NaaS emerges as challenger to legacy network models; likely to grow rapidly along with SD WAN market

Enterprises are starting to think “much more strategically” about how to support remote and hybrid workers, with as-a-service network models beginning to take over the market, IDC Analyst Brandon Butler told SDxCentral. Organizations are increasingly looking to extend enterprise-class networks to remote and hybrid workers, a concept IDC calls “the branch of one.” IDC reported that 69% of global respondents to a recent survey are planning to invest in network transformation over the next 12 months, highlighting network-as-a-service (NaaS) as a challenger to legacy network models that necessitate substantial upfront capital.

“I would say in the early days there were a lot of what I would call band-aid solutions in terms of, well, maybe I’m just going to spin up some more VPN capacity to be able to support my remote and hybrid workers,” Butler told SDxCentral. IDC conducted a web survey of technology-buying decision makers in 402 medium to large organizations (with 500+ employees), across 13 countries in North America, Europe, and Asia/Pacific, and in nine industries to understand the role of Network as a Service in their network strategy. Here is what they found:

As organizations leverage the value of their networks to jumpstart digital transformation, the Network as a Service market is expected to grow rapidly, at a similar rate as the SD WAN market, which is forecast at a 41% compound annual growth rate from 2019 to 2024.

- The most important Network as a Service capabilities are a hybrid network and SD WAN [1.].

- Real-time, high-bandwidth capabilities are needed for the future network.

- Many enterprises outsource network services, mainly ongoing managed network services, preventative management, and network design.

- Virtualizing, automating, and modernizing the network as well as dealing with security threats are top priorities in a pandemic and post-pandemic world. Specifically – adding virtualized network and security services as well as cloud security are top of the list of things to upgrade.The majority of enterprises plan a network transformation in the next two years. Skills shortages, stakeholder buy-in, and legacy infrastructure hold back progress. The cost of doing nothing can be significant.

Note 1. According to Reasarch@Markets, the global SD-WAN market is projected to grow from USD 3.4 billion in 2022 to USD 13.7 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 31.9% during the forecast period.

In 2022, companies like Verizon and Aruba worked to bolster their NaaS offerings. The global NaaS market generated $11.2 billion in revenues in 2021, and is estimated to reach $72.2 billion in revenue by 2031, according to a report from Allied Market Research.

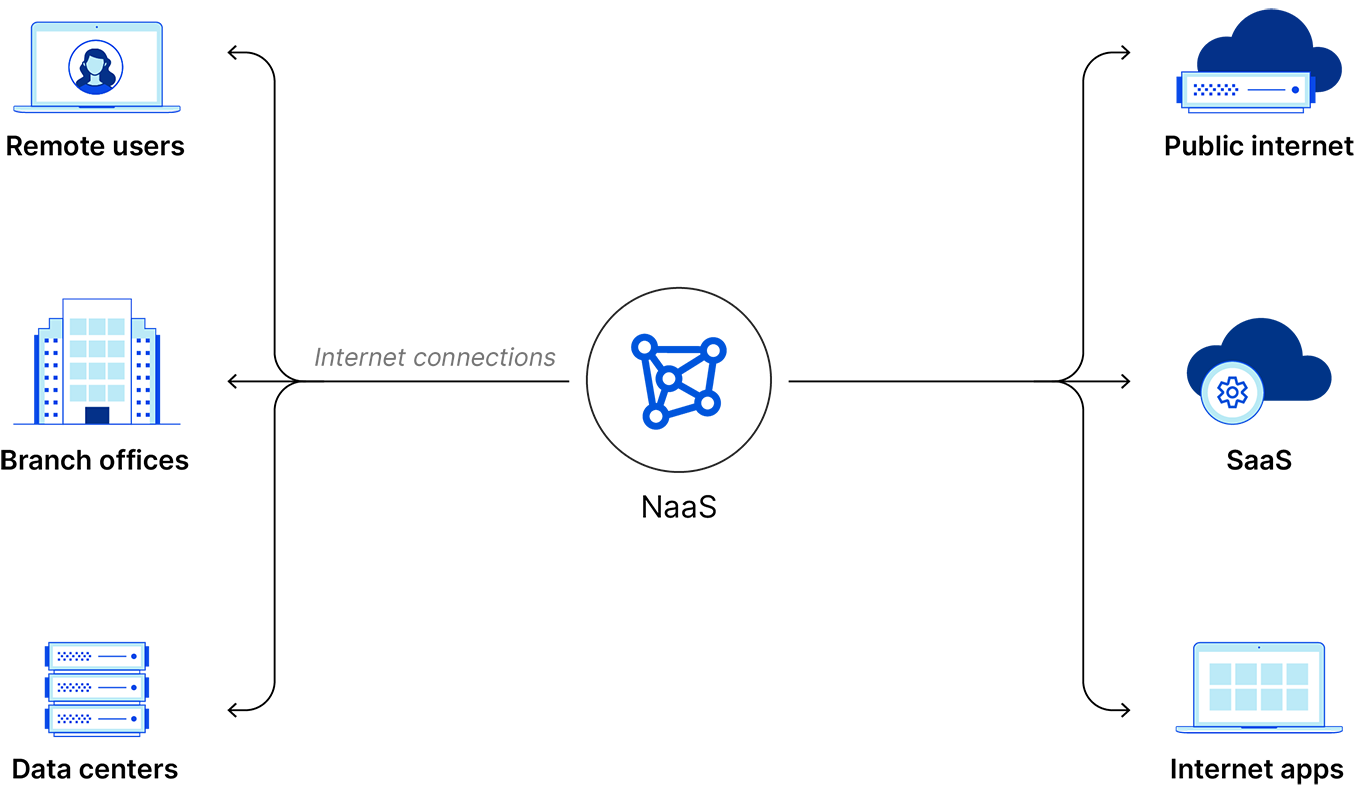

NaaS replaces legacy network architecture like hardware-based VPNs and MPLS connections or on-premises networking appliances like firewalls and load balancers. Enterprises use NaaS to operate and control a network without needing to purchase, own, or maintain network infrastructure.

Butler said these as-a-service models are “really helping organizations sort of transform how they’re thinking about their relationships with their vendors. Things like as-a-service models, they certainly take into account a sort of consumption model and having more subscriptions, and operating expenses versus capital expenses.”

NaaS models also bring in other benefits, like “being able to be faster or to be able to spin up services or spin down services, that sort of elasticity of them.”

The ability to add and remove features more dynamically, and manage networks from the cloud is another “tenant” that Butler said is key to as-a-service models.

“I always like to say that it’s it’s important to think about what the business needs from the IT department,” he added.

“That’s, I think, the best place to start in terms of what sort of business problems is your broader organization looking to solve and what goals does your organization have,” Butler said. “And then I think that can help determine what sort of technology solutions are the right fit to help meet those business goals.”

References:

https://www.sdxcentral.com/articles/interview/will-2023-be-the-year-of-naas/2023/01/

https://www.naasenterprisesurvey.com/#executive-summary

https://www.alliedmarketresearch.com/network-as-a-service-market

https://www.cloudflare.com/learning/network-layer/network-as-a-service-naas/

ABI Research: Network-as-a-Service market to be over $150 billion by 2030

3 thoughts on “NaaS emerges as challenger to legacy network models; likely to grow rapidly along with SD WAN market”

Comments are closed.

Is there any difference in functionality (not technology) between NaaS and 1970 -1980 era of time sharing network access, e.g. Tymnet, Tymshare, etc?

NaaS is more than timesharing which was not responsible for enterprise networks but was rather a wide area scheme to rent computers for as long as you needed them. That was a precursor to cloud computing.

NaaS outsources the entire premises access and WAN to a 3rd party managed service provider that configures/operates routers, selects protocols, WAN optimizers and other components, such as firewalls or software-defined-WAN endpoints. Those responsibilities are handled by a third-party provider and then made available to enterprise customers who pay only for the time they use the facilities.

The functionality of the infrastructure may be included in a single NaaS flat fee, or the business may individually subscribe to each service, which can include optimization, firewall — or other security — and SD-WAN, depending on the service provider. Some NaaS providers have specific focus areas, like ultra-secure connectivity, ultra-simple configuration, or providing services to mobile and temporary locations.

For more info see: https://www.techtarget.com/searchnetworking/definition/Network-as-a-Service-NaaS

NTT Data is teaming with Aviatrix, an intelligent cloud networking company to deploy the Aviatrix Cloud Networking Platform.

NTT Data Business Solutions leverages Aviatrix to deliver business-critical SAP application services for customers and to overcome networking, security, visibility and multicloud limitations of AWS, Azure and Google Cloud services.

“Migrating business-critical enterprise applications, such as SAP, to the cloud requires business-critical cloud infrastructure and expertise,” said Andrie Jumari, head of cloud infrastructure services Malaysia at NTT Data Business Solutions.

“Our service infrastructure operations teams will support multiple cloud providers in a consistent way, with advanced capabilities not available across cloud providers.

“Aviatrix allows us to deliver a cloud NaaS to support enterprise SAP deployments in a unique way, like increasing customer satisfaction and SAP application up-time.”

The cloud networking platform will offer providers both private and public advanced network, security and operational visibility to support business-critical applications.

“Multicloud networking is fundamental to enterprise cloud infrastructure today,” said Nauman Mustafa, vice president of business development and global service provider partners at Aviatrix.

“NTT DATA Business Solutions is a globally recognized solution provider, delivering proven solutions for business-critical enterprise SAP applications in the cloud. It has been a pleasure working with our partners at NTT DATA Business Solutions to architect, deploy, and operate their cloud NaaS infrastructure in support of their Intelligent Enterprise SAP services.”

https://www.capacitymedia.com/article/2b4udkxmu636wfeybnf9c/news/ntt-data-launches-cloud-platform-with-aviatrix