5G in Europe

Ookla: Europe severely lagging in 5G SA deployments and performance

According to a new joint study from Omdia and Ookla, Europe has had the poorest 5G SA availability and performance among major regions. In Q4 2024, China (80%), India (52%), and the United States (24%) led the world in 5G SA availability based on Speedtest® sample share, markedly ahead of Europe (2%).

The European region also lagged behind its peers in performance, with the median European consumer experiencing 5G SA download speeds of 221.17 Mbps—lower than those in the Americas (384.42 Mbps) and both Developed (237.04 Mbps) and Emerging (259.73 Mbps) Asia Pacific. The interplay of earlier deployments, a more diversified multi-band spectrum strategy, and greater operator willingness to invest in the 5G core to monetize new use cases have driven rollouts at a faster pace in regions outside Europe.

The European Commission has championed measures to accelerate private investment in 5G SA, highlighting network slicing—a flagship capability of cloud-native core networks—as a key potential driver of its broader industrial strategy in sectors such as precision manufacturing, defense and clean energy. Up until this point, high-quality public data examining Europe’s progress in 5G SA—and benchmarking its competitive position relative to other global regions—has been scarce. In its latest annual report, Connect Europe, the trade body representing Europe’s telecoms operators, noted that “there is limited information available about the extent of operators’ rollout of 5G SA.”

Advanced network capabilities enabled by the technology remain stubbornly limited to just a few operators in leading markets such as the U.S., according to the study, while Europe lags behind its peers on several 5G SA performance indicators, “raising concerns about the bloc’s competitiveness in the technology.”

Network operator investment per capita also lags in Europe as per the below chart:

When faced with choices among investments in fiber, 5G RAN, and 5G SA core, the latter frequently loses out, since operators can still launch a “5G” network by leveraging alternative technologies. There is also a lack of 5G SA-compatible devices, especially devices with User Equipment Routing Selection Policy (URSP) technology, which allows a device to dynamically select a slice (or multiple slices) provisioned by an operator. However, only Android 12/iOS 17 mobile devices support that largely unknown technology.

While capital spending on the 5G core transition is now increasing rapidly, European network operators will remain committed to strict cost discipline Based on Omdia’s Q3 2024 quarterly core software market share and forecast, the research firm believes that the global core market revenue from both 4G and 5G network functions will grow with a five-year CAGR of 3.2% between 2023 and 2028. When considering the spending in 5G core software, the forecasted growth with a five-year CAGR during the same period is of 17.0%.

Omdia now forecasts that 5G SA core spending in EMEA will grow with a five-year CAGR of 26.2% between 2023 and 2028. Nonetheless, as a prerequisite, deploying the 5G core also requires a good 5G radio coverage, to avoid a degraded experience where the 5G coverage is limited or nonexistent, and where the user falls back on 4G-LTE or 2G/3G. This means operators must invest in 5G RAN, which is usually considered the highest capex draining activity for an operator. While 5G is known for very high throughput speeds using mid-band (and particularly C-band) spectrum, these bands need to be complemented by sub-GHz spectrum deployment, in order to offer improved in-building and wide area coverage. This rollout has been slow in many European markets, with 5G availability in all countries outside the Nordics remaining significantly lower than that in the United States and China, according to Ookla’s Q4 2024 Speedtest Intelligence® data.

One bright spot is that Europe has made progress on achieving low latency on its 5G networks. In Q4 2024, the average country-wide median latency in Europe was 32 milliseconds (ms) compared to 35 ms in the Americas and 36 ms in Emerging Asia Pacific region.

References:

https://www.lightreading.com/5g/eurobites-europe-behind-on-5g-sa-study

https://www.ookla.com/s/media/2025/02/ookla_omdia-5GSA_0225.pdf

Building and Operating a Cloud Native 5G SA Core Network

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

GSA 5G SA Core Network Update Report

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

Nokia and Eolo deploy 5G SA mmWave “Cloud RAN” network

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

Telefónica launches 5G SA in >700 towns and cities in Spain

Telefónica has followed Orange with the official launch of a 5G standalone (SA) network in more than 700 towns and cities throughout Spain. The service is branded Movistar 5G+ even though it is just 3GPP defined real 5G (with its own core network , rather than 5G NSA which uses LTE core network). The new Telefónica 5G SA network uses Ericsson and Nokia network equipment. Huawei has been excluded from it because the European Commission wants to ban Huawei in the EU for its alleged espionage work for the Chinese government.

Telefonica said its 5G NSA service in the 700 MHz band is currently available to around 85 percent of the Spanish population across 2,200 municipalities. The Spanish operator also uses the 3.5 GHz band for 5G and invested EUR 20 million to secure the maximum possible 1 GHz of spectrum in the 2.6 GHz band.

“Movistar customers will be able to enjoy 5G+ automatically and at no additional cost both in large cities and in small municipalities thanks to a highly capillarity deployment that will allow ultra-fast speeds and very low latency to be obtained in practically all of Spain,” the company explained in a statement.

The launch of 5G+, which offers greater coverage and browsing speeds of up to 1,600 megabits per second (Mbps), will take place within the scope of Movistar’s deployment in the 3,500 MHz band. In practice, 5G+ translates into better mobile experience in content downloads at the speed of fiber optics, streaming High quality and uninterrupted gaming. It also offers greater coverage in crowded spaces such as a sporting event or a music concert, according to Telefónica.

Movistar currently covers a total of 11 cities with 5G SA: Madrid, Barcelona, Malaga, Seville, Palma de Mallorca, Las Palmas de Gran Canaria, Ávila, Segovia, Castellón, El Ferrol and Vigo. The goal for the end of the year is to have “extensive 5G SA coverage in most cities with more than 250,000 inhabitants,” as well as in smaller towns, so that the capillarity of the service continues to be consolidated. However, in order to enjoy this service it is necessary to have a mobile that supports 5G SA. For the moment, Movistar has the new Xiaomi terminals to which new brands will be added.

Gabriel Brown, principal analyst at Heavy Reading, notes that Movistar operates the biggest network in Spain and has the largest number of live 3.5GHz sites, according to the independent AntenasMoviles website.

Said deployment is completed with the coverage in the 700 MHz band that Movistar has been offering since last year and currently reaches more than 2,200 municipalities, with advantages such as improved indoor coverage. The so-called low band is complemented in 5G with that of 3,500 MHz, ideal for services that require a user experience at a very high transmission speed, both for rural areas and large urban centers. In this way, Movistar already offers 5G coverage to more than 85% of the population, reports the company.–

Orange leads 5G SA coverage as it already reaches more than twenty cities that cover 30% of the population in Spain. In the case of Vodafone and MásMóvil, 5G SA is expected to be available before March 2024.

Heavy Reading’s Brown said, “It will be interesting to see if this gives it an edge in SA. Orange Spain, meanwhile, says it will launch network slicing before the end of the year.”

References:

https://euro.eseuro.com/business/572316.html

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Kearney’s “5G Readiness Index 2022” and How to Monetize 5G

A new report from management consultancy Kearney analyzes a year of 5G progress across 33 countries around the world. The Kearney “5G Readiness Index 2022” assesses 5G and how close countries are to realizing all the potential and benefits of widespread 5G in the context of the overall maturity of a country’s telecoms market and its socio-economic position. The report covers 33 countries, all of which had launched 5G by the third quarter of 2022. To be included, countries must have launched 5G by the fourth quarter of 2021.

“Europe is falling behind on 5G!” is a cry we heard at the latest Mobile World Congress. The Kearney 5G Readiness Index 2021 reflected it, and our 2022 Index confirms it, at least for now (see Figure 1).

11 out of 28 countries tracked have at least one operator with a standalone 5G core network launched. Asia leads with seven countries, while Europe trails with just Finland and Germany reaching this point. Only in two countries have all operators launched standalone cores—Singapore and China—opening up their markets for a 5G transformation.

This year’s Index reveals that only 10 countries have made high band spectrum available, and operators in just five of them (the United States, Australia, South Korea, Thailand, and Japan) have launched full commercial services within it. So far, no European countries have gotten this far, although select services have been launched on limited mmWave licenses, including in Germany. The lack of availability of mmWave spectrum is disappointing because its advantages are the cornerstone of new, high speed 5G-enabled services.

The Index identified more key developments during the past year:

- The United States continues to push ahead of other countries. Its regulator has provided spectrum in all three band classes, and national operators have made the most of it by launching services. One operator has launched a standalone 5G core. Canada also has an operator offering 5G services via its new standalone core.

- South Korea, which ranked second in the 2021 Index, has dropped to fifth because it has not made low band spectrum available, despite high subscriber penetration.

- Most Nordic countries are pulling ahead, thanks to wider spectrum availability and broader deployment across bands, but Sweden is held back by the lack of mmWave spectrum as full availability of 26 GHz isn’t planned before 2025. This slows Sweden down and risks muting consumer excitement.

- Germany moved from laggard to leader of the EU4 (France, Germany, Italy, and Spain) plus the United Kingdom, thanks to operators launching 5G in multiple bands. Only one operator has launched a 5G standalone core.

- France now trails other larger European countries because of its late launch of 5G (November 2020) and customers’ apparent limited interest in it.

- A strong showing in the Middle East (Saudi Arabia, United Arab Emirates, and Qatar) is a testament to their networks’ quality and strong rollouts. Penetration is 9 to 11 percent. A Saudi operator has launched a standalone 5G core.

- Australia was one of the first countries to launch 5G, has continuously expanded spectrum access across all bands, and enjoys successful commercialization. It has 18 percent 5G penetration, the second highest in the Index.

Kearney also uncovered the following findings:

- Take-up (as a percentage of total subscribers in the first quarter, 2022) is paltry across Europe. Switzerland is the best with 13 percent but launched in April 2019. Belgium is the worst offender at 1.7 percent of connections. Take-up is 31 percent in South Korea.

- In South Korea, the government has announced a push for creating an ecosystem of companies that innovate and leverage 5G (aiming for 1,800 5G service firms by 2026). They understand operators won’t be solo drivers but enablers.

- Rollout of new capacity in the United States allows operators to launch impactful services, such as 5G fixed wireless access (FWA). One operator is using

- 5G to equip ambulances with high-quality video feeds that medical professionals can view while patients are en route.

Europe is behind, but not irreparably so. Vigilance and focus are required, together with operators’ preparation to win with 5G when their countries have reached ready status.

Monetize 5G step-by-step, building up to an ecosystem of products, services, and partners:

Currently, 5G lacks killer uses cases to drive customer uptake. Without seductive 5G products or services, people won’t see its benefits. Yet, operators wonder whether advancing investment in 5G is wise. It’s classic chicken-and-egg, but it will start somewhere, spearheaded by first-mover operators along with third-party providers that will figure out what will make everyone want 5G. Plan monetization first with small steps, and then plan the ecosystem to realize its potential.

It still may seem like early days in the 5G journey, but time grows shorter for European telcos to catch up with the United States and other markets. Getting your strategy rolling now is the only way to take advantage of the European market when it becomes fully 5G ready.

References:

Ericsson Mobility Report: 5G monetization depends on network performance

Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

PwC report on Monetizing 5G should be a wake up call to network operators!

How 5G network operators can stay competitive and grow their business

Reuters: Telcos draft proposal to charge Big Tech for EU 5G rollout; Meta offers a rebuttal

Big tech companies accounting for more than 5% of a telecoms provider’s peak average internet traffic should help fund the rollout of 5G and broadband across Europe, according to a draft proposal by the telecoms industry. The proposal is part of feedback to the European Commission which launched a consultation into the issue in February. The deadline for responses is Friday.

Alphabet’s Google, Apple Facebook-owner Meta, Amazon, Netflix and TikTok would most likely be hit with fees, according to industry estimates. Google, Apple, Meta, Netflix, Amazon and Microsoft together account for more than half of data internet traffic.

The document, which was reviewed by Reuters and has not been published, was compiled by telecoms lobbying groups GSMA and ETNO. They represent 160 operators in Europe, including Deutsche Telekom, Orange, Telefonica and Telecom Italia. Telecom operators have lobbied for years for leading technology companies to help foot the bill for 5G and broadband roll-out, saying that they create a huge part of the region’s internet traffic. This is the first time they have tried to define a threshold for who should pay.

“We propose a clear threshold to ensure that only large traffic generators, who impact substantially on operators’ networks, fall within the scope,” the draft stated. “Large traffic generators would only be those companies that account for more than 5% of an operator’s yearly average busy hour traffic measured at the individual network level,” it said. The European Commission declined to comment.

Meta on Wednesday urged Brussels to reject any proposals to charge Big Tech for additional network costs. In a Facebook blog post, Markus Reinisch, Meta’s VP for Public Policy for Europe, described potential fees as a “private sector handout for selected telecom operators” that would disincentivize innovation and investment, and distort competition. “We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concerns, and abandon these misguided proposals as quickly as possible,” he said. Here are Meta’s takeaways:

- Network fee proposals misunderstand the value that content platforms bring to the digital ecosystem.

- We support the Commission’s goal of “ensuring access to excellent connectivity for everyone,” but network fee proposals will hurt European consumers and businesses.

- We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concern, and drop these proposals.

References:

Network Fee Proposals Will Ultimately Hurt European Businesses and Consumers

https://www.euractiv.com/section/5g/news/eu-telcos-call-for-big-tech-to-share-5g-network-costs/

GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

European telcos need to address very high 5G energy consumption

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

GSMA says in order to stay competitive European economies must ‘digitalize’ themselves through faster 5G rollouts and make a fair contribution. The telco trade body and owner of MWC event has released its 2022 Mobile Economy Report for Europe, in which it states the EU will not meet its ‘digital decade goals’ unless it starts rolling out 5G faster across the continent.

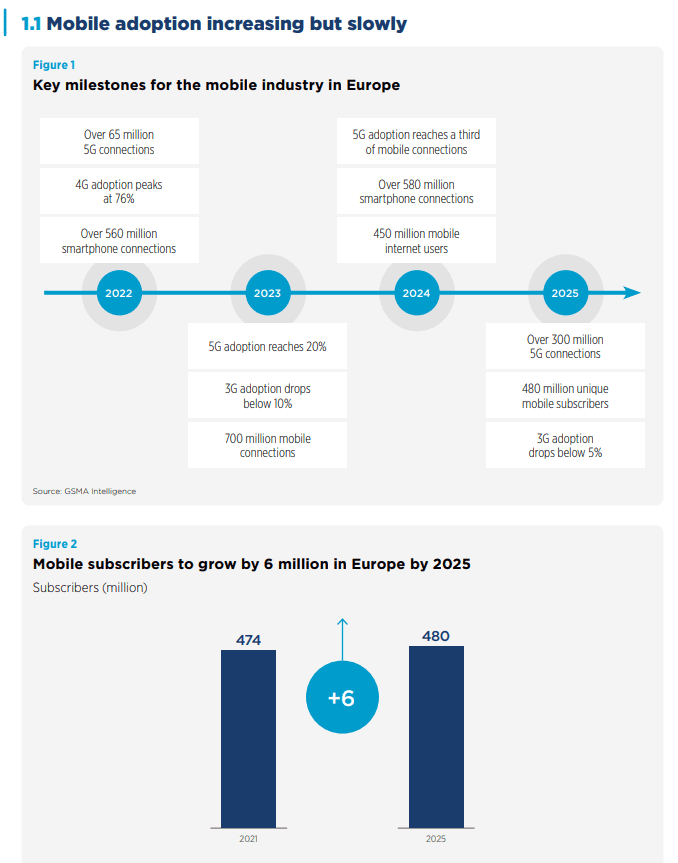

In 2021, 474 million people in Europe (86% of the population) were subscribed to mobile services, and this is expected to grow to 480 million by 2025.

The majority of countries in Europe have now deployed commercial 5G services, and nearly two thirds of wireless network operators in the region have launched 5G networks. At the end of June 2022, 108 operators in 34 markets across Europe had launched commercial 5G services, while consumer uptake was at 6% of the mobile customer base. Norway trended above this with 16% of its citizens using 5G, followed by Switzerland (14%), Finland (13%), the UK (11%) and Germany (10%).

GSMA forecasts that by 2025, there will be 311 million 5G connections across Europe, a 44% adoption rate. However, European markets still lag behind global peers such as Japan, South Korea and the U.S. in the adoption of 5G technology. In 2025, the UK and Germany will have the highest 5G adoption rates in Europe at 61% and 59% respectively, compared to 73% in South Korea and 68% in Japan and the U.S. 4G adoption in Europe will peak in 2022 and then decline. However, it is set to remain the dominant technology across the region, accounting for just over half of total connections by 2025.

The pace of 5G coverage expansion across Europe will be a key factor in the transition from 4G to 5G. Although 5G network coverage in Europe will rise to 70% in 2025 (from 47% in 2021), nearly a third of the population will remain without 5G coverage. This compares to 2% or less in South Korea and the U.S.

SOURCE: GSMA

“Europe is adopting 5G faster than ever before, but greater focus on creating the right market conditions for infrastructure investment is needed to keep pace with other world markets. This should include the implementation of the principle of fair contribution to network costs,” said Daniel Pataki, GSMA Vice President for Policy & Regulation, and Head of Europe.

Which of course is a reference to the ‘fair contribution’ argument that telcos and now the GSMA itself has been making for some time now, which in a nutshell says that since internet firms like Netflix and Facebook make tons of money, they should contribute to the building of physical network infrastructure because it is expensive and telcos don’t make as much cash as they used to.

This announcement from the GSMA goes a bit further than saying it’s unfair that content providers make much more margin streaming TV shows that telcos do on digging holes and dragging up cell towers, and seems to be asserting that unless something is done about all this then the entire continent of Europe will become uncompetitive on the world stage.

As economies and societies around the world digitalize, the acceleration of 5G in Europe is necessary to ensure that traditional industrial and manufacturing strengths are not dragged down by weaknesses in the ICT sector. To achieve this, it is vital to create the right conditions for private infrastructure investment, network modernization and digital innovation. A financially sustainable mobile sector is key to the delivery of innovative services and the deployment of new networks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/10/051022-Mobile-Economy-Europe-2022.pdf