Router-Switch market

Cisco 800G line card for Cisco 8000 Series Routers powered by Silicon One ASIC

Cisco today announced 800G innovations that continue to transform the economics and sustainability of the Internet for the Future, to help its customers connect the nearly 40% of the world’s population that remains unconnected or underserved.

As IoT devices grow from billions to trillions, demand for bandwidth grows not only from connecting devices with 5G and Wi-Fi, but also from the AI/ML workloads required to drive insights from IoT. Applications such as generative AI, search, language processing, and recommendation engines, are driving rapid growth of AI/ML clusters in data center environments that require more bandwidth over traditional workloads. AI/ML fabrics need to scale with denser spines that are critical to support the massive number of processors with low latency, in addition to capacity expansion in Data Center Interconnect.

While bandwidth growth seems unlimited, space and power are limited. Dense and power-efficient platforms are required. Cisco is doubling the capacities of communication service provider and Webscale customer backbones, metro core, and data center networks compared to 400G/100G modular solutions.

The new 28.8Tbps / 36 x 800G line card for Cisco 8000 Series Routers is powered by Cisco Silicon One [1] and lowers operational costs while protecting investments as communication service providers and cloud operators transform networks from 100G to 400G, and 800G capacities. Customers can benefit from carbon savings by using less hardware to scale, and equipment reuse.

Note 1. Cisco Silicon One is claimed to be the only unifying architecture enabling customers to deploy the best-of-breed silicon from Top of Rack (TOR) switches all the way through the web scale data centers and across the service provider networks with a fully unified routing and switching portfolio.

“We continue to expand 800G to more use cases, from AI/ML fabrics to the core, to help our customers meet their performance and sustainability goals,” said Kevin Wollenweber, Senior Vice President and General Manager, Cisco Networking, Data Center and Provider Connectivity. “With our dense core and spine solutions using new double density line cards with Cisco Silicon One, we have accelerated the transition to 800G anywhere.”

Key Benefits of Modular Cisco 8000 Series Router Systems Powered by Cisco Silicon One P100:

- Economics: With up to 83% space savings, customers can build denser networks using much of the same infrastructure to support use cases such as 5G, IoT, broadband and AI/ML. Other benefits include:

- By doubling the capacity in the same chassis footprint, the Cisco 8000 Series Router platform has up to twice the space efficiency over 400G single chassis systems.

- These 800G single chassis systems can now support equivalent traffic loads with up to 6x more space efficiency compared to current 400G distributed chassis solutions, by delivering up to 15 Tbps per Rack Unit.

- New 800G modular systems can also provide the equivalent bandwidth capacity with up to an estimated 68% savings in power compared to 400G solutions to help reduce operational costs.

- Sustainability: With up to 68% power savings, the 800G systems can help customers meet their sustainability goals.

- Assuming a single 800G system is in use 24 hours per day, 365 days per year, the potential energy savings over 400G systems would reduce GHG emissions by up to 215,838 CO2e per year.

- This amount of carbon savings is estimated to be equivalent to reducing carbon emissions from charging 40 million smartphones or burning 366,923 pounds of coal a year [1]

- Customers can also reuse common equipment when upgrading to 800G systems to help cut down on e-waste.

- Architectural Innovations: Powered by Cisco Silicon One P100 ASICs and Cisco pluggable optics, the new line card offers massive throughput for Cisco 8800 Series modular systems. Key features include:

- Advanced 100G SerDes technology allows customers to double current 400G port densities and increase by 8-fold current 100G port densities in the same form factor, supporting 72 x 400G and 288 x 100G ports per slot.

- Ability to scale up to 800G to support increasing traffic demands with four, eight, twelve, and 18-slot chassis. Customers can scale up to 518 Tbps capacity with a single 18-slot modular 800G system.

- Pay-as-you-grow Flexible Consumption Model helps customers futureproof their deployments by right-sizing the network, adding capacity over time to better align to business outcomes.

- Cisco’s new generation of pluggable optics provide investment protection through backwards compatibility with existing QSFP pluggable transceivers.

- Operational Simplicity: With advanced visualization dashboards, services monitoring with actionable insights, and closed-loop network optimization customers can detect issues and troubleshoot faster.

- With the latest enhancements in Crosswork Network Automation the speed at which network elements and services can be added has been significantly improved.

- New IOS XR Path Tracing provides hop-by-hop visibility of the packet’s path through the network.

Industry Response:

“Based on our extensive market research and traffic analysis, we are forecasting continued growth in data traffic with fixed and mobile services, including for 5G, broadband, IoT and cloud. These trends are putting networks under increasing pressure, which is why scaling to 800G throughput in the future with solutions such as Cisco 8000 will be in demand, while helping service providers and cloud providers improve operational efficiency, sustainability, and user experience.” — Simon Sherrington, Research Director, Analysys Mason

“Together with Cisco, we seek new approaches to drive market differentiation and deliver business outcomes through agile, secure infrastructure at every stage of the technology journey. As a key enabler of the kingdom’s Vision 2030, we must ensure that our technology stays at the forefront of technological Innovations. With modular 800G innovations and Silicon One P100 on the Cisco 8000 Series, we continue to push towards new levels of cloud connectivity and digital transformation while benefiting from operational efficiencies that allow stc group to maintain providing a high-performing, lower cost-per-bit service to our customers.” — Bader Allhieb – stc Infrastructure, stc

“Colt is working towards ESG By Design, which means our firm commitment to sustainability spans every part of our business. It’s imperative that we work with partners that share our values and strive to build a better, cleaner planet. Cisco’s latest routing innovation shows its dedication to finding powerful and effective ways of scaling capacity, whilst mitigating the environmental impact. It marks an exciting next stage in the future of sustainable digital infrastructure.” — Kelsey Hopkinson, VP-ESG, Colt Technology Services

“With the implementation of Florida LambdaRail’s new FLRnet4 400G backbone, space becomes one of our primary concerns as we had exhausted our existing footprint in many of our sites. The combination of unbelievable forwarding capacity, operational efficiency, and the dependable IOS XR network operating system made the Cisco 8000 Series the obvious choice for our new network. We couldn’t be more pleased with our choice. We not only have a state-of-the-art network, but the Cisco 8000 series solution ensures there is enough opex savings to scale our network for years to come.” — Chris Griffin, Chief Network Architect, Florida LambdaRail

Supporting Resources:

- Read the Blog: Scaling the Internet for the Future with 800G Innovation, by Satish Surapaneni

- https://blogs.cisco.com/sp/scaling-the-internet-for-the-future-with-800g-innovationsMass-Scale Infrastructure for Core

- Cisco 8000 Series

- Cisco Silicon One

- Cisco Optics

- Crosswork Network Automation

- Cisco IOS XR Path Tracing

References:

Arista’s WAN Routing System targets routing use cases such as SD-WANs

Arista Networks, noted for its high performance Ethernet data center switches, has taken its first direct step into WAN routing with new software, hardware and services, an enterprise-class system designed to link critical resources with core data-center and campus networks. The Arista WAN Routing System combines three new networking offerings: enterprise-class routing platforms, carrier/cloud-neutral internet transit capabilities, and the CloudVision® Pathfinder Service to simplify and improve customer wide area networks.

Based on Arista’s EOS® routing capabilities, and CloudVision management, the Arista WAN Routing System delivers the architecture, features, and platforms to modernize federated and software-defined wide area networks (SD-WANs. The WAN Routing introduction is significant because it is Arista’s first official routing platform.

The introduction of the WAN Routing System enables Arista’s customers to deploy a consistent networking architecture across all enterprise network domains from the client to campus to the data center to multi-cloud with a single instance of EOS, a consistent management platform, and a modern operating model.

Brad Casemore, IDC’s research vice president, with its Datacenter and Multicloud Networks group said:

“In the past, their L2/3 data-center switches were capable of and deployed for routing use cases, but they were principally data-center switches. Now Arista is expressly targeting an expansive range of routing use cases with an unambiguous routing platform.” By addressing SD-WAN use cases, WAN Routing puts Arista into competition in the SD-WAN space, Casemore noted.

“Arista positions the platform’s features and functionalities beyond the parameters of SD-WAN and coverage of traditional enterprise routing use cases, but it does SD-WAN, too, and many customers will be inclined to use it for that purpose. SD-WAN functionality was a gap in the Arista portfolio, and they address it with the release of this platform.”

Doug Gourlay, vice president and general manager of Arista’s Cloud Networking Software group wrote in a blog about the new package:

“Routed WAN networks, based on traditional federated routing protocols and usually manually configured via the CLI, are still the most predominant type of system in enterprise and carrier wide-area networks.”

“Traditional WAN and SD-WAN architectures are often monolithic solutions that do not extend visibility or operational consistency into the campus, data-center, and cloud environment,” Gourlay stated. “Many SD-WAN vendors developed highly proprietary technologies that locked clients into their systems and made troubleshooting difficult.”

“We took this feedback and client need to heart and developed an IP-based path-computation capability into CloudVision Pathfinder that enables automated provisioning, self-healing, dynamic pathing, and traffic engineering not only for critical sites back to aggregation systems but also between the core, aggregation, cloud, and transit hub environments.”

Modern WAN Management, Provisioning, and Optimization:

A new Arista WAN Routing System component is the CloudVision Pathfinder Service, which modernizes WAN management and provisioning, aligning the operating model with visualization and orchestration across all network transport domains. This enables a profound shift from legacy CLI configuration to a model where configuration and traffic engineering are automatically generated, tested, and deployed, resulting in a self-healing network. Arista customers can therefore visualize the entire network, from the client to the campus, the cloud, and the data center.

“As an Elite Partner and Arista Certified Services Provider (ACSP), we have been using Arista EOS and CloudVision for years and testing the Arista WAN Routing System in production environments for several quarters. The software quality and features within the system are ideal for enterprise network architectures embracing modern distributed application architectures across a blend of edge, campus, data center, cloud and SaaS environments,” stated Jason Gintert, chief technology officer at WAN Dynamics.

Arista WAN Platform Portfolio:

An enterprise WAN also requires modern platforms to interconnect campus, data center, and edge networks, as well as a variety of upstream carriers and Internet-based services. In addition to CloudEOS for cloud connectivity, the new Arista 5000 Series of WAN Platforms, powered by Arista EOS, offer high-performance control and data-plane scaling fit-to-purpose for enterprise-class WAN edge and aggregation requirements. Supporting 1/10/100GbE interfaces and flexible network modules while delivering from 5Gb to over 50Gbps of bidirectional AES256 encrypted traffic with high VRF and tunnel scale, the Arista 5000 Series sets the standard for aggregation and critical site interconnect with multiple use cases such as:

- Aggregation and High-Performance Edge Routing – The Arista 5500 WAN System, supporting up to 50Gbps of encrypted traffic, is ideal for data center, campus, high-performance edge, and physical transit hub architectures.

- Flexible Edge Routing – The Arista 5300 WAN System is suited for high-volume edge connectivity and transitioning WAN locations to multi-carrier, 5G, and high-speed Internet connectivity with performance rates of up to 5Gbps of encrypted traffic.

- Scalable Virtual Routing – Arista CloudEOS is a binary-consistent virtual machine implementing identical features and capabilities of the other Arista WAN systems. It is often deployed in carrier-neutral transit hub facilities or to provide scale-out encryption termination capabilities.

- Public Cloud Edge Routing – Arista CloudEOS is also deployable through public cloud marketplaces and enables Cloud Transit routing and Cloud Edge routing capabilities as part of the end-to-end WAN Routing System. CloudEOS is available on AWS, Azure, Google Cloud, and through Platform Equinix.

- CPE Micro Edge – In addition to the fully integrated, dynamically configured, and adaptive Arista WAN Routing System platforms, the Arista Micro Edge is capable of small-site interoperability with the WAN Routing System to provide simple downstream connectivity options.

Cloud and Carrier Neutral Transit Hubs:

The Arista WAN Routing System also embraces a new implementation of the traditional WAN core – the Transit Hub. These are physical or virtual routed WAN systems deployed in carrier-neutral and cloud-neutral facilities with dense telecommunications interconnections.

Artista has partnered with Equinix so Transit Hubs can be deployed on Equinix Network Edge and Bare Metal Cloud platforms via Arista CloudEOS software. CloudEOS is available on AWS, Azure, Google Cloud, and Equinix. As a result, Arista’s WAN Routing System will be globally deployable in Equinix International Business Exchange™ (IBX®) data centers. This enables customers to access a distributed WAN core leveraging multi-carrier and multi-cloud transit options – all provisioned through the CloudVision Pathfinder Service.

“Arista Pathfinder leverages Equinix’s Network Edge, Equinix Metal, and Equinix Fabric services to deliver scalable routing architectures that accelerate customers with cloud and carrier-neutral networking,” stated Zachary Smith, Global Head of Edge Infrastructure Services at Equinix. “Pathfinder’s ability to scale, in software, from a single virtual deployment to a multi-terabit globally distributed core that reallocates paths as network conditions change is a radical evolution in network capability and self-repair.”

“The Arista Transit Hub Architecture and the partnership with Equinix positions Arista for growth in hybrid and multicloud routing,” Casemore added.

Pricing and Availability:

The Arista WAN Routing system is in active customer trials and deployments with general availability in the summer of 2023. The following components are part of the Arista WAN Routing System:

- The Arista 5510 WAN Routing System for high-performance aggregation, transit hub deployment, and critical site routing which starts at $77,495.

- The Arista 5310 WAN Routing System for high-performance edge routing which starts at $21,495.

- Arista CloudEOS software for transit hub and scale-out routing in a virtual machine form factor.

- Arista CloudEOS, delivered through the public cloud for Cloud Edge and Cloud Transit routing, is available on AWS, Azure, Google Cloud Platform, and Platform Equinix.

- The CloudVision Pathfinder Service and CloudVision support for the Arista WAN Routing System is in field trials now and will generally be available in the second half of 2023.

About Arista Networks:

Arista Networks is an industry leader in data-driven client to cloud networking for large data center, campus, and routing environments. Arista’s award-winning platforms deliver availability, agility, automation, analytics, and security through an advanced network operating stack. For more information, visit www.arista.com.

ARISTA, EOS, CloudVision, NetDL and AVA are among the registered and unregistered trademarks of Arista Networks, Inc. in jurisdictions worldwide. Other company names or product names may be trademarks of their respective owners. Additional information and resources can be found at www.arista.com.

References:

Arista’s Doug Gourlay’s blog here

Deep dive into many of the technologies and innovations available with this video from the product and engineering leaders.

https://www.arista.com/en/solutions/enterprise-wan

https://blogs.arista.com/blog/modernizing-the-wan-from-client-to-cloud

https://www.networkworld.com/article/3691113/arista-embraces-routing.html

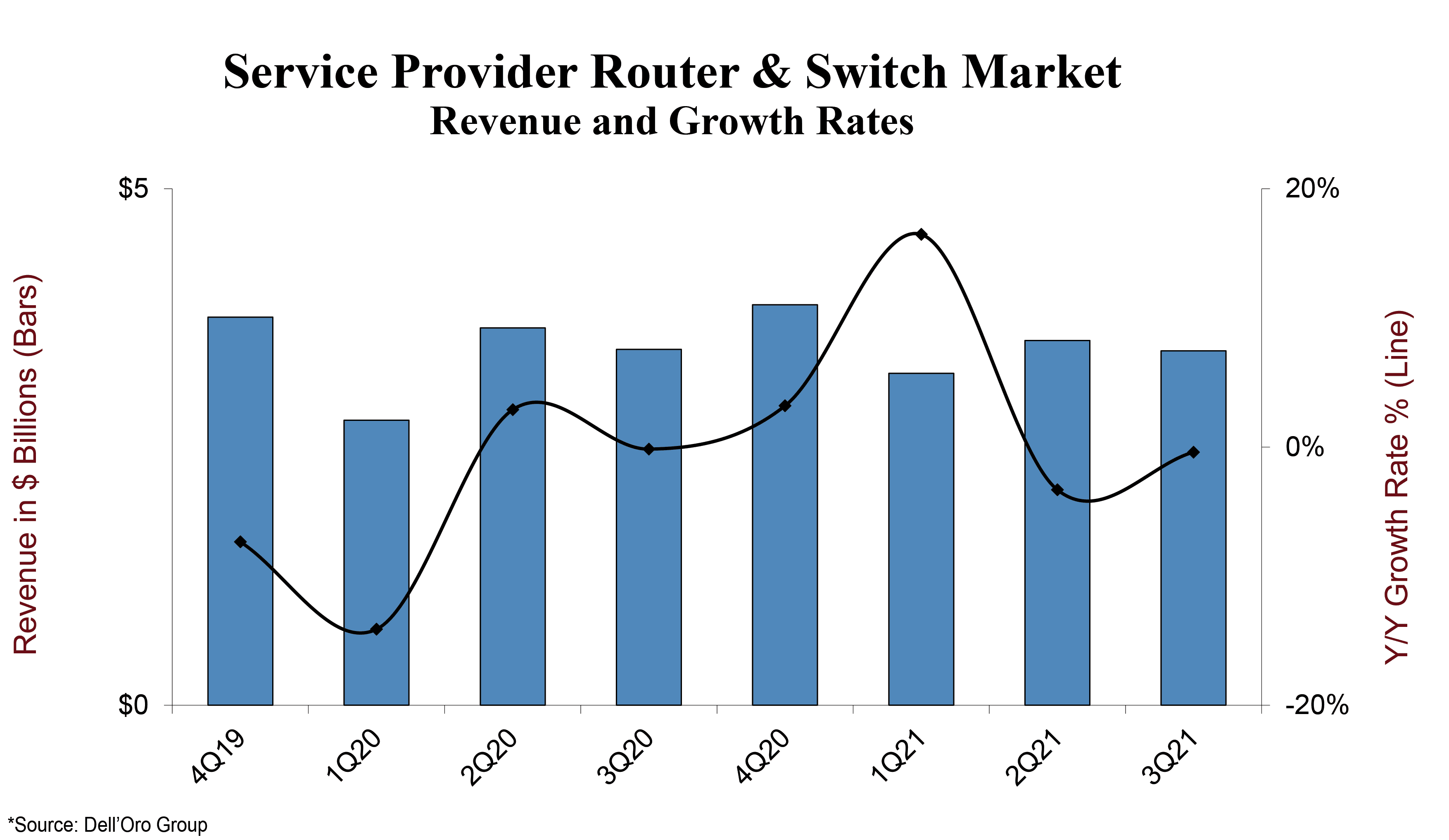

Dell Oro and IDC on the Global Service Provider Router and Switch market in 3Q-2021

According to a new report by Dell’Oro Group, the worldwide Service Provider Router and Switch market was flat in 3Q 2021. Market growth was stifled during the quarter due in large part to global supply chain constraints that affected vendors’ ability to deliver products to customers.

“Despite global supply chain problems, the underlying demand to upgrade backbone and 5G transport networks remains strong,” said Shin Umeda, Vice President at Dell’Oro Group. “Service providers are transitioning to new network architectures, and demand for 400 Gbps capable systems and enhanced edge routers offer the networking capabilities required to achieve the transformations,” added Umeda.

Additional highlights from the 3Q 2021 Service Provider Router and Switch Report:

- Cisco was the top-ranked vendor for the first three quarters of 2021, followed by Huawei, Nokia, Juniper, and ZTE.

- The Service Provider Router and Switch market is projected to grow at a slightly lower rate for 2021 due to the negative effect of supply chain constraints.

- The North American region outperformed all other regions with double-digit revenue growth through the first three quarters of 2021.

The Dell’Oro Group Service Provider Router and Switch Quarterly Report offers complete, in-depth coverage of the Service Provider Router and Switch market for future current and historical periods. The report includes qualitative analysis and detailed statistics for manufacture revenue by regions, customer types, and use cases, average selling prices, and unit and port shipments. To purchase these reports, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

……………………………………………………………………………………..

On December 8th, IDC reported that the worldwide Ethernet switch market recorded $8.1 billion in revenue in the third quarter of 2021 (3Q21), an increase of 7.5% year over year.

Meanwhile, worldwide total enterprise and service provider (SP) router market revenues grew 4.7% year over year in 3Q21 to $3.8 billion. These growth rates are according to results published in the International Data Corporation (IDC) Worldwide Quarterly Ethernet Switch Tracker and IDC Worldwide Quarterly Router Tracker.

Ethernet Switch Market Highlights

The Ethernet switch market’s 7.5% annualized growth in 3Q21 builds on growth in the first half of the year. Year-to-date through the first three quarters of 2021, the market is up 8.6% compared to the first three quarters of 2020. On a sequential basis, the 3Q21 Ethernet switch market revenues were up 9.3% from the previous quarter. And compared to the third quarter of 2019, which was before the COVID-19 pandemic, revenues increased 9.6%, indicating strong organic growth in the market.

From a geographic perspective, the 3Q21 Ethernet switch market had strong results across most parts of the world. In the Asia/Pacific region, the People’s Republic of China increased 18.1% year over year while Japan’s market declined 13.6%. In the rest of Asia/Pacific (excluding China and Japan) (APeJC), the market rose 7.3% year over year, buoyed by the market in Korea growing 22.3% annually. In Europe, results were mixed: Western Europe’s market rose 16.7% year over year with strength from Germany, which grew 18.3%. Central and Eastern Europe’s market rose 3.3%. In the Middle East & Africa, the market declined 8.9% year over year. Across the Americas, the market in the United States rose 5.5%; Canada’s market fell 0.2%, and Latin America’s market increased 16.0% year over year with Brazil rising 43.6% compared to 3Q20.

“The Ethernet switching market continues to demonstrate impressive resilience. Through the first three quarters of 2021, the market has recorded healthy growth compared to 2020, driven by demand in both the enterprise campus and branch markets, as well as from hyperscalers and other cloud providers, which continue to invest in datacenter switching capacity,” notes Brad Casemore, research vice president, Datacenter and Multicloud Networking. “There are some headwinds in the market, though: supply-chain constraints occasioned by the COVID-19 pandemic mean that customers and vendors must plan accordingly as they look to the year ahead, and the pandemic itself continues to sow uncertainty among technology buyers, especially enterprises in certain industries.”

Overall port shipments increased 9.1% with growth in both the non-datacenter and datacenter portions of the Ethernet switch market. Non-datacenter Ethernet switch revenues grew 6.5% in 3Q21 year over year with port shipments increasing 9.1%. The non-datacenter Ethernet switch portion of the market makes up 87.1% of port shipments and 56.7% of total market revenues with the balance of revenues and port shipments in the datacenter portion of the market. In the datacenter segment, revenues rose 8.8% year over year while port shipments increased 8.7%.

The higher-speed segments of the Ethernet switch market continue to see significant growth driven by hyperscalers and cloud providers. Market revenues for 200/400 GbE switches grew 70.4% from the second quarter to the third quarter of 2021 with port shipments more than doubling (+118.1%) on a sequential basis. 100GbE revenues increased 13.8% on an annualized basis while port shipments rose 13.1% year over year. 100GbE revenues make up 24.5% of the Ethernet switch market’s total revenues. 25/50 GbE revenues declined 1.1% annually while port shipments declined 7.8%.

Lower-speed switches, a more mature part of the market, saw mixed results. 10GbE port shipments declined 1.5% year over year with revenue dropping 6.0% annually; 10GbE switches make up 23.0% of the market’s total revenue. 1GbE switches increased 10.5% year over year in port shipments and increased 7.6% in revenue. 1GbE accounts for 34.4% of the total Ethernet switch market’s revenue. 2.5/5GbE switch revenue increased 7.3% sequentially from 2Q21 to 3Q21 while port shipments rose 6.7% quarter-over-quarter.

Router Market Highlights

The worldwide enterprise and service provider router market increased 4.7% year over year in 3Q21 with the major service provider segment, which accounts for 76.4% of revenues, increasing 3.6% and the enterprise segment increasing 8.3%. From a regional perspective, the combined service provider and enterprise router market increased 15.4% in APeJC. Japan’s market declined 6.1% while the People’s Republic of China market was up 2.2% year over year. Revenues in Western Europe were off 1.6% compared to 3Q20 while the Central and Eastern Europe the combined enterprise and service provider declined 4.9% annually. The Middle East & Africa region declined 1.7%. In the U.S., the enterprise segment increased 27.6% while the service provider revenues increased 5.4% giving the combined markets a 10.6% increase on an annualized basis. The Latin American market grew 7.3% on an annualized basis and Canada’s market increased 6.2% year over year.

Vendor Highlights

Cisco finished 3Q21 with a year-over-year decline of 1.3% in overall Ethernet switch revenues and market share of 45.4%. Meanwhile, Cisco’s combined service provider and enterprise router revenue grew 10.7% year over year with enterprise router revenue increasing 14.1% and SP revenues increasing 8.7%. Cisco’s combined SP and enterprise router market share stands at 37.5% in the quarter.

Huawei’s Ethernet switch revenue increased 11.4% on an annualized basis in 3Q21 giving the company market share of 10.7%. The company’s combined SP and enterprise router revenue increased 4.0% year over year giving the company a market share of 28.1%.

Arista Networks saw its Ethernet switch revenues increase 23.0% in 3Q21, bringing its share of the total market to 7.3%.

H3C’s Ethernet switch revenue increased 18.6% year over year giving the company market share of 6.2% in the quarter. In the combined service provider and enterprise routing market, H3C’s revenues grew 31.3%, giving the company a 2.2% market share.

HPE‘s Ethernet switch revenue increased 23.6% year over year in 3Q21, giving the company a market share of 5.8%.

Juniper‘s Ethernet switch revenue, which includes the company’s cloud-managed, enterprise campus Mist portfolio as well as its EX and QFX switch portfolios, increased 25.6% year over year in 3Q21, bringing its Ethernet switch market share to 3.2%. Juniper saw an 11.0% decline in combined enterprise and SP router sales, bringing its market share in the router market to 10.0%.

“Results in the Ethernet switch market were generally strong across the globe, indicating that most regions of the world continue to recover from the COVID-19 pandemic that caused decreased spending on network infrastructure,” noted Petr Jirovsky, research director, IDC Networking Trackers. “The growth in the third quarter of 2021 compared to the same period in 2019 indicates strong fundamentals for the market, which is a positive sign for the future.”

The Worldwide Quarterly Ethernet Switch Tracker and the Worldwide Quarterly Router Tracker provide total market size and vendor shares for the Ethernet switch and router technologies in an easy-to-use Excel pivot table format. The geographic coverage for both the Ethernet switch market and the router market includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The Ethernet switch market is further segmented by speed (100Mb, 1000Mb, 2.5Gb/5Gb, 10Gb, 25Gb/50Gb, 50Gb, 100Gb, 200Gb/400Gb), product (fixed managed, fixed unmanaged, modular), and layer (Ethernet switch, ADC). Measurement for the Ethernet switch market is provided in vendor revenue, value, and port shipments. The router market is further split by product (high-end, mid-range, low-end, SOHO), deployment (service provider, enterprise), connectivity (core, edge), and the measurements are in vendor revenue, value, and unit shipments.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.