5G Patents

Huawei, Qualcomm, Samsung, and Ericsson Leading Patent Race in $15 Billion 5G Licensing Market

According to a new LexisNexis report, the 5G patent licensing market is now worth ~$15 billion a year. The report underscores that high-fidelity patent data has become a core business variable, with millions of dollars in annual licensing value potentially reallocated as courts, licensors, and implementers increasingly anchor negotiations, litigation strategy, and Fair, Reasonable, and Non-Discriminatory (FRAND) rate-setting on standards-essential patents (SEP) and portfolio analytics. As the 5G end point market scales out from smartphones into industrial IoT, automotive, healthcare, and other mission- and safety-critical infrastructure domains, SEPs are now a primary lever shaping competitive dynamics and value capture in global technology markets.

Lately, Ericsson CEO Börje Ekholm has been talking about humanoid robots and “physical AI” as future cellular connected objects. Others are forecasting the transformation of passive, data-collecting Internet of Things (IoT) devices into autonomous, intelligent agents that leverage 5G/6G networks, edge computing, and on-device neural processing.

The LexisNexis report extends their patent analysis to leadership across granted and in-force 5G SEP family declarations, value-adjusted portfolio strength indicators, and the depth and quality of technical contributions into the 3GPP work program.

Key findings from the 2026 analysis include:

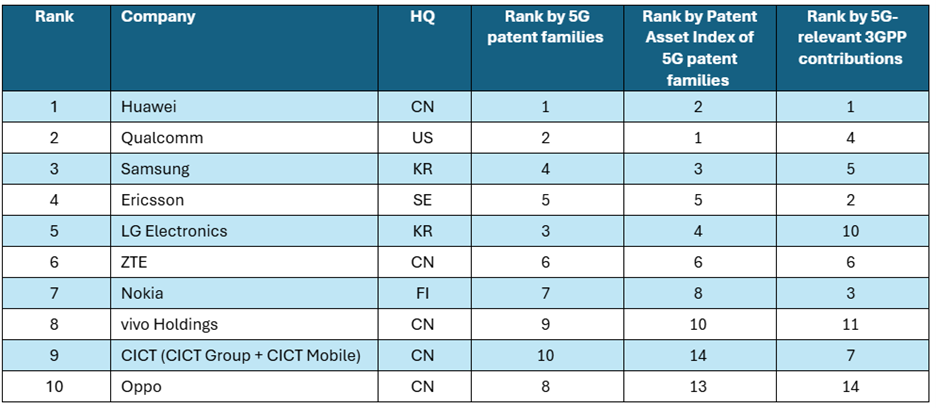

- Huawei, Qualcomm, Samsung, and Ericsson continued to lead the global ranking of 5G patent powerhouses as assessed by granted and active 5G patent family volume, portfolio impact, and standards contributions.

- Patent data accuracy has a significant financial impact, as even small discrepancies in perceived portfolio share can translate into hundreds of millions of dollars in annual licensing value in a $15 billion global market.

- New entrants to the Top 50 list in 2026 include research-focused organizations, licensing and investment-led IP holders, and automotive and IoT connectivity specialists, which replaced several operator-centric and diversified industrial portfolios that fell below the Top 50 threshold.

- Top 50 5G patent owners reflected broad geographic diversity, with companies headquartered in China (14), Japan (9), the United States (9), Europe (7), Taiwan (5), South Korea (5), and Canada (1).

- Patent data is increasingly relied upon in FRAND determinations, making the quality, consistency, and verification of declaration data a critical factor for both licensors and implementers.

Top 10 5G Patent Leaders 2026:

The Top 10 ultimate patent owners based on granted and active 5G patent families, value-adjusted portfolio indicators, and sustained participation in 3GPP standards development.

“As 5G licensing moves deeper into industrial, automotive, and infrastructure markets, the financial stakes tied to patent data accuracy continue to rise,” said Tim Pohlmann, Director of SEP Analytics for LexisNexis Intellectual Property Solutions. “In a licensing environment of this scale, even small differences in how 5G patent portfolios are measured can materially influence negotiations. That is why verified, unbiased data has become essential, not only for understanding who leads the 5G patent race, but for supporting defensible, data-driven FRAND discussions.”

The 2026 analysis is grounded in the Cellular Verified initiative led by LexisNexis Intellectual Property Solutions. Through this initiative, LexisNexis compared public ETSI declaration data with internal records from 35 ETSI-declaring companies, applying rigorous matching, normalization, patent family expansion, and corporate-tree ownership analysis.

This validation process is designed to reduce bias introduced by differing declaration practices and to provide a more accurate and impartial representation of declared 5G patent portfolios, an increasingly critical requirement as rankings and portfolio assessments are used as economic and legal reference points in licensing and litigation contexts.

About LexisNexis® Legal & Professional

LexisNexis® Legal & Professional provides AI-powered legal, regulatory, business information, analytics, and workflows that help customers increase their productivity, improve decision-making, achieve better outcomes, and advance the rule of law around the world. As a digital pioneer, the company was the first to bring legal and business information online with its Lexis® and Nexis® services. LexisNexis Legal & Professional, which serves customers in more than 150 countries with 11,800 employees worldwide, is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers.

About LexisNexis® Intellectual Property Solutions

LexisNexis® Intellectual Property Solutions brings clarity to innovation for businesses worldwide. We enable innovators to accomplish more by helping them make informed decisions, be more productive, comply with regulations, and ultimately achieve a competitive advantage for their business. Our broad suite of workflow and analytics solutions (LexisNexis® PatentSight+™, LexisNexis® Classification, LexisNexis® TechDiscovery, LexisNexis® IPlytics™, LexisNexis PatentOptimizer®, LexisNexis PatentAdvisor®, and LexisNexis TotalPatent One®, LexisNexis® IP DataDirect), enables companies to be more efficient and effective at bringing meaningful innovations to our world. We are proud to directly support and serve these innovators in their endeavors to better humankind.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Comment and Analysis:

Huawei’s #1 5G patent position, while significant on headline indicators, does not fully capture the nuances of 5G SEP strength and monetization potential. Portfolio experts consistently stress that patent quality and essentiality vary widely; not every declared SEP underpins a core feature, just as a car seat does not have the same system-critical role as the motor in the overall vehicle architecture.

Beyond raw declaration counts and 3GPP contribution volume, LexisNexis applies its Patent Asset Index methodology to weight portfolio value using factors such as citation impact and international coverage, a framework under which Qualcomm currently ranks first and Huawei second. This aligns with the industry view that some of the most fundamental 5G capabilities extend directly from 4G-era OFDM-based air-interface work, an area where Qualcomm consolidated a strong position with its roughly 600 million dollar acquisition of OFDM specialist Flarion in 2006.

On the licensing side, Qualcomm remains the most financially leveraged SEP holder in the current ranking peer group: its Qualcomm Technology Licensing (QTL) unit generated about 5.6 billion dollars in fiscal 2024 revenue, or roughly 14% of total sales, and delivered around 4 billion dollars in pre-tax earnings, close to 30% of company-wide profit. Huawei, by contrast, reported approximately 630 million dollars in patent licensing revenue for 2024, equivalent to around 0.5% of its overall turnover, and notes that its cumulative royalty outpayments are nearly triple the royalties it has collected to date. While Huawei’s licensing income has roughly doubled compared with its pre‑2020 baseline, the company still spends several times more on patents and R&D than it earns from licensing, reflecting its dual role as both major licensor and large-scale implementer across devices and networks.

Ericsson and Nokia sit between the two on monetization intensity: in 2024, Ericsson’s IPR licensing revenue was about 14 billion Swedish kronor (roughly 1.57 billion dollars), or around 6% of group sales, while Nokia’s licensing business generated approximately 1.9 billion euros (about 2.3 billion dollars), roughly 10% of its total revenue, with both vendors showing solid double‑digit percentage growth in licensing since 2019. The updated LexisNexis study also segments 5G SEP leadership by 3GPP release based on active and granted declared 5G patent families: for Release 15, characterized as the foundational 5G baseline, the top six are Huawei, Qualcomm, Samsung, Ericsson, ZTE, and Nokia, while for Release 18—framing the first wave of 5G‑Advanced—the leaders shift toward LG Electronics, ETRI Korea, Samsung, Oppo, Foxconn, and Huawei, with Nokia the highest-ranked European or US player at eighth.

Assuming the ecosystem avoids major standards fragmentation, current trajectories suggest that Huawei and Qualcomm are well placed to carry substantial 5G-era influence into 6G, which is increasingly positioned as an evolutionary extension of 5G that pushes OFDM-based radio technologies into higher frequency bands and more advanced use cases. Barring disruptive structural changes, future 3GPP plenary and working group meetings are therefore likely to remain populated by the same core SEP powerhouses that dominate today’s 5G landscape.

References:

https://www.lexisnexisip.com/resources/5g-patent-race-2026/

The full “Who Is Leading the 5G Patent Race 2026” analysis, including the Top 50 5G Patent Rankings 2026 and detailed information on the underlying data methodology and validation process, is available at www.LexisNexisIP.com/5G-Report-2026

https://www.lightreading.com/5g/huawei-and-qualcomm-tussle-for-5g-patents-lead-as-6g-draws-closer

Huawei’s Electric Vehicle Charging Technology & Top 10 Charging Trends

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

Samsung Partners with NEC and Qualcomm for 5G, Licenses Nokia Patents

New data from IPlytics and Tech+IP Advisory LLC show regions and companies leading 5G Patent Race

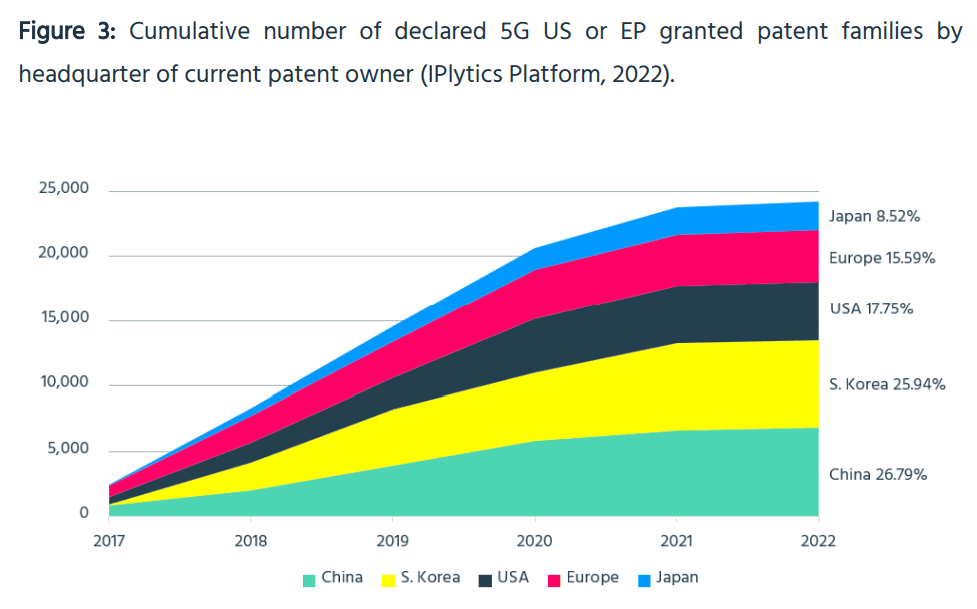

Licensing of 5G Standard Essential Patents (SEPs) [1.] promises to become a highly lucrative market, making the 5G patent race more competitive than ever before – although the latest 5G patent data shows the question of who is currently winning it remains unclear. Although it may be difficult to answer the question about who wins the 5G race, the report shows a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families.

IPlytics data shows that, of the SEP holders that have self-declared at least 10 patent families over the past decade, the number of unique patent owners has risen from 99 in 2010 to 261 in 2021 (by factor 2.6x). The uptick in the number of SEP holders is largely driven by market entrants from China, Taiwan and South Korea, which develop smartphones, network devices, computer chips or semiconductor technology. In Q1 2022, over 50,000 active and granted patent families were declared for 5G following a rapid increase in only four years. Indeed, Chinese and South Korean companies have led in 5G patent development (more below).

Note 1. SEPs is a misnomer as there is only one authentic 5G standard – ITU-R M.2150 and it is incomplete, because the URLLC specification from 3GPP does not meet the ITU-R M.2410 Performance Requirements and the companion ITU-R M.1036 IMT Frequency Arrangements (especially for mmWave spectrum) has yet to be approved. Almost all the SEPs are based on 3GPP Technical Specifications (TSs), some of which have been rubber stamped as ETSI standards.

……………………………………………………………………………………………………………………………………………………………………………………………

While current litigation in the auto industry concerns 3G and 4G SEPs, the question of how much value 5G brings to a vehicle is more difficult to answer when advanced driving systems heavily rely on 5G-enabled connectivity and increasing litigation is anticipated. But adoption of 5G in other industries is expected in the future, as the number of IoT applications that will make use of 5G is endless. One thing is certain: the majority of SEP holders will actively monetize and enforce their SEP portfolios covering 5G standards in this fast-moving, high-investment environment. However, SEP owners as well as standard implementers are faced with the challenge of managing operational and financial risks and cost exposures, while striving to maximize value. This IPlytics report takes a closer look the major 5G patent owner as well as standards developing companies.

……………………………………………………………………………………………………………………………………………………………………………………………

5G smartphone devices announced by the major licensors represent “a substantial increase in royalties over what they received for 4G”, according to an Ankura study published by IAM last year. Using IPlytics data, Ankura argues that “these rises are not explained by an increased share of patent holding.” But is patent counting enough to understand the value of 5G?

Current SEP litigation (Ericsson v Apple; Nokia v Oppo and Vivo; InterDigital v Oppo, among others) has been triggered by the present cycle of upgrading SEP licensing deals from 3G/4G to 3G/4G/5G and the questions of how much additional value 5G brings. It is undeniable that investment in 5G is larger by far compared to all earlier generations (Figure 1), when counting the number of technical standards contributions submitted by standards developers.

Licensing of 5G SEPs takes place globally, while litigation is local. The rise of so-called anti-suit injunctions shows that international courts are competing to set global FRAND (fair, reasonable and non-discriminatory) rates. Regulators (including the current EU Commission communications) in different countries compete to set rules for leadership in technology standards innovation and products alongside the related SEP licensing ecosystem, thus influencing the global technology equilibrium. In this context, a balanced framework for SEP licensing on FRAND terms is more important than ever, while competition for 5G leadership goes beyond companies as it is relevant to entire economies. This poses the question: who is leading the 5G patent race?

Although it may be difficult to answer the question about who wins the 5G race, we can observe a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families. Figure 3 shows that Chinese organizations are leading, even though the 5G patent numbers in Figure 3 only consider European or US granted patent families.

However, not all self-declared patents are essential and valid, also SEPs vary by value – with some covering core technologies of the standard and others only claiming inventions on minor improvements to the standard. One approach to identifying investment in developing 5G technology is to count the number of standards contributions. The IPlytics database enables identification of approved and agreed technical submissions to 5G standards development, ensuring that only technical contributions are counted.

Senior patent directors, licensing executives or legal counsel should bear the following in mind:

• Future technologies that enable connectivity will increasingly rely on patented technology standards, such as 5G.

• The quantity of 5G SEP declarations as well as the number of SEP owners has constantly increased. Licensees must consider royalty costs and appropriate security payments in advance.

• Patent directors and licensing executives ought not only to consider information retrieved from patent data, but also monitor and study patent declaration data, SEP claims and standards section comparisons alongside, for example, technical contributions to understand the landscape of 5G patent holders.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about 5G leadership. Further refinement and analysis are needed to identify essentiality rates.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about the 5G leadership situation. Further refinement and analysis are needed to identify essentiality rates.

……………………………………………………………………………………………………………………………………………………………………………………………

Tech + IP 4G-5G SEP Update – Comments and Key Takeaways:

While 4G SEP patent counts are flattening, and precedent is adding up, 5G SEPs are accelerating as patent filings mature and, among other things, international filings turn into issued patents. It is more important than ever to carefully assess 4G data to help guide economically rational practices in a 5G (and coming 6G ) world.

Geographic data — both on the patent side and on the market side — is particularly important in assessing SEP patent importance, and this report goes to great lengths to begin to document such data. At the same time, we posit that other data such as the technical importance (and contribution) of certain technical specifications to which described and claimed inventions relate — as compared to other technical specifications — must also be assessed just as technical contribution and degree of technical difficulty is assessed in engineering and other technical domains.

In addition, most SEP landscapes focus solely on jurisdictions where compliant products are used or sold, ignoring markets where compliant devices are made, despite the black letter law of infringement and real world licensing negotiation outcomes where royalty rates often differ based on these factors.

Despite the large number of patents potentially necessary for any 4G-5G compliant mobile handset or network and the plethora of landscapes published by 3rd parties, however, there is almost no public discussion of: what patent families are truly global (and deserving of premium FRAND rates) versus what patent families are merely regional or national (and deserving of lower FRAND rates) and how the foregoing relates to where an infringing product is made, used or sold; and what assets map to which technical specifications (“TSs”), how do the TSs rank in terms of technical contribution, and whether and why that matters.

The goal of this 4G-5G SEP report is to provide an updated set of statistics related to 4G-5G SEPs for use by the community of patent holders and implementers, and to start to delve into more sophisticated groupings and analysis of such SEPs informed both by recent court decisions and the global marketplace of licensors and licensees. The analysis proposes a method for creating family value scores that is based on real world licensing and value contexts. The methodology is applied to the 4G stack of patents because the data set is less volatile and more mature.

In 2021, approximately 24,000 new patents and applications (“Assets”) were identified to the 4G-5G standards body (ETSI) [2.] as essential to one or both of those standards. The total number of Assets declared essential to 4G-5G standards (“4G-5G SEPs”) is now approximately 200,500 (at least according to their owners). At the same time, a large number (nearly 25% of all declared families) are declared for both 4G & 5G Technical Specifications.

Note 2. ETSI is not the “4G-5G standards body.” In fact, they make contributions to ITU-R WP 5D which is the standards body for all of International Mobile Telecommunications (IMT). As per Note 1, ETSI often rubber stamps (aka “transposes”) 3GPP TS’s as ETSI standards without making any changes. ETSI is the host for 3GPP meetings and manages their website.

In 2021, ~95% of newly issued / declared Assets are related to 5G technology, strongly mirroring the evolution being seen in the market to 5G deployments. The data further shows that there are three core regions of SEPs — the US, “Core EP” and “Core Asia” countries (see the Appendix for our definitions of these regions). However, the data also indicates that many more companies are seeking and receiving SEPs in “Fast Growth” countries like India, Brazil, Indonesia and Malaysia.

Analyzing top company portfolios, we can identify different leaders in different segments of Assets and Families.

-Huawei is the leading company when analyzing overall numbers of Families that are declared to 4G-5G.

-Qualcomm’s coverage stands out when analyzing Core and Fast Growth jurisdictions.

–Samsung leads if one looks at the largest number of Families declared to both 4G & 5G Technical Specifications (TSs).

4G Stack: Out of 145 assignees that have at least one 4G Core TS Family, Samsung leads in declarations, followed by Huawei and ZTE. Together these three hold 28% of total 4G Core TS Families.

5G Stack: Huawei leads in total Family counts across all key geographic regions (Core Global, Core EP, and Core Asia) except Fast Growth regions. Samsung has the most declarations in 2021 (18% of all Assets) declared in Core EP jurisdictions (2,796). In Core Asia jurisdictions OPPO leads in regard to Assets declared in 2021 (2,129), followed by Samsung (1,818) and Vivo (751). Fast Growth “2021” analysis shows that again Samsung and Oppo have the leading positions, holding 162 and 160 Assets, respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Regarding other patent research firms, Plytics and GreyB both put Huawei at the top of their 5G patent rankings. But UK law firm Bird & Bird ranked Ericsson at the top, while PA Consulting put Nokia at the top of its list. Separately, a recent study by the US Patent and Trademark Office suggested that six companies – Ericsson, Huawei, LG, Nokia, Qualcomm and Samsung – are the top 5G patent holders, with no single discernable leader.

References:

https://www.iplytics.com/wp-content/uploads/2022/06/5G-patent-race-June-2022_website.pdf

https://www.lightreading.com/5g/huawei-ranks-1-in-new-5g-patent-survey/d/d-id/777984?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

USPTO: No clear winners in 5G patent filings; caution urged when reviewing claims of “5G dominance”

Is a new 5G Patent War in the works? Expert Opinion + Review of 5G patent studies

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

USPTO: No clear winners in 5G patent filings; caution urged when reviewing claims of “5G dominance”

A report published in February 2022 examines which companies have filed for patents at the USPTO (US Patent and Trademark Office) in four technologies: Management of Local Wireless Resources, Multiple Use of Transmission Path, Radio Transmission Systems, and Information Error Detection or Error Correction in Transmission Systems. USPTO says that approach narrowed the focus to patent flings on technologies central to 5G innovation. The report concludes that there’s no clear lead to be seen: “The findings of the report call into question claims that any single firm or country is ‘winning’ the 5G technology race.“

Six companies topped the results, none with any notable lead. They were: Ericsson, Huawei, LG, Nokia, Qualcomm and Samsung. The report notes that while ZTE often is mentioned as a competitor to those six firms, it filed far fewer patents outside of China during the study period. The report authors did a textual analysis of the 22,000-plus patent filings studied to see if any of these competing firms stood out in particular attributes. Here, more subtle differences emerged.

Qualcomm’s patents had the most “legal breadth,” in the sense of making shorter (and therefore generally broader) claims about covered inventions; Ericsson and Nokia ranked higher for “radicalness,” meaning they cited less prior art as references; and Qualcomm and Samsung did well on “technical relevance,” or how often other patents cited their own patents or applications as prior-art references.

The USPTO report references a January 6, 2021 directive from the NTIA (National Telecommunications and Information Administration), the “National Strategy to Secure 5G Implementation Plan,” in which the NTIA sought “an informed understanding of the global competitiveness and economic vulnerabilities of United States 5G manufacturers and suppliers.”

This line from the USPTO report is significant: “Given the complexity of the results, caution is recommended when reviewing media claims of 5G dominance.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

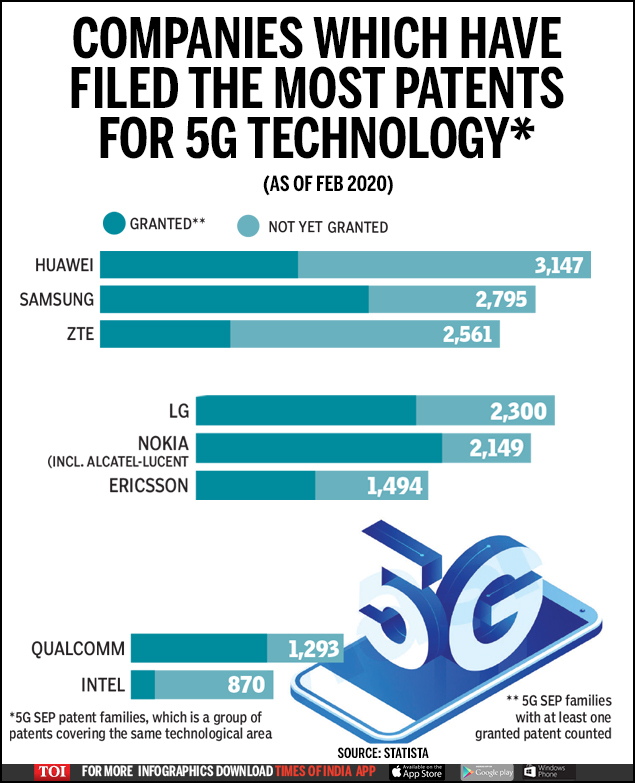

Here’s Statista’s take on leading 5G patent holders (as of February 2021):

An IEEE Techblog post from March 2021 examined claims that Huawei and Samsung were the leaders in 5G SEPs (Standard Essential Patents). Earlier related IEEE Techblog posts are listed in the References.

Even though there is no definition of 6G (while 5G standards and frequency arrangements are woefully incomplete), an April 2021 report authored by the Chinese Patent Office states that China currently holds 35% of all 6G patents worldwide. The report urged China to “utilize its technological advantage in 5G to continue staying ahead.”

–>If you believe that, I’d like to sell you a 6G smart phone!

References:

https://www.uspto.gov/sites/default/files/documents/USPTO-5G-PatentActivityReport-Feb2022.pdf

https://www.lightreading.com/5g/uspto-study-everyones-winner-in-5g-patents/d/d-id/776174?

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

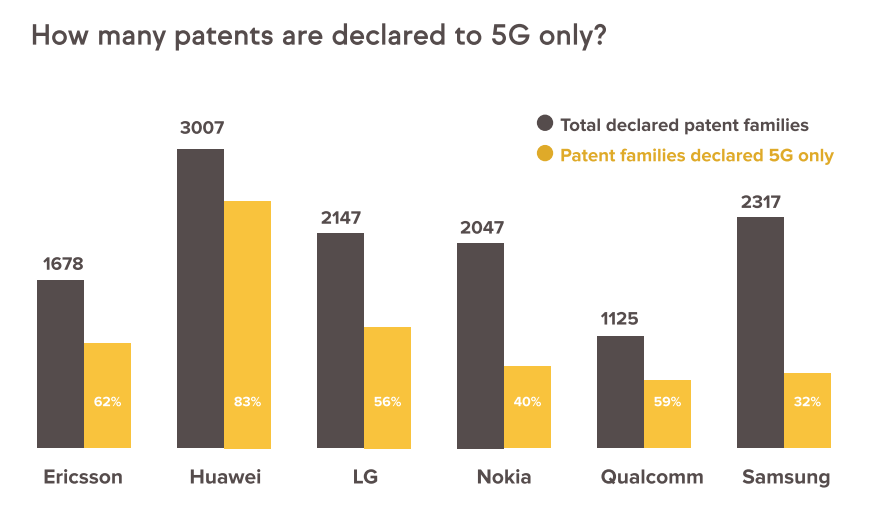

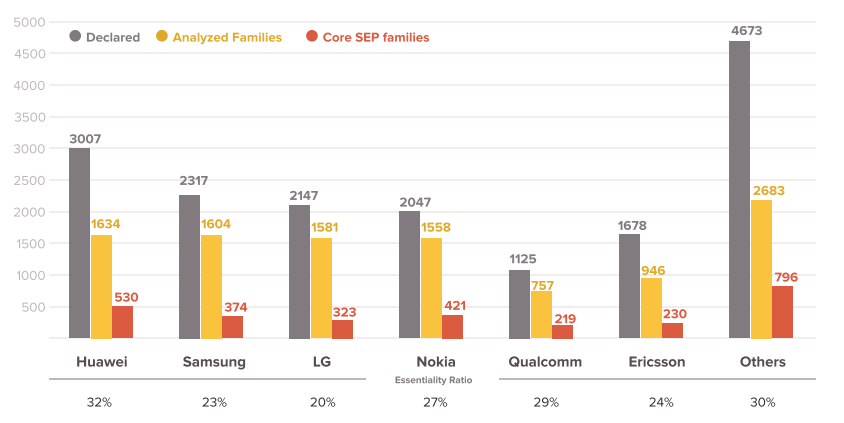

A new report, jointly released by IP consulting and analysis companies, Amplified and GreyB, disclosed that the top 6 companies (Huawei, Samsung, LG, Nokia, Ericsson, Qualcomm) account for 64.9% in 18,887 declared patent families. In granted 10,763 declared patent families, 2,893 families have been identified as core SEPs where top 6 companies account for 72.5%.

Huawei was first with 530 patent families and a ratio 18.3%. Nokia and Samsung were ranked No. 2 and No. 3 with 14.6% and 12.9%. respectively.

The report is an update of the previous report “Exploration of 5G Standards and Preliminary Findings on Essentiality” released on May 26, 2020.

………………………………………………………………………………………………………………………………

Separately, Samsung Electronics Co., Ltd. announced on March 10th that it has ranked first in 5G Standard Essential Patent (SEP)¹ shares according to a patent essentiality study conducted by IPlytics2, a Berlin-based market intelligence firm comprised of economists, scientists and engineers. The findings were published in IPlytics’ recent report: “Who is leading the 5G patent race? A patent landscape analysis on declared SEPs and standards contributions.”

Samsung also ranked second in two other categories: share of 5G granted3 and active patent4 families5, and share of 5G granted and active patent families with at least one of them granted by the EPO (European Patent Office) or USPTO (United States Patent and Trademark Office).

Last year, Samsung also led in 5G patents as a result of its research and development of 5G standards and technologies.

the top 10 companies own more than 80% of all granted 5G patent families, while the top 20 own more than 93% of all 5G granted patent families. These numbers confirm that there are only a few major large 5G patent owners, but looking at overall 5G declarations, the IPlytics Platform database identified more than 100 independent companies, which have declared ownership of at least one 5G patent.

The 5G patent family statistics presented in Table 1 are not based on verified SEP families. Neither ETSI nor the declaring companies have published independent assessments of the essentiality or validity of the declared 5G patents. Thus, the 5G patent families presented are only potentially essential. Many well-known SEP studies estimate that between 20% and 30% of all declared patents are essential. However, the essentiality rate differs across patent portfolios. To better understand the essentiality rate across portfolios, IPlytics created a data set of 1,000 5G-declared patent families (EPO/USPTO granted), which independent experts have mapped to 5G specifications. Here, the experts mapped the patents for six hours in a first check and then EPO/USPTO patent attorneys double-checked the mapping for a further three hours.

Table 1. Top 5G patent declaring companies (with >1% share)

| Current Assignee | 5G families | 5G granted and active families | 5G EPO/USPTO granted and active families | 5G EPO/USPTO granted and active families not declared to other generations |

| Huawei (CN) | 15.39% | 15.38% | 13.96% | 17.57% |

| Qualcomm (US) | 11.24% | 12.91% | 14.93% | 16.36% |

| ZTE (CN) | 9.81% | 5.64% | 3.44% | 2.54% |

| Samsung Electronics (KR) | 9.67% | 13.28% | 15.10% | 14.72% |

| Nokia (FN) | 9.01% | 13.23% | 15.29% | 11.85% |

| LG Electronics (KR) | 7.01% | 8.7% | 10.3% | 11.48% |

| Ericsson (SE) | 4.35% | 4.59% | 5.25% | 3.79% |

| Sharp (JP) | 3.65% | 4.62% | 4.66% | 5.50% |

| Oppo (CN) | 3.47% | 0.95% | 0.64% | 1% |

| CATT Datang Mobile (CN) | 3.44% | 0.85% | 0.46% | 0.68% |

| Apple (US) | 3.21% | 1.46% | 1.66% | 2.15% |

| NTT Docomo (JP) | 3.18% | 1.98% | 2.25% | 1.9% |

Source: IPlytics

………………………………………………………………………………………………………………………………..

Superscript Notes:

[1] “A patent that protects technology essential to a standard”, European Commission report – “Setting out the EU approach to Standard Essential Patents”, p1, November 2017.

[2] “IPlytics derived the “essential rate” by creating a random data set of 1,000 5G-declared patent families (EPO/USPTO granted) and mapping it to 5G specifications.” . Available : https://www.iam-media.com/who-leading-the-5g-patent-race-patent-landscape-analysis-declared-seps-and-standards-contributions

[3] “a patent that is granted by at least one of patent offices”, IPlytics report – “who is leading the 5G patent race”, p5, November 2019.

[4] “in active status, which means it has not lapsed, been revoked or expired”, IPlytics report – “who is leading the 5G patent race”, p3, November 2019.

[5] “a collection of patent applications covering the same or similar technical content”, . Available: https://www.epo.org/searching-for-patents/helpful-resources/first-time-here/patent-families.html

…………………………………………………………………………………………………………………………………………….

References:

https://www.amplified.ai/news/

https://www.greyb.com/5g-patents/

https://news.samsung.com/us/samsung-extends-leadership-5g-patents/

Is a new 5G Patent War in the works? Expert Opinion + Review of 5G patent studies

Introduction:

A recent Bloomberg article sees an increasing amount of patent litigation arising from the use of 5G and other (unnamed) wireless technologies. Wireless telecom patent producers, like Qualcomm and Nokia (along with many others not mentioned in the article) may reap royalties from many different types of products that communicate using wireless networks. Examples include “talking cars” (aka V2V or V2X), and IoT devices [1.] being planned in agriculture, medicine, appliances and other sectors.

………………………………………………………………………………………………………………………………………………………………..

Note 1. The 5G/IMT 2020 use case “Massive Machine to Machine communications” is the wireless connectivity used in the IoT. Note that IMT 2020.SPECS includes NB-IoT as one of the Radio Interface Technologies supported by 3GPP, China, Korea, and India/TSDSI.

………………………………………………………………………………………………………………………………………………………………..

“So many different types of companies have to find a way to get these deals done,” said Joe Siino, president of Via Licensing, a Dolby Laboratories Inc. unit that works with audio, wireless, broadcast and automotive industries. “It’s taking the problems we had with smartphones and multiplying it by 10.”

After noting the “4G smartphone patent wars,” Bloomberg says the new wireless patent disputes are potentially more lucrative, as sales of 5G devices is forecast to grow to $668 billion globally in 2026 from $5.5 billion this year, according to Allied Market Research. Here’s a review of recent court rulings, again from Bloomberg:

Courts in the U.S. and Europe have in the past few weeks rejected efforts claiming the telecommunications companies’ licensing policies violated antitrust laws and confirmed their ability to limit the use of fundamental wireless technology by those who refuse to meet their licensing demands.

Those rulings have already favored the telecoms in cases brought by the automobile industry in Europe and the U.S. over the current wireless standards

In the past few weeks, judges in Germany sided with Sharp Corp.’s request to limit Daimler AG sales in its home country for using its mobile technology without a license. In an unrelated case a federal judge in Texas threw out an antitrust lawsuit filed by Continental AG, a Daimler parts supplier, against a patent-licensing pool (aka Patent Troll) set up as a one-stop shop for access to patents.

That pool, Avanci LLC, handles licensing patents owned by Qualcomm, Nokia, Sharp and other telecom companies. It charges $15 per vehicle for a range of patented inventions needed to comply with 2G, 3G and 4G standards, and is developing a plan to charge for the next generation, known as 5G.

In a letter to the U.S. Federal Trade Commission (FTC), Daimler and Ford Motor Co. warned that an appeals court ruling won by Qualcomm could “destabilize the standards ecosystem by encouraging the abuse of market power acquired through collaborative standard-setting.”

And a few selected quotes:

“Patent owners want to get paid because they are proud of what they created and continue to innovate,” Kasim Alfalahi, founder and CEO of Avanci. “You have to find a middle ground, you have to find a place where these things can meet.”

“The fact that more and more industries are going to start incorporating technology that has to be standardized means it’s going to be even more important to resolve these issues,” said Katie Coltart, a patent lawyer with Kirkland & Ellis’s London office.

“You’ve got a handful of companies that are investing billions of dollars in research,” said Mark Snyder, deputy general counsel for Qualcomm. “In a functioning market, you want people to engage in earnest negotiation. FRAND is a two-way street.”

Telecoms.com Scott Bicheno wrote: “Around half of Huawei’s 5G patent applications seem to have been made in China, and they account for half of all such applications made in China. While there’s nothing intrinsically wrong with that, it’s worth noting that Samsung and LG, which are in the top three 5G patent applicants alongside Qualcomm, have hardly filed any applications in Korea. It’s almost as if the barrier to entry for patent filing in China is lower.”

5G Patent Expert Yigang Cai, PhD [2.] Comments:

- Currently, most companies generating 5G patents aim to license royalty revenues rather than to protect the intellectual property they have created.

- A high percentage of the many patents granted are not essential (professionals call them garbage patents), or only quite least claims among those patents are useful. It is kind of a waste of financial expenses and resources worldwide.

- Restrictions on the use of 5G patents will hurt most industries in the future, when 5G use cases and industry vertical applications are being developed.

Note 2. Among other honors, Yigang Cai, PhD was awarded the first ever Alcatel-Lucent “Distinguished Inventor Award” (2013) with his inventive accomplishments and patent contributions throughout his career with the company. Yigang has filed a total of 1000+ patents globally, of which 669 are granted patents (including 196 U.S. granted patents as of this week). Many of his inventions in wireless networks have been built into products and systems of 2G/3G/4G and 5G, and deployed worldwide. He is one of the pioneers and leaders in developing the principles and components of Machine Type Communications (MTC). Dr. Cai generated many 5G inventions, including 5G New Radio (NR), 5G end-to-end architectures and use cases (both Access Networks and Core Networks), Network Slicing, MEC, 5G Machine Type Communications (MTC), and Device-to-Device Communications.

Review of 5G Patent Studies:

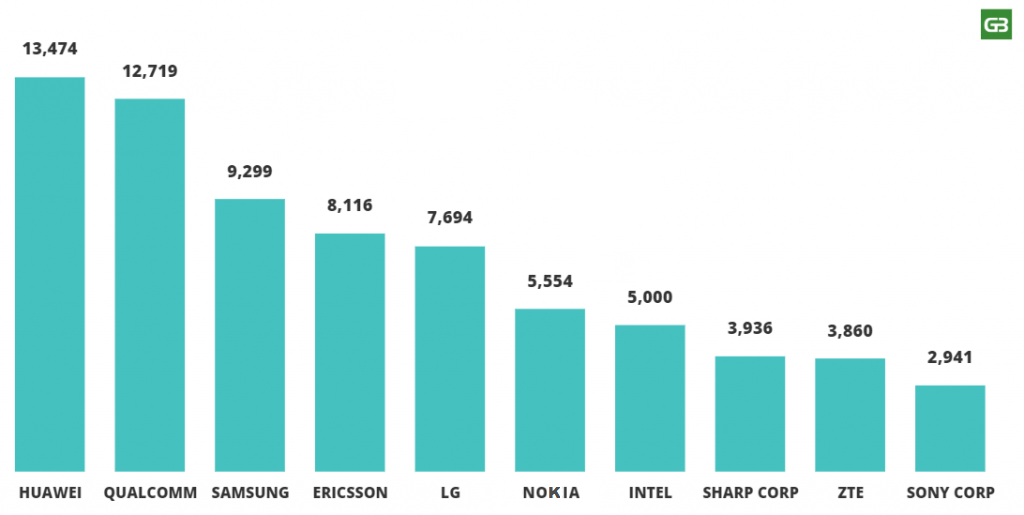

1. In a 2019 study by GreyB, a research company, Huawei was found not only to hold more 5G-related patents than any other company (some 13,474), but also to hold the bigger share of standard-essential patents (or SEPs) – about 19% of them vs 15% for Samsung, 14% for LG, 12% for each of Nokia and Qualcomm, and just 9% for Ericsson.

Authors of the study wrote: “Huawei holds the most 5G patents i.e. 13473 followed by Qualcomm and then Samsung with 12719 and 9299 respectively. China wants to have an upper hand in 5G therefore, it won’t come as a surprise to see Chinese companies such as Huawei and ZTE surpass some of the top companies worldwide.”

Here is the list of top 10 companies holding most 5G patents:

2. In a January 2020 released study, Berlin, Germany based Iplytics found that the 5G standard is highly patented. In total 95,526 5G

declarations patents have been declared for 5G which breaks down to 21,571 unique patent families. Only 44% of these patent families have yet been granted.

As most 5G patents have been recently filed, we would expect the rate of granted patents to further increase in the next few years. Most 5G patents where declared between 2017 and 2019 showing a sharp increase year by year. And as the 5G standard development is not yet completed (that includes IMT 2020.SPECS and 3GPP Release 16) further patent declarations are expected in the upcoming years.

It’s also interesting that 24% of the patents declared for 5G have before already been declared for 4G. This shows that some 4G technologies are still relevant for the new 5G specifications. As of January 1st, 2020 Huawei (CN) has declared most 5G patents followed by Samsung (KR), ZTE (CN), LG (KR), Nokia (FI), Ericsson (SE) and Qualcomm (US). All of those top 5G patent owners have already been active in the 4G standard development.

The study identified new market players. Here the Chinese companies Guangdong Oppo (CN), Vivo Mobile (CN), FG Innovation (CN), Spreadtrum Communications (CN) and the Taiwanese ASUSTeK Computer (TW) are new in the top patent owner list comparing 5G and 4G. The study shows however that the larger share of the Chinese newcomers’ patent portfolios is yet filed locally in China and are yet not granted. Given that 5G is a recent technology the study shows that the patent portfolios of these Chinese companies are still very young and could very well still be filed and granted internationally.

This study also investigated companies’ participation in the standards development, where technical contributions submitted to the 3GPP (3rd Generation Partnership Project) – the spec writing organization that develops complete radio and non-radio telecommunications specs for 3G, 4G and 5G – were counted and analyzed.

The main 4G standard developers such as Huawei, Ericsson, Nokia, Qualcomm, ZTE or Samsung and LG are again strong players for the 5G development. Here again the data shows increasing participation from new and upcoming Chinese players. When counting only approved 5G standard contributions, Huawei, Ericsson, Nokia and Qualcomm are the strongest players.

3. As of February 2020, The Times of India says that Huawei has filed the most 5G patents, but Samsung has been GRANTED the most.

Conclusions:

Bloomberg believes that there may be some “bumps in the road” for 5G and other wireless patent owners. A Chinese court has issued an order that would limit InterDigital Inc.’s powers in a royalty spat with handset maker Xiaomi Corp., even though the legal fight is in India. And judges in Dusseldorf indicated they want the European Union’s top court to weigh in on the dispute between Nokia and Daimler, which could turn the tide against the former handset maker if the EU top judges side with the carmaker.

The concern is that if there isn’t enough money for patent owners, they won’t work together to develop a single system that can be used for anyone. Too much money, though, means manufacturers will increase their prices or opt to pass on using the latest technology, said Mauricio Uribe, a patent lawyer with Knobbe Martens in Seattle. “Neither extreme is good for consumers,” he said.

……………………………………………………………………………………………………………………………………………………………………………..

References:

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Market research firm GreyB cooperated with Amplified, which develops software for intellectual property research, to publish a “preliminary” report named ‘Who Owns Core 5G Patents? – A Detailed Analysis of 5G Standard Essential Patents (SEP)s.’ The stated aim of the project is ‘to bring greater transparency to the landscape of 5G standard essential patents.’

The caveat is that the data used for the study in this report is from March 2019 and its taken from the ETSI website, rather than ITU-R WP5D–IMT 2020 website. Note that 3GPP members declare IPR not to 3GPP (which is not a legal entity but is a collaborative activity between several SDOs), but to their regional standard bodies for which they are participating. Many of the 3GPP members are also ETSI members, so they declare their IPR to ETSI.

For info on 3GPP IPR handling: https://www.3gpp.org/about-3gpp/legal-matters

………………………………………………………………………………………………………………………………………………..

From the report authors:

The report is the first of a series of collaborations between Amplified and GreyB that aim to bring greater transparency to the landscape of 5G standard essential patents. The data is large, opaque, and highly technical. Our focus will be on making the data involved more accessible and understandable. The issues are nuanced and complicated. We hope that this report and the following reports enable the many stakeholders involved to have more effective discussions and make better decisions.

Patents, which help protect the rights of the innovators who contribute to building the standard, may be declared as potentially essential and relevant to the standard. These are known as SEPs. Declaration does not require verification. Verifying that a patent is essential to a particular standard is a complex task

requiring significant time from experts in the field.

Importance of Standards:

Standards benefit businesses, policy makers, and society in general.

• They promote innovation in the market through rewarding R&D

• Help to commercialize the technology and bring products to market faster

• Ensure and define interoperability and interchangeability which gives manufacturers and consumers more choice

• Encourage improvement and competition in the market

• Help protect consumer safety

They balance cooperation and competition among innovative companies such that the net benefit is greater than the sum of their individual parts.

Manufacturers who implement standardized technology get an even playing field – a blueprint from which they can all build from at a predictable cost. This encourages more companies to participate in a market and innovate around the core technology.

Standards provide the ground rules for different devices, systems and processes to work together. Interoperable and interchangeable products gives consumers more choice and that encourages market pressure towards better, safer, and cheaper products.

Finally, standards provide policymakers with well-documented baselines and rules for implementation which helps them to understand the implications of new technology and take action to protect consumer, business, societal interests

……………………………………………………………………………………………………………………….

5G Patent Leaders:

The strong conclusion of the report is that Huawei is the 5G SEP leader, and not just by a little bit. As you can see in the chart below, Huawei accounts for 19% of core (used in 5G standards/3GPP specs) patents, followed by the two Korean tech giants, which are surprisingly ahead of Huawei’s main rivals in this case.

GreyB originally got in touch with Telecoms.com after reading an article there titled: 5G patent chest-beating is an unhelpful distraction. The purpose of the research is an attempt to cut through the noise created by various competing claims and get to the heart of the matter.

“5G is going to be next disruptive technology,” report co-author Muzammil Hassan of GreyB, told Telecoms.com. “And going by all the fuss around, it is important to know where each of the top contributors of 5G technology stand in terms of quality of innovation. Some may want to switch gears and file better inventions.”

One other metric GreyB was keen to flag up was ‘essentiality ratio,’ which seeks to illustrate the proportion of filed patents that make it into the core standard. Once more, in the chart below, Huawei comes top, but it should be noted that the ratio is derived from only those patents analyzed.

As a proportion of all declared patents Huawei is among the lowest at 13%, compared to the leader Nokia with 20%. Ericsson has the lowest ranks of all by this metric with 11%. The Sweden based company is also the lowest in SEPs with only 9%.

Problems and pitfalls:

Reviewing historical work done in this field we’ve identified the following pitfalls which we seek to avoid:

• Extrapolating conclusions done from a small sample size

• Using proxies from 4G and projecting those onto 5G

• Taking declared numbers at face-value

• Implicitly framing all patents as equal by focusing on patent quantity only without accounting for quality

The complex nature of patent data analysis simply makes it impossible to address these issues completely so unfortunately it may be impossible to avoid all of these in entirety. However, it is our goal to create a reliable report and therefore we believe it is critical to acknowledge and account for them transparently and to the best of our ability. Our methodology is detailed in the appendix and we invite corrections, additions, criticism, and contributions.

Patent Source and Study Methodology:

The data covered was all patents from the ETSI website 5G declaration list March 2019 version. This covers any patent or patent application declared to the ETSI 5G standard. Essentiality evaluation involves significant time and effort so there is a lag between release date of our report and data covered. We’ll issue updates as we continue to analyze the data.

• All patents declared to relevant 5G specifications and projects were selected resulting in 63,985 individual patent documents (granted patents, published patent applications, and non-public patent applications)

• ~500 Non-public patent documents, unavailable for inspection, were removed

• The remaining ~63,500 patent documents were grouped into 12,002 patent families.

• 6,402 of the 12,002 patent families with a granted patent having live legal status as of 31st December 2019 were kept, the rest were removed

• We determined our understanding of each of the 6,402 patent families by reading the claims and related embodiments from these granted patents and checked the correspondence history and documentation at the patent office to understand each patent.

• We determined essentiality for each patent family as a Core SEP or not by checking any specifications declared to be relevant by the patent holder to the SEP and compared the specific sections of these to compare overlap of the patent claims with those sections. If partial or no overlap was found, we then broadened our comparison to the wider group of all other specifications to repeat this process.

………………………………………………………………………………………………..

References:

2021: Who Owns Core 5G Patents? – A Detailed Analysis of 5G SEPs

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

Strategy Analytics: Huawei 1st among top 5 contributors to 3GPP 5G specs