AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

The three most dominant broadband wireline ISPs in the U.S. all lost wireline subscribers in Q2-2023.

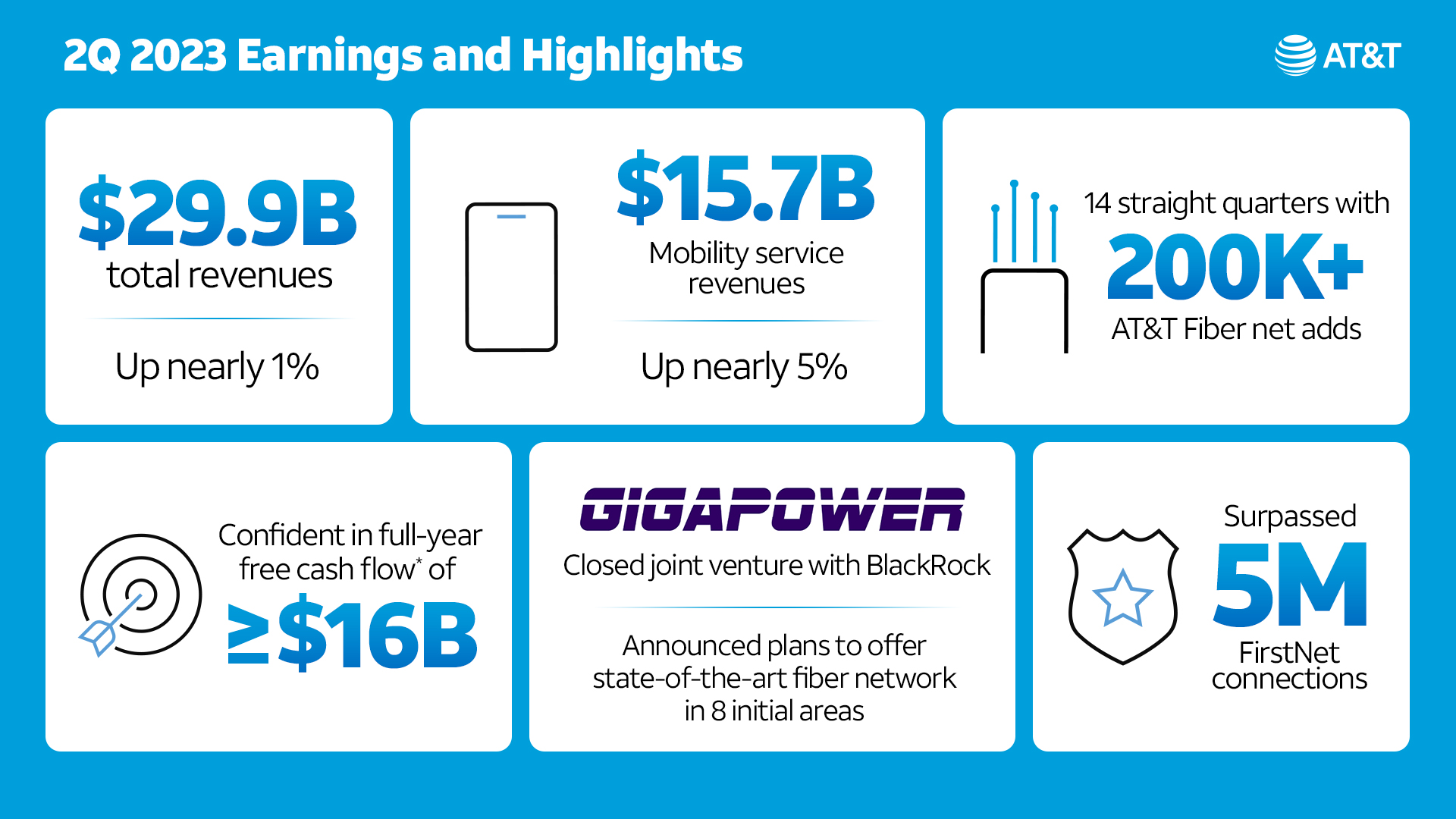

1. AT&T’s net total broadband access showed a loss of 35,000 subscribers in Q2-2023, which widened from a loss of -25,000 in the year-ago quarter. AT&T ended Q2 with 15.3 million broadband connections (including DSL), down 1.3% from 15.5 million a year earlier.

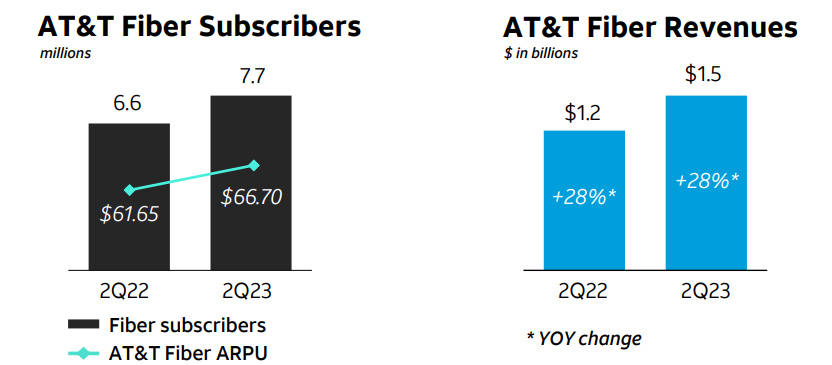

AT&T continued to add new fiber subscribers, but the pace of that growth slowed. AT&T added 251,000 fiber subs in Q2, down from +316,000 in the year-ago quarter and down from +272,000 in the prior quarter.

AT&T ended the period with 7.73 million fiber subs. Fiber average revenue per user (ARPU) was $62.26, up from $57.64 in the year-ago period.

(Source: AT&T Q2 2023 earnings presentation)

AT&T added about 500,000 fiber locations during the quarter, ending Q2 with 20.2 million. CEO Stankey said AT&T remains on track to build fiber-to-the-premises (FTTP) tech to 30 million locations by 2025.

AT&T’s average fiber penetration rate is hovering at 38%. “Everywhere we put fiber in the ground, we feel good about our ability to win with consumers,” Stankey said.

AT&T shed 286,000 non-fiber subscribers in the quarter, lowering that total to 5.95 million. AT&T also lost another 25,000 DSL subs in the quarter, ending the period with just 259,000.

Source: AT&T

…………………………………………………………………………………………………………………..

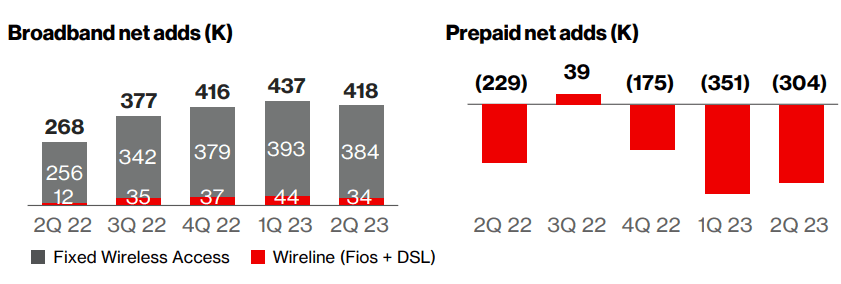

2. While Verizon added 54K FiOS internet subscribers in 2Q-2023 (51K FiOS net adds from Consumer, 3K from Business customers), it had a net loss of 304K wireline broadband subs when the loss of DSL subscribers was factored in.

From Verizon’s 2Q-2023 earnings call presentation:

Source: Verizon

Remarkably, Verizon added a net 384K fixed wireless subscribers, an increase from 256,000 fixed wireless net additions in second-quarter 2022. Verizon now has nearly 2.3 million subscribers on its fixed wireless service.

Due to FWA growth, Verizon reported total broadband net additions of 418,000 in 2Q-2023.

……………………………………………………………………………………………………………………………..

Comcast, the largest U.S. ISP, lost 20,000 residential broadband subscribers, lowering its total to 29.79 million. Comcast’s total broadband subscriber loss of 19,000 (including a gain of 1,000 business broadband customers), was better than the -74,000 expected by Wall Street analysts.

Comcast, which lost 10,000 residential broadband subs in the year-ago quarter, warned in April that it doesn’t expect to see much in the way of broadband subscriber growth gains in the near-term. The company also noted that it expected those numbers to be even lower in Q2 due to a slow housing move market paired with traditional “seasonality” driven by students and retirees returning for the summer.

Dave Watson, president and CEO of Comcast Cable, said on today’s earnings call that he expects Comcast to return to broadband subscriber growth “over time.” One way Comcast is pursuing subscriber growth is through network expansion and edge-outs that will total about 1 million locations in 2023. Comcast, which operates in 39 US states, also intends to participate in the Broadband Equity Access and Deployment (BEAD) program, which recently announced state-by-state funding allocations.

Comcast has cited average revenue per user (ARPU) growth as the key metric of its broadband business. And Comcast’s broadband ARPU grew 4.5% in the quarter, matching the ARPU growth rate it posted in the prior quarter.

……………………………………………………………………………………………………………………..

Here are the top 20 broadband wireline ISPs in the U.S.:

| # | Internet Service Provider | Type | States |

| 1 | Comcast | Cable | National |

| 2 | Charter Communications | Cable | National |

| 3 | AT&T | Fiber | National |

| 4 | Verizon | Fiber | Mid-Atlantic, Northeast |

| 5 | Cox Communications | Cable | National |

| 6 | Altice USA | Cable/Fiber | National |

| 7 | Lumen Technologies | Fiber | West, Florida |

| 8 | Frontier Communications | Fiber | National |

| 9 | Mediacom Communications | Cable | Midwest, Southeast |

| 10 | Astound Broadband | Cable/Fiber | National |

| 11 | Windstream Holdings | Fiber | South, Midwest, Northeast |

| 12 | Brightspeed | Fiber | Midwest, Southeast |

| 13 | Cable One | Cable | West, Midwest, South |

| 14 | Breezeline | Cable/Fiber | East Coast |

| 15 | WideOpenWest (WOW!) | Cable/Fiber | AL, FL, GA, MI, SC, TN |

| 16 | TDS Telecom | Cable/Fiber | National |

| 17 | Midco (Midcontinent Communications) | Cable | MN, ND, SD, WI, KS |

| 18 | Consolidated Communications | Fiber | National (22 states) |

| 19 | Google Fiber | Fiber | National (16 states) |

| 20 | Ziply Fiber | Fiber | WA, OR, ID, MT |

Source: https://dgtlinfra.com/top-internet-providers-us/

……………………………………………………………………………………………………………………………..

References:

https://about.att.com/story/2023/q2-earnings.html

One thought on “AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023”

Comments are closed.

It’s definitely a mature market. As alluded to by Comcast, it will be interesting to see how the housing market (especially new housing formation) impacts broadband growth in the next year or so.

It will also be interesting to see if AT&T and Verizon follow Comcast to the BEAD funding for growth opportunities outside their existing footprints.