China Tower had ~2.1M telecom towers installed with 3.36M tower tenants at end of 2022

China Tower ended 2022 with 2.05 million telecom towers installed, representing a net increase of 17,000 sites from the end of 2021. The company installed approximately 745,000 5G base-stations during the year, with more than 96 percent of sites delivered through sharing existing network infrastructure. Through the end of 2022, China Tower reported that it has received cumulative orders of nearly 1.8 million new 5G cell sites. The total tower tenants rose by 102,000 in the year to 3.36 million, pushing the average number per tower from 1.62 as of the end of 2021 to 1.65 at end-2022.

China Tower primarily serves the country’s state-owned telecommunications service providers (TSP) – China Mobile, China Telecom, China Unicom, and China Broadnet. The four TSPs accounted for a total of nearly 3.4 million tower tenants, a 102,000 year-over-year increase. The TSP tenancy ratio increased from 1.60 to 1.65 over the same period last year, showing a continuous increase in the level of site colocation.

Operating revenue for 2022 reached $13.4 billion, up 6.5 percent YoY. Revenue from the TSP segment was $12.0 billion, up by 3.5 percent over the same period last year, and accounting for 90 percent of operating revenue. The TSP business comprises revenue from towers and indoor distributed antenna system (DAS) business. Towers contributed $11.3 billion, up nearly 2 percent, while DAS revenue was $845 million, a 34 percent YoY increase. Capital expenditures for new tower builds and site augmentation was $3.0 billion in 2022, up 5 percent over nearly $2.9 billion in 2021.

The company sees “5G + DAS” as its dual-growth engines, with DAS as the fastest growing segment. The DAS business focuses on providing 5G coverage under various scenarios in key sectors including education, cultural tourism, transportation, and healthcare, with an integrated approach to coordinating resources and demands.

At year-end 2022, China Tower’s DAS deployments covered buildings with a cumulative area of 7,390 million square meters, representing a 48 percent YoY increase. The company expanded DAS coverage to 10,429 kilometers in high-speed railway tunnels and to 9,611 kilometers in subways, coverage reaching a cumulative length of 20,040 kilometers, up 19 percent from a year ago.

China Tower has Commercial Pricing Agreements and Service Agreements with each of the TSPs. In a statement, the company reiterated its commitment to meeting its TSP customer network construction needs using innovative construction and service models that provide low-cost and efficient coverage.

Zhang Zhiyong, chairman of China Tower said: “Looking ahead, we will remain focused on grasping the opportunities brought by the development of 5G new infrastructure, the digital economy, and the green-oriented transition of energy. With a focus on “Digital Tower,” our Smart Tower business growth accelerated. Serving the national strategic goals.”

Tower business. China Tower advocated for the inclusion of 5G base-station sites in development planning and played an active role in setting the wireless communications specifications for buildings. Complying with these specifications, we have been included in the administrative approval process for new construction projects, further strengthening our ability to coordinate and share resources. We launched innovative low-cost construction solutions to sharpen our capability in providing integrated wireless communications coverage solutions. A higher level of resource sharing enabled us to comprehensively satisfy customer demand for 5G construction. We completed approximately 745,000 5G base-stations during the year, of which more than 96% were delivered through sharing existing resources. In addition, we focused our efforts on tackling difficult sites and continued to enhance our service quality. Alongside an improving capability in site maintenance, customer satisfaction grew. In 2022, our Tower business generated revenue of RMB77,204 million, or year-on-year growth of 1.8%. As of 31 December 2022, we managed 2.055 million tower sites, representing a net increase of 17,000 sites from the end of 2021. The number of TSP tenants reached 3.362 million, an increase of 102,000 from the end of 2021, and the TSP tenancy ratio also increased from 1.60 to 1.65 over the same period of last year, showing a continuous increase in the level of site co-location.

DAS business. China Tower focused on providing 5G coverage for key scenarios and key sectors including education, cultural tourism, transportation and healthcare, with an integrated approach to coordinating resources and demands. Playing an important role in coordinating site entry and construction, we were able to take up all DAS construction demand for key venues, scenarios and sectors, providing customers with differentiated and diversified indoor coverage solutions. In addition, we stepped up innovation to develop sharable DAS products and solutions. We enhanced our professional capabilities to optimize our advantages in providing low-cost and green and low-carbon DAS solutions, complemented by our quality services, driving accelerated growth in the DAS business. This business has increasingly become the second growth engine of our development. In 2022, our DAS business recorded revenue of RMB5,827 million, representing a year-on-year increase of 34.3%. As of 31 December 2022, we had covered buildings with a cumulative area of 7,390 million square meters, representing a year-on-year increase of 48.1%. Our high-speed railway tunnels and subway coverage reached a cumulative length of 20,040.2 kilometers, a year-on-year increase of 18.5%.

Grasping strategic opportunities to boost strong growth in Two Wings business:

By leveraging the opportunities brought forth by the growth of the “digital economy” and the “dual carbon” goals, we focused on product innovation and business optimization to fortify our competitive advantages. As a result, the Two Wings business sustained a robust growth trajectory with revenue in 2022 reaching RMB8,904 and accounting for 9.7% of our overall operating revenue, an increase of 2.6 percentage points from the same period in 2021. The business contributed 49.7% to our incremental operating revenue for the year, an increase of 9.7 percentage points year-on-year, further solidifying our multi-pillar business development structure.

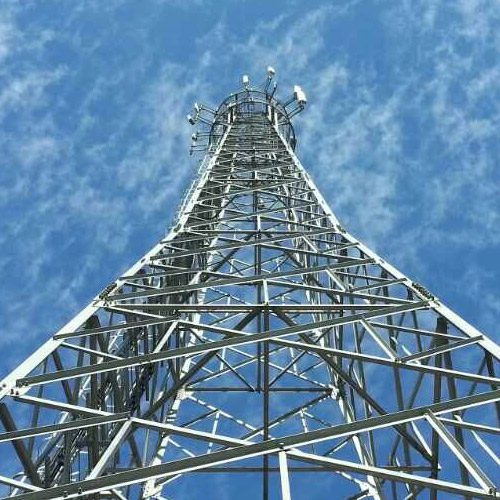

Image courtesy of China Tower

…………………………………………………………………………………………………………………………………………………………………………………………

China’s wireless network operators had deployed a total of 2.29 million 5G base stations nationwide as of the end of November, according to the latest available data from China’s Ministry of Industry and Information Technology. This figure represents an increase of 862,000 compared to the end of 2021 and accounts for 21.1% of all mobile base stations in the country.

Chinese operators recorded a net gain of 16.53 million 5G subscribers in January, according to the operators’ latest available statistics. China Mobile, the world’s largest operator in terms of subscribers, added a total of 8.46 million 5G subscribers during the first month of the year. The carrier said it ended last month with 622.47 million 5G subscribers. China Mobile added a total of 227.2 million subscribers in the 5G segment during 2022.

Meanwhile, China Telecom added 5 million 5G subscribers last month to take its total 5G subscribers base to 273 million. During 2022, the telco added a total of 80.16 million 5G subscribers.

Rival operator China Unicom said it added a total of 3.07 million 5G subscribers during last month. The carrier ended January with 215.8 million 5G subscribers. China Unicom added over 42 million subscribers in the 5G segment during 2022.

…………………………………………………………………………………………………………………………………………………………………………………………

References: