Dell Oro and IDC on the Global Service Provider Router and Switch market in 3Q-2021

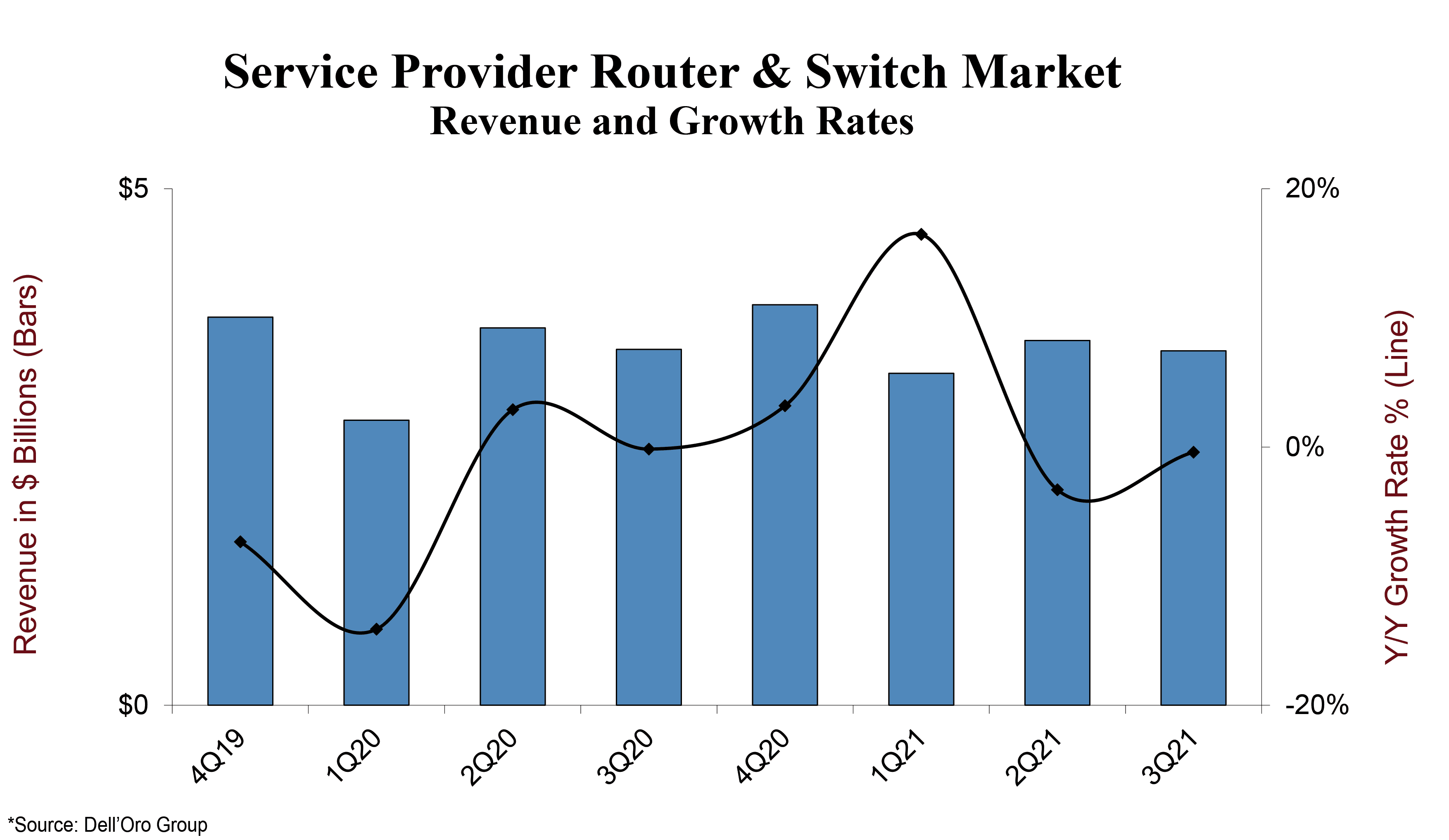

According to a new report by Dell’Oro Group, the worldwide Service Provider Router and Switch market was flat in 3Q 2021. Market growth was stifled during the quarter due in large part to global supply chain constraints that affected vendors’ ability to deliver products to customers.

“Despite global supply chain problems, the underlying demand to upgrade backbone and 5G transport networks remains strong,” said Shin Umeda, Vice President at Dell’Oro Group. “Service providers are transitioning to new network architectures, and demand for 400 Gbps capable systems and enhanced edge routers offer the networking capabilities required to achieve the transformations,” added Umeda.

Additional highlights from the 3Q 2021 Service Provider Router and Switch Report:

- Cisco was the top-ranked vendor for the first three quarters of 2021, followed by Huawei, Nokia, Juniper, and ZTE.

- The Service Provider Router and Switch market is projected to grow at a slightly lower rate for 2021 due to the negative effect of supply chain constraints.

- The North American region outperformed all other regions with double-digit revenue growth through the first three quarters of 2021.

The Dell’Oro Group Service Provider Router and Switch Quarterly Report offers complete, in-depth coverage of the Service Provider Router and Switch market for future current and historical periods. The report includes qualitative analysis and detailed statistics for manufacture revenue by regions, customer types, and use cases, average selling prices, and unit and port shipments. To purchase these reports, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

……………………………………………………………………………………..

On December 8th, IDC reported that the worldwide Ethernet switch market recorded $8.1 billion in revenue in the third quarter of 2021 (3Q21), an increase of 7.5% year over year.

Meanwhile, worldwide total enterprise and service provider (SP) router market revenues grew 4.7% year over year in 3Q21 to $3.8 billion. These growth rates are according to results published in the International Data Corporation (IDC) Worldwide Quarterly Ethernet Switch Tracker and IDC Worldwide Quarterly Router Tracker.

Ethernet Switch Market Highlights

The Ethernet switch market’s 7.5% annualized growth in 3Q21 builds on growth in the first half of the year. Year-to-date through the first three quarters of 2021, the market is up 8.6% compared to the first three quarters of 2020. On a sequential basis, the 3Q21 Ethernet switch market revenues were up 9.3% from the previous quarter. And compared to the third quarter of 2019, which was before the COVID-19 pandemic, revenues increased 9.6%, indicating strong organic growth in the market.

From a geographic perspective, the 3Q21 Ethernet switch market had strong results across most parts of the world. In the Asia/Pacific region, the People’s Republic of China increased 18.1% year over year while Japan’s market declined 13.6%. In the rest of Asia/Pacific (excluding China and Japan) (APeJC), the market rose 7.3% year over year, buoyed by the market in Korea growing 22.3% annually. In Europe, results were mixed: Western Europe’s market rose 16.7% year over year with strength from Germany, which grew 18.3%. Central and Eastern Europe’s market rose 3.3%. In the Middle East & Africa, the market declined 8.9% year over year. Across the Americas, the market in the United States rose 5.5%; Canada’s market fell 0.2%, and Latin America’s market increased 16.0% year over year with Brazil rising 43.6% compared to 3Q20.

“The Ethernet switching market continues to demonstrate impressive resilience. Through the first three quarters of 2021, the market has recorded healthy growth compared to 2020, driven by demand in both the enterprise campus and branch markets, as well as from hyperscalers and other cloud providers, which continue to invest in datacenter switching capacity,” notes Brad Casemore, research vice president, Datacenter and Multicloud Networking. “There are some headwinds in the market, though: supply-chain constraints occasioned by the COVID-19 pandemic mean that customers and vendors must plan accordingly as they look to the year ahead, and the pandemic itself continues to sow uncertainty among technology buyers, especially enterprises in certain industries.”

Overall port shipments increased 9.1% with growth in both the non-datacenter and datacenter portions of the Ethernet switch market. Non-datacenter Ethernet switch revenues grew 6.5% in 3Q21 year over year with port shipments increasing 9.1%. The non-datacenter Ethernet switch portion of the market makes up 87.1% of port shipments and 56.7% of total market revenues with the balance of revenues and port shipments in the datacenter portion of the market. In the datacenter segment, revenues rose 8.8% year over year while port shipments increased 8.7%.

The higher-speed segments of the Ethernet switch market continue to see significant growth driven by hyperscalers and cloud providers. Market revenues for 200/400 GbE switches grew 70.4% from the second quarter to the third quarter of 2021 with port shipments more than doubling (+118.1%) on a sequential basis. 100GbE revenues increased 13.8% on an annualized basis while port shipments rose 13.1% year over year. 100GbE revenues make up 24.5% of the Ethernet switch market’s total revenues. 25/50 GbE revenues declined 1.1% annually while port shipments declined 7.8%.

Lower-speed switches, a more mature part of the market, saw mixed results. 10GbE port shipments declined 1.5% year over year with revenue dropping 6.0% annually; 10GbE switches make up 23.0% of the market’s total revenue. 1GbE switches increased 10.5% year over year in port shipments and increased 7.6% in revenue. 1GbE accounts for 34.4% of the total Ethernet switch market’s revenue. 2.5/5GbE switch revenue increased 7.3% sequentially from 2Q21 to 3Q21 while port shipments rose 6.7% quarter-over-quarter.

Router Market Highlights

The worldwide enterprise and service provider router market increased 4.7% year over year in 3Q21 with the major service provider segment, which accounts for 76.4% of revenues, increasing 3.6% and the enterprise segment increasing 8.3%. From a regional perspective, the combined service provider and enterprise router market increased 15.4% in APeJC. Japan’s market declined 6.1% while the People’s Republic of China market was up 2.2% year over year. Revenues in Western Europe were off 1.6% compared to 3Q20 while the Central and Eastern Europe the combined enterprise and service provider declined 4.9% annually. The Middle East & Africa region declined 1.7%. In the U.S., the enterprise segment increased 27.6% while the service provider revenues increased 5.4% giving the combined markets a 10.6% increase on an annualized basis. The Latin American market grew 7.3% on an annualized basis and Canada’s market increased 6.2% year over year.

Vendor Highlights

Cisco finished 3Q21 with a year-over-year decline of 1.3% in overall Ethernet switch revenues and market share of 45.4%. Meanwhile, Cisco’s combined service provider and enterprise router revenue grew 10.7% year over year with enterprise router revenue increasing 14.1% and SP revenues increasing 8.7%. Cisco’s combined SP and enterprise router market share stands at 37.5% in the quarter.

Huawei’s Ethernet switch revenue increased 11.4% on an annualized basis in 3Q21 giving the company market share of 10.7%. The company’s combined SP and enterprise router revenue increased 4.0% year over year giving the company a market share of 28.1%.

Arista Networks saw its Ethernet switch revenues increase 23.0% in 3Q21, bringing its share of the total market to 7.3%.

H3C’s Ethernet switch revenue increased 18.6% year over year giving the company market share of 6.2% in the quarter. In the combined service provider and enterprise routing market, H3C’s revenues grew 31.3%, giving the company a 2.2% market share.

HPE‘s Ethernet switch revenue increased 23.6% year over year in 3Q21, giving the company a market share of 5.8%.

Juniper‘s Ethernet switch revenue, which includes the company’s cloud-managed, enterprise campus Mist portfolio as well as its EX and QFX switch portfolios, increased 25.6% year over year in 3Q21, bringing its Ethernet switch market share to 3.2%. Juniper saw an 11.0% decline in combined enterprise and SP router sales, bringing its market share in the router market to 10.0%.

“Results in the Ethernet switch market were generally strong across the globe, indicating that most regions of the world continue to recover from the COVID-19 pandemic that caused decreased spending on network infrastructure,” noted Petr Jirovsky, research director, IDC Networking Trackers. “The growth in the third quarter of 2021 compared to the same period in 2019 indicates strong fundamentals for the market, which is a positive sign for the future.”

The Worldwide Quarterly Ethernet Switch Tracker and the Worldwide Quarterly Router Tracker provide total market size and vendor shares for the Ethernet switch and router technologies in an easy-to-use Excel pivot table format. The geographic coverage for both the Ethernet switch market and the router market includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The Ethernet switch market is further segmented by speed (100Mb, 1000Mb, 2.5Gb/5Gb, 10Gb, 25Gb/50Gb, 50Gb, 100Gb, 200Gb/400Gb), product (fixed managed, fixed unmanaged, modular), and layer (Ethernet switch, ADC). Measurement for the Ethernet switch market is provided in vendor revenue, value, and port shipments. The router market is further split by product (high-end, mid-range, low-end, SOHO), deployment (service provider, enterprise), connectivity (core, edge), and the measurements are in vendor revenue, value, and unit shipments.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

One thought on “Dell Oro and IDC on the Global Service Provider Router and Switch market in 3Q-2021”

Comments are closed.

Ethernet-based Routers and Switch continue to make up an increasing portion of the Data Center Interconnect (DCI) market as ZR modules and 400 Gbps platforms begin to ramp in volume.

Cloud service provider network topologies favor the use of Ethernet systems. As these operators continue to carry a growing proportion of Internet traffic, Ethernet-based systems are transporting a growing amount of all Internet and 5G traffic. ZR and ZR+ will play an important role in defining boundaries between edge and core data centers as well as the backhaul of 5G traffic.

“Ethernet-based Routers and Switch continue to make up an increasing portion of the DCI market as ZR modules and 400 Gbps platforms begin to ramp in volume,” said Alan Weckel, Founder and Technology Analyst at 650 Group. “Cloud service provider network topologies favor the use of Ethernet systems. As these operators continue to carry a growing proportion of Internet traffic, Ethernet based systems are transporting a growing amount of all Internet and 5G traffic. ZR and ZR+ will play an important role in defining boundaries between edge and core data centers as well as the backhaul of 5G traffic.”

The Quarterly DCI report indicates that the top four western Ethernet DCI vendors were Juniper, Cisco, Arista, and Nokia. The top four Optical Transport DCI vendors were Ciena, Cisco, Infinera, and Nokia. In addition, the report highlights how Cloud providers, especially Hyperscalers, adopt technology differently than traditional SPs.

About the Ethernet Switch Quarterly Report

The Data Center Interconnect (DCI) Report offers a market assessment of vendor performance and market share across Routers, Switches, and Optical Transport gear used for DCI. The report covers Modular, Fixed, regional data, and segmentation for Cloud, Telco, and Colocation based deployments. For more information about the report, contact the sales department at 650 Group at +1 650 600 7104 or [email protected] or http://www.650group.com.

About 650 Group:

650 Group is a leading Market Intelligence Research firm for communications, data center, and cloud markets. Our team has decades of research experience, has worked in the technology industry, and is actively involved in standards bodies.

https://www.650group.com/press-releases/ethernet-data-center-interconnect-dci-reaches-new-all-time-high-in-3q21-according-to-650-group