FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

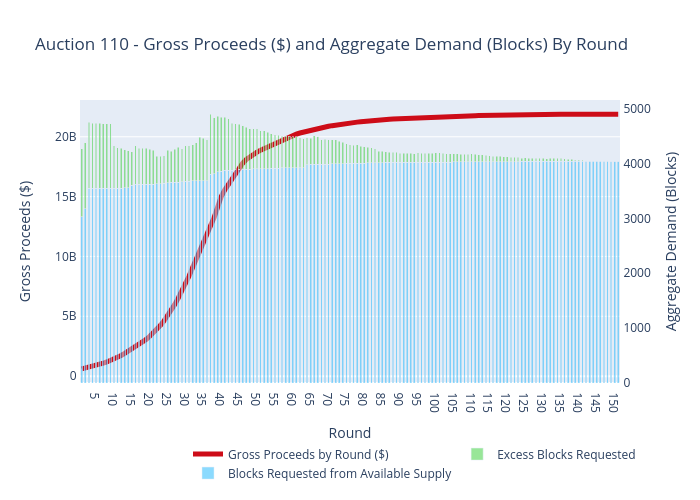

The latest FCC auction (#110) of mid-band spectrum for 5G ended Tuesday with a total of $21.9 billion in winning bids. That total is roughly in line with pre-auction estimates.

Auction 110 offered 100 megahertz of mid-band spectrum in the 3.45–3.55 GHz band (the 3.45 GHz Service) for flexible use, including 5G wireless. The 100 megahertz of spectrum available in Auction 110 will be licensed on an unpaired basis divided into ten 10-megahertz blocks in partial economic areas (PEAs) located in the contiguous 48 states and the District of Columbia (PEAs 1–41, 43–211, 213–263, 265–297, 299–359, and 361–411). These 10-megahertz blocks are designated as A through J.

The clock phase concluded on November 16, 2021. The FCC will release a public notice within the next few business days announcing details about the assignment phase, including the date and time when bidding in the assignment phase will begin.

See the Auction 110 website for more information.

Highlights:

- Qualified Bidders (Clock Phase)= 33

- Licenses Won=4041

- FCC Held Licenses=19

- Total Licenses=4060

- Gross Proceeds as of Clock Phase=$21,888,007,794

Next up is the auction’s “assignment” phase, wherein winning bidders can select the specific frequencies they want to use. After that phase is over, the FCC will announce the identities of the winning bidders. That might not happen until December or January.

Major participants in the auction included AT&T, Verizon, T-Mobile, Dish Network, Grain Management and Columbia Capital.

The spectrum in this auction is ideal for 5G. Mid-band spectrum is in high demand because it is widely viewed as providing the optimum mix of speed and coverage for 5G. Licenses in Auction 110 sold for an average of $0.666 per MHz per person (MHz pop) in the coverage area, according to Sasha Javid, chief operating officer for BitPath, who has been doing a detailed daily analysis of auction results.

Auction 110 winners will pay less per MHz pop in comparison with what Auction 107 (C-band) winners paid but more than Auction 105 CBRS band winners paid, according to Javid. Those other two auctions also included mid-band spectrum and the C-band auction was record breaking.

Javid notes that the CBRS licenses were subject to power restraints, making them less valuable. He didn’t offer an opinion on why Auction 110 licenses were less costly than Auction 107 licenses (on a MHz-pop basis), but perhaps the disparity is related to license size.

Winning bidders will need to purchase new radio equipment from base station/kit makers Ericsson, Nokia, and Samsung (but not Huawei or ZTE which are banned in the U.S.) to put their spectrum licenses into 5 commercial service.

Unlike past spectrum auctions, cable companies including Comcast and Charter did not participate in the auction. Based on Dish Network’s recent fundraising, the company appears poised to potentially account for as much as a fourth of the auction’s total.

Broadly, the FCC’s 110 auction of spectrum licenses between 3.45GHz and 3.55GHz can be considered a success. The auction started October 5, and bidding crossed the critical $14.8 billion reserve price October 20. That was a necessary milestone considering that reserve price is the cost to move existing, incumbent military users out of the band.

The auction was worth around $0.70 per MHz-POP. The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.

In comparison, the recent CBRS auction of mid-band spectrum drew winning bids of just $0.215 per MHz-POP, whereas the massive C-band auction generated winning bids of $0.945 per MHz-POP, a figure that does not account for additional clearing costs.

This FCC auction is the agency’s third-biggest spectrum auction ever. As noted by Next TV, only the $45 billion AWS-3 auction in 2015 and the $81 billion C-band auction earlier this year generated more in winning bids. The auction earlier this month passed the FCC’s broadcast incentive auction of 600MHz licenses, which ended with $19.8 billion in winning bids in 2017.

The value of the spectrum licenses in this auction could rise if interference with aircraft concerns continue to drag on the C-band. However, CTIA President and CEO, Meredith Attwell Baker in response to the bulletin maintained that 5G using C-band won’t cause interference and that timely deployments are key for 5G leadership. “5G networks using C-band spectrum operate safely and without causing harmful interference to aviation equipment.

References:

https://www.fcc.gov/auction/110

https://auctiondata.fcc.gov/public/projects/auction110

https://www.fcc.gov/auction/110/factsheet

https://sashajavid.com/FCC_Auction110.php

FCC Pockets Close to $22B in Auction 110 of 3.45 GHz Band Spectrum

5 thoughts on “FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids”

Comments are closed.

Thanks for the update, Alan. This auction has been overshadowed by the C-Band FCC/FAA controversy.

True. Earlier this month the FAA issued a warning over potential interference to airplane safety systems from upcoming 5G deployments in C-band frequencies. The ongoing FCC vs FAA debate focuses on interference with radio altimeters, which operate in the nearby 4.2-4.4 GHz band and help with important aviation systems such as landing in bad weather, avoiding collisions and preventing crashes.

For more info on this issue: https://www.fiercewireless.com/regulatory/faa-issues-warning-potential-safety-risks-from-5g-c-band

Email excerpts from Stephane Teral of Light Counting:

The FCC acted swiftly to reorganize the C-band spectrum used by satellites and auction it such that the U.S. could join the 5G mid-band club and be on par with the rest of the world. In addition, it’s worth noting that the C-band addresses capacity issues and closes the gap between AT&T and Verizon, and T-Mobile US.

However, as C-band rollouts were just about to start this fall, the Federal Aviation Administration (FAA) issued a warning on potential safety risks from C-band, specifically interferences with radio altimeters used in the aeronautical radio-navigation service.

Given that: theoretically, interferences between the cellular radio and the radio altimeter waves should not occur because their respective center frequency are different, and the 2 radio waves do not start in phase,

the ITU addressed this potential risk 8 years ago and published a comprehensive set of recommendations,

there is a guard band large enough between the 5G C-band frequency band and that of the radio altimeter,

3.5GHz is widely used in 4G LTE TDD networks; by at least 230 CSPs in 101 countries/territories that have launched TDD LTE or TDD 5G networks in the 3.3-3.8GHz spectrum band, and early 5G adopter South Korea, now joined by more than 100 countries using 3.5GHz, has not reported a single incident, this “Made in America” story sounds like a hoax.

Email excerpts from John Strand, Stand Consult:

A recent US Federal Aviation Administration (FAA) bulletin warning that 5G transmissions could interfere with aircraft altimeters took foreign aviation and telecom regulatory authorities by surprise. European authorities now must scramble to assuage public safety concerns about a problem which did not exist before. Though the FAA asserts there is no evidence of actual interference, US mobile operators have paused their deployment in the band for one month for additional study.

Since 2019, 5G has been deployed in 175 networks in some 50 countries with no report of interference. US pilots who fly into Europe’s 3.7-3.98 MHz band with no problem from 5G are now told to watch their altimeters for problems in the US. It begs the question whether physics operates differently in the US, or whether something else is behind the FAA’s bulletin. For example political and jurisdictional conflicts between the FAA and the Federal Communications Commission (FCC) have been reported. Moreover, altimeters do not benefit from a professionalized, international standards development process like 3GPP offers for mobile networks and phones.

Strand Consult asked noted spectrum and public safety communications expert Steffen Ring for comment. Read his assessment in Telecom Expert Voices.

Steffen Ring, M.Sc.E.E. is the CEO and founder of Ring Advocacy LLC, a globally operating telecommunications consultancy specialising within spectrum regulation and standard related matters.

Steffen Ring served for Motorola Inc. as spectrum, standards and regulatory expert for 39 years, the last 10 years as officer in the Global Government Affairs dept., Washington D.C., where he gained a substantial experience and a global personal network amongst regulators through participating in meetings all the way from ITU-R to regional and national telecommunication regulators.

Ring serve clients developing new wireless products, ensuring the compliant use of radio frequency spectrum all the way from radiolocation radar systems, nanosatellites, and civil drones to IoT and SRD devices. In particular the industrial applications of 5G/LTE platforms are amongst the most counselled subjects today.

Furthermore, Steffen Ring also undertakes to represent and advocate clients’ needs regarding radio spectrum matters in all official meetings of the CEPT/ECC and the various working groups of ITU-R.

Finally, Ring has a close working relationship with the EU Commission (CNECT) and other relevant DG’s. The corporation is registered in the EU Transparency Register in order to function in full transparency on behalf of industrial clients.

Reference:

https://strandconsult.dk/blog/5g-is-suddenly-a-flight-safety-concern-amid-rapid-network-roll-out-in-the-us-strand-consult-investigates-with-leading-eu-spectrum-and-public-safety-communications-expert/

AT&T, Dish, and T-Mobile spend billions on more 5G spectrum

AT&T, Dish, and T-Mobile dropped billions of dollars in a Federal Communications Commission (FCC) auction to acquire more 5G spectrum licenses in the midrange 3.45GHz to 3.55GHz band.

While AT&T was the biggest spender at $9 billion, Dish spent $7.3 billion, and T-Mobile followed behind at $2.9 billion. Verizon was notably absent from the auction. A number of smaller players also made the list.

The auction officially ended in November, but the FCC hasn’t publicly disclosed the winning bidders until now (PDF). Total bids reached about $22.5 billion, making it the third-largest FCC spectrum auction yet. Only last year’s $80 billion C-band auction (over half of which was contributed by Verizon), and 2015’s $44.9 billion AWS-3 auction top this amount of spending, as pointed out by Next TV (via Light Reading).

When it comes to using the 3.45GHz band, however, Light Reading says that companies will have to deploy new radios on cell towers that have the ability to broadcast signals across it. Smartphones that support C-band may already be capable of using the band, Light Reading also notes, as they both fall under the 3rd Generation Partnership Project’s (3GPP) n77 technical standards that cover 3.3GHz to 4.2GHz, which existing 5G smartphones already use.

Although the 3.45GHz band operates closely to C-band, the WSJ notes that it’s not as likely to interfere with aircraft equipment. Verizon and AT&T are set to deploy their expanded 5G C-band services on January 19th after the Federal Aviation Administration (FAA) delayed the rollout twice due to aircraft safety concerns.

https://www.theverge.com/2022/1/15/22885320/att-dish-tmobile-5g-spectrum-billions-auction