Comcast

U.S. Home Internet prices DECLINE amidst fierce competition between wireless carriers and cablecos

Home internet prices in the U.S. are being driven down by fierce competition between mobile carriers offering Fixed Wireless Access (FWA) and cable internet companies offering legacy Hybrid Fiber Coax connections. The increased competition has driven down the cost of home internet service, a welcome break for consumers when prices are rising for many other essential products. The price of home internet service fell 3.1% in May from a year earlier, while the overall consumer-price index rose 2.4%, according to the Labor Department.

The WSJ reports that major home-internet service providers including Verizon VZ, Comcast/Xfinity and T-Mobile launched a flurry of price-lock guarantees, promising steady rates for as long as five years. CableCos Charter, which is acquiring Cox, unveiled a three-year deal last year.

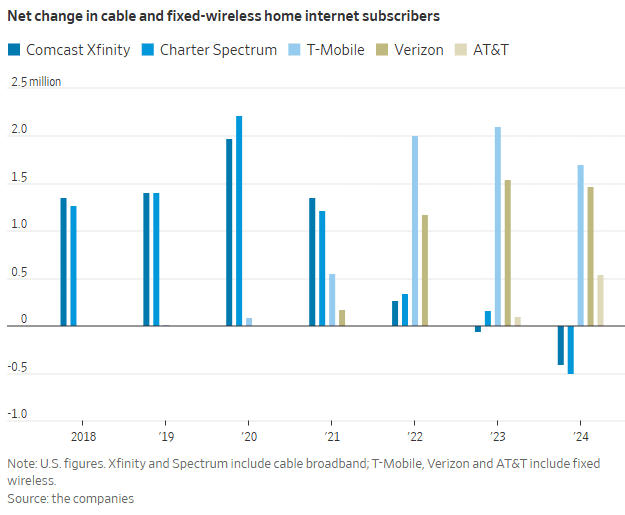

Cable companies have struggled to retain broadband internet subscribers since mobile carriers began offering more affordable 5G fixed-wireless access (FWA) internet service in 2018. FWA, which relies on over the air transmission to cell towers instead of HFC access, brought competition into markets where cable companies had long enjoyed being the only game in town. Now both types of providers are growing more aggressive to attract—and keep—customers.

“The cable companies went from gaining subscribers and raising rates every year to declining subscribers and giving people price locks,” said John Hodulik, a UBS analyst. “They’re seeing churn rise in their broadband subscriber base. And they’re trying to nip that in the bud.” Fixed wireless can sometimes cost half as much as a cable-provided internet plan. Though network congestion and other connectivity issues can be an issue for some users, the lower price point has been luring cable customers away.

T-Mobile, Verizon and AT&T added a combined 3.7 million FWA customers in 2024. In sharp contrast, Comcast’s Xfinity and Charter’s Spectrum lost more than 900,000 home internet subscribers. That’s depicted in this graph:

“Our pricing wasn’t breaking through in the marketplace,” said Steve Croney, chief operating officer for Comcast’s connectivity and platforms business. He said the company’s five-year price lock, introduced in April, competes well against the telecom companies’ offerings.

Frank Boulben, chief revenue officer at Verizon’s consumer group, said his company has been trying to address the “pain points” customers have with cable companies, such as price hikes. That’s why the telco is emphasizing FWA vs its FiOS fiber to the home based service. Boulben said his company would focus on selling fiber service to customers as it becomes available to them.

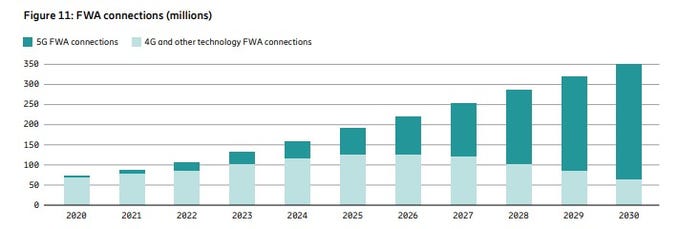

Is FWA the ONLY real killer application for 5G? Even though it was NOT one of the envisioned use cases? Ericsson’s recently released Mobility Report says FWA will account for more than 35% of all new fixed broadband connections, with an expected increase to 350 million by the end of 2030. The report states that more than half of all network service providers (wireless telcos) who offer FWA now do so with “speed-based monetization benefits enhanced by 5G.”

About 80% of the global network operators sampled by Ericsson currently offer FWA, with the most rapid area of growth among CSPs (communications service providers) offering 5G-enabled speed-based tariff plans. These opportunities are about the ability to offer a range of subscriber packages with different downlink and uplink data options with 5G FWA. As with fiber deals, “increasing monetization opportunities for CSPs compared to earlier generations of FWA.” 51% of operators with FWA offerings now include these speed-based options, which is up from 40% on the same period in June 2024 and represents a 27.5% increase. The June 2024 number had grown 50% on the June 2023 equivalent.

Source: Ericsson Mobility Report

…………………………………………………………………………………………………………………………………………………………………..

“We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation,” said Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer. “The recent advancements in 5G standalone (SA) networks, coupled with the progress in 5G-enabled devices, have led to an ecosystem poised to unlock transformative opportunities for connected creativity. Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”

Fixed-wireless doesn’t work everywhere. Besides congestion weak signals can make coverage spotty. If your cell phone doesn’t pick up 5G coverage smoothly, fixed-wireless from the same company probably won’t work either.

Verizon, AT&T and T-Mobile are winning converts to FWA at a faster pace than many anticipated, said Jonathan Chaplin, a managing partner at equity research firm New Street Research. Charter agreed to buy Cox last month for $21.9 billion in equity and assume $12 billion of its outstanding debt, in part to acquire scale to better compete with fixed wireless access. However, fixed-wireless growth can’t last indefinitely. The wireless networks on which they run will eventually hit capacity, limiting how many subscribers they can add. Chaplin estimates the networks can support around 19 million total fixed-wireless subscribers—which he predicts they will reach in about five years, accounting for planned network expansions that the companies have announced. When that limit is reached, cable companies may regain the upper hand and keep growing their fiber customer base, Chaplin said.

The big three wireless carriers (AT&T, Verizon and T-Mobile) have all been investing in fiber-based wired networks via build-outs and acquisitions. AT&T is bringing new customers in via FWA, with the long-term goal to convert them to fiber-based service, said Erin Scarborough, who runs that company’s broadband and connectivity initiatives.

References:

https://www.telecoms.com/5g-6g/ericsson-says-fwa-is-boosting-telco-monetization-opportunities

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.consumeraffairs.com/news/cable-vs-wireless-war-is-driving-prices-down-062525.html

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

Comcast faces competitive intensity; loses 120K broadband subs in 2Q-2024

Comcast today reported adjusted earnings of $1.21 a share for the quarter, beating Wall Street’s call for $1.12, according to FactSet. Revenue of $29.7 billion was slightly below consensus estimates of $30 billion. However, the company reported a loss of 120,000 total domestic broadband customers and 419,000 domestic video subscribers in the 2nd quarter.

“The competitive intensity that we’ve seen for the past several quarters, and which is particularly felt in the market for price-conscious consumers, remains essentially unchanged,” Comcast President Mike Cavanagh said on today’s earnings call.

“One of the most important metrics we monitor is the magnitude of data traffic flowing across our network. And again, we saw a double-digit year-over-year growth this quarter, with broadband-only households consuming over 700 gigabytes of data each month. And our customers continue to take faster speeds, with around 70% of our residential subscribers receiving speeds of 500 megabits per second or higher and one-third getting a gigabit or more. These positive consumer trends play to our strengths and will only accelerate with the shift of live sports to streaming, which together with entertainment on streaming accounts for nearly 70% of our network traffic today.My final thought on broadband is the importance of bundling with mobile, with 90% of Xfinity Mobile smartphone traffic traveling over our WiFi network. These two products work seamlessly together to benefit our customers from both the products’ experience and financial value standpoint.”

Seaport Research analyst David Joyce:

“Due to continued Broadband subscriber losses (where growth is driven by pricing), an elevated competitive environment for the time being, and the mixed Media topline and profitability trajectories, we remain Neutral,” Joyce wrote. Sentiment will improve when there are signs of stabilization in broadband market share, he added.

Comcast is moving ahead with HFC network upgrades, including “mid-splits” that dedicate more capacity to the upstream. Watson said mid-splits have been completed in about 42% of Comcast’s HFC footprint, a figure he expects to reach 50% by the end of the year. Comcast’s mid-splits are occurring alongside a plan to deploy DOCSIS 4.0 upgrades that are initially delivering symmetrical speeds of up to 2 Gbit/s. Comcast has D4.0-based services available in three markets – Philadelphia, Atlanta and Colorado Springs – with Seattle up next.

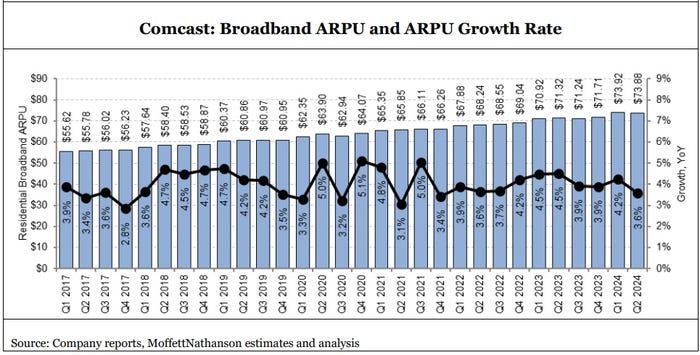

Broadband average revenue per unit (ARPU), which was up 3.6% in the quarter, remains a bright spot as customers continue to gravitate to higher speed tiers. Comcast CEO Brian Roberts: “Broadband ARPU increased by 3.6% and we delivered 6% revenue growth in our connectivity businesses, while expanding our Adjusted EBITDA margin across Connectivity & Platforms to a record-high 41.9%.”

“Faster homes passed growth shouldn’t be expected to turn broadband subscribership back into a growth engine, but it is a critical factor in keeping broadband subscriber results stable,” MoffettNathanson analyst Craig Moffett explained in a research note (payment required) issued today.

Comcast also expects to participate in the $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

Comcast’s pay-TV business continued its downward spiral. The company lost 419,000 video subs in Q2, an improvement from a year-ago loss of 543,000. Analysts were expecting Comcast to shed about 502,000 video subs in Q2.

The Peacock streaming service, which broadcasts live sporting events like the upcoming summer Olympics, reported paid subscribers soared 38% from a year ago to 33 million, while revenue rose 28% in the 2nd quarter to $1 billion.

2nd Quarter 2024 Highlights:

• Adjusted EPS Increased 7.0% to $1.21; Generated Free Cash Flow of $1.3 Billion, Including a Tax

Payment Related to the Previously Announced Hulu Transaction and Other Tax Related Matters

• Return of Capital to Shareholders Totaled $3.4 Billion Through a Combination of $1.2 Billion in

Dividend Payments and $2.2 Billion in Share Repurchases

• Connectivity & Platforms Adjusted EBITDA Increased 1.6% to $8.5 Billion and Adjusted EBITDA

Margin Increased 90 Basis Points to 41.9%, Its Highest on Record

• Continued the Successful Execution of Our Domestic Network Expansion and Upgrade Strategy;

Expanded Deployment of Mid-Split Technology to 42% of Our Footprint; And Added 302,000 New

Homes and Businesses Passed in the Second Quarter

• Domestic Broadband Average Rate Per Customer Increased 3.6%, Driving Domestic Broadband

Revenue Growth of 3.0% to $6.6 Billion.

• Domestic Wireless Customer Lines Increased 20% Compared to the Prior Year Period to 7.2 Million,

Including Net Additions of 322,000 in the Second Quarter.

• Business Services Connectivity Adjusted EBITDA Increased 4.4% to $1.4 Billion and Adjusted

EBITDA Margin Was 57.0%.

• Media Adjusted EBITDA Increased 9.0% to $1.4 Billion, Driven by Improved Performance at Peacock

• Peacock Paid Subscribers Increased 38.0% Compared to the Prior Year Period to 33 Million;

Peacock Revenue Increased 28% to $1.0 Billion; Best Year-Over-Year Improvement in Adjusted

EBITDA for Any Quarter Since Launch in 2020.

…………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/static-files/68abe434-80f7-437e-8e7a-fa457e43e63b

https://seekingalpha.com/article/4705822-comcast-corporation-cmcsa-q2-2024-earnings-call-transcript

Comcast frequent, intermittent internet outages + long outage in Santa Clara, CA with no auto-recovery!

For over one year now, many U.S. Comcast customers have experienced frequent, but short Xfinity internet and pay TV outages several times per week.

Here is what two customers wrote on the Xfinity Community Forum:

- Outages being reported CONSTANTLY: “I have intermittent outages several times a day for over a month. I work from home and this is inconvenient as I have been kicked out of important meetings and even streaming movies at night is a challenge with these frequent outages.”

For the last month, my Xfinity internet service has REPEATEDLY been dropping, and outages of over 100 people have been getting reported on Xfinity’s website.

It was every day for 10-14 days, then stopped for about a week, and now it’s back to every other day. I contact tech support, and they do the “reset your modem” dance, but inevitably reach the end of their binder of answers. I’ve had two techs out, one told me I needed a new modem, didn’t fix the problem.

But inevitably, a little while after I notice problems, I check Status Center and see there is an outage in my area due to “Network Damage”, affecting 100-500 people. It gets fixed…then in a day or two, it’s dropping me again,and another “Network Damage” outage affecting 100s of people.

Is there a local or regional rep I can speak to who can explain to me why this service I pay for is suddenly the victim of repeated outages every day/every other day due to “network damage”?? I haven’t had issues in years with service, and now I don’t know if this is a coordinated terrorist attacking on the network, the squirrels have declared war on the wires, or what is causing repeated failures. I had more than one person at Xfinity tell me that their techs are just unplugging people in the middle of the day to do network upgrades. My wife and I both use the Internet for work, we are losing money when this happens.

Can anyone recommend next steps for obtaining more information on why Comcast can’t go more than 48 hours without an area outage for the last month?

2. From a Seattle, WA Xfinity internet customer posted on Reddit:

“Looks like there’s a widespread Comcast internet outage. In the image below, Each of the dots represents 500-2000+ reports of internet problems. I know Comcast had some scheduled overnight maintenance to “upgrade the systems,” which has now been updated to “damaged network with no ETA for fixing.”

A much longer Xfinity outage report on Reddit:

“Service out for 36 hours, Xfinity keeps blaming power outage. The only support I can receive is Bots via the chat or a prompt goodbye when I call the phone support. What gives?”

……………………………………………………………………………………………………………..

And there are many, many more social media reports of Xfinity outages, which also takes down the company’s nearby WiFi hot spots, which could be a backup when you lose Xfinity wireline internet service.

………………………………………………………………………………………………………………..

Personal Experience:

On Friday, June 21st, most Xfinity customers in Santa Clara, CA (including this author) experienced a severe and long service outage, which (for me) lasted 17 hours, It was due to a fiber backbone cut by vandals. Here’s one of many text messages I received:

“Hi, it’s Xfinity Assistant. We’re aware you’re experiencing an interruption due to damage to our fiber lines in your area. We’re still working to get you back up and running. We apologize for the inconvenience.”

That outage was a killer for me, as I could not participate in two webinars that morning and had to cancel a 3pm Zoom call with my Doctor (for which I had to pay for since I cancelled <24 hours before the scheduled session). Obviously, my four smart Amazon/Google speakers didn’t work, nor did either of my two Amazon internet TVs. I had to use my cell phone to make voice calls as VoIP was also down.

For three weeks, I’ve been urgently trying to get an explanation from Comcast for why the Santa Clara outage lasted so long. In particular, why wasn’t there protection switching (1:1 or 1:n), self healing rings, router restoration via a standby fiber facility available for auto-switch over of the backbone traffic?

As that did not happen, the fiber cable had to be manually repaired, which took a very long time. Despite endless voicemail tag, I never received an answer to that question.

The only written response was the following:

“As I think you know now, that outage was caused by vandalism to our network. Vandals inflicted severe, significant damage to our system that required extensive, complex and time consuming repairs to our fiber. On behalf of our entire team I want you to know how sorry we are that this caused your services to be down for a lengthy duration.”

Here is what the Fiber Optic Association recommends:

In the case of fiber optic network restoration, nothing is more important than having complete, up-to-date documentation on the network. If possible, design a network with backup options. Many users run dual links, one transmitting data and one “hot back-up” ready to switch over in milliseconds. Electronics must be installed with duplicate links and all power must be backed up with batteries, generators or fuel cells.

Critical systems should add in geographic diversity; two links available running paths that are as widely separated as possible to ensure that if one suffers a failure due to damage to the fiber optic cable plant itself, the other can be switched in immediately. Rings provide a logical way to have route diversity, but simply being able to patch fibers manually to switch over to another fiber/cable is still quicker than repair. Even with backup, a failure requires immediate restoration, as one should never depend on a single link any longer than necessary.

All cables should have spare fibers, especially since fiber is extremely inexpensive compared to installation or restoration costs. Fibers tend to get broken at the ends where terminated or inside splice closures during splicing or re-entry. Having spare fibers makes it easy to simply switch fibers to restore operation. Whenever possible, store extra cable in service loops that can be pulled together for splicing. This can save immense amounts of restoration time for cables installed indoors or pulled in conduit outdoors.

OSP underground cables should be buried sufficiently deep (~1m/3 feet) that it is protected from casual digging and marker tapes that show up on cable locators buried above them. (See OSP Underground Construction in the FOA Guide) Bright colored conduits also help visibility. Cables should be listed in the “Dial 811, Call Before You Dig” database and markers installed where possible.

………………………………………………………………………………………………….

This post will be updated if and when I get an answer from Comcast as to why it took so long to restore service after the fiber cut.

References:

https://www.thefoa.org/tech/ref/restoration/rest.html

https://en.wikipedia.org/wiki/Self-healing_ring

https://www.advsyscon.com/blog/self-healing-it-operations/

Comcast’s DOCSIS 4.0 Deployment: Multi-Gig Symmetrical Speeds to be offered across the U.S.

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References:

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Comcast’s DOCSIS 4.0 Deployment: Multi-Gig Symmetrical Speeds to be offered across the U.S.

Next week, Comcast will begin to deploy DOCSIS 4.0 technology (described below) which can deliver multi-gigabit symmetrical speeds to customers over the connections that already exist in tens of millions of homes in Comcast markets across the country. Xfinity customers in Colorado Springs will be able to sign up online for the new DOCSIS 4.0-powered Internet plans next week.

As a part of the launch, Comcast will introduce a new portfolio of symmetrical products for residential customers. Comcast will begin rolling out DOCSIS 4.0 to select neighborhoods in Colorado Springs, CO, and will launch new markets throughout the country over the next few years. Select areas of Atlanta, GA and Philadelphia, PA are expected to begin rolling out before the end of this year.

“The ubiquity of our network, which is already accessible to tens of millions of homes, provides us with an incredible opportunity to bring multi-gigabit upload and download speeds to communities across the country with the scale and efficiency that no other provider can replicate,” said Dave Watson, President & CEO, Comcast Cable. “Our connectivity experience, powered by the Xfinity 10G Network, will allow us to deliver speeds up to 10 Gbps over our traditional network to virtually all our customers, plus even better reliability, lower latency, and the best in-home WiFi coverage.”

“We’re entering the next phase of this industry leadership with DOCSIS 4.0 technology to introduce X-Class Internet products that will revolutionize the way our customers get online today and many years into the future,” Watson added.

Symmetrical 10 Gbps service based on fiber-to-the-home (FTTH) technology is already available in all of Comcast’s markets, and as part of its continued network evolution and the introduction of DOCSIS 4.0, multi-gig symmetrical speeds are rolling out.

New and existing residential customers connected via DOCSIS 4.0 will have access to Comcast’s newly introduced next-generation X-Class Internet portfolio. X-Class speed tiers include X-300 Mbps, X-500 Mbps, X-1 Gbps and X-2 Gbps upload and download speeds and low lag for the ultimate live sports streaming experience on Peacock, smooth connections on work calls, and ultra-responsive gaming.

The DOCSIS 4.0 launch is the latest in a long line of world firsts that Comcast has spearheaded in the effort to implement DOCSIS 4.0. In April 2021, Comcast conducted the first-ever live test of full duplex DOCSIS and later that year tested the world’s first 10G connection all the way from the network to a modem. In 2022, Comcast conducted a world-first live trial and connected a business location in the Philadelphia region to its live network including a DOCSIS 4.0-enabled 10G node and multiple cable modems. In February 2023, the company marked another major milestone in the nation’s largest and fastest multi-gig deployment by announcing its latest Xfinity 10G Network upgrade launched to 10 million homes and businesses.

In addition to Comcast’s efforts to deploy DOCSIS 4.0 and other 10G upgrades across its footprint, the company continually invests in delivering a superior connectivity experience that is not only fast but is also reliable with less lag.

- Award Winning Tech – Comcast has lead the industry in deploying technologies within its network to enhance speed, reliability and latency like distributed access architecture (DAA) and a vCMTS, which earned an Emmy® Award for Technology and Engineering.

- Smart Network – Comcast-developed technology like Comcast Octave and Xfinity Fiber Meter (XMF), enables optimized network performance by proactively identifying and even repairing network impairments that impact customers’ services.

- Storm-Ready WiFi – In August 2023, Comcast introduced Storm-Ready WiFi, the first product of its kind offered by an Internet provider designed to maintain a connection during a power or local outage.

- Low Latency – Deployed Active Queue Management (AQM) system nationally and currently trialing the latest CableLabs low latency DOCSIS (LLD) specification.

DOCSIS Technology

Data Over Cable Service Interface Specification (DOCSIS) was first introduced in 1997 as a solution for high-speed data to be transmitted over existing cable wires, replacing dial-up phone lines for an Internet connection. Comcast has been a leader in deploying DOCSIS updates to deliver faster speeds to all the homes and businesses in its service areas. In early 2016, Comcast was the first to introduce DOCSIS 3.1-powered Gigabit Internet service and rapidly expanded Gigabit speeds across the country to more locations than any other provider.

References:

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Comcast launches symmetrical 10-Gigabit speeds over Ethernet FTTP

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Comcast to roll out DOCSIS 4.0 and Multi-Gig speeds in 2023; Fiber (not FWA) is the real competitor

AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

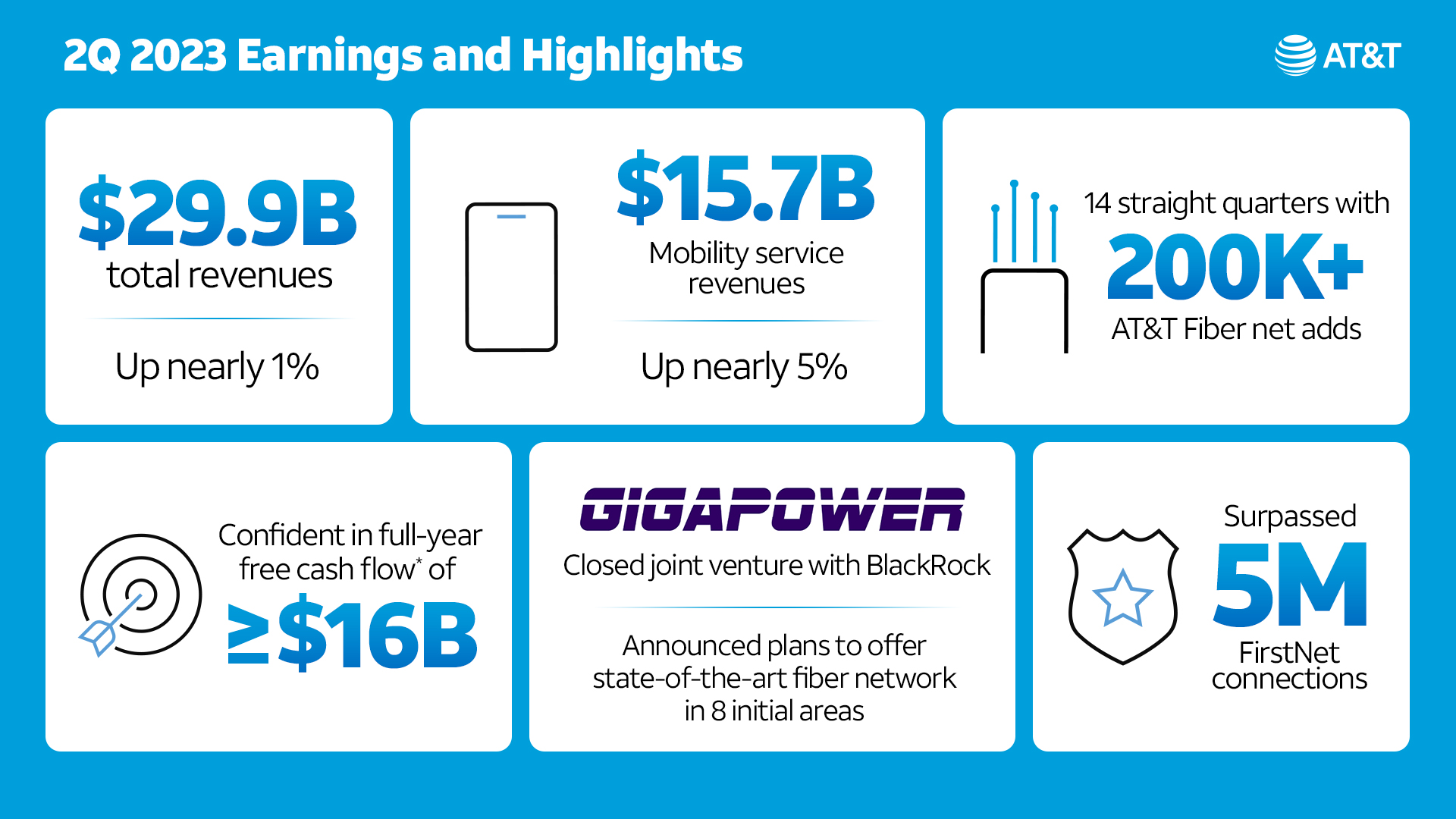

The three most dominant broadband wireline ISPs in the U.S. all lost wireline subscribers in Q2-2023.

1. AT&T’s net total broadband access showed a loss of 35,000 subscribers in Q2-2023, which widened from a loss of -25,000 in the year-ago quarter. AT&T ended Q2 with 15.3 million broadband connections (including DSL), down 1.3% from 15.5 million a year earlier.

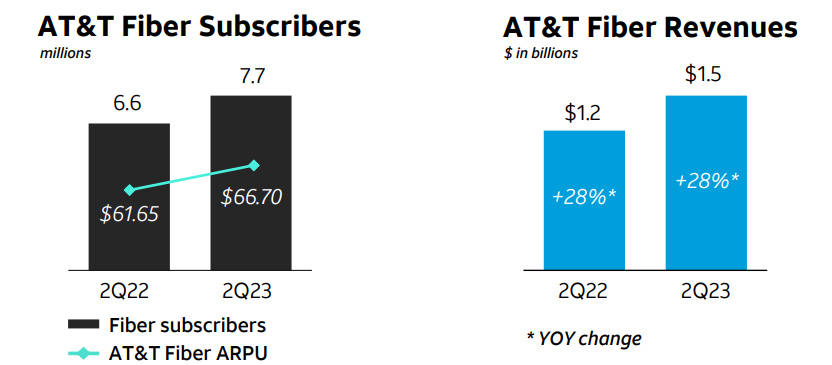

AT&T continued to add new fiber subscribers, but the pace of that growth slowed. AT&T added 251,000 fiber subs in Q2, down from +316,000 in the year-ago quarter and down from +272,000 in the prior quarter.

AT&T ended the period with 7.73 million fiber subs. Fiber average revenue per user (ARPU) was $62.26, up from $57.64 in the year-ago period.

(Source: AT&T Q2 2023 earnings presentation)

AT&T added about 500,000 fiber locations during the quarter, ending Q2 with 20.2 million. CEO Stankey said AT&T remains on track to build fiber-to-the-premises (FTTP) tech to 30 million locations by 2025.

AT&T’s average fiber penetration rate is hovering at 38%. “Everywhere we put fiber in the ground, we feel good about our ability to win with consumers,” Stankey said.

AT&T shed 286,000 non-fiber subscribers in the quarter, lowering that total to 5.95 million. AT&T also lost another 25,000 DSL subs in the quarter, ending the period with just 259,000.

Source: AT&T

…………………………………………………………………………………………………………………..

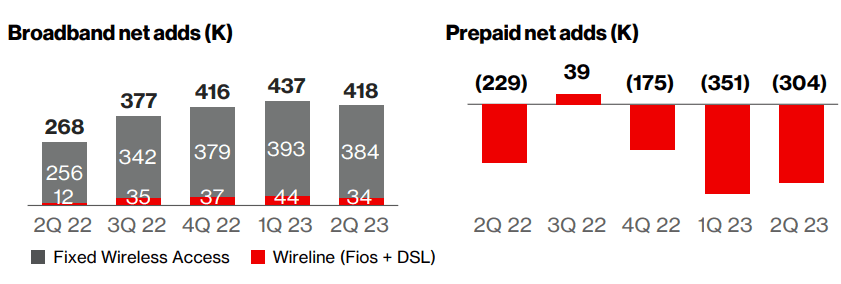

2. While Verizon added 54K FiOS internet subscribers in 2Q-2023 (51K FiOS net adds from Consumer, 3K from Business customers), it had a net loss of 304K wireline broadband subs when the loss of DSL subscribers was factored in.

From Verizon’s 2Q-2023 earnings call presentation:

Source: Verizon

Remarkably, Verizon added a net 384K fixed wireless subscribers, an increase from 256,000 fixed wireless net additions in second-quarter 2022. Verizon now has nearly 2.3 million subscribers on its fixed wireless service.

Due to FWA growth, Verizon reported total broadband net additions of 418,000 in 2Q-2023.

……………………………………………………………………………………………………………………………..

Comcast, the largest U.S. ISP, lost 20,000 residential broadband subscribers, lowering its total to 29.79 million. Comcast’s total broadband subscriber loss of 19,000 (including a gain of 1,000 business broadband customers), was better than the -74,000 expected by Wall Street analysts.

Comcast, which lost 10,000 residential broadband subs in the year-ago quarter, warned in April that it doesn’t expect to see much in the way of broadband subscriber growth gains in the near-term. The company also noted that it expected those numbers to be even lower in Q2 due to a slow housing move market paired with traditional “seasonality” driven by students and retirees returning for the summer.

Dave Watson, president and CEO of Comcast Cable, said on today’s earnings call that he expects Comcast to return to broadband subscriber growth “over time.” One way Comcast is pursuing subscriber growth is through network expansion and edge-outs that will total about 1 million locations in 2023. Comcast, which operates in 39 US states, also intends to participate in the Broadband Equity Access and Deployment (BEAD) program, which recently announced state-by-state funding allocations.

Comcast has cited average revenue per user (ARPU) growth as the key metric of its broadband business. And Comcast’s broadband ARPU grew 4.5% in the quarter, matching the ARPU growth rate it posted in the prior quarter.

……………………………………………………………………………………………………………………..

Here are the top 20 broadband wireline ISPs in the U.S.:

| # | Internet Service Provider | Type | States |

| 1 | Comcast | Cable | National |

| 2 | Charter Communications | Cable | National |

| 3 | AT&T | Fiber | National |

| 4 | Verizon | Fiber | Mid-Atlantic, Northeast |

| 5 | Cox Communications | Cable | National |

| 6 | Altice USA | Cable/Fiber | National |

| 7 | Lumen Technologies | Fiber | West, Florida |

| 8 | Frontier Communications | Fiber | National |

| 9 | Mediacom Communications | Cable | Midwest, Southeast |

| 10 | Astound Broadband | Cable/Fiber | National |

| 11 | Windstream Holdings | Fiber | South, Midwest, Northeast |

| 12 | Brightspeed | Fiber | Midwest, Southeast |

| 13 | Cable One | Cable | West, Midwest, South |

| 14 | Breezeline | Cable/Fiber | East Coast |

| 15 | WideOpenWest (WOW!) | Cable/Fiber | AL, FL, GA, MI, SC, TN |

| 16 | TDS Telecom | Cable/Fiber | National |

| 17 | Midco (Midcontinent Communications) | Cable | MN, ND, SD, WI, KS |

| 18 | Consolidated Communications | Fiber | National (22 states) |

| 19 | Google Fiber | Fiber | National (16 states) |

| 20 | Ziply Fiber | Fiber | WA, OR, ID, MT |

Source: https://dgtlinfra.com/top-internet-providers-us/

……………………………………………………………………………………………………………………………..

References:

https://about.att.com/story/2023/q2-earnings.html

Comcast launches symmetrical 10-Gigabit speeds over Ethernet FTTP

Comcast has announced a new symmetrical 10-Gigabit service tier for its Gigabit Pro fiber customers and reiterated a plan to bring multi-gigabit options to millions of cable internet customers. The move comes as Comcast prepares to launch DOCSIS 4.0 capabilities for cable customers by the end of the year.

Launched as a 2-Gig residential broadband service back in 2015, Gigabit Pro has been upgraded in recent years. Before heading to 10-Gig, the service delivered symmetrical speeds of 6 Gbit/s. Billed as a premium offering, Gigabit Pro runs $299 per month, plus installation costs. Comcast has not announced how many of its 32.32 million broadband subscribers have opted for Gigabit Pro.

Comcast began field testing 10-Gig capabilities for customers shortly thereafter, with some users stating on Reddit in October 2022 that they were starting to see these speeds.

According to the latest data from the Federal Communications Commission (FCC), Comcast today primarily offers fiber to the premises in the areas around Chicago, Detroit, Indianapolis, Nashville, Knoxville, Atlanta, Jacksonville, Miami and West Palm Beach.

Comcast Cable EVP and Chief Network Officer Elad Nafshi told Fierce that the product is technically available nationwide, not just in areas where it has fiber. If a cable customer decides they want 10G, Comcast will come in and upgrade their drop from coaxial cable to fiber, he said. The “highly-targeted” Gigabit Pro service continues to be delivered on an Ethernet-based FTTP platform.

Nafshi told Fierce in February that the operator isn’t planning to overlay its cable network with fiber anytime soon. However, he noted the distributed access architecture it is adopting ahead of its DOCSIS 4.0 rollout is opening the door for more fiber deployments.

Comcast said it is still planning to make multi-gig speeds available to more than 50 million locations by the end of 2025 and expects to begin rolling out DOCSIS 4.0 before the end of this year.

Nafshi told Fierce it is “heads down hardening and operationalizing products to meet the target deadline” for DOCSIS 4.0 and said the launch will by its nature include the introduction of a new speed tier.

“DOCSIS 4.0 will enable us to launch greater speeds and more speed symmetry when we launch, which by definition means it’s going to be a new tier service because we don’t currently offer those symmetrical tiers,” he concluded. “A lot more to come.”

References:

https://www.fiercetelecom.com/broadband/comcast-debuts-symmetrical-10-gig-fiber-broadband-tier

https://www.xfinity.com/support/articles/requirements-to-run-xfinity-internet-speeds-over-1-gbps

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Ethernet Alliance multi-vendor interoperability demo (10GbE to 800GbE) at OFC 2023

Comcast Business expands SD-WAN portfolio for SMBs and single location customers

Comcast Business is expanding its SD-WAN portfolio to give more options to SMB customers. The MSO/ cableco on Friday announced two new solutions geared toward standalone business locations. Comcast says the new solutions cater to partners who need to connect to cloud and Software-as-a-Service (SaaS) applications.

The SD-WAN solutions enable small and medium businesses, with either a single location or multiple standalone locations, to help securely connect and manage their network, applications, and users. These businesses rely on SaaS applications and cloud services to operate, making secure networking a critical requirement. Comcast Business’ full range of global secure networking solutions provide connectivity, security, application optimization and control, as well as threat monitoring and response for single and multi-site customers.

![]()

In today’s digital economy, companies of all sizes need to provide their users fast, reliable, and secure connectivity to applications everywhere. This includes delivering high-quality, consistent, and predictable quality of experience for critical applications residing in the Cloud or SaaS and accessed via the public Internet. With the addition of these tailored SD-WAN solutions, Comcast Business can bring the benefits of secure networking to standalone and multi-site businesses around the world.

“Comcast Business’ global SD-WAN solutions are a central component of our secure network solutions strategy,” said Shena Seneca Tharnish, Vice President, Cybersecurity Products, Comcast Business. “With the addition of capabilities that support standalone sites, we are more prepared than ever to partner with businesses of all sizes to tailor solutions that meet their unique needs. At Comcast Business, we’re committed to preparing every business for what’s next.”

The enhancements to Comcast Business’ SD-WAN solutions enable secure networking and application optimization for single or multi-site businesses who need to connect to the Cloud or SaaS applications but may not require site-to-site networking. These solutions provide businesses with resiliency and visibility, as well as intelligent application prioritization and traffic steering, with advanced managed service. Key features include:

- Diverse connectivity, intelligent traffic steering, and direct connections to Cloud services enhance application performance and resiliency

- Advanced security capabilities to help protect against cyberthreats

- 24×7 Security Operations Center (SOC)

- Low-touch deployment capabilities provide easy installation

- Highly competitive pricing

These solutions are ideal for companies that lack IT budgets or a corporate network but need to support single locations with cloud connectivity using public Internet services.

Comcast Business was recognized as a leader by market research firm Frost & Sullivan in its 2022 Managed SD-WAN Services in North America report [1.]. At the time, Comcast was touted as the second-largest provider of SD-WAN connections in North America. Frost & Sullivan noted that the provider is “especially successful among enterprise customers with 250 or more sites.” The market research firm also gave a nod to Comcast’s strategic acquisition of SD-WAN leader Masergy and “the resultant portfolio enhancements and expanded partner ecosystem for SD-WAN and cloud solutions it has enabled.”

Note 1. Frost & Sullivan assessed 12 leading network and managed service providers in the North American market, analyzing their SD-WAN portfolios based on factors including partnerships with SD-WAN equipment vendors, breadth of underlay network technologies, self-service customer portals, and ability to offer value-added virtualized network functions (e.g., firewalls and routers) and other security solutions such as SASE.

…………………………………………………………………………………………………………………………………………………………………..

Previously, Aryaka announced enhanced SD-WAN and SASE products specifically designed to meet the needs of SMEs with a new entry pricing of under $150 per site. Aryaka Chief Product Officer Renuka Nadkarni told SDxCentral that ease of management is another key concern for many small businesses, which is why so many prefer managed services. Dell’Oro Group predicted the untapped networking and security SMB market will grow significantly this year on the backs of providers who can offer managed services.

…………………………………………………………………………………………………………………………………………………………………..

About Comcast Business:

Comcast Business offers a suite of Connectivity, Communications, Networking, Cybersecurity, Wireless, and Managed Solutions to help organizations of different sizes prepare for what’s next. Powered by the nation’s largest Gig-speed broadband network, and backed by 24/7 customer support, Comcast Business is the nation’s largest cable provider to small and mid-size businesses and one of the leading service providers to the Enterprise market. Comcast Business has been consistently recognized by industry analysts and associations as a leader and innovator, and one of the fastest growing providers of Ethernet services.

References:

To learn more about Comcast Business SD-WAN solutions: https://business.comcast.com/enterprise/products-services/sd-wan-solutions/sd-wan

https://www.sdxcentral.com/articles/news/comcast-tailors-sd-wan-portfolio-to-smbs/2023/03/

https://store.frost.com/frost-radartm-managed-sd-wan-services-in-north-america-2022.html

Gartner: changes in WAN requirements, SD-WAN/SASE assumptions and magic quadrant for network services

Arista’s WAN Routing System targets routing use cases such as SD-WANs

Have we come full circle – from SD-WAN to SASE to SSE? MEF’s SD-WAN and SASE standards

Enterprises Deploy SD-WAN but Integrated Security (SASE) Needed

Comcast selects Nokia’s 5G SA Core software to support its mobile connectivity efforts

Today, Comcast announced it will roll out Nokia’s 5G Stand Alone Core networking software to support its deployment of CBRS and 600MHz spectrum to Xfinity Mobile and Comcast Business Mobile customers in its service areas across the United States.

Comcast will deploy that spectrum in select, high-traffic areas in support of both residential and business customers that take mobile services from the operator. Deploying fresh spectrum in those areas will give Comcast a greater degree of ownership economics with wireless and help to offset a portion of the MVNO costs associated with its pact with Verizon. Those deployments will also build on Comcast’s current Wi-Fi offload strategy that involves millions of access points deployed in customer homes and in certain metro areas.

Nokia will supply Comcast with its 5G Stand Alone Core networking software, including Packet Core, delivering near zero touch automation and ultra low latency capabilities, as well as operations software and consulting services. These offerings will support Comcast’s efforts to deliver enhanced 5G access to consumer and business customers in the U.S. using Citizens Broadband Radio Service (CBRS) and 600 MHz spectrum.

By combining Nokia’s software with Comcast’s targeted, capital-light network design, Comcast can cost-effectively deliver enhanced 5G and WiFi mobile connectivity to its more than five million Xfinity Mobile and Comcast Business Mobile customers. Comcast and Nokia are currently conducting field trials, which includes Comcast employee testing.

As the demand for reliable Internet access inside and outside of the home and office rapidly increases, Comcast’s mid-band (CBRS) and low-band (600MHz) spectrum enable the company to supplement its existing Xfinity WiFi network and cellular network partnership with additional targeted 5G coverage in certain high-traffic areas within its service territory.

Xfinity Mobile and Comcast Business Mobile services are built for the way people use mobile today, with the Internet at the core of the experience. Calls and texts are free, and customers can experience the freedom of paying by the gig or unlimited, and switch between payment options at any time for any line on their account. For complete pricing and availability details, please visit Xfinity Mobile or Comcast Business Mobile.

Nokia claims to be leading the 5G Standalone Core market, with over 80 communication service provider (CSP) customers around the world. In addition, 25 of the top 40 CSPs by revenue rely on Nokia Core network products.

Comcast and Nokia are currently conducting field trials, including tests with Comcast employees. Comcast didn’t reveal the location of its test markets, but the announcement indicates the operator is finally starting to gear up this important piece of its wireless strategy.

This deal comes more than two years after the company bid for and won licensed CBRS spectrum. Comcast also spent $1.7 billion on 600MHz spectrum licenses in 2017.

Though Comcast has no plans to deploy a national wireless network, it estimates that its current spectrum holdings cover roughly 80% of its homes passed and about 50% of the US population.

Tom Nagel, SVP, Wireless Strategy at Comcast, said: ”We are pleased to be working with Nokia to enable Comcast’s advanced 5G mobile products and services for our customers. Combining Nokia’s industry-leading solutions with Comcast’s targeted network design and new dual SIM technology allows us to create exciting next-generation wireless offerings.”

Fran Heeran, SVP & General Manager of Core Networks, Cloud and Network Services, at Nokia, said: “We are delighted to partner with Comcast and provide Nokia’s advanced 5G Core portfolio to deliver innovative 5G customer offerings securely, at scale, and with advanced operational efficiencies.”

………………………………………………………………………………………………………………………………….

Last fall, Comcast announced it would use Samsung radios, including strand-mounted small cells, for its targeted 5G network. Comcast will deploy separate Samsung radios for the CBRS and 600MHz bands and use its wireline network to help backhaul traffic.

At the time, Comcast confirmed to Light Reading that its wireless network deployment is “using a multi-vendor solution but not within an open RAN framework.”

Comcast’s wireless network evolution is underway as the operator continues to grow a mobile business that launched almost six years ago. Comcast added a record 365,000 mobile lines in Q4 2022, raising its total to 5.31 million.

Meanwhile, Comcast recently introduced a limited-time service convergence bundle for new customers that offers one unlimited mobile line and a 200Mbit/s home broadband service (with the Wi-Fi gateway included) for $50 per month – for a period of 24 months.

……………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g-and-beyond/comcast-shares-wireless-wealth-with-nokia/d/d-id/783415

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

https://www.nokia.com/networks/core/5g-core/

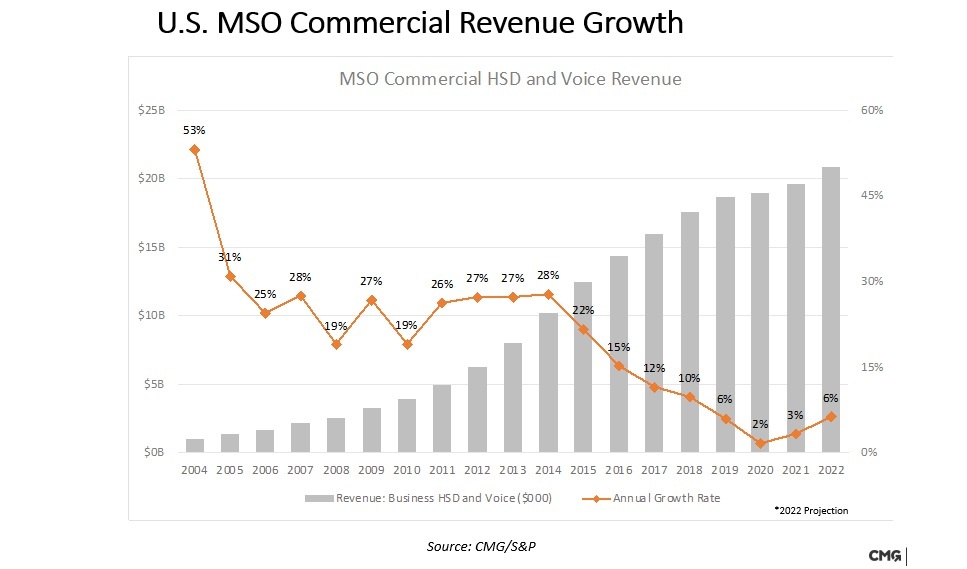

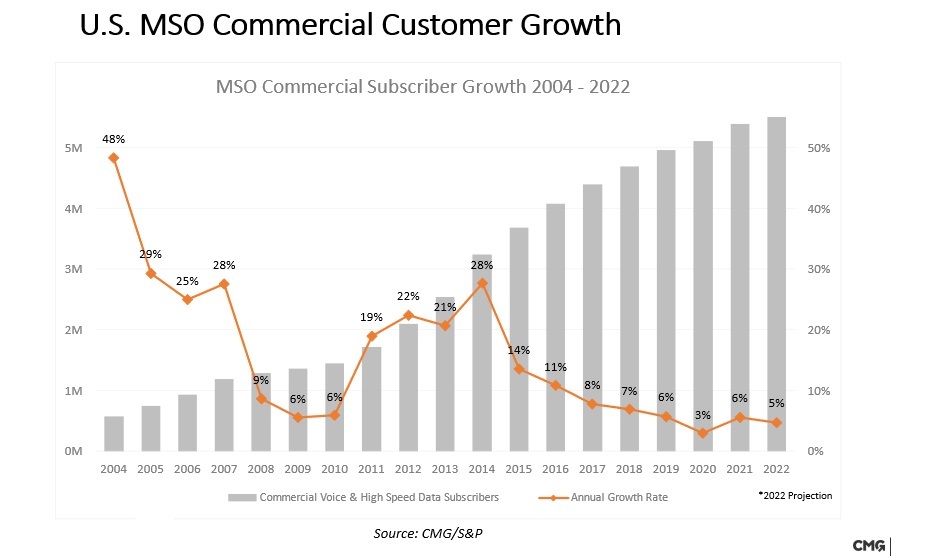

U.S. cable commercial revenue to grow 6% in 2022; Comcast Optical Network Architecture; HFC vs Fiber

U.S. cable multi-service operators (MSO’s) now generate more than $20 billion a year in business services revenues as the sector has emerged as one of the most profitable for the industry. However, cablecos face major challenges in maintaining their growth pace because of the economic meltdown wrought by COVID-19 and the emergence of new all-fiber and wireless competitors.

Cable business service revenues and customer growth each slowed during the first two years of the COVID-19 pandemic, but they are clearly increasing again at the end of 2022.

U.S. cablecos commercial revenue growth is set to hit 6% in 2022, up from just 2% in 2020 and 3% in 2021, Alan Breznick, cable/video practice leader at Light Reading and a Heavy Reading analyst said in opening remarks at Light Reading’s 16th-annual CABLE NEXT-GEN BUSINESS SERVICES DIGITAL SYMPOSIUM, which focused on cable business services. [The source of that data is CMG/S&P.]

“There are signs of things pointing up again for the [cable] industry,” Breznick told the virtual audience.

U.S. cable is expected to bring in $20.5 billion in total commercial services revenues in 2022. Broken down by segment, small businesses (up to 19 employees), at $14.6 billion, will continue to represent the lion’s share, followed by medium businesses (20-99 employees), at $3.3 billion, and large businesses (100-plus employees), at $2.6 billion.

Commercial customer growth is estimated to reach 5% in 2022, down slightly from 2021 levels, but almost doubling the growth rate seen in 2020, when businesses across the country were hit by pandemic-driven shutdowns and lockdowns. Breznick estimates that US cable has about 5.5 million commercial customers.

Christopher Boone, senior VP of business services and emerging markets at Cable One, acknowledged that the commercial services market is returning to a faster rate of growth. However, businesses – and smaller businesses, particularly – are feeling labor and inflationary pressure as things continue to open up.

“Everything is expensive, including labor, and it’s hard to find [workers],” Boone explained. “For the small business owner, I think it’s pretty tough right now.”

During the earlier phases of the pandemic, Boone said Cable One didn’t emphasize new work-from-home products but instead focused on the broader customer experience. For example, Cable One put some customers on a seasonable pause for the first time, forgave early termination fees, issued credits and, where appropriate, helped customers move to lower-level services.

“We really threw the rulebook out and just said, do what it takes to take care of the customers,” he said. Even if some small businesses fail, the hope is that those entrepreneurs will return and choose Cable One again, remembering that the company did right by them when times were tough. Moving forward, he said Cable One will stick to its knitting and focus on connectivity rather than look to expand its product line for the business segment.

“I think our product menu needs to look like In-N-Out and not The Cheesecake Factory,” Boone said, noting that Cable One has opted to sit on the sidelines with product categories such as SD-WAN. “We’re pretty cautious in terms of new product launches … We feel that connectivity is really our sweet spot.”

…………………………………………………………………………………………………………………………………………………………………………………………..

Comcast Business now serves, small, mid-range and enterprise-level customers with a variety of services including Metro Ethernet, wavelength services and Direct Internet Access. An important piece of the firm’s broader strategy revolves around a “unified optical network architecture” initiative that enables the MSO to serve a broad range of customer types, including those requiring that services are delivered to multiple locations in multiple markets.

Comcast’s unified optical architecture combines the access and metro optical networks using a set of items: network terminating equipment (NTE), a Wave Integration Shelf (WIS) and OTN (Optical Transport Network – ITU standard) “tails.”

The NTE is a small, optical shelf that today supports 10-Gig and 100-Gig up to a 400-Gig wavelength, and can reside at a single customer site or a data center. The WIS resides in the Comcast headend or hub, co-located with the metro optical line system, and serves as the demarcation point for commercial services. The OTN Tails are the key to connecting the access network to the metro network.

“We needed a way to provide commercial services to customers that were located in the access [network], but needed to reach the metro network to get to one of our routers for Internet access or possibly another segment of the access to connect their locations together,” Stephen Ruppa, senior principal engineer, optical architecture for Comcast’s TPX (technology, product and experience) unit, said this week during his keynote presentation.

The combining/meshing of the access and metro networks enables features such as remote management, performance monitoring data, alarming and a full “end-to-end circuit view,” including the customer sites themselves. “We use the same hardware, standards, configurations, designs, procurement, processes … in all the networks, regardless of the vendor,” Ruppa said.

And while there was once little need to connect two non-Comcast sites that resided in different areas or to provide connections greater than 10 Gbit/s, customer demands have changed. Ruppa said two products drove that demand and the desire to create the company’s unified optical architecture: wavelength services and high-bandwidth Metro Ethernet.

A modular, simplified, commoditized and easily repeatable architecture enables Comcast Business to “easily offer the next gen of 400-Gig wavelengths and Ethernet services with a very light lift,” he added.

………………………………………………………………………………………………………………………………………………….

Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia presented the final keynote.

The panel session “Fighting Fiber with Fiber” was moderated by Breznick with panelists:

- Christian Nascimento, VP, Product Management & Strategy, Comcast Business

- Brian Rose, Assistant VP, Product Internet, Networking & Carrier Services. Cox Communications

- Steve Begg, VP/GM, Business Services, Armstrong Business Solutions

- Mark Chinn, Partner, CMG Partners

- Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia

Decades old hybrid fiber-coax networks (HFC) drive fiber to the node outside of the premises, which is then hooked up using older cable (coaxial) technology. However, due to advances in cable technology such as the latest DOCSIS 4.0 technology, the cable industry has touted its newly developed technological capacity to support multi-gig symmetrical speeds over those hybrid networks. DOCSIS 4.0 currently supports speeds of up to 10 Gigabits (Gbps) per second download and 6 Gbps upload – its predecessor, DOCSIS 3.1, offered only 5 Gbps * 1.5 Gbps.

Christian Nascimento of Comcast stated that hybrid networks that deliver multi-gigabit speeds are “adequate” for smaller enterprises. “This is matter of matching the technology up with…the customer’s needs,” he said, adding that Comcast delivers these services in a “cost-effective way.”

For Cox Communications, the hybrid model is “an ‘and,’ not an ‘or,’” said Brian Rose, the assistant vice president of product internet for the cable company. While Cox may invest more heavily in fiber networks going forward, Rose said it will continue to invest in its cable networks as well. Rose said he welcomes market challenges from insurgent fiber deployers. “Competition is good for customers and the industry overall,” he said. “It pushes people to be better and to push the envelope.”

The panel wasn’t unanimously bullish on older cable technology, however. Ed Harstead of Nokia argued that a widespread transition to fiber is inevitable. “I don’t doubt that mom-and-pop businesses will be perfectly fine on [cable]. But to the extent that you need higher speeds and symmetrical speeds…it’s going to be fiber.”

The cable broadband industry faces an onslaught of criticism from fiber advocates. Organizations like the Fiber Broadband Association say their preferred technology performs better, last longer, and costs less in the long term than the competition. FBA President Gary Bolton has strongly opposed government support for all manner of non-fiber technology, including satellite and wireless.

……………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cable-tech/cable-business-services-bounce-back/d/d-id/782175

Cable Providers Back Hybrid Fiber-Coax Networks in Face of Pure Fiber