Global Data: Wireless telcos don’t know how to market 5G SA

A study by leading data and analytics company GlobalData reveals that network operators don’t seem to know how to market this new phase of the technology to their customers. The study by GlobalData Technology was a July 2022 audit of around 30 standalone 5G (5G SA) commercial deployments worldwide.

The conclusion was that although operators are keen to promote the adoption of 5G SA in general marketing messages—largely focusing on the improved network quality and capabilities for enterprises—the number of 5G SA references within consumer 5G service portfolios are few and far between. GlobalData found “many operators marketed 5G SA very similarly to how operators have been marketing non-standard 5G for years,” which itself has yet to be a financial success for wireless telcos.

Emma Mohr-McClune, Service Director at GlobalData, comments: “The lack of effective standalone 5G promotion is a real problem for the future of 5G monetization. Standalone 5G will be a vital requirement for a lot of the more exciting 5G use cases, from autonomous devices to commercial augmented and virtual reality.”

The research found that there were a few exceptional cases of standalone 5G marketing and branding, but many operators marketed standalone 5G very similarly to how operators have been marketing non-standard 5G for years.

Mohr-McClune continues: “The few exceptional cases—in Singapore, but also in Germany and elsewhere—make for fascinating study. In the future, we could see more operators position standalone 5G as greener, safer and more reliable than future generations of wireless technology, but the current industry is still waiting for signature use cases to give the upgrade meaning to consumers. In the meantime, we believe that most operators will focus on marketing the technology to the business sector, where there are more immediate and distinctive use cases emerging.

“In the Enterprise sector, it’s an entirely different story. Standalone 5G enables enterprises to set up their own, closed Private 5G networks, to better manage the connectivity in ultra-connected working set-ups, such as ports and mines – or even ‘slice’ the network for prioritized levels of service for mission-critical operations. The benefits, use cases and ROI are far clearer. But in selling Standalone 5G to consumers, operators are going to have to make sure they don’t repeat the same promises they spun out for non-standalone 5G, or risk appearing to contradict themselves.

The GlobalData report echoed one recently put forth by LightCounting, which tied the tepid deployment pace of 5G SA networks to the industry’s inability to produce compelling use and business cases.

The firm noted that ongoing “headwinds” have limited the deployment of 5G SA networks to just 20 at the end of last year. This was just 10% of the 200 5G non-standalone (NSA) commercial networks deployed worldwide.

Those headwinds are led by “the lack of 5G business cases beyond enhanced mobile broadband combined with some network architecture issues” that continue “to inhibit 5GC SBA [5G core service-based architecture] rollouts.”

“Communications service providers are just sweating their EPC/vEPC [evolved packet core/virtualized evolved packet core] assets, in such conditions, there is no rush to move to 5GC SBA,” the firm explained.

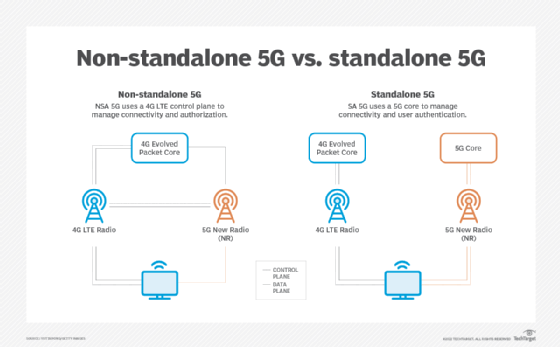

Here’s a simplified block diagram of 5G non-standalone vs 5G standalone networks:

References:

One thought on “Global Data: Wireless telcos don’t know how to market 5G SA”

Comments are closed.

Dell’Oro research director Dave Bolan recently wrote, “We found that 27 5G SA networks have been commercially deployed and only one MNO is running its 5G workloads in the public cloud. The balance chose to run their own telco clouds.”