Dell’Oro: Total RAN market to grow 10-15% in 2021; Microwave Transmission equipment grows 11% YoY

Dell’Oro Group has once again upgraded its forecast for the total RAN market, now projecting it to grow 10-15% this year. As expected, Huawei and ZTE are gaining market share in China, while Ericsson and Nokia are gaining everywhere else. Ericsson and Samsung increased their RAN revenue outside of China.

“The underlying long-term growth drivers have not changed and continue reflect the shift from 4G to 5G, new FWA (Fixed Wireless Access) and enterprise capex, and the transitions towards active antenna systems,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “At the same time, a string of indicators suggest this output acceleration is still largely driven by the shift from 4G to 5G, which continued at a torrid pace in the quarter (but only for the RAN; not for the 5G SA core network), even as LTE surprised on the upside,” continued Pongratz.

“With the improved outcome in Latin America, we estimate that four out of the six regions we track increased at a double-digit rate in the second quarter,” Stefan said via email. He was kind enough to send me these charts:

Additional highlights from Dell’Oro’s 2Q 2021 RAN report:

- RAN rankings did not change – Huawei and ZTE were the No.1 and No.2 suppliers in China while Ericsson and Nokia maintained their No.1 and No.2 positions outside of China.

- Revenue shares changed slightly – preliminary estimates suggest Ericsson and Samsung recorded revenue share gains outside of China, while Huawei and ZTE improved their positions in China.

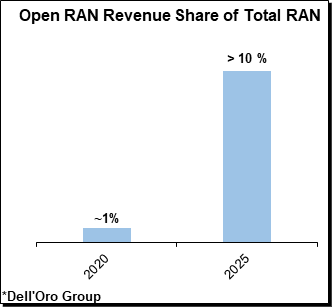

- The combined share of the smaller RAN suppliers, excluding the top five vendors, improved by ~1% between 2020 and the first half of 2021, in part as a result of the ongoing Open RAN greenfield deployments in Japan and the U.S. “It’s all relative and it will take some time before open RAN moves the needle,” Pongrantz said.

- The RAN market remains on track for a fourth consecutive year of growth. The short-term outlook has been revised upward – total RAN is now projected to advance 10 to 15% in 2021.

………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceiver, macro cell, small cell BTS shipments, and Open RAN for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, and LTE. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook.

- Segments: LTE, Sub 6 GHz 5G NR, Millimeter Wave 5G NR, Massive MIMO, Macro Cell, Small Cell, Open RAN

- Regions: North America, Europe, Middle East & Africa, Asia Pacific, China and CALA (Caribbean and Latin America)

To purchase this report, please contact: [email protected]

References:

2021 Outlook Upgraded for RAN Market, According to Dell’Oro Group

…………………………………………………………………………………………………………………………………..

Separately, Dell’Oro Group says that the demand for Microwave Transmission equipment grew 11% year-over-year in the first half of 2021, driven by LTE and 5G. In that period, microwave revenue from mobile backhaul application grew 16 percent.

“The Microwave Transmission market is recovering from the decline caused by the spread of COVID-19 as evidenced by the strong growth in the first half of 2021,” stated Jimmy Yu, Vice President at Dell’Oro Group. “Almost all of the vendors in this industry are benefiting from the improving mobile backhaul market, especially the top vendors. Since demand is rising, each vendor’s performance this year will come down to how well they navigate the supply issues created by the pandemic and semiconductor shortages,” added Yu.

Highlights from the 2Q 2021 Quarterly Report:

- All regions contributed to the positive market growth this quarter with the exception of Latin America. Latin America declined year-over-year for a ninth consecutive quarter, shrinking to its lowest quarterly revenue level that we have on record.

- The top three vendors in the quarter continued to be Huawei, Ericsson, and Nokia. In 2Q 2021, Huawei regained most of the market share lost in the previous quarter and returned to holding a 10 percentage point lead over Ericsson.

- E/V Band revenue growth remained positive for another consecutive quarter and held its double-digit year-over-year growth rate.

The Dell’Oro Group Microwave Transmission & Mobile Backhaul Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, ports/radio transceivers shipped, and average selling prices by capacities (low, high and E/V Band). The report tracks point-to-point TDM, Packet, and Hybrid Microwave as well as full indoor and full outdoor unit configurations.

The following markets are covered in the report:

- TDM, Packet, and Hybrid Microwave

- Microwave Transmission by Application: Mobile Backhaul and Verticals

- Split mount units, Full indoor units, and full outdoor units

- E/V Band systems

To purchase this report, please contact [email protected]

References:

5G and LTE Drive Mobile Backhaul Microwave Market 16 Percent in 1H 2021, According to Dell’Oro Group

One thought on “Dell’Oro: Total RAN market to grow 10-15% in 2021; Microwave Transmission equipment grows 11% YoY”

Comments are closed.

Wireless telecoms industry analyst Stefan Pongratz, vice president of the Dell’Oro Group, this week told attendees to the Open RAN Forum that as operators connect radio site total cost of ownership with savings presented by new Open RAN architectures, revenues derived from disaggregated systems could overtake proprietary revenues in the 2025 timeframe.

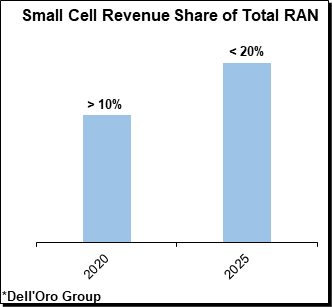

Pongratz identified “three broad architecture trends” being addressed by operators and vendors to essentially “do more with less.”:

A shift from centralized to distributed RAN as baseband functionality is moved away from sites;

a move from custom baseband hardware to general purpose hardware supporting virtualized RAN;

and a move from closed, proprietary RAN interfaces to Open RAN interfaces.

Pongratz said a big driver here is operators’ wanting more vendor optionality as opposed to working with Ericsson, Huawei and Nokia, which control about 80% of global RAN market share. “They want to see more suppliers,” he said. “It’s not necessarily they want more to work with once they decide…but they want to have a broader selection from the get-go. When it comes to the decision-making then of course there’s going to be some collective good kind of thinking, but I also think a lot of the decisions from operators will ultimately boil down to maximizing that TCO over the lifespan of the product.”

He also gave a bit of a breakdown of RAN costs noting that wireless capex is around $150 billion to $160 billion per year with RAN representing between 20% and 25% of the capital spend. Drilling down to individual radio sites, this represents between 10% and 20% of total operating budgets. In terms of lowering TCO by switching to Open RAN, vRAN, or a combination of the two, “The likelihood is the majority of [the cost saving]is coming from the non-RAN bucket,” things like automation, reducing headcount and improving energy efficiency. “There’s a significant non-RAN component to keep in mind.”

Pongratz tracked spending on Open RAN solutions showing significant increases from around $100 million in the first half of 2020, to around $1 billion in the first half of 2021. And, “We have just upped short-term and longer-term projections,” as more than 80% of the top 20 global service providers by revenue have deployed, committed to deploy, or are otherwise evaluating Open RAN.

“When it comes to how Open RAN will be deployed going forward, I think we kind of envisioned it would be multiple phases,” he said. “Some large Tier 1 European operators will say the technology, the architecture, will not be ready for primetime until lets say 2022 or 2025. That’s when we see that the Open RAN revenues will actually surpass more traditional solutions. At the same time we now have operators in Japan that have gone from let’s say 0% Open RAN to more than 75% or 80% Open RAN in just a couple quarters with 5G. Not all Open RAN is the same; they’re doing something different.”

Going forward from this initial phase will include increasing focus on multi-vendor deployments, more vRAN, then layering in RAN Intelligent Controller software platforms and white box hardware. “It will take some time to realize the full Open RAN vision,” Pongratz said.

https://www.rcrwireless.com/20210917/open_ran/open-ran-revenues-could-surpass-proprietary-ran-revenues-by-2025-delloro-group