Markets and Markets: Managed Services Market revenues at $354.8 billion by 2026

According to a new report by Markets and Markets, the global Managed Services market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% annually, to reach $354.8 billion by 2026 from $242.9 billion in 2021. Enterprises across the globe and verticals are highly investing in their IT infrastructure to maintain their competitive position and attain operational excellence.

The report is titled, “Managed Services Market with COVID-19 Impact Analysis, by Service Type (Managed Security, Managed Network, and Managed Data Center and IT Infrastructure), Vertical, Organization Size, Deployment Type, and Region – Global Forecast to 2026.”

As enterprises are adopting highly complex technologies regardless of their size, they turn to MSPs to manage their IT infrastructure, thus delivering services faster and more efficiently. These technologies are forcing enterprises to redefine their business strategies and emphasize information security. Managed services help enterprises maintain and manage the IT infrastructure and address risks associated with IT assets in an efficient and cost-effective way. This helps enterprises focus on their core competency without increasing the IT footprint.

Managed service vendors around the globe have increased their offerings in the managed services segment. The emergence of new technologies such as blockchain, AI, ML, and data analytics is helping MSPs to enhance their offerings and empower organizations. Enterprises require experts to guide them with their complex IT infrastructure. MSPs around the globe are helping organizations with different managed services such as managed security and managed networks. The objective of these managed services is to enhance and bolster different business verticals so that productivity can be improved, and organizations can focus on their core businesses.

Lack of IT skilled professionals, cost reduction and IT budget constraints, need for cloud-based managed services, high security monitoring to avoid high data loss and downtime cost, and enhanced business productivity are the major factors expected to drive the growth of the Managed Services Market. The lack of sales and marketing staff, training, and cybersecurity could create challenges in front of MSPs during the forecast period. The major factor that may restrain the growth of the Managed Services Market is increasing pressure from statutory regulations across the globe. However, high cloud adoption, the need for automation, and a continuous increase in the demand from SMEs are creating opportunities for MSPs.

Organizations existing IT staff may not be adequately capable of keeping up with new technological trends. Hiring skilled professionals for SMEs and small businesses in their growing stage might not be a good idea as it will misbalance the budget for organizations. A lack of skilled IT security services has made organizations vulnerable to cyber-attacks hindering their brand equity. Managed services can help in bridging the gap by providing their expertise to organizations so that they can focus on their core businesses. Lack of IT skilled professionals can boost Managed Services Market, as it can support growing enterprises that cannot afford to hire additional permanent staff for their IT systems. These technologies are complex in nature, thus required IT experts to deliver maximum output. However, enterprises are finding it difficult to find such talents and thus are reaching out to MSPs.

According to a survey, 60% of enterprises reported that the IT challenges are becoming more acute, and IT is getting harder to manage, while ~90% of the IT enterprises report that their cloud skills gaps have nearly doubled in the past three years (2016–2019), in one or more cloud disciplines, compared with just 50% in 2016. Nearly 70% of the enterprises are reaching out to MSPs to fill cloud IT skill gaps.

Organizations always look for third parties with experts who can provide them managed services in cost-effective and reduced risks. Managed services help to control and reduce various costs and risks. MSP can provide cost-effective and risk-aversion solutions to organizations where they mitigate risk for organizations with their team of experts. Also, with the dynamic nature of work, various risks have been identified and addressed. This can boost Managed Services Market. Low IT budgets and the adoption of the Operation Expenditure (OPEX) model put tremendous pressure on enterprises. IT downtime affects enterprises’ revenue severely. Managed services reduce Total Cost of Ownership (TCO), increase IT uptime, and cut additional staffing costs. Hence, to tackle the above challenges and inherent benefits, enterprises are leveraging managed IT services.

According to a study, unplanned downtime costs enterprises USD 58,000 for every 100 users. Owing to a server and network downtime, the average employee loses 12.4 hours and 6.2 hours per year, respectively. However, by implementing managed IT infrastructure services, it is possible to reduce server and network downtime by more than 85%. By bypassing the need for additional staffing costs, enterprises have experienced a 42% savings in IT budget, according to a study.

North America is one of the most technologically advanced regions in the world. It holds the highest share in the global Managed Services Market. It consists of countries such as the US and Canada. These countries are the early adopters of managed services in the region as North American countries have sustainable and well-established economies, which empower them to invest in R&D activities, thereby contributing to the development of new technologies strongly. The leading managed service vendors in the region include IBM, Cisco, Cognizant, Rackspace, and DXC Technologies. These vendors are investing heavily toward the adoption of managed services by various organic and inorganic strategies. Managed services played a crucial role in the North American channel. Value-added resellers (VAR) are transforming their business by adopting remotely delivered services to their portfolios. These services drive the growth and profitability of channel partners. Network security, cloud-based application, and endpoint security are the majorly used managed services in the region. As the report of Barracuda MSP prepared by 2112 Group “, 21% to 30% of revenue is generated from managed services by channel partners.”

Cloud technology is being used to build new platforms both for customer engagements and for digital transformation. Nearly 70% of enterprises are working in a multi-cloud environment. However, applying a multi-cloud environment to enhance customer engagement is a challenge for most enterprises due to the lack of skill and infrastructure. This has opened an opportunity for MSPs with DevOps experience and those who can offer consumption-based pricing models. Also, during the COVID-19 pandemic, the cloud is gaining more and more traction. This shift from on-premise mode to the cloud is proving to be a boon for managed service providers as it opens an array of opportunities in verticals such as managed security, managed network, managed data center, and IT infrastructure, managed mobility, managed information, and managed communication and collaboration services.

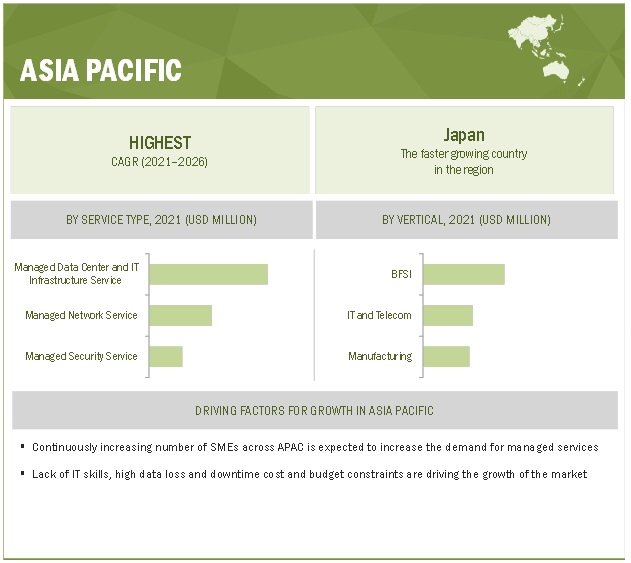

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is one of the fastest-growing regions in terms of the adoption of managed services. Enterprises across APAC are demanding more managed services as compared to other regions to tackle to address the growing range of technology and business challenges. The highly competitive market conditions and the need for improved productivity have forced APAC enterprises to adopt advanced technologies cloud, AI, ML, and IoT. This has fueled the growth of the managed services market further. Australia, India, Japan, New Zealand, and China are the major contributors to the managed services market in the region. However, MSP business models and technology are now mature in the US, Australia, and across Europe; thus, there is a huge potential in APAC.

Additionally, the lack of IT skills, high data loss, and downtime cost and budget constraints drive the growth of the market in the region. Managed security services are the most demanded service across the region by enterprises due to a large number of cyberattacks and less developed infrastructures to discover breaches. According to a study, Asian enterprises take 1.7 times longer than the global median to discover a breach. Large enterprises in APAC could incur an economic loss of USD 30 million due to a cyberattack or data breach. Retails and consumer goods, healthcare, manufacturing, and telecom and IT are the top verticals contributing to the managed services market in the region.

The Managed Services Market report includes major vendors, such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericssion (Sweden), GTT Communications (US), NTT Data (Japan), Happiest Minds (India), Huawei (China), Nokia Networks (Finland), CenturyLink (US), Wipro (India), Cognizant (US),Capgemini (France), BT (UK), Deloitte (UK), Secureworks (US), Alert Logic(US), BAE Systems (UK), Trustwave (US), Hughes (US), MeTtel (US), Microland (India), Optanix (US), Essintial (US), Intact Tech (US), 1-Net (Singapore), Ascend technologies (US), SecureKloud (India), Aunalytics (US), AC3 (Australia), Cloud Specialists (Australia), Corsica Technologies (US), and Empist (US).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1141

North America is one of the most technologically advanced regions in the world. It holds the highest share in the global Managed Services Market. It consists of countries such as the U.S. and Canada. These countries are the early adopters of managed services in the region as North American countries have sustainable and well-established economies, which empower them to invest in R&D activities, thereby contributing to the development of new technologies strongly. The leading managed service vendors in the region include IBM, Cisco, Cognizant, Rackspace, and DXC Technologies. These vendors are investing heavily toward the adoption of managed services by various organic and inorganic strategies. Managed services played a crucial role in the North American channel. Value-added resellers (VAR) are transforming their business by adopting remotely delivered services to their portfolios. These services drive the growth and profitability of channel partners. Network security, cloud-based application, and endpoint security are the majorly used managed services in the region. As the report of Barracuda MSP prepared by 2112 Group “, 21% to 30% of revenue is generated from managed services by channel partners.”

The Managed Services Market report includes major vendors, such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericsson (Sweden), GTT Communications (US), NTT Data (Japan), Happiest Minds (India), Huawei (China), Nokia Networks (Finland), CenturyLink (US), Wipro (India), Cognizant (US),Capgemini (France), BT (UK), Deloitte (UK), Secureworks (US), Alert Logic(US), BAE Systems (UK), Trustwave (US), Hughes (US), MeTtel (US), Microland (India), Optanix (US), Essintial (US), Intact Tech (US), 1-Net (Singapore), Ascend technologies (US), SecureKloud (India), Aunalytics (US), AC3 (Australia), Cloud Specialists (Australia), Corsica Technologies (US), and Empist (US).

References:

https://www.marketsandmarkets.com/Market-Reports/telecom-managed-services-market-117103536.html