Light Counting: Wireless infrastructure market grew at a slower pace than in the past 2 years

In contrast to Dell’Oro Group’s assessment of the RAN market, Light Counting says that the wireless infrastructure market grew QoQ and YoY but at a slower pace than in the past 2 years. In addition, global sales were affected by supply chain issues that created logistical nightmares and led to increase in network node average sales prices.

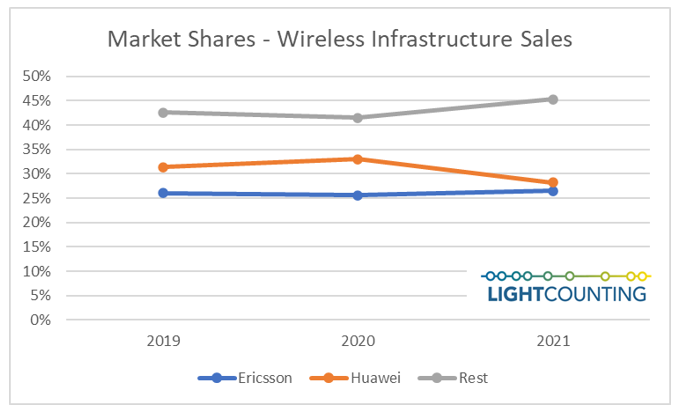

This environment is divided into two spheres of influence, China versus the West and its allies. Both Ericsson and Nokia gained market share at the expense of Huawei and ZTE in 4Q21:

–>Ericsson moved into the #1 position, Huawei dropped to #2, Nokia came back to #3 while ZTE slipped to #4; although Samsung gained share, it was not enough to surpass ZTE. Note that Dell’Oro still has Huawei as #1.

For the full year, Ericsson finished neck and neck with Huawei with just 1 percentage point separating the 2 vendors. “In 4Q21, the wireless infrastructure market equilibrium reached and reported last quarter was on full display: the 2 opposite spheres of influence were fully balanced. As a result, the 2 respective markets reached roughly the same size and Ericsson closed the market share gap with Huawei. 2021 was a reset year that signaled a return to normalcy with a market peak in 2022,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

|

|

After this year’s peak, our model points to a slow single-digit declining market. This bell-shaped pattern reflects the differences in regional and national agendas, including the COVID-19 impact as well as the impact of “the 2-year step function”—2 years (2019 and 2020) in a row of double-digit growth. The model considers all the 5G 3-year rollout plans we have gathered from many service providers and indicates strong activity through 2022 and 2023.

About the report:

Wireless Infrastructure quarterly report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2021, on quarterly market size and vendor market shares, and a detailed market forecast through 2027 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America).

The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

For more information about the market report go to LightCounting.com or email us at [email protected].

References:

|