GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

GSMA says in order to stay competitive European economies must ‘digitalize’ themselves through faster 5G rollouts and make a fair contribution. The telco trade body and owner of MWC event has released its 2022 Mobile Economy Report for Europe, in which it states the EU will not meet its ‘digital decade goals’ unless it starts rolling out 5G faster across the continent.

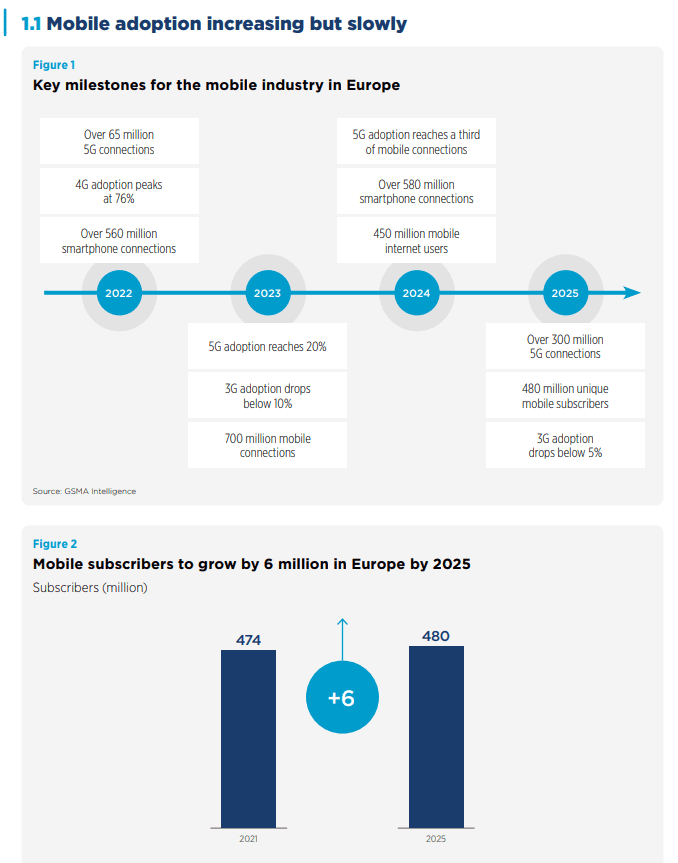

In 2021, 474 million people in Europe (86% of the population) were subscribed to mobile services, and this is expected to grow to 480 million by 2025.

The majority of countries in Europe have now deployed commercial 5G services, and nearly two thirds of wireless network operators in the region have launched 5G networks. At the end of June 2022, 108 operators in 34 markets across Europe had launched commercial 5G services, while consumer uptake was at 6% of the mobile customer base. Norway trended above this with 16% of its citizens using 5G, followed by Switzerland (14%), Finland (13%), the UK (11%) and Germany (10%).

GSMA forecasts that by 2025, there will be 311 million 5G connections across Europe, a 44% adoption rate. However, European markets still lag behind global peers such as Japan, South Korea and the U.S. in the adoption of 5G technology. In 2025, the UK and Germany will have the highest 5G adoption rates in Europe at 61% and 59% respectively, compared to 73% in South Korea and 68% in Japan and the U.S. 4G adoption in Europe will peak in 2022 and then decline. However, it is set to remain the dominant technology across the region, accounting for just over half of total connections by 2025.

The pace of 5G coverage expansion across Europe will be a key factor in the transition from 4G to 5G. Although 5G network coverage in Europe will rise to 70% in 2025 (from 47% in 2021), nearly a third of the population will remain without 5G coverage. This compares to 2% or less in South Korea and the U.S.

SOURCE: GSMA

“Europe is adopting 5G faster than ever before, but greater focus on creating the right market conditions for infrastructure investment is needed to keep pace with other world markets. This should include the implementation of the principle of fair contribution to network costs,” said Daniel Pataki, GSMA Vice President for Policy & Regulation, and Head of Europe.

Which of course is a reference to the ‘fair contribution’ argument that telcos and now the GSMA itself has been making for some time now, which in a nutshell says that since internet firms like Netflix and Facebook make tons of money, they should contribute to the building of physical network infrastructure because it is expensive and telcos don’t make as much cash as they used to.

This announcement from the GSMA goes a bit further than saying it’s unfair that content providers make much more margin streaming TV shows that telcos do on digging holes and dragging up cell towers, and seems to be asserting that unless something is done about all this then the entire continent of Europe will become uncompetitive on the world stage.

As economies and societies around the world digitalize, the acceleration of 5G in Europe is necessary to ensure that traditional industrial and manufacturing strengths are not dragged down by weaknesses in the ICT sector. To achieve this, it is vital to create the right conditions for private infrastructure investment, network modernization and digital innovation. A financially sustainable mobile sector is key to the delivery of innovative services and the deployment of new networks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/10/051022-Mobile-Economy-Europe-2022.pdf

One thought on “GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base”

Comments are closed.

India and China now account for nearly 50 per cent of the global mobile traffic, compared to their 12 per cent share 10 years ago. The growth in digital infrastructure has led to a surge in Internet appetite in these countries.

In 2012, India contributed to only 2 per cent of the world’s mobile data traffic and China held a 10 per cent share, while the western market accounted for 75 per cent of the global market share. The two Asian tigers, India and China, grew massively in a span of two years. According to the latest data for 2022, India holds a 21 per cent share of the global mobile data traffic and China 27 per cent, while the western markets of North America and Europe account for only a quarter of the global traffic for mobile data services.

India has the highest mobile data consumption rate at 12 GB/user a month in the world, and the country is adding as many as 25 million new smartphone users every quarter. According to OoKla, between September and October, India recorded the highest median mobile download speed in the last 13 months (from 13.87 Mbps in September to 16.50 Mbps).

The proliferation of digital infrastructure and online services have a huge role to play in these trends, especially for India. Within this decade, telecom operators such as Reliance Jio reduced the cost of data massively, allowing more and more people to come online using 4G services. Indian telcos continue to have the lowest monthly ARPUs in the world at $2.5 per month.

Consumer tech start-ups, entertainment services and digital financial inclusion initiatives by the government (UPI) have also contributed to the data consumption boom. The sheer population of India also massively contributes to these numbers.

Sanchit Vir Gogia, Chief Analyst & CEO at Greyhound Research, said: “The kind of scale that consumer mobility enjoys in India is unlike anywhere else in the world. Consumer-facing businesses have to cater to a massive scale. Moreover, as devices and data plans become cheaper, more and more customers are moving from 2G to 4G services. The sheer depth of variety among Indian consumers is also massively increasing demand in the country, as brands and marketers jump to cater to the demand in every vernacular.”

SOURCE: THG Publishing Pvt. Ltd.