GSA: 200 global operators offer 5G services; only 20 (Dell’Oro says 13) have deployed 5G SA core network

200 global network operators in 78 countries are offering 5G mobile and/or fixed wireless services at the end of 2021, according to the GSA. 487 operators in 145 countries are investing in 5G, including trials and spectrum license acquisitions, up from 412 operators at the end of 2020.

Notably, only 187 of the operators offering 5G services provide 5G mobile services, in 72 countries. The others are delivering 5G fixed-wireless access (even though it’s not an IMT 2020 use case). In total, 83 operators in 45 countries/territories have launched 3GPP-compliant 5G fixed-wireless access services.

Only 99 operators in 50 countries are investing already in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks).

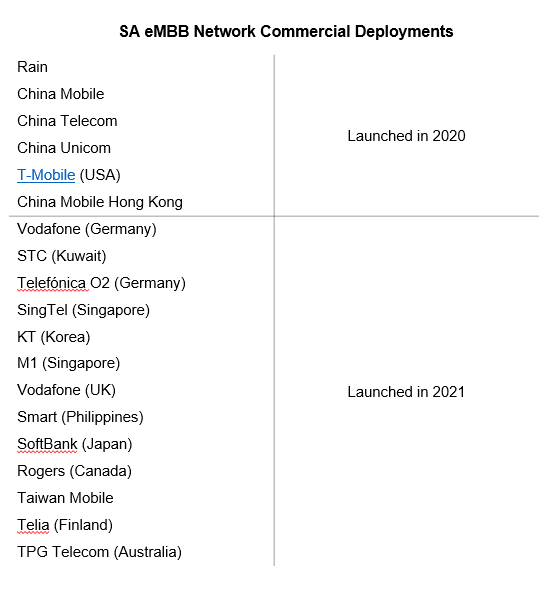

GSA has catalogued just 20 operators in 16 countries with 5G standalone deployed/launched in public networks.

13 January 2022 update from Dave Bolan of Dell’Oro Group:

We count 13 CSPs that commercially deployed 5G SA networks for enhanced Mobile Broadband (eMBB) in 2021, and they were nowhere close to the aggressiveness in breadth and depth of the buildouts that we saw by the Chinese Service Providers in 2020, or for that matter in 2021. We thought all three CSPs in Korea would have launched by now, but so far only KT has launched.

And we expected AT&T and Verizon in the U.S., and the CSPs in Switzerland to have launched 5G SA in 2021. In spite of these disappointments, the projected growth rate for 2021 is 61% Y/Y for 2021 and lowering to 18% Y/Y for 2022 due to the expected decline in growth rate by the Chinese CSPs.

The 5G device market is growing much more quickly. The GSA counted 1,257 announced devices at year-end, up nearly 125 percent from 2020. Around half (614) are 5G phones, up more than 120 percent from 278 at the end of 2020.

In total, 857 of the devices are commercially available, up more than 155% from the 335 on the market at the end of 2020. GSA has identified 614 announced 5G phones, up more than 120% from 278 at the end of 2020.

References:

https://gsacom.com/technology/5g/

GSA: 5G Market Snapshot – 5G networks, 5G devices, 5G SA status

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

4 thoughts on “GSA: 200 global operators offer 5G services; only 20 (Dell’Oro says 13) have deployed 5G SA core network”

Comments are closed.

It’s great to know that more than 78 countries will be using 5G internet technology in 2022.

If you are looking for the best5G home internet service in USA rural areas, I suggest you investigate Comlink 5G Home Internet. From their website:

5G home internet is cheaper and provides a more reliable connection with unlimited data than 5G cell phones or hotspots. In general, 5G home internet services offer speeds between 200 and 1,000 Mbps for less than $70 each month. They charge a single rate for every package. There are no hidden equipment or installation costs and they don’t require long-term contracts.

Verizon, T-Mobile, and Starry are now offering 5G home internet services. Each service provider has a single plan, and it’s only provided in certain sections of a few U.S. cities. Towns. Additionally, both Verizon and T-Mobile offer 4G LTE internet services. It operates similarly to 3G but via a faster cellular connection.

Although research on 5G home internet is still in its infancy, it already appears to be an excellent service. It’s not widely available, but it’s a less expensive, easier, and just as fast alternative to traditional fibre and residential cable connections.

https://comlinkinternet.com/5g-home-internet-service-in-usa/

Dave Bolan of Dell’Oro Group:

The 2021 5G MCN market came in 10% below our expectations from 2020, and this is due to the lack of more aggressive 5G Standalone (SA) network buildout than anticipated. We count 13 CSPs that commercially deployed 5G SA networks for enhanced Mobile Broadband (eMBB) in 2021, and they were nowhere close to the aggressiveness in breadth and depth of the buildouts that we saw by the Chines SPs in 2020, or for that matter in 2021. We thought all three CSPs in Korea would have launched by now, but so far only KT has launched. And we expected AT&T and Verizon in the US, and the CSPs in Switzerland to have launched 5G SA in 2021. In spite of these disappointments, the projected growth rate for 2021 is 61% Y/Y for 2021 and lowering to 18% Y/Y for 2022 due to the expected decline in growth rate by the Chinese CSPs.

The outlook is still positive for the overall MCN market growth rate with a 6% Y/Y for 2021 and 8% for 2022 being driven by the expansion of existing 5G SA networks and new 5G SA networks poised to launch for the 5G MCN and IMS Core markets.

https://www.delloro.com/predictions-2022-mobile-core-network-market/

Bolan points to multiple surprising holdouts on 5G standalone core adoption, including Verizon, AT&T, two of the three operators in Korea, and operators in Switzerland.

Carriers With 5G Cores Remain Lonely

5G cores remain incredibly rare — only 19 5G standalone (SA) networks have been deployed on these cores to date — and while that number could double in 2022, it still signals a “slow uptake,” according to Dave Bolan, research director at Dell’Oro Group.

“At a minimum, I would expect about as many as in 2021, but not more than 20 to 25,” Bolan wrote in response to questions.

T-Mobile activated the world’s first 5G SA network in August 2020, followed later that year by all three of China’s largest carriers, and Rain in South Africa, according to Bolan. An additional 13 networks joined the 5G SA party in 2021, including Vodafone’s networks in Germany and U.K., Telefónica O2 in Germany, SingTel, KT, STC, M1, Smart, SoftBank, Rogers, Taiwan Mobile, Telia, and TPG Telecom, he added.

“5G SA network deployments have not matched the hype,” Bolan concluded.

https://www.sdxcentral.com/articles/news/carriers-with-5g-cores-remain-lonely/2022/01/

Dell’Oro Group’s Dave Bolan:

“We found that 27 5G SA networks have been commercially deployed and only one MNO is running its 5G workloads in the Public Cloud. The balance chose to run their own Telco Clouds. Further findings show that another 130 MNOs have already cut contracts with 5G Core vendors to deploy their own Telco Clouds, and two MNOs have committed to run their networks in the Public Cloud.

“As a result, for the short-term, HCPs are focusing on the Enterprise opportunities extending their services to the network edge, either themselves or partnering with an MNO integrating their services inside the Telco Cloud. Longer term there is much more opportunity for the HCPs to host 5G workloads in their Public Clouds with 75 5G Non-Standalone (5G NSA) MNOs and another 600 LTE MNOs still to announce their 5G SA plans. The forecast exits 2026 with a higher year-over-year percentage growth rate for 5G workloads moving to the Public Cloud than for the growth rate of the Telco Cloud,” Bolan added.

https://www.prnewswire.com/news-releases/public-cloud-5g-workloads-to-grow-at-88-percent-cagr-4-6-billion-over-five-years-according-to-delloro-group-301598636.html