Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro Group announced today the launch of its new Fixed Wireless Access Infrastructure and CPE advanced research report (ARR). Preliminary findings suggest total Fixed Wireless Access (FWA) revenues, including both RAN equipment and CPE revenue remain on track to advance 35% in 2022, driven largely by subscriber growth in North America.

“Fixed Wireless Access has become a key component to bridging the digital divide and connecting rural and underserved markets globally. What we are also seeing is that FWA can effectively compete with existing fixed broadband technologies, especially with the advent of 5G and other higher-throughput, non-3GPP technologies,” said Jeff Heynen, Vice President and analyst with the Dell’Oro Group.

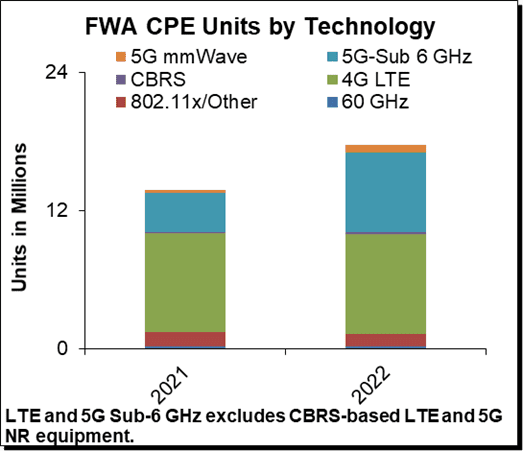

“Right now, CPE for fixed wireless access using 5G sub-6GHz technologies are growing the fastest. We do expect these units to tail off over time as current investments in fiber networks, along with cable’s DOCSIS 4.0 and fiber upgrades, will limit the addressable market for large-scale fixed wireless services,” Jeff added.

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Global FWA revenues are projected to surpass $5 B by 2026, reflecting sustained investment and subscriber growth in both 3GPP- and non-3GPP-based network deployments.

- The North American market remains the most dynamic in terms of deployed FWA technology options, with CBRS and other sub-6GHz options growing alongside 5G NR and 60GHz options.

- Long-term subscriber growth is expected to occur in emerging markets in Southeast Asia and MEA, due to upgrades to existing LTE networks and a need to connect subscribers economically.

- The Satellite Broadband market will also be a key enabler of broadband connectivity in emerging markets, thanks to LEOS-based providers including Starlink, OneWeb, and Project Kuiper.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional subscriber forecasts for FWA and satellite broadband technologies, as well as Gateway forecasts for satellite broadband deployments. To purchase this report, please contact us by email at [email protected].

Note: The IEEE Techblog has featured many FWA success stories and that FWA is probably the top 5G use case to date. The main reason is that a 5G FWA network doesn’t involve roaming or a 5G SA core network for which there are no ITU/ETSI standards or 3GPP implementation specs. As long as the FWA CPE supports 5G NR (via ITU M.2150 recommendation or 3GPP Release 16) all the other functions can be customized in software which only has to work with the network provider offering the FWA service.

References:

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

One thought on “Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America”

Comments are closed.

Right now, CPE for fixed wireless access using 5G sub-6GHz technologies are growing the fastest. We do expect these units to tail off over time as current investments in fiber networks, along with cable’s DOCSIS 4.0 and fiber upgrades, will limit the addressable market for large-scale fixed wireless services