projected spending this year is in the range of $17.5-18.5 billion.

5G mmWave: The super-fast 5G mmWave network that Verizon launched two years ago has seen slow growth, even though Verizon has put up 17,000 cell sites. It’s a very short-range technology, and it’s best used in places like stadiums, concert halls, and convention centers—all the places that have been hardest hit by the pandemic.

Only 5% of Verizon’s total network usage will be on millimeter-wave by the end of 2021, although that could double if stadiums fill up again, according to Verizon CTO Kyle Malady. Only 9% of the carrier’s postpaid customer base has mmWave-capable phones.

Ultimately, he sees as much as 50% of 5G network usage moving to mmWave in dense cities. Of course, that involves people going outside to use it, because mmWave requires line of sight communications so can’t penetrate building walls or other structures.

Verizon is looking at using millimeter-wave for focused backhaul, which will let it put up more rural sites quickly without worrying about running fiber to them.

The company intends to put up another 14,000 millimeter-wave sites this year, Malady said. There’s still technical room for improvement with millimeter-wave, he added. Verizon is working with three different repeater vendors to improve range without adding entire new sites, and he has a “roadmap with Qualcomm” for better beamforming and software features to improve both range and latency.

…………………………………………………………………………………………………………………………………………

In the next 12 months, Verizon expects to have incremental 5G bandwidth via the new spectrum available to 100 million people in the initial 46 markets, delivering 5G Ultra Wideband performance on C-Band spectrum. Over 2022 and 2023, coverage is expected to increase to more than 175 million people and by 2024 and beyond, when the remaining C-Band is cleared, more than 250 million people are expected to have access to Verizon’s 5G Ultra Wideband service on C-Band spectrum.

In addition, Verizon is committing to an additional $10 billion in capital expenditures over the next three years to deploy C-Band as quickly as possible. This spend will be in addition to the current capital expenditure guidance of $17.5B-$18.5B for 2021, which is expected to be at comparable levels through 2023.

C-Band spectrum in Verizon’s Network:

More than 70% of the 5G devices in the hands of customers today are C-Band compatible. Every iPhone 12 model is C-Band compatible. The Samsung Galaxy S21 series and Google Pixel 5 are also compatible. Going forward, all new 5G handsets Verizon brings to market to postpaid customers will be C-Band compatible, with more than 20 C-Band compatible devices offered by the end of the year.

The acquisition of this C-Band spectrum will be a critical component in Verizon’s 5G broadband strategy — 5G Home and 5G Business Internet.

5G Home: By the end of this year, Verizon expects to cover nearly 15 million homes with its home broadband product, and by the end of 2023, 30 million homes, using both 4G and 5G.

To accompany the growth in fixed broadband offerings, the company introduced new 5G Home devices which will be simple for customers to install in their homes – including the Internet Gateway, and the Verizon Smart Display, which join the Verizon 5G Internet Gateway. All three devices will have a sleek design and ‘self setup’ featuring AR guidance, simple instruction videos, and in-app chat and call support.

5G Home internet, the super fast service with download speeds up to 1 Gbps, depending on location, is currently available in 18 markets, with one to two million households expected to be covered via mmWave by end of 2021 and a total of 15 million with LTE Home and the arrival of the first tranche of C-Band. Verizon has teamed up with some of the best content providers in the industry to bring customers plenty of options for all their gaming and streaming needs.

5G Business Internet: 5G Business Internet complements the full suite of Verizon Business tools and offerings, including OneTalk voice communications, BlueJeans by Verizon video-collaboration platform, advanced security and other business services.

By using a high powered fixed 5G receiver, business customers will be able to access the broadband speeds they need with the reliability from Verizon they have come to expect. 5G Business Internet is now available in three markets on mmWave with plans to bring the product to 20 more before the end of the year.

Accelerate 5G Edge:

Verizon Business is well positioned to capture significant edge compute share and is in-market today with both public and private MEC models in collaboration with leading cloud providers. With the addition of C-Band spectrum, the company expects a wider and faster path to monetization.

By the end of 2022, the total edge compute addressable market in the U.S. is estimated to reach $1 billion, and by 2025, rapid adoption of Edge Compute is estimated to create a $10 billion addressable marketplace.

Public MEC Model: Last year, the company partnered with AWS: Wavelength and immediately connected AWS’s 1 million plus developer community to the nearly 170 million end-devices across Verizon’s 4G and 5G Nationwide networks at the edge. Developers today are building use cases spanning a wide array of commercial applications – all through an easy on-ramp in the AWS portal where they can move their workloads to the edge of our network, automatically triggering a recurring revenue share for Verizon and AWS. This partnership enables Verizon Business to be a key participant in this growing opportunity with C-Band accelerating our reach and time to market.

Private MEC Model: Last year, Verizon Business announced a collaboration with Microsoft to deliver a Private MEC model for customers that want a completely dedicated edge compute infrastructure on-premise to provide unique connectivity for their employees, enable data-intensive applications and benefit from solutions like computer vision, augmented reality and machine learning – all built to increase productivity, provide enhanced security and reduce latency in ways that wi-fi cannot.

This fully integrated Verizon 5G solution includes:

- Verizon Private Edge, which combines the power of Microsoft Azure cloud and edge capabilities with 5G on the customer premise.

- Verizon Private network connectivity, which is forecast to be a $10 billion dollar global market by 2025.

- Co-developed real-time enterprise solutions like Intelligent Logistics, Predictive Maintenance, Robotics and Factory Automation, which give Verizon Business a direct line of sight to another $12 billion applications and solutions addressable opportunity by 2025 that will be commercialized through a growing partner ecosystem, including IBM, Cisco, Deloitte and SAP.

The demand for MEC services unlocks an estimated Verizon total market that is forecast to exceed $30 billion by 2025, revenue that will be shared with partners.

Verizon expects to increase service revenues by shifting people to higher-tier unlimited (text, talk, Internet) cellular plans.

…………………………………………………………………………………………………………………………………………………….

Quotes from Executives:

Hans Vestberg, Chairman and CEO of Verizon

FCC C-Band auction results

“Today is one of the most significant days in our 20-year history. This was a highly successful auction for Verizon – a once in a lifetime opportunity – and I am thrilled with what we were able to accomplish.”

Verizon’s strategy

“Our growth model is based on a clear vision: We are a multi-purpose network company with the best networks architected by the best engineers on the planet. This idea of a multi-purpose network at scale is our strategic foundation to maximize growth and put us in a position to realize the best return on investment in the fully-networked economy.”

Verizon’s competitive advantage

“Since we began building 5G, we have had a first mover advantage. We are more than a year ahead in building and selling mmWave with our 5G Ultra Wideband service and still the only company with commercial Mobile Edge Compute. Now we intend to extend our lead by accelerating our deployment of C-Band. Our new C-Band position combined with our mmWave, means we are the only carrier suited to deploy the fastest, most powerful 5G experience to the most people – or as we call it, 5G built right.”

Ronan Dunne, CEO of Verizon Consumer Group

5G adoption

“Customers are migrating to 5G in earnest. As of YE 2020, 9% of our Consumer postpaid phone base were on a 5G device. With the exciting device lineup we have in store, and the superior 5G experience that we deliver, we expect to reach 50% some 18 months ahead of GSMA forecast, and end 2023 ahead of even the more ambitious Ericsson Mobility Report forecast.”

5G devices

“Overall we have 10M 5G Ultra Wideband devices in the hands of customers on our network today. And of those, approximately 70% are already C-Band compatible. Going forward all new 5G handsets we sell to postpaid customers will be C-Band compatible.”

Step ups

“We have seen tremendous step-ups from our customers from Metered to Unlimited and Unlimited to Premium Unlimited as we discussed back in November. We continue to see this with over 20% of our postpaid accounts ending the year on a Premium Unlimited plan. We expect this number to grow to over 30% this year and approximately 50% by 2023. With C-Band included, we think step-ups to premium will only accelerate.”

5G Home acceleration

“By the end of 2021 we will have between 1 and 2 million millimeter wave 5G Homes open for sale and some 15 million in total with the arrival of the first tranche of C Band. By the end of 2023 this will have risen to more than 30 million households we can serve.”

Tami Erwin, CEO of Verizon Business

Mobile Edge Compute

“Verizon Business has a strong first-mover advantage to build a nationwide Mobile Edge Compute platform and be both a market leader and a market maker. This is not just an idea, it’s happening. Companies in every industry are finding exciting ways to bring 5G and 5G Edge to life – leveraging the full capabilities of 5G from throughput and ultra-low latency to sensor densification and rock solid reliability.”

Kyle Malady, CTO of Verizon

Auction results

“We secured a game-changing amount of C-Band spectrum to go along with our leadership in millimeter wave spectrum. We’ve been planning for many months, and are already working to make this the fastest deployment of new spectrum ever. As the leader in the wireless industry, we have consistently deployed a deep portfolio of strong spectrum holdings with best in class technology capabilities. This same focus will continue to position us for growth for years to come.”

Matt Ellis, CFO of Verizon

“Our Network as a Service strategy is our foundation when considering significant investments. We’ve leveraged that framework, investing in key strategic areas, such as spectrum, network assets, partnerships, and disciplined M&A, to position us for this next technology era.”

“Our strategy is working. Our core business is producing revenue growth today. More customers are experiencing the benefits of 5G Ultra Wideband every month on our millimeter wave spectrum and C-Band helps us accelerate the timeline and expand upon that growth.”