New data from IPlytics and Tech+IP Advisory LLC show regions and companies leading 5G Patent Race

Licensing of 5G Standard Essential Patents (SEPs) [1.] promises to become a highly lucrative market, making the 5G patent race more competitive than ever before – although the latest 5G patent data shows the question of who is currently winning it remains unclear. Although it may be difficult to answer the question about who wins the 5G race, the report shows a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families.

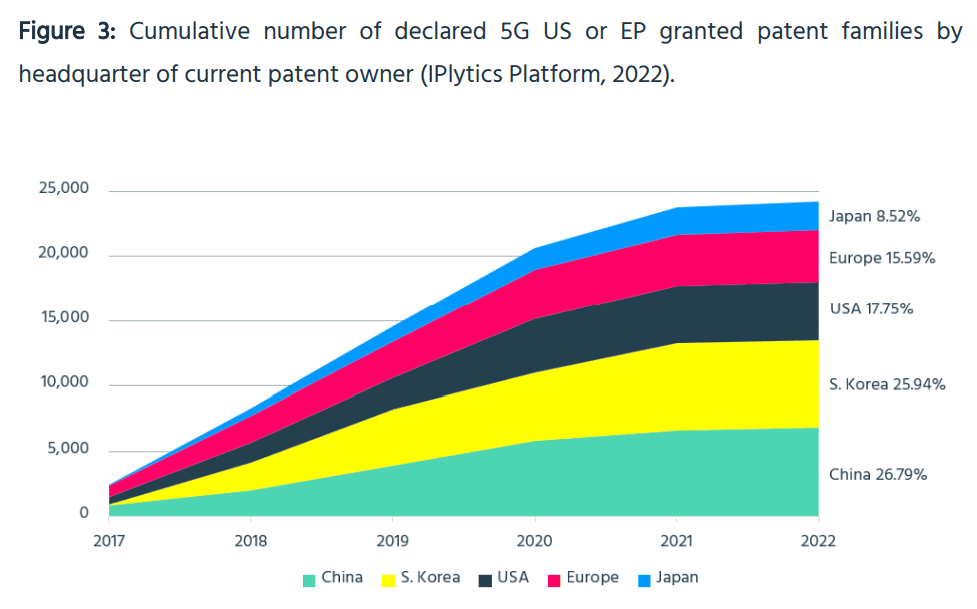

IPlytics data shows that, of the SEP holders that have self-declared at least 10 patent families over the past decade, the number of unique patent owners has risen from 99 in 2010 to 261 in 2021 (by factor 2.6x). The uptick in the number of SEP holders is largely driven by market entrants from China, Taiwan and South Korea, which develop smartphones, network devices, computer chips or semiconductor technology. In Q1 2022, over 50,000 active and granted patent families were declared for 5G following a rapid increase in only four years. Indeed, Chinese and South Korean companies have led in 5G patent development (more below).

Note 1. SEPs is a misnomer as there is only one authentic 5G standard – ITU-R M.2150 and it is incomplete, because the URLLC specification from 3GPP does not meet the ITU-R M.2410 Performance Requirements and the companion ITU-R M.1036 IMT Frequency Arrangements (especially for mmWave spectrum) has yet to be approved. Almost all the SEPs are based on 3GPP Technical Specifications (TSs), some of which have been rubber stamped as ETSI standards.

……………………………………………………………………………………………………………………………………………………………………………………………

While current litigation in the auto industry concerns 3G and 4G SEPs, the question of how much value 5G brings to a vehicle is more difficult to answer when advanced driving systems heavily rely on 5G-enabled connectivity and increasing litigation is anticipated. But adoption of 5G in other industries is expected in the future, as the number of IoT applications that will make use of 5G is endless. One thing is certain: the majority of SEP holders will actively monetize and enforce their SEP portfolios covering 5G standards in this fast-moving, high-investment environment. However, SEP owners as well as standard implementers are faced with the challenge of managing operational and financial risks and cost exposures, while striving to maximize value. This IPlytics report takes a closer look the major 5G patent owner as well as standards developing companies.

……………………………………………………………………………………………………………………………………………………………………………………………

5G smartphone devices announced by the major licensors represent “a substantial increase in royalties over what they received for 4G”, according to an Ankura study published by IAM last year. Using IPlytics data, Ankura argues that “these rises are not explained by an increased share of patent holding.” But is patent counting enough to understand the value of 5G?

Current SEP litigation (Ericsson v Apple; Nokia v Oppo and Vivo; InterDigital v Oppo, among others) has been triggered by the present cycle of upgrading SEP licensing deals from 3G/4G to 3G/4G/5G and the questions of how much additional value 5G brings. It is undeniable that investment in 5G is larger by far compared to all earlier generations (Figure 1), when counting the number of technical standards contributions submitted by standards developers.

Licensing of 5G SEPs takes place globally, while litigation is local. The rise of so-called anti-suit injunctions shows that international courts are competing to set global FRAND (fair, reasonable and non-discriminatory) rates. Regulators (including the current EU Commission communications) in different countries compete to set rules for leadership in technology standards innovation and products alongside the related SEP licensing ecosystem, thus influencing the global technology equilibrium. In this context, a balanced framework for SEP licensing on FRAND terms is more important than ever, while competition for 5G leadership goes beyond companies as it is relevant to entire economies. This poses the question: who is leading the 5G patent race?

Although it may be difficult to answer the question about who wins the 5G race, we can observe a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families. Figure 3 shows that Chinese organizations are leading, even though the 5G patent numbers in Figure 3 only consider European or US granted patent families.

However, not all self-declared patents are essential and valid, also SEPs vary by value – with some covering core technologies of the standard and others only claiming inventions on minor improvements to the standard. One approach to identifying investment in developing 5G technology is to count the number of standards contributions. The IPlytics database enables identification of approved and agreed technical submissions to 5G standards development, ensuring that only technical contributions are counted.

Senior patent directors, licensing executives or legal counsel should bear the following in mind:

• Future technologies that enable connectivity will increasingly rely on patented technology standards, such as 5G.

• The quantity of 5G SEP declarations as well as the number of SEP owners has constantly increased. Licensees must consider royalty costs and appropriate security payments in advance.

• Patent directors and licensing executives ought not only to consider information retrieved from patent data, but also monitor and study patent declaration data, SEP claims and standards section comparisons alongside, for example, technical contributions to understand the landscape of 5G patent holders.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about 5G leadership. Further refinement and analysis are needed to identify essentiality rates.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about the 5G leadership situation. Further refinement and analysis are needed to identify essentiality rates.

……………………………………………………………………………………………………………………………………………………………………………………………

Tech + IP 4G-5G SEP Update – Comments and Key Takeaways:

While 4G SEP patent counts are flattening, and precedent is adding up, 5G SEPs are accelerating as patent filings mature and, among other things, international filings turn into issued patents. It is more important than ever to carefully assess 4G data to help guide economically rational practices in a 5G (and coming 6G ) world.

Geographic data — both on the patent side and on the market side — is particularly important in assessing SEP patent importance, and this report goes to great lengths to begin to document such data. At the same time, we posit that other data such as the technical importance (and contribution) of certain technical specifications to which described and claimed inventions relate — as compared to other technical specifications — must also be assessed just as technical contribution and degree of technical difficulty is assessed in engineering and other technical domains.

In addition, most SEP landscapes focus solely on jurisdictions where compliant products are used or sold, ignoring markets where compliant devices are made, despite the black letter law of infringement and real world licensing negotiation outcomes where royalty rates often differ based on these factors.

Despite the large number of patents potentially necessary for any 4G-5G compliant mobile handset or network and the plethora of landscapes published by 3rd parties, however, there is almost no public discussion of: what patent families are truly global (and deserving of premium FRAND rates) versus what patent families are merely regional or national (and deserving of lower FRAND rates) and how the foregoing relates to where an infringing product is made, used or sold; and what assets map to which technical specifications (“TSs”), how do the TSs rank in terms of technical contribution, and whether and why that matters.

The goal of this 4G-5G SEP report is to provide an updated set of statistics related to 4G-5G SEPs for use by the community of patent holders and implementers, and to start to delve into more sophisticated groupings and analysis of such SEPs informed both by recent court decisions and the global marketplace of licensors and licensees. The analysis proposes a method for creating family value scores that is based on real world licensing and value contexts. The methodology is applied to the 4G stack of patents because the data set is less volatile and more mature.

In 2021, approximately 24,000 new patents and applications (“Assets”) were identified to the 4G-5G standards body (ETSI) [2.] as essential to one or both of those standards. The total number of Assets declared essential to 4G-5G standards (“4G-5G SEPs”) is now approximately 200,500 (at least according to their owners). At the same time, a large number (nearly 25% of all declared families) are declared for both 4G & 5G Technical Specifications.

Note 2. ETSI is not the “4G-5G standards body.” In fact, they make contributions to ITU-R WP 5D which is the standards body for all of International Mobile Telecommunications (IMT). As per Note 1, ETSI often rubber stamps (aka “transposes”) 3GPP TS’s as ETSI standards without making any changes. ETSI is the host for 3GPP meetings and manages their website.

In 2021, ~95% of newly issued / declared Assets are related to 5G technology, strongly mirroring the evolution being seen in the market to 5G deployments. The data further shows that there are three core regions of SEPs — the US, “Core EP” and “Core Asia” countries (see the Appendix for our definitions of these regions). However, the data also indicates that many more companies are seeking and receiving SEPs in “Fast Growth” countries like India, Brazil, Indonesia and Malaysia.

Analyzing top company portfolios, we can identify different leaders in different segments of Assets and Families.

-Huawei is the leading company when analyzing overall numbers of Families that are declared to 4G-5G.

-Qualcomm’s coverage stands out when analyzing Core and Fast Growth jurisdictions.

–Samsung leads if one looks at the largest number of Families declared to both 4G & 5G Technical Specifications (TSs).

4G Stack: Out of 145 assignees that have at least one 4G Core TS Family, Samsung leads in declarations, followed by Huawei and ZTE. Together these three hold 28% of total 4G Core TS Families.

5G Stack: Huawei leads in total Family counts across all key geographic regions (Core Global, Core EP, and Core Asia) except Fast Growth regions. Samsung has the most declarations in 2021 (18% of all Assets) declared in Core EP jurisdictions (2,796). In Core Asia jurisdictions OPPO leads in regard to Assets declared in 2021 (2,129), followed by Samsung (1,818) and Vivo (751). Fast Growth “2021” analysis shows that again Samsung and Oppo have the leading positions, holding 162 and 160 Assets, respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Regarding other patent research firms, Plytics and GreyB both put Huawei at the top of their 5G patent rankings. But UK law firm Bird & Bird ranked Ericsson at the top, while PA Consulting put Nokia at the top of its list. Separately, a recent study by the US Patent and Trademark Office suggested that six companies – Ericsson, Huawei, LG, Nokia, Qualcomm and Samsung – are the top 5G patent holders, with no single discernable leader.

References:

https://www.iplytics.com/wp-content/uploads/2022/06/5G-patent-race-June-2022_website.pdf

https://www.lightreading.com/5g/huawei-ranks-1-in-new-5g-patent-survey/d/d-id/777984?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

USPTO: No clear winners in 5G patent filings; caution urged when reviewing claims of “5G dominance”

Is a new 5G Patent War in the works? Expert Opinion + Review of 5G patent studies

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

One thought on “New data from IPlytics and Tech+IP Advisory LLC show regions and companies leading 5G Patent Race”

Comments are closed.

During my career, I was an active contributor to 2G/3G/4G SEPs. They effectively endorse the commercial viability of innovative new technologies.

However, increasingly, in recent years, the SEPs become a tool by the Chinese Communist Party (CCP). Some companies like Huawei intended to control and dominate 5G standards, even though SEPs from Chinese companies may not really be “essential” to the implementation of the standard(s) or specification(s). Many of those “SEPs” are not complete enough to construct a reliable 5G architecture, radio access network and core network.

For many years, the negative influence of SEPs from Chinese companies is obvious. Also, no 5G standard(s) or specification(s) are effective today due to so many holes (e.g. URLLC not meeting 5G performance requirements, no 5G core network standards, no standard for 5G mmWave frequencies, etc).

As an example, current 5G standards/specifications for so many SEP families cannot be utilized for vehicle automation and control when the Chinese claimed for years that the vehicle industry is the most important vertical application for 5G.

In conclusion, I have to say I am disappointed with many of the so called “5G SEPs.”