Managed Services Market

BT to offer HPE Aruba managed wireless LAN service

UK network operator BT announced a partnership with HPE’s Aruba division [1.] to offer customers a new managed wireless LAN service powered by HPE Aruba Networking delivering improved performance, flexibility and control of local area networks (LANs). It combines BT’s global reach and extensive experience in the design, deployment and management of in-building wired and wireless connectivity with the latest HPE Aruba Networking LAN solutions.

Note 1. On March 2, 2015, Hewlett-Packard announced it would acquire Aruba Networks for approximately $3 billion. It’s interesting that enterprise LANs are now moving from Ethernet to WiFi where Aruba has been a leader (see IDC chart below).

Many legacy LANs struggle to support hybrid workers’ expectations when accessing apps in offices, branches, warehouses, factories or campuses. This is exacerbated by increasing use of bandwidth-hungry video collaboration tools. Colleagues also expect consistent and reliable Wi-Fi connectivity around the building. The increasing number of connected devices, including internet of things (IoT), adds further complexity and cyber security risks.

BT’s new HPE Aruba Networking Managed LAN service will allow customers to securely modernise connectivity to support changing workstyles and keep apace of IoT demands.

As a first step, BT audits the LAN to identify what is already in place and what could be re-used and anything that should be replaced. HPE Aruba Networking provides interoperable technology that can avoid the need to replace the entire network. BT will work collaboratively with the customer to manage costs by providing a staged approach to modernisation with benefits realised at each stage.

BT then evaluates how to secure and protect connected devices. It simplifies visibility by giving customers a single dashboard hosted in the cloud. This centralises reporting, analytics, security, scalability and resilience in one platform to help customers deliver a consistent end-user experience. It can also identify redundant devices using unnecessary power and automate network and energy optimisation.

Andrew Small, director of voice and digital work, Business, BT Group, said: “It’s clear that legacy in-building networks can’t handle modern hybrid working and IoT devices, never mind what comes next. That’s why we’re expanding customer choice of managed LAN solutions by partnering with HPE Aruba Networking. This will offer the visibility, flexibility and security customers need to deliver productive, trusted wired and wireless connectivity.”

“Global customers that are building their connectivity strategies are focusing on modern enterprise networks that are secure, agile, responsive to business needs and simple to operate, while being powerful drivers of transformation,” said Phil Mottram, executive vice president and general manager, HPE Aruba Networking. “HPE Aruba Networking is at the forefront of reinventing how customers and partners can consume or deliver business-outcome focused networking, and by integrating our AI, security, automation, and Network as a Service capabilities, our global managed LAN service with BT is an example of how the network is helping customers achieve their business objectives.

Benefits from Aruba LAN managed by BT:

- Visibility across your network: Through cloud-native management console and single operating system that simplifies visibility and improves performance.

- Optimized existing assets: A solution that integrates and optimizes existing LAN infrastructure, so you are future-ready.

- Supported by BT’s experience in managing and transforming multi-vendor solutions to a more simplified and efficient network.

- Remove the skills gaps: With a trusted partnership that has the combined breadth and depth of our expertise to deliver standalone LAN, campus-wide LAN, and wider transformation solutions.

- Secure and automate: End-to-end managed service and deployment. Scale up or down as needed. Implement additional services, such as advanced security to gain greater insight into your network and apps.

- Innovate and grow: Through centralised reporting, analytics, security, scalability, and resilience all in one platform that helps you deliver a consistent end-user experience and build a robust and innovative LAN.

- Sustainable solution: BT’s Aruba LAN can identify redundant devices using unnecessary power. In addition, it uses automation to optimise network management and energy efficiency.

Market Assessment:

According to Dell’Oro group, enterprise WLAN revenues surged 48% year-on-year in the first quarter of the year, reaching $2.7 billion. Dell’Oro’s Wireless LAN research director Siân Morgan noted that the market hasn’t seen such consistent y-o-y revenue growth for 10 years. Dell’Oro expects revenues to reach $10 billion this year. Dell’Oro said the growth in Q1 appears to have been driven by backlogged orders being filled, and that this is actually masking a decline in new orders.

IDC published its own figures this month that put global enterprise Wireless LAN (WLAN) revenue at $2.8 billion in the first quarter, up 43.3 percent on last year. Similarly to Dell’Oro, IDC said growth was driven by the easing of component shortages and supply constraints, allowing suppliers to catch up with back orders.

In terms of vendors, IDC ranks HPE Aruba second by Q1 market share at 16 percent, noting that its revenue grew 39.5%. Cisco is still the clear leader, with a market share of 47.1% and impressive enterprise WLAN revenue growth of 62.7% (see chart).

References:

https://newsroom.bt.com/bt-and-hpe-partner-for-new-global-managed-lan-service/

https://www.globalservices.bt.com/en/solutions/products/aruba-lan

https://www.arubanetworks.com/products/wireless/access-points/indoor-access-points/

https://telecoms.com/522453/bt-taps-hpe-for-global-managed-lan-service/

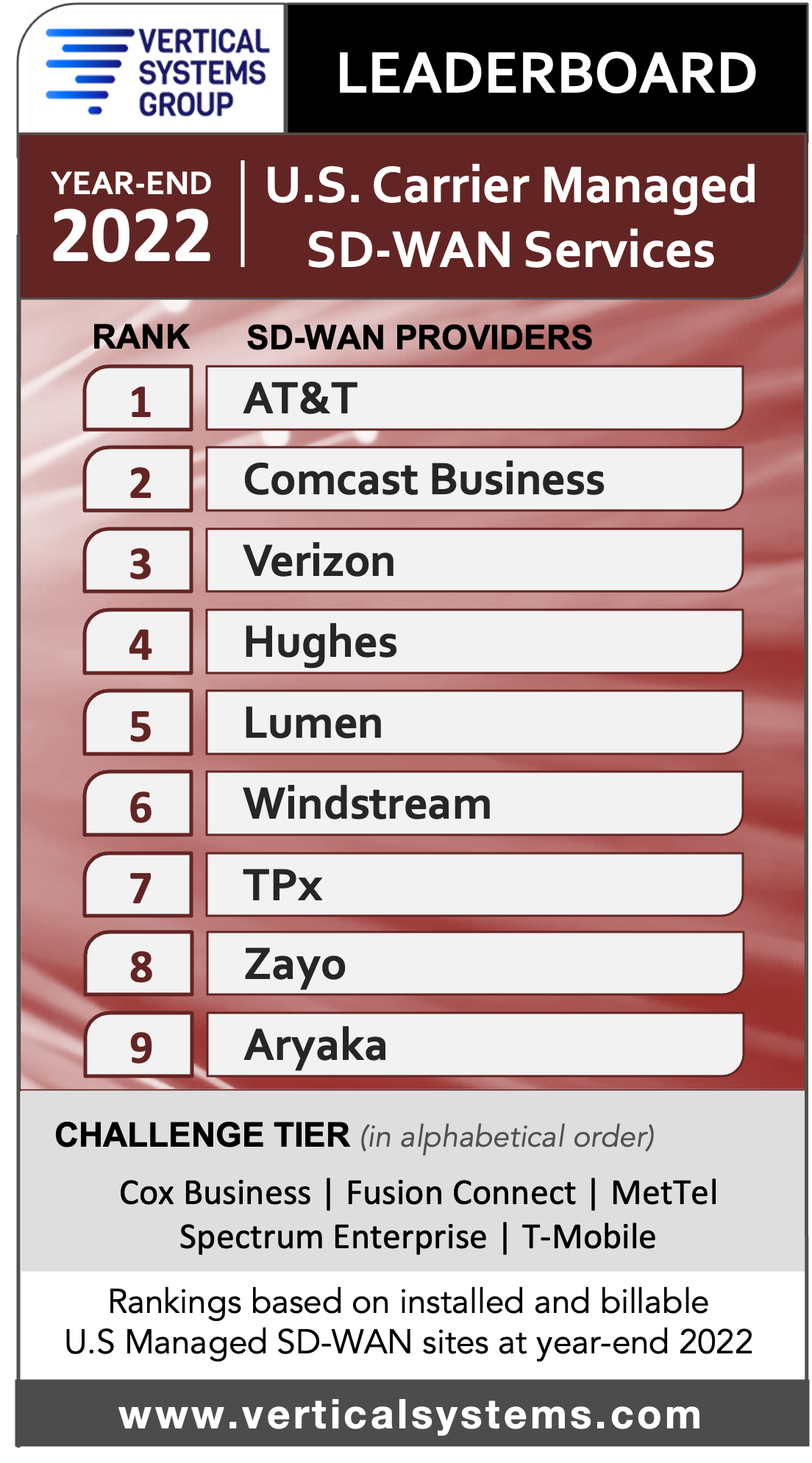

AT&T Tops VSG 2022 Global Provider Carrier Managed SD-WAN Leaderboard

AT&T attained first place on Vertical Systems Group’s (VSG) 2022 Global Provider Carrier Managed SD-WAN Leaderboard, followed by Orange Business, Verizon, BT Global Services, NTT, Telefonica Global Solutions, Hughes and Vodafone. AT&T bumped Orange out of first place on the 2022 leaderboard. No surprise as AT&T continues to top VSG’s 2022 U.S. Carrier Managed SD-WAN Leaderboard for five consecutive years!

BT Global Services overtook NTT for 4th place. Hughes moved out of the Challenge Tier and onto the leaderboard. The top three service providers – AT&T, Orange Business and Verizon – also have MEF 3.0 SD-WAN certification.

This leaderboard includes service providers with 4% or more billable retail site share outside their home countries, which are shown in the graphic below:

Twelve companies qualify for the 2022 Global Provider Managed SD-WAN Challenge Tier (in alphabetical order): Aryaka (U.S.), Colt (U.K.), Comcast Business (U.S.), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (U.S.), Liberty Networks [formerly Cable & Wireless] (Barbados), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden), and Telstra (Australia). The Challenge Tier includes companies with site share between 1% and 4% of this defined SD-WAN segment.

“Leading global SD-WAN providers continued to expand their footprints into dozens of new countries during 2022, with the goal of providing multinational customers with seamless connectivity,” said Rosemary Cochran, principal of Vertical Systems Group. “There was some shuffling of provider rankings since our last Leaderboard release, as competition for global customers is intense and share differentials in this segment are extremely tight.”

Research Highlights:

- Share results for this new Global Provider Managed SD-WAN LEADERBOARD include each provider’s installed year-end 2022 base of multinational customer sites, excluding home country. Vertical’s initial benchmark for this specialized segment was the Mid-2021 Global Provider Managed SD-WAN LEADERBOARD, which included site installations as of June, 30 2021. The share comparisons provided in this analysis are based on these two time periods.

- The roster of companies ranked on the LEADERBOARD increased to eight in 2022, up from seven previously.

- AT&T advances to first position on the LEADERBOARD, up from second and displacing Orange Business. AT&T also ranks first on the 2022 U.S. Carrier Managed SD-WAN LEADERBOARD.

- BT Global Services moves up to the fourth LEADERBOARD position, which drops NTT to fifth position.

- Hughes enters the LEADERBOARD in seventh position, moving up from the Challenge Tier. Vodafone dips from seventh to the eighth and final position.

- The 2022 Challenge Tier remains at twelve companies, however with lineup changes. Lumen drops from the Challenge Tier into the Market Player tier, and Comcast Business (includes Masergy) moves up from the Market Player tier.

- Carrier Managed SD-WAN solutions for multinational customers are typically custom hybrid network configurations that require global infrastructures and technical expertise, and may incorporate MPLS VPNs bundled with cloud connectivity, plus advanced security that is integral or provided with technology partners.

- MEF 3.0 SD-WAN certification has been attained by the top three companies ranked on the 2022 Global Provider Carrier Managed SD-WAN LEADERBOARD – AT&T, Orange Business, and Verizon. Additionally, five companies cited in the Challenge Tier have MEF 3.0 SD-WAN certification as follows: Colt, Comcast Business, PCCW Global, Tata and Telia.

- The primary technology suppliers utilized by the Global Provider SD-WAN LEADERBOARD and Challenge Tier companies are as follows (in alphabetical order): Cisco, Fortinet, HPE Aruba, Nuage Networks from Nokia, Palo Alto, Versa and VMware.

The Market Player tier includes all other companies with Global Provider SD-WAN site share below one percent (1%), including the following companies (in alphabetical order): Batelco (Bahrain), China Telecom (China), Cirion (Argentina), Claro Enterprise Solutions (Mexico), CMC Networks (South Africa), Cogent (U.S.), Embratel (Brazil), Epsilon (Singapore), Etisalat (Abu Dhabi), Exponential-e (U.K.), Flo Networks (Mexico), Fusion Connect (U.S.), HGC Global (Hong Kong), Intelsat (U.S.), KDDI (Japan), Lumen (U.S.), Meriplex (U.S.), PLDT Enterprise (Philippines), Retelit (Italy), SES (Luxembourg), Sparkle (Italy), StarHub (Singapore), T-Mobile (U.S.), Telenor (Norway), Telin (Singapore), TelMex (Mexico), Transtelco (U.S.), Virgin Media (U.K.), Zayo (U.S.) and other providers selling SD-WAN services outside their home country.

Vertical Systems Group’s Definition: Carrier Managed SD-WAN Service:

Vertical Systems Group defines a Carrier Managed SD-WAN Service for segment analysis and share calculations as a carrier-grade offering for business customers that is managed by a network operator. Required components and functionality for these offerings include an SDN service architecture that provides dynamic optimization of traffic flows, a purpose-built SD-WAN appliance or CPE-hosted SD-WAN VNF at each customer edge site, support for multiple active underlay connectivity services, automated failover fast enough to maintain active sessions, and centralized network orchestration with traffic and application visibility end-to-end. Security is the most essential additional managed SD-WAN service capability that may be provided or integrated based on specific customer requirements.

References:

Markets and Markets: Managed Services Market revenues at $354.8 billion by 2026

According to a new report by Markets and Markets, the global Managed Services market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% annually, to reach $354.8 billion by 2026 from $242.9 billion in 2021. Enterprises across the globe and verticals are highly investing in their IT infrastructure to maintain their competitive position and attain operational excellence.

The report is titled, “Managed Services Market with COVID-19 Impact Analysis, by Service Type (Managed Security, Managed Network, and Managed Data Center and IT Infrastructure), Vertical, Organization Size, Deployment Type, and Region – Global Forecast to 2026.”

As enterprises are adopting highly complex technologies regardless of their size, they turn to MSPs to manage their IT infrastructure, thus delivering services faster and more efficiently. These technologies are forcing enterprises to redefine their business strategies and emphasize information security. Managed services help enterprises maintain and manage the IT infrastructure and address risks associated with IT assets in an efficient and cost-effective way. This helps enterprises focus on their core competency without increasing the IT footprint.

Managed service vendors around the globe have increased their offerings in the managed services segment. The emergence of new technologies such as blockchain, AI, ML, and data analytics is helping MSPs to enhance their offerings and empower organizations. Enterprises require experts to guide them with their complex IT infrastructure. MSPs around the globe are helping organizations with different managed services such as managed security and managed networks. The objective of these managed services is to enhance and bolster different business verticals so that productivity can be improved, and organizations can focus on their core businesses.

Lack of IT skilled professionals, cost reduction and IT budget constraints, need for cloud-based managed services, high security monitoring to avoid high data loss and downtime cost, and enhanced business productivity are the major factors expected to drive the growth of the Managed Services Market. The lack of sales and marketing staff, training, and cybersecurity could create challenges in front of MSPs during the forecast period. The major factor that may restrain the growth of the Managed Services Market is increasing pressure from statutory regulations across the globe. However, high cloud adoption, the need for automation, and a continuous increase in the demand from SMEs are creating opportunities for MSPs.

Organizations existing IT staff may not be adequately capable of keeping up with new technological trends. Hiring skilled professionals for SMEs and small businesses in their growing stage might not be a good idea as it will misbalance the budget for organizations. A lack of skilled IT security services has made organizations vulnerable to cyber-attacks hindering their brand equity. Managed services can help in bridging the gap by providing their expertise to organizations so that they can focus on their core businesses. Lack of IT skilled professionals can boost Managed Services Market, as it can support growing enterprises that cannot afford to hire additional permanent staff for their IT systems. These technologies are complex in nature, thus required IT experts to deliver maximum output. However, enterprises are finding it difficult to find such talents and thus are reaching out to MSPs.

According to a survey, 60% of enterprises reported that the IT challenges are becoming more acute, and IT is getting harder to manage, while ~90% of the IT enterprises report that their cloud skills gaps have nearly doubled in the past three years (2016–2019), in one or more cloud disciplines, compared with just 50% in 2016. Nearly 70% of the enterprises are reaching out to MSPs to fill cloud IT skill gaps.

Organizations always look for third parties with experts who can provide them managed services in cost-effective and reduced risks. Managed services help to control and reduce various costs and risks. MSP can provide cost-effective and risk-aversion solutions to organizations where they mitigate risk for organizations with their team of experts. Also, with the dynamic nature of work, various risks have been identified and addressed. This can boost Managed Services Market. Low IT budgets and the adoption of the Operation Expenditure (OPEX) model put tremendous pressure on enterprises. IT downtime affects enterprises’ revenue severely. Managed services reduce Total Cost of Ownership (TCO), increase IT uptime, and cut additional staffing costs. Hence, to tackle the above challenges and inherent benefits, enterprises are leveraging managed IT services.

According to a study, unplanned downtime costs enterprises USD 58,000 for every 100 users. Owing to a server and network downtime, the average employee loses 12.4 hours and 6.2 hours per year, respectively. However, by implementing managed IT infrastructure services, it is possible to reduce server and network downtime by more than 85%. By bypassing the need for additional staffing costs, enterprises have experienced a 42% savings in IT budget, according to a study.

North America is one of the most technologically advanced regions in the world. It holds the highest share in the global Managed Services Market. It consists of countries such as the US and Canada. These countries are the early adopters of managed services in the region as North American countries have sustainable and well-established economies, which empower them to invest in R&D activities, thereby contributing to the development of new technologies strongly. The leading managed service vendors in the region include IBM, Cisco, Cognizant, Rackspace, and DXC Technologies. These vendors are investing heavily toward the adoption of managed services by various organic and inorganic strategies. Managed services played a crucial role in the North American channel. Value-added resellers (VAR) are transforming their business by adopting remotely delivered services to their portfolios. These services drive the growth and profitability of channel partners. Network security, cloud-based application, and endpoint security are the majorly used managed services in the region. As the report of Barracuda MSP prepared by 2112 Group “, 21% to 30% of revenue is generated from managed services by channel partners.”

Cloud technology is being used to build new platforms both for customer engagements and for digital transformation. Nearly 70% of enterprises are working in a multi-cloud environment. However, applying a multi-cloud environment to enhance customer engagement is a challenge for most enterprises due to the lack of skill and infrastructure. This has opened an opportunity for MSPs with DevOps experience and those who can offer consumption-based pricing models. Also, during the COVID-19 pandemic, the cloud is gaining more and more traction. This shift from on-premise mode to the cloud is proving to be a boon for managed service providers as it opens an array of opportunities in verticals such as managed security, managed network, managed data center, and IT infrastructure, managed mobility, managed information, and managed communication and collaboration services.

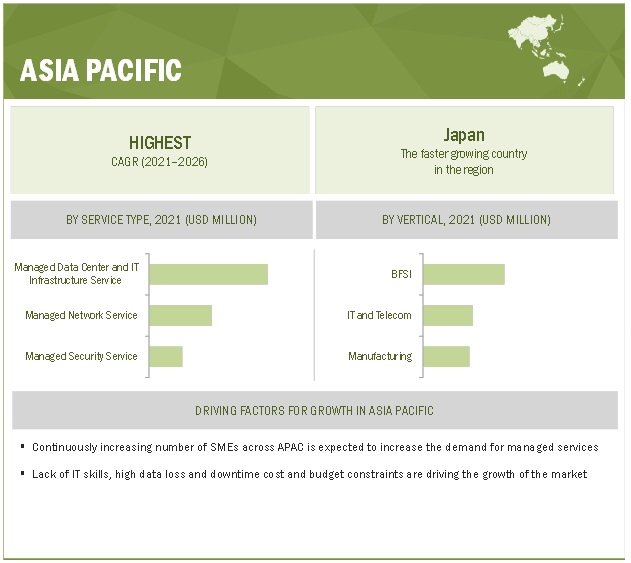

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is one of the fastest-growing regions in terms of the adoption of managed services. Enterprises across APAC are demanding more managed services as compared to other regions to tackle to address the growing range of technology and business challenges. The highly competitive market conditions and the need for improved productivity have forced APAC enterprises to adopt advanced technologies cloud, AI, ML, and IoT. This has fueled the growth of the managed services market further. Australia, India, Japan, New Zealand, and China are the major contributors to the managed services market in the region. However, MSP business models and technology are now mature in the US, Australia, and across Europe; thus, there is a huge potential in APAC.

Additionally, the lack of IT skills, high data loss, and downtime cost and budget constraints drive the growth of the market in the region. Managed security services are the most demanded service across the region by enterprises due to a large number of cyberattacks and less developed infrastructures to discover breaches. According to a study, Asian enterprises take 1.7 times longer than the global median to discover a breach. Large enterprises in APAC could incur an economic loss of USD 30 million due to a cyberattack or data breach. Retails and consumer goods, healthcare, manufacturing, and telecom and IT are the top verticals contributing to the managed services market in the region.

The Managed Services Market report includes major vendors, such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericssion (Sweden), GTT Communications (US), NTT Data (Japan), Happiest Minds (India), Huawei (China), Nokia Networks (Finland), CenturyLink (US), Wipro (India), Cognizant (US),Capgemini (France), BT (UK), Deloitte (UK), Secureworks (US), Alert Logic(US), BAE Systems (UK), Trustwave (US), Hughes (US), MeTtel (US), Microland (India), Optanix (US), Essintial (US), Intact Tech (US), 1-Net (Singapore), Ascend technologies (US), SecureKloud (India), Aunalytics (US), AC3 (Australia), Cloud Specialists (Australia), Corsica Technologies (US), and Empist (US).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1141

North America is one of the most technologically advanced regions in the world. It holds the highest share in the global Managed Services Market. It consists of countries such as the U.S. and Canada. These countries are the early adopters of managed services in the region as North American countries have sustainable and well-established economies, which empower them to invest in R&D activities, thereby contributing to the development of new technologies strongly. The leading managed service vendors in the region include IBM, Cisco, Cognizant, Rackspace, and DXC Technologies. These vendors are investing heavily toward the adoption of managed services by various organic and inorganic strategies. Managed services played a crucial role in the North American channel. Value-added resellers (VAR) are transforming their business by adopting remotely delivered services to their portfolios. These services drive the growth and profitability of channel partners. Network security, cloud-based application, and endpoint security are the majorly used managed services in the region. As the report of Barracuda MSP prepared by 2112 Group “, 21% to 30% of revenue is generated from managed services by channel partners.”

The Managed Services Market report includes major vendors, such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericsson (Sweden), GTT Communications (US), NTT Data (Japan), Happiest Minds (India), Huawei (China), Nokia Networks (Finland), CenturyLink (US), Wipro (India), Cognizant (US),Capgemini (France), BT (UK), Deloitte (UK), Secureworks (US), Alert Logic(US), BAE Systems (UK), Trustwave (US), Hughes (US), MeTtel (US), Microland (India), Optanix (US), Essintial (US), Intact Tech (US), 1-Net (Singapore), Ascend technologies (US), SecureKloud (India), Aunalytics (US), AC3 (Australia), Cloud Specialists (Australia), Corsica Technologies (US), and Empist (US).

References:

https://www.marketsandmarkets.com/Market-Reports/telecom-managed-services-market-117103536.html