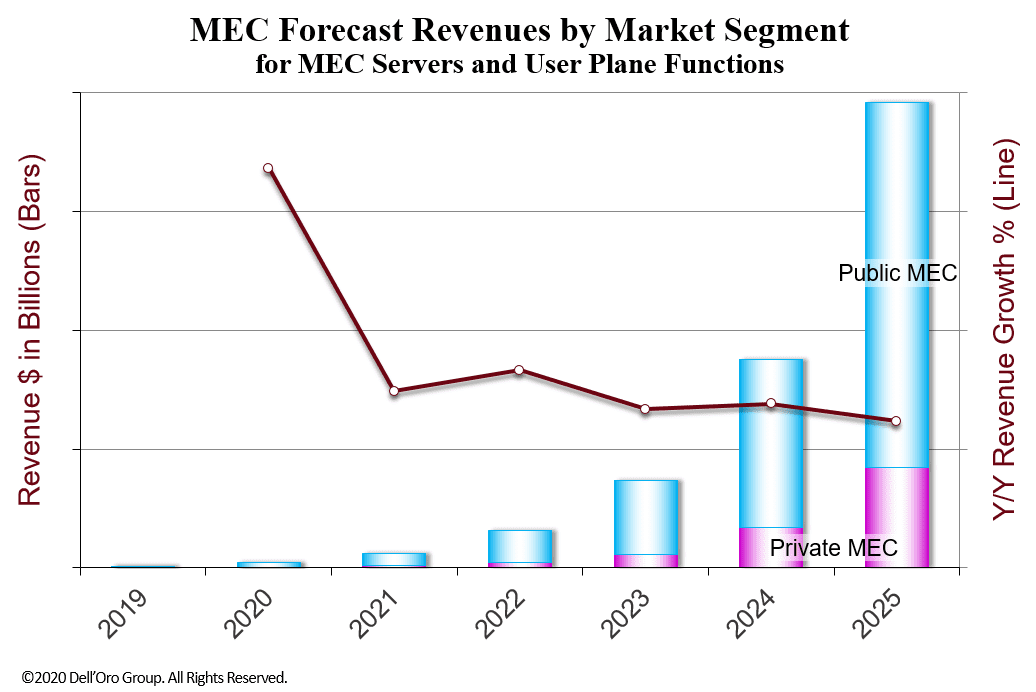

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Dell’Oro Group has published an update to its Multi-Access Edge Computer (MEC) 5-year forecast report. According to Dave Bolan, Research Director, Dell’Oro has lowered their expectations from the previous forecast, because of the slower start than anticipated for 5G SA buildouts, especially for federated MEC capability.

MEC investments are expected to increase at a 140% compounded annual growth rate (CAGR) in Servers and Packet Core User Plane Functions over the next five years. However, MEC specifications need to evolve for federated MEC networking to address broader requirements in the market.

“The cumulative five-year investment in MEC is expected to be $11B. Approximately 60% of the revenues will come in 2025. Though it looks lopsided in terms of 2025 revenues, when you look at units, the MEC servers are split almost 50/50 between Public MEC and Private MEC (on-premises), wrote David Bolan, Research Director at Dell’Oro Group.

“Though the CAGR is the same as our previous forecast, the cumulative forecast has decreased due to a slower than anticipated wide-scale launches of 5G Standalone (5G SA) networks. This may be due to 5G service providers (SPs) investigating the role that Public Cloud SPs could play in their networks.”

Image Credit: Dell’Oro Group (Dave Bolan)

………………………………………………………………………………………

“Another factor may be the need for specifications for federated MEC networking,” commented Bolan. “European Telecommunications Standards Institute (ETSI) MEC committee and GSM Association (GSMA) Operator Platform Group just released their requirements for federated MEC networking, identifying seven uses cases that the SP community needs,” added Bolan.

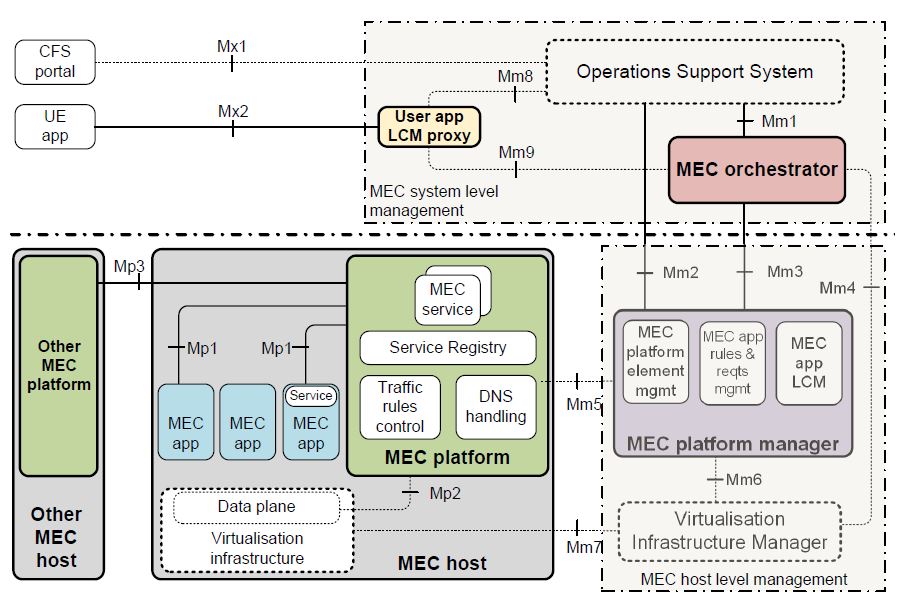

ETSI Model of MEC:

“While MEC can be done for both 4G and 5G, 4G networks need to be upgraded with control and user plane separation. That separation is inherent in 5G. Another inherent characteristic of 5G is lower latency than 4G LTE. While the forecast has some 4G MEC, the vast majority is based on 5G standalone for MEC to reach its full potential.”

Dell’Oro Group’s Multi-Access Edge Computing Advanced Research Report offers a complete overview of the market opportunity for the Infrastructure Edge to reduce latency. MEC is a new networking technology designed to capitalize on the opportunity. The market is segmented by Public MEC and Private MEC, and offers a worldwide view of the total available market in revenue and units. The MEC Report includes Definition and Scope, Market Drivers, Use Cases, System Architecture, Vendor Ecosystem, US MEC System Deployment Model, and a 5-year MEC Revenues and Shipments Forecast for Servers and the packet core User Plane Functions.

To purchase the report, please email [email protected].

References:

3 thoughts on “Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025”

Comments are closed.

Terrific article on MEC market.

I can’t find your email subscription link or e-newsletter service. Do you have any? Please permit me to subscribe. Thanks.

There is no email sign up to receive notifications for new IEEE Techblog posts. You can either follow me on Twitter @ajwdct OR subscribe for free to IEEE Techblog weekly post notifications at https://www.feedspot.com.

Or simply check this website every day for new posts and comments.

Bullish Forecast for Edge Computing:

The global edge computing market size is projected to reach USD 155.90 billion by 2030 and register a CAGR of 38.9% from 2022 to 2030. The integration of artificial intelligence (AI) into the edge environment is expected to propel market expansion. An edge AI system can assist businesses in making quick decisions in real-time.

Key Industry Insights & Findings from the report:

The COVID-19 outbreak has bolstered the use of edge computing and data centers as more and more businesses are prioritizing the development of communications infrastructure.

Based on component, the hardware segment captured a significant revenue share in 2021 due to the increasing number of IIoT and IoT devices. Edge cloud servers must have powerful routers that are flexible and able to handle a volume of incoming traffic while maintaining low latency.

The Industrial Internet of Things (IIoT) applications segment dominated the global edge computing market in 2021 owing to the rampant digitization of services and the emergence of industry 4.0.

Based on industry vertical, the energy and utility segment accounted for a revenue share of over 15% in 2021 as a result of the rising adoption of smart grids that mandates device edge infrastructure.

Smart grids are being installed to aid alternative renewable power generation from sources such as wind and solar. Smart grids enhance operational efficiencies, including incorporation with smart appliances, real-time consumption control, and microgrids to support power generation from dispersed renewable sources.

Geographically, Asia Pacific accounted for a significant market share due to the widespread development of connected device ecosystems in countries such as India and China.

Read 254 page full market research report for more Insights, “Edge Computing Market Size, Share & Trends Analysis Report By Component, By Application, By Industry Vertical, By Region And Segment Forecasts From 2022 To 2030”, published by Million Insights.

Edge Computing Market Growth & Trends

Moreover, the necessity to reduce privacy breaches related to the transmission of massive volumes of data, as well as latency and bandwidth limitations that restrict an organization’s data transmission capabilities, is expected to drive market growth in the forthcoming years.

Precision monitoring and machinery control are a few use cases that employ AI on the edge. A fast-moving production line needs the minimum amount of latency possible, which can be achieved by using edge computing. It can be very beneficial to move data processing close to the manufacturing facility because it can be accomplished with AI. Many different endpoint devices, including sensors, cameras, smartphones, and other Internet of Things (IoT) devices, can make use of artificial intelligence-based edge devices.

Edge computing is currently in its early phases of development. Its operating and deployment models are still in their nascent stages; nonetheless, edge computing is anticipated to present considerable growth opportunities for new entrants in the coming years. As communications infrastructure continues to be developed, demand for edge computing will increase in the years following the COVID-19 pandemic. Working from home is gradually replacing traditional office work and the telecommunications industry is making strides in the development of video conferencing software.

Prominent platforms such as Zoom and Microsoft Teams are creating new solutions to cater to the growing demand. For example, in December 2020, Amazon Web Services and SK Telecom collaborated to launch 5G MEC-based edge cloud services. Energy & utility, healthcare, agriculture, transportation & logistics, retail, telecommunication, and real estate industries are rapidly adopting edge computing as it improves application performance and results, lowers operational costs, and eliminates centralized storage and redundant transmission expenditures.

https://www.prnewswire.com/news-releases/edge-computing-market-to-be-worth-155-90-billion-by-2030-million-insights-301683681.html