Another Opinion: 5G Fails to Deliver on Promises and Potential

Introduction:

For many years now, this author has repeatedly stated that 5G would be the biggest train wreck in all of tech history. That is still the case. It’s primarily due to the lack of ITU standards (really only one- ITU M.2150) and 5G core network implementation specs (vs 5G network architecture) from 3GPP.

We’ve noted that the few 5G SA core networks deployed are all different with no interoperability or roaming between networks. I can’t emphasize enough that ALL 3GPP defined 5G functions and features (including security and network slicing) require a 5G SA core network. Yet most of the deployed 5G networks are NSA which use a 4G infrastructure for everything other than the RAN.

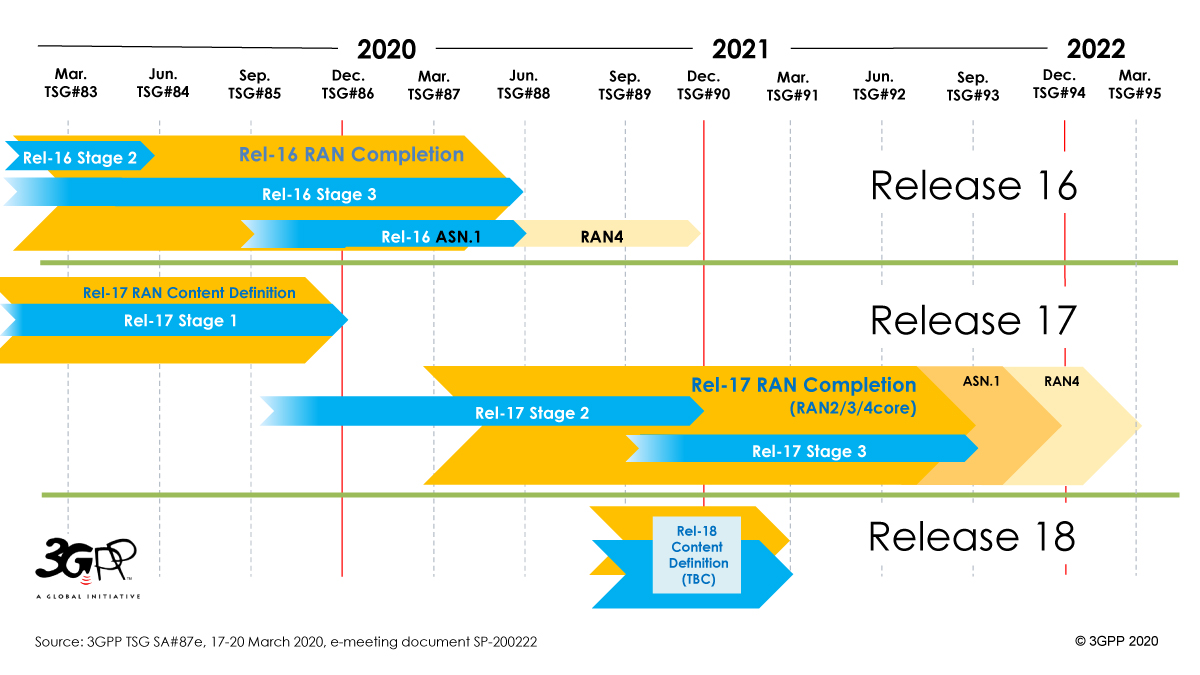

It also must be emphasized that the 5G URLLC Physical layer specified in ITU-R M.2150 does not meet the performance requirements in ITU-R M.2410 as the URLLC spec is based on 3GPP Release 15. Astonishingly, the 3GPP Release 16 work item “URLLC in the RAN” has yet to be completed, despite Release 16 being “frozen” in June 2020 (2 1/2 years ago). The official name of that Release 16 work item is “Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC)” with the latest spec version dated June 23, 2022. That work item is based on the outcome of the study items resulting in TR 38.824 and TR 38.825. It specifies PDCCH enhancements, UCI enhancements, PUSCH enhancements, enhanced inter UE TX prioritization/multiplexing and enhanced UL configured grant transmission.

Finally, revision 6 of ITU-R recommendation M.1036 on terrestrial 5G frequency arrangements (especially for mmWave), still has not been agreed upon by ITU-R WP5D. That has resulted in a “frequency free for all,” where each country is defining their own set of 5G mmWave frequencies which inhibits 5G end point device interoperability.

……………………………………………………………………………………………………………………………………………………………………..

In an article titled, 5G Market Growth, Mohamad Hashisho provides his view of why 5G has not lived up to its promise and potential.

Standalone 5G Is Yet to Breakout:

5G market growth still needs to feel as imposing as many imagined it. A technology created to replace previous generations still relies on their infrastructure. Standalone (SA) 5G is unrestricted by the limits of the prior generation of telecommunications technology because it does not rely on the already-existing 4G infrastructure. As a result, it can deliver the fast speeds and low latency that 5G networks have consistently promised. Clearly, standalone(SA) 5G is the way to go, so why do we not see effective implementation and marketing for it?

The numerous challenges businesses encounter while using SA are alluded to in the various telco comments about device availability, carrier aggregation, and infrastructure upgrades. The 5G New Radio system is connected to the current 4G core, the network’s command center, with older NSA. As its name suggests, SA sweeps this crutch aside and substitutes a new 5G core. But operators face several difficulties when they push it out, according to Brown. The first is the challenge of creating “cloud-native” systems, as they are known in the industry. Most operators now want to fully utilize containers, microservices, and other Internet-world technologies rather than simply virtualizing their networks. With these, networks risk being less efficient and easier to automate, and new services may take longer to launch. But the transition is proving to be challenging.

Overpromising, Yet to Deliver:

5G came out of the corner swinging. Huge promises were thrown around whenever the subject of 5g was discussed. It has been a while since 5G came to fruition, yet its market growth remain humble. Some might say that the bark was way more extensive than the bite. While some of these promises were delivered, they weren’t as grand as the ones yet to happen.

Speed was one of the main promises of 5G. And while some argue that this promise is fulfilled, others might say otherwise. Speeds are yet to reach speeds that can eclipse those of 4G. It is not only about speeds, though. It is about the availability of it. The high-speed services of 5G networks are only available in some places. Its been years and many regions are yet to receive proper 5G services. Simply put, a large portion of the dissatisfaction surrounding 5G can be attributed to the failure to fully deploy the infrastructure and the development of applications that fully utilize 5G.

5G of Tomorrow Struggles With Its Today:

5G is, without a doubt, the way to go for the future, but does its present state reflect that? Maybe. That is the issue. Years into its adoption, the answer should be decisive. Telcos might see potential in the maybes and work based on tomorrow’s potential. Consumers won’t be as patient. The consumers need the promised services now. You need to keep your customer base around with promises of the future. Especially when 4G LTE did the job well, really well.

Moreover, some areas in the US, not in struggling countries, have speeds slower than 4G LTE. Some 5G phones struggle to do the minimum tasks. Phones have to stick to specific chips capable of 5G support. But it is not about the small scale. Let’s think big, going back to the big promises 5G made. Smart cities, big-scale internet activities happening in real-time. IoT integration everywhere, controlling drones and robots from across the world. Automated cars as well, 5G was promised to deliver on all that, today and not tomorrow, but here we are.

Finally, the marketing was hit and miss, more miss, to be frank. Most consumers pay more to be 5G ready, while 5G still needs to be truly prepared. It’s hard to keep people interested when 4G is doing great. The only thing that the people needed was consistency, and sadly 5G is less consistent than some would hope.

Concluding Thoughts:

Lastly, innovation waits for none. This even includes 5G and 5G market growth. There are talks, even more than talks, about 6G. China is pushing for 6G supremacy, while Nokia and japan are starting the conversation about 7G. A major oversight that 5G missed was range. 5 G does great over small distances.

When the promises were massive in scale and global, you practically shot yourself in the foot. Time is running out for 5G, or is it pressuring 5G to live up to its potential?

……………………………………………………………………………………………………………………………………………………………………………

References:

https://insidetelecom.com/5g-market-growth/

https://www.itu.int/rec/R-REC-M.2150/en

https://www.itu.int/pub/R-REP-M.2410

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.1036-6-201910-I!!PDF-E.pdf

https://www.3gpp.org/specifications-technologies/releases/release-16

11 thoughts on “Another Opinion: 5G Fails to Deliver on Promises and Potential”

Comments are closed.

URLLC in the RAN is critically important for both mission critical (ultra high reliability) and real time control (ultra low latency) 5G applications which do not exist at this time. 3GPP Release 16 work item:

Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) needs to be completed with independent performance testing before it can be implemented.

Once that work item is 100% complete, I assume 3GPP will submit it (via ATIS) to ITU-R WP5D for the next version of ITU-R M.2150 (5G RIT/SRIT) recommendation.

For years, Alan J Weissberger has been nearly a single and consistent voice in the wilderness; speaking out against the fragmented, do-your-own, deployments of 5G. If you believe that interoperability, security (requires 5G SA core network), and inter-network roaming are minimum, baseline requirements for any standard cellular network, then you are compelled to conclude that the ITU, 3GPP and entire carrier community have failed all of us. 5G as deployed today is at best an incremental offering beyond 4G and it has only served the self-promotional interests of a select few.

If you’ve worked in this industry since the late 1980s’ era Analog/”1G” it’s impossible not to conclude that the inescapable truth is that odd Gs are primarily the transition between the industry-changing even Gs. 2G with low power handheld devices unleashed the explosion of the massive growth, 3G was an over-hyped but useful transition to mobile data. 4G/LTE w/OFDMA was the smartphone/mobile broadband breakthrough. 5G is a transition to 6G.

Thanks for your comment, but how can 5G be a transition to 6G when standardized/inter-operable 5G has not been completed yet and no one has defined the requirements for 6G?

Although I agree with the premise that 5G is overhyped and hasn’t lived up to its technical expectations, most average consumers probably don’t care. It is just another feature in a long list that are higher priority (e.g. camera resolution, size, ease of use). Since the majority of wireless data is carried via Wi-Fi, the speed is even less important (I couldn’t find current data, but the charts referenced in the 2016 Fierce Wireless article show how Wi-Fi dominates cellular as a mobile data carrier).

https://www.fiercewireless.com/wireless/how-much-cellular-and-wi-fi-data-are-smartphone-users-consuming-and-which-apps-verizon-at

I would argue that this isn’t the biggest tech trainwreck, as the investment in 5G hasn’t driven any of the major carriers or providers out of business.

LightReading’s Mike Dano seems to agree with me. “Operators’ 5G investments show no clear signs of paying off”

Over the past few years, big wireless network operators all over the globe have spent billions of dollars building speedy 5G networks. But so far most have little to show for their efforts. And some analysts are beginning to worry that things are just going to get worse.

“New 5G mobile services have failed to materialize,” wrote the financial analysts at LightShed Partners in a recent assessment of the US market.

Broadly, the LightShed analysts expect Verizon to generate 2.2% in wireless service revenue growth during 2022 – or less than half of what they expect from Verizon’s rivals AT&T and T-Mobile.

“In the absence of organic growth or a failing plan, CEOs often turn to inorganic solutions,” wrote the LightShed analysts. “It would need to be something transformational with sizable claimed synergy opportunities. We are not arguing that this is the best or right thing to do, but simply noting it’s the predictable next step.”

https://www.lightreading.com/5g/operators-5g-investments-show-no-clear-signs-of-paying-off/a/d-id/782309?

“In 2023 realisation will become widespread that there are no significant new revenue sources on the horizon. It will be widely accepted that 5G has failed to result in an uplift of ARPU and cellular IoT has been so disappointing that MNOs will exit that space, selling off or shutting down their IoT divisions.”

https://telecoms.com/519116/what-will-2023-hold-for-the-telecoms-industry/

Here is the latest status of URLLC in the RAN in the 3GPP Release 16 specification as of 6 January 2023:

Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) NR_L1enh_URLLC 1 Rel-16 R1 6/15/2018 12/22/2022 96% complete RP-19158

UE Conformance Test Aspects – Physical Layer Enhancements for NR URLLC NR_L1enh_URLLC-UEConTest 2 Rel-16 R5 12/14/2020 12/22/2022 90% complete RP-202566 RP-221485

In reply to Ken Pyle’s 12-12-2022 comment that most average consumers probably don’t care that 5G hasn’t lived up to expectation:

I just today spoke with a friend here in the Detroit, Michigan area. He told me that since they installed 5G in his neighborhood, his cellular phone service has been terrible. People speaking to him at different times during their conversations have a hard time hearing what he says.

In addition, there’s the concern about the harm 5G radiation can cause to people sensitive to it.

Does your friend have a 5G phone? Note that most cellular phone calls today use VoLTE (4G) and NOT 5G. Carriers still supporting 3G may use GSM or CDMA for cellular voice calls.

Huge capex outlays for 5G fail to drive revenues. By Matt Walker and Arun Menon

For the 3 months ended September 2022, total revenues for the telecommunications network operator (telco) sector declined 6.5% from 3Q21. This decline followed a similar 6.1% dip in 2Q22. These declines are largely due to weak service revenues. In 3Q22, for instance, service revenues dropped 7% YoY, while equipment revenues grew 2%. Services account for nearly 90% of revenues, so they tend to drive the average, but volatility in equipment revenues can be significant and impact the sector’s growth curve. With the rollout of 5G networks and availability of new devices, there has been a pickup in equipment revenues over the last 2 years. For the 3Q20 annualized period, equipment accounted for 9.4% of total revenues, but this has steadily grown since then, to 11.2% in 3Q22. Annualized equipment revenues for telcos were $204.6B in the 3Q22 annualized period, up 23% from 3Q20’s $166.7B. In the same timeframe, annualized services revenues grew less than 1%.

In general, telcos do not prioritize profitability when it comes to selling equipment. Their main priority is signing up and retaining subscription customers, who drive their service revenues. As such, big jumps in equipment revenues don’t necessarily help profits. They are nice, but don’t guarantee growth in related service revenues. It’s more important to focus on service revenues in assessing the health of the telco sector. That’s particularly important now, as telcos have spent heavily on their networks to deploy 5G. Telco capital intensity, or capex/revenues, reached an all-time high in 3Q22 of 17.9% (annualized), up from 16.8% in 3Q21. Telcos, and their investors, expect new revenue streams to result from these buildout costs. So far, 5G has not delivered.

https://www.mtn-c.com/product/huge-capex-outlays-for-5g-fail-to-drive-revenues/