Verizon Business

Verizon partners with Nokia to deploy large private 5G network in the UK

Nokia and Verizon Business are collaborating to deploy a private 5G network across the Thames Freeport, a major UK industrial cluster including the Port of Tilbury and Ford Dagenham. This project is one of the UK’s largest private 5G deployments. It aims to modernize operations, boost efficiency, and drive economic growth in the region. The Thames Freeport, a 34 km-wide economic corridor, is the site of the deployment. This includes major industrial sites like the Port of Tilbury, Ford Dagenham, and DP World London Gateway. The deployment will cover 1,700 acres across multiple industrial sites within the Freeport.

Nokia will be the sole hardware and software provider, utilizing its Digital Automation Cloud (DAC) and MX Industrial Edge (MXIE) solutions.

This private 5G network will enable advanced use cases like AI-driven data analytics, predictive maintenance, process automation, autonomous vehicle control, and real-time logistics orchestration, according to Telecoms Tech News. The network is expected to modernize port operations, improve cargo handling, and enhance overall efficiency in the Freeport. The project also aims to boost the local economy, support job creation and training, and foster innovation and R&D collaborations.

Verizon and Nokia win a Thames Freeport private 5G deal. (Art by midJourney for Fierce Network)

“Band 77 in the U.K. is available at low cost on a local-area licensed basis — enterprises can readily get access to exclusive use mid-band spectrum in the 3.8-4.2 GHz range. The U.K. regulator, Ofcom, has pioneered this model globally,” said Heavy Reading Senior Principal Analyst for Mobile Networks Gabriel Brown in an email to Fierce Network. Brown noted that though it is based in the U.S., Verizon has an established smart ports business in the U.K., with the Port of Southhampton one of its private 5G network clients. He added the operator also has an ongoing relationship with Nokia around private 5G. “This new win shows advanced wireless technologies can scale to support nationally critical infrastructure with diverse stakeholders and use cases,” Brown said.

“To date, over 530 licenses have been issued to more than 90 licensees in this frequency range,” said SNS Telecom & IT 5G research director Asad Khan.

Verizon Business has been working on building its ports business for a while now, having already scored the aforementioned Southampton deal in April 2021. And its efforts appear to be paying off.

“I know there’s been chatter about how Verizon Business was able to outbid domestic carriers,” AvidThink Principal Roy Chua stated. “It’s likely some combination of demonstrated expertise in rolling out similar deployments and favorable financial terms. Definitely a win for Verizon Business (and Nokia) for sure.”

References:

https://www.fierce-network.com/wireless/verizon-and-nokia-win-one-largest-private-5g-projects-uk

FWA a bright spot in otherwise gloomy Internet access market

Parks Associates’ newly launched Broadband Market Tracker, states that U.S. Fixed Wireless Access (FWA) adoption from a mobile network operator hit 7.8 million U.S. residential home internet connections in Q1-2024. That’s in comparison to 106.3 million U.S. households that had home internet service at the end of 2023.

Kristen Hanich, director of research at Parks Associates, told Fierce Network FWA and satellite internet are the “fastest growing” segments of the broadband market, “attracting consumers who were previously unserved or underserved by traditional providers.” She noted for the past several years, the FWA base has grown by 700,000 to 900,000 subscribers per quarter while cable connections have declined.

T-Mobile in Q1-2024 passed the 5 million mark for FWA subscribers and Verizon reported a total FWA tally of 3.4 million subscribers. These figures include both residential and business FWA customers.

Key FWA Findings from OpenSignal:

- 5G FWA has reshaped the U.S. broadband market. It has allowed U.S. mobile operators to rapidly expand their broadband footprints for minimal incremental network investment. This has seen 5G FWA absorb all broadband subscriber growth in the market since mid-2022.

- FWA is the secret sauce for 5G monetization. FWA benefits from lower prices compared to wireline competition, access to existing mobile retail channels and subscribers, and the ability to deliver a “good enough” broadband service.

- U.S. mobile networks have proven to be resilient. Despite adding millions of 5G FWA subs since 2021, 5G speeds on T-Mobile and Verizon’s mobile networks have continued to improve. Their success in managing FWA traffic is due to a variety of factors, including plentiful access to mid-band spectrum, localized load management, and differences in peak usage time of day patterns between mobile and FBB usage.

- Elsewhere, there are mixed results. In India, Jio is seeing no discernible impact from FWA on the mobile experience of its users, while in Saudi Arabia Zain is seeing the additional load on its network from FWA having a greater influence on mobile users’ experience, depending on the time of day or the level of FWA penetration.

“Despite adding more than eight million 5G FWA subs using 400+ GB per month of data since Q1 2021, the overall mobile network experience on T-Mobile and Verizon’s mobile networks has not been compromised,” Opensignal analyst Robert Wyrzykowski wrote in the firm’s new assessment of FWA technology.

In its new report, Opensignal found that areas in the U.S. with a larger number of FWA customers actually showed better networking performance than areas with fewer FWA customers. Meaning, Verizon and T-Mobile offered increasingly speedy connections even in geographic locations with higher concentrations of FWA users.

“We would expect low-FWA penetration areas to see better mobile and FWA performance because of less load on the network. However, our data demonstrates the opposite trend,” Wyrzykowski explained.

Other Opensignal findings:

- Around 6% of urban Internet customers subscribe to FWA; in rural areas that figure is 7%.

- Some 74% of FWA customers pay less than $75 per month for their services.

- 35% of FWA customers are between 18-34 years old, whereas that age range is 25% for cable.

Opensignal’s findings provide an important view into the FWA industry in the US as its subscriber growth begins to slow. For example, T-Mobile added 405,000 FWA customers during the first quarter, far less than the 541,000 FWA customers it added during the fourth quarter of 2023.

“5G FWA services have been on a dramatic growth trajectory in the U.S., absorbing all broadband subscriber growth in the market since mid-2022 and amassing more than 600-700 thousand net adds per quarter,” wrote Opensignal’s Wyrzykowski. “This is despite the USA being a mature broadband market with nearly 97% broadband adoption and modest household growth.”

…………………………………………………………………………………………………………….

U.S. cable companies have recorded historic declines in their core Internet businesses amid the growth of FWA in the U.S. Financial analysts at TD Cowen predict the U.S. cable industry will collectively lose more than half a million customers in the second quarter of this year. They attribute that decline to FWA competition as well as other factors including the end of the U.S. government’s Affordable Connectivity Program (ACP).

The situation for cable might get even worse if FWA providers like T-Mobile and Verizon decide to invest further into their fixed wireless businesses.

“The pain for cable may continue for longer than expected as the ability for cable to return to broadband subscriber growth may take longer (if ever),” wrote the TD Cowen analysts in a recent note to investors.

Others agree. For example, the analysts at S&P Global wrote that cable service providers in general have been losing value to wireless network operators despite cable’s efforts to bundle mobile services into cable offerings.

………………………………………………………………………………………………………

Parks’ Hanich said fiber optic access technology is on an upswing and Parks is seeing “excellent growth in the markets where it is available and high customer satisfaction with the customers who have it.”

“But the numbers are not quite as dramatic as what’s been going on with T-Mobile, Verizon and Starlink,” she said, noting the “growing convergence” of satellite and mobile networks is something else to keep an eye on.

Asked whether the demise of the Affordable Connectivity Program has had any impact on Parks’ findings, Hanich said, “we are concerned that the end of the program will result in households and families needing to disconnect from the internet for financial reasons.”

“For a good percentage of Americans, household budgets have been hit by rising inflation and lower-income families especially are having to cut back,” she said. “Thankfully we are seeing ISPs step up, try and transition people onto other plans and initiatives.”

…………………………………………………………………………………………………………….

Separately, Parks found adoption of mobile virtual network operator (MVNO) services reached over 15 million residential customer mobile lines in the quarter. In an MVNO model, broadband operators lease spectrum capacity from a wireless network to stand up their own mobile offering.

NTIA published some findings from its latest Internet Use Survey. Unsurprisingly, internet usage in the U.S. has gone up, with 13 million more people using the internet in 2023 compared to 2021. However, a lot of that usage is coming from lower-income households. Specifically, internet adoption among households making less than $25,000 per year increased from 69% in 2021 to 73% in 2023.

References:

https://www.fierce-network.com/broadband/fixed-wireless-continues-its-climb-among-us-homes-parks

https://www.lightreading.com/fixed-wireless-access/fwa-in-the-usa-getting-ready-for-phase-2

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon’s 2023 broadband net additions led by FWA at 375K

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Verizon’s 2023 broadband net additions led by FWA at 375K

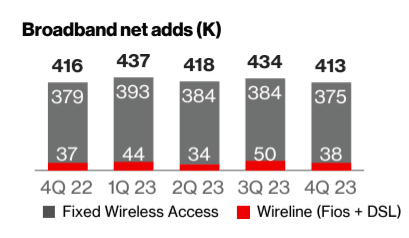

At the end of 2023, Verizon’s total broadband base was 10.7 million, with fixed wireless access (FWA) customers making up the bulk of quarterly net additions. For all of 2023, Verizon posted 375,000 net FWA additions, bringing its total fixed wireless subscriber base to over 3 million.

Total broadband net additions were 413,000, compared to 416,000 in Q4 2022. Although Verizon doesn’t post metrics for its DSL customers, overall wireline net adds were 38,000, implying the company lost 17,000 DSL subscribers in the quarter.

In the 4th quarter of 2023, Verizon added 55,000 Fios Internet customers, marking a year-on-year decline of 4,000. Consumer Fios revenue of $2.9 billion increased 1% from Q4 2022, but for the full year was relatively flat at $11.6 billion. Business Fios revenue for the quarter increased 2.6% to $312 million, while jumping 2.8% to $1.2 million for full-year 2023.

CEO Hans Vestberg noted on the earnings call broadband net adds for full-year 2023 totaled more than 1.7 million, “with more than one and a half million from fixed wireless access.” Fios net additions for the year came to 248,000.

Total Broadband:

- Total broadband net additions of 413,000, represented the fifth consecutive quarter that Verizon reported more than 400,000 broadband net additions. Total broadband net additions included 375,000 fixed wireless net additions, bringing the subscriber base to over 3 million. In fourth-quarter 2023, more than 80 percent of Consumer fixed wireless gross additions were in Verizon’s first 76 C-Band markets. Verizon is ahead of schedule to achieve its goal of 4 to 5 million subscribers by the end of 2025.

- 55,000 Fios Internet net additions, down 4,000 from the fourth-quarter 2022.

- 10.7 million total broadband subscribers as of the end of fourth-quarter 2023.

Total Wireless:

- Total wireless postpaid net additions for full-year 2023 increased 26 percent compared to 2022.

- Total wireless service revenue of $19.4 billion, a 3.2 percent increase year over year.

- Retail postpaid phone net additions of 449,000, and retail postpaid net additions of 1,460,000.

- Retail postpaid churn of 1.18 percent, and retail postpaid phone churn of 0.93 percent.

“After delivering continuous improvement throughout 2023, we ended the year strong and continue to pursue the right balance of growth and profitability,” CEO Hans Vestberg said in the 4th quarter earnings statement.

References:

https://www.verizon.com/about/investors/quarterly-reports/4q-2023-earnings-conference-call-webcast

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Verizon once again delays 5G Standalone (SA) commercial service

Verizon once again delays 5G Standalone (SA) commercial service

Like AT&T, Verizon has promised 5G standalone (SA) core network for a very long time. The mostly wireless U.S. carrier initially said it would launch standalone 5G in 2020. Some in the industry thought it did so in 2022. But the company said the technology ‘is in testing now’ and is still not available commercially.

“We have it in trials only at this point. We don’t have it commercially available for our customers,” Verizon’s chief networking executive, Joe Russo, said on a podcast last month hosted by Recon Analytics. “So more to come in the next several months as Verizon will be entering the standalone core game.”

“It is absolutely a capability that we think will be another enabler to new use cases. But … the reliability and performance of Verizon’s network is what we stand for, and I don’t put technology out into the network that is a step back. It has to be a step forward. And all of the data that I see – both internal testing and with external testing that happens out there in the market – tells me that SA [standalone] needs a little bit more time.”

“We’re doing significant developing and testing to make sure that both the data session and the voice sessions in a standalone world are as good or better than what you would expect in our 4G network today. So we see that in the next several months we’re going to get there, but it was not my goal to be first in deploying standalone. It’s my goal to be best in deploying standalone.”

……………………………………………………………………………………………………………………………..

Verizon spokesperson Kevin King clarified that “we have commercial traffic running on our 5G non standalone core. That is what we announced earlier in the year. Joe was referring to our 5G standalone core which is in testing now.”

That cop-out was contradicted by a statement made during a webinar for analysts on September 29th, which was obtained by Light Reading. “People talk about the standalone core. Just terminology-wise, that’s the 5G core essentially. If you guys have read the stuff we’ve said publicly, certainly we serve some customers on portions of our 5G core,” said Mike Haberman, Verizon’s SVP of strategy and transformation, And then we have some internal stuff going on with other functionality on the core. We’re in the process of rolling out (5G SA) in a very smart fashion.”

“Here’s the deal: When you go to the standalone core, you can’t aggregate your LTE carriers. With the non standalone core I’m aggregating together both 5G and 4G. So when you go standalone you start to bifurcate the spectrum. So that’s the impact to the RAN [radio access network]. So you better be sure that your mobile [customer] distribution, where they are geography, makes sense. Or what will happen is those customers will experience a lower service level. No good. We want to be careful of that. So that’s why, when you do the standalone core, you have to pay very close attention to your radio access network because they are directly attached.”

On April 27th Verizon issued a press release describing the benefits of 5G standalone (SA) technology and how it’s “what sets Verizon apart.” However, the release doesn’t specifically say that Verizon launched the technology. That despite Verizon last year announced it had begun moving traffic onto its new 5G core, which supports both the non standalone (NSA) and standalone (SA) versions of the technology.

Last year, Mobile World Live reported that Verizon was migrating “commercial traffic onto SA 5G core.” The article cited an unnamed Verizon representative. Mobile World Live also reported that Ericsson, Casa Systems, Oracle and Nokia supply Verizon’s 5G core.

Dell’Oro Group, in January 2023, listed Verizon among the few North American wireless providers that had commercially launched the technology.

“This is a moving target,” Recon Analytics analyst Roger Entner told Light Reading. But Entner said Verizon’s position on the standalone version of 5G makes sense. “The benefits you can get today from standalone are limited.”

–>This author totally disagrees with Mr. Entner, because TRUE 5G=5G SA. IN OTHER WORDS, ALL OF THE 3GPP DEFINED 5G FEATURES REQUIRE 5G SA! That includes 5G security and network slicing.

…………………………………………………………………………………………………………………………………

Light Reading’s Mike Dano wrote:

Verizon now appears to be roughly three years behind its initial standalone 5G rollout plans. In the summer of 2020, Verizon said it would begin moving traffic onto its standalone 5G core “in the second half of 2020 with full commercialization in 2021.”

Then, in early 2022, Verizon CTO Kyle Malady suggested that the operator would begin moving some of its fixed wireless access (FWA) traffic onto its standalone 5G core by June of that year. He also said at the time that Verizon would start putting smartphone traffic onto that core in 2023.

………………………………………………………………………………………………………….

T-Mobile US and Dish Wireless are the only two 5G carriers that have launched commercial 5G SA. AT&T has made a lot of noise about it’s 5G SA plans but has yet to launch.

AT&T’s chief networking executive, Chris Sambar, wrote in a September 29th blog post that AT&T was moving some customers to standalone 5G. “Many of the newest mobile devices are ready for 5G standalone, and we continue to move thousands of customers every day. We also recently launched AT&T Internet Air home fixed wireless service, and from the start, this product rides on standalone 5G.”

https://www.lightreading.com/5g/verizon-surprises-with-ongoing-delays-in-5g-standalone-rollout

https://www.verizon.com/about/news/5g-standalone-why-it-matters

https://about.att.com/blogs/2023/network-ready.html

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

GSA 5G SA Core Network Update Report

5G subscription prices rise in U.S. without killer applications or 5G features (which require a 5G SA core network)

Verizon transports 1.2 terabytes per second of data across a single wavelength

Verizon has upgraded its optical to electrical conversion cards to send data at speeds of 1.2 Tbps on a single wavelength through the carrier’s live production network. The trials demonstrated increased reliability and overall capacity as well, Verizon said.

The trials, which were conducted in metro Long Island, N.Y., were in partnership with Cisco and included technology from Acacia, as well. They utilized Cisco’s NCS 1014 transceiver shelf and Acacia’s Coherent Interconnect Module (CIM 8). Verizon said the module features silicon semiconductor chips with 5nm complementary metal-oxide semiconductor (CMOS) digital processing and 140 Gbaud silicon photonics using 3D packaging technology. In short, digital processing capabilities and transistor density both are increased.

Verizon said that it transmitted a 1.0 Tbps single wavelength through the Cisco NCS 20000 line system for more than 205 km. It traversed 14 fiber central offices (COs). The carrier said this is significant because progressive filtering and signal-to-noise degradation impact wavelengths as they pass through each CO. The trials also featured 800 Gbps transmission for 305 km through 20 COs — and a 1.2 Tbps wavelength that traversed three offices.

“We have bet big on fiber. Not only does it provide an award-winning broadband experience for consumers and enterprises, it also serves as the backbone of our wireless network. As we continue to see customers using more data in more varied ways, it is critical we continue to stay ahead of our customers’ demands by using the resources we have most efficiently,” said Adam Koeppe, SVP of Technology Planning at Verizon.

Image courtesy of Verizon

In addition to increasing data rates, the new optics technology from Cisco reduces the need for regeneration of the light signal (conversion to electrical and back to optical signals) along the path by compensating for the degradation of the light signal traveling through the fiber cable. This adds reliability and leads to a reduced cost per bit operating expense for more efficient network management.

Bill Gartner, senior vice president and general manager of Cisco Optical Systems and Optics, added, “This trial demonstrates our commitment to continuous innovation aimed at increasing wavelength capacity and reducing costs. The Verizon infrastructure built with the Cisco NCS 2000 open line system supports multiple generations of optics, thus protecting investments as technology evolves.”

In March, Windstream Wholesale said that it sent a 1 Tbps wave across its Converged Optical Network (ICON) between Dallas and Tulsa, a distance of 541 km.

References:

https://www.verizon.com/about/news/verizon-fiber-technology-advancement-results

Verizon Touts 1.2 Tbps Wavelengths Over Production Network – Telecompetitor

https://www.verizon.com/about/news/verizon-transports-800-gbps

AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

Verizon says it has approximtely 222 million people covered with its mid-band C-band network, [1.] a figure the company hopes to increase to 250 million by the end of next year. “C-band is a game change for our business,” CEO Hans Vestberg said on the telco’s 3rd quarter earnings call. “Our network is winning.”

Note 1. C-band sits between the two Wi-Fi bands, which are at 2.4GHz and 5GHz. It’s slightly above and very similar to the 2.6GHz band that Clearwire and then Sprint used for 4G starting in 2007, and which T-Mobile currently uses for mid-band 5G. And it adjoins CBRS, a band from 3.55 to 3.7GHz that’s currently being deployed for 4G. ITU-R divided C-band into three chunks, referred to as band n77, band n78, and band n79.

……………………………………………………………………………………………………………………………

Verizon officials said the company is using the capacity in its mid-band 5G network to pursue opportunities like fixed wireless access (FWA) and private wireless networks. “We see demand for the product continuing to grow,” Vestberg said of Verizon’s private wireless network offerings. He added that Verizon is working to transition its private wireless customers from pilots to commercial deployments. He also said the company is growing its ecosystem of suppliers for that business.

…………………………………………………………………………………………………………………………

T-Mobile announced Tuesday it now covers 300 million people with its 2.5GHz mid-band network, reaching that goal three months earlier than the company had planned. T-Mobile’s overall 5G footprint has expanded as well, now covering more than 330 million people or 98% of the population.

“We have been leaders in the 5G era from the start, deploying the largest, fastest, most awarded and most advanced 5G network in the country faster than anyone else,” said Ulf Ewaldsson, President of Technology at T-Mobile. “While the other guys are playing catch-up, finally beginning to build out their mid-band 5G networks, we are maintaining our lead and will continue offering customers the best network – paired with the best value – for years to come.”

“T-Mobile’s turnaround story is incredible, going from network underdog a decade ago to the undeniable network leader today,” said Anshel Sag, Principal Analyst at Moor Insights and Strategy. “T-Mobile has not only built out a robust 5G network with unmatched coverage and capacity, but the Un-carrier is also leading the way in rolling out new capabilities that will unlock the true promise of 5G.”

………………………………………………………………………………………………………………………..

Last week, AT&T said it ended the third quarter covering 190 million subscribers for its mid-band 5G network, and said it remains on track to cover 200 million by the end of the year. On the telco’s 3-2023 earnings call, CEO John Stankey said, “we continue to enhance the largest wireless network in North America and expand the nation’s most reliable 5G network. It’s no surprise that when you combine our high-value customer growth and rising revenues per user, we continue to grow profits in our wireless business.”

Regarding FWA, Stankey touted the company’s Internet Air offering. “We have no issues selling Internet Air into the business segment. It’s a really attractive thing for us to do. It’s a really helpful product on a number of different fronts. It meets a particular need.

……………………………………………………………………………………………………..

References:

https://www.lightreading.com/private-networks/verizon-jumps-too-as-mobility-biz-surprises-in-q3

https://www.pcmag.com/news/what-is-c-band

https://www.fool.com/earnings/call-transcripts/2023/10/19/att-t-q3-2023-earnings-call-transcript/

https://www.att.com/internet/internet-air/

AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

The three most dominant broadband wireline ISPs in the U.S. all lost wireline subscribers in Q2-2023.

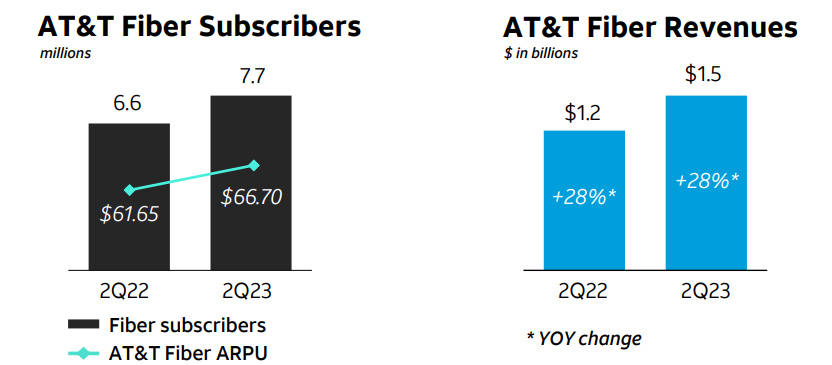

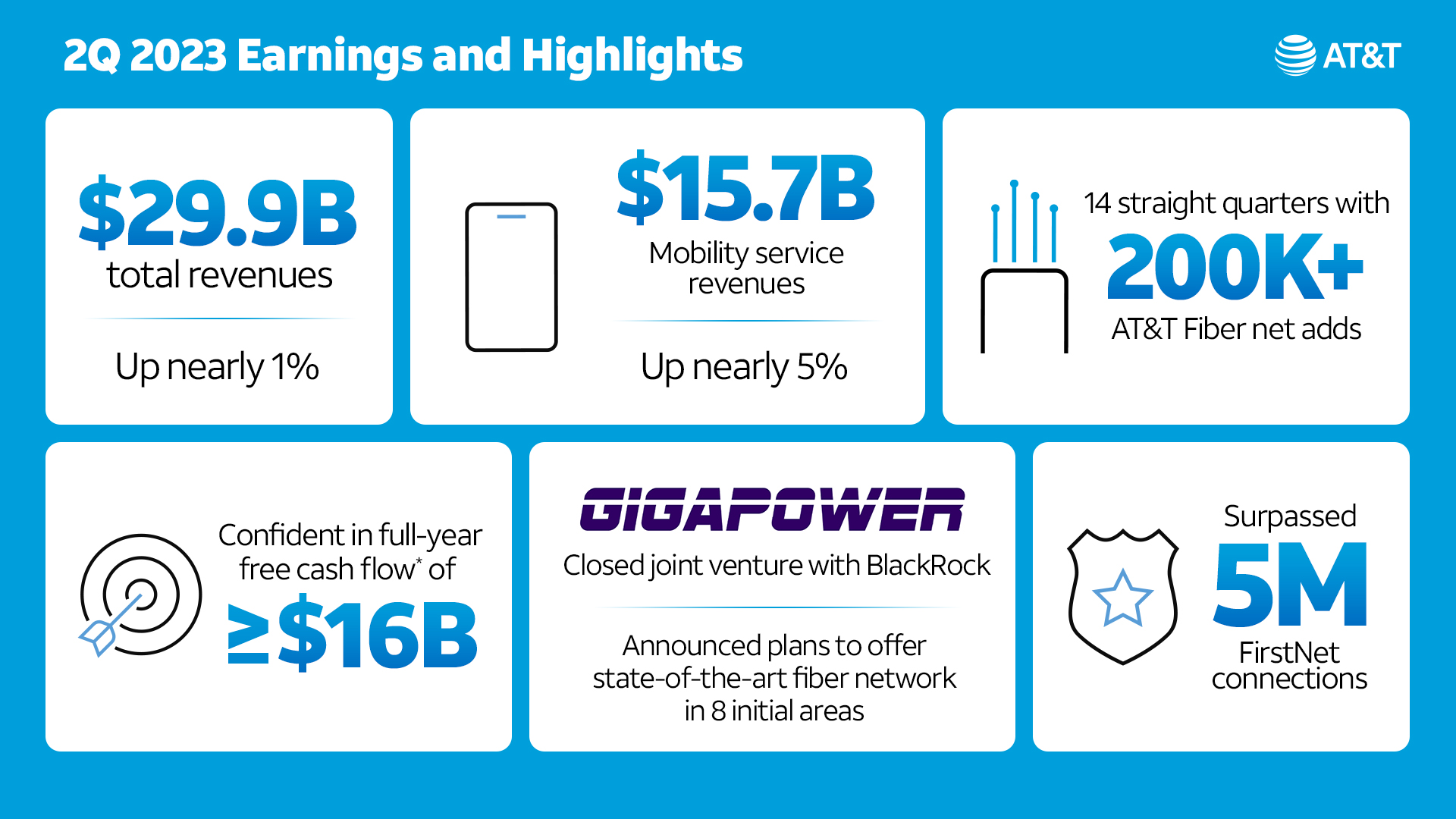

1. AT&T’s net total broadband access showed a loss of 35,000 subscribers in Q2-2023, which widened from a loss of -25,000 in the year-ago quarter. AT&T ended Q2 with 15.3 million broadband connections (including DSL), down 1.3% from 15.5 million a year earlier.

AT&T continued to add new fiber subscribers, but the pace of that growth slowed. AT&T added 251,000 fiber subs in Q2, down from +316,000 in the year-ago quarter and down from +272,000 in the prior quarter.

AT&T ended the period with 7.73 million fiber subs. Fiber average revenue per user (ARPU) was $62.26, up from $57.64 in the year-ago period.

(Source: AT&T Q2 2023 earnings presentation)

AT&T added about 500,000 fiber locations during the quarter, ending Q2 with 20.2 million. CEO Stankey said AT&T remains on track to build fiber-to-the-premises (FTTP) tech to 30 million locations by 2025.

AT&T’s average fiber penetration rate is hovering at 38%. “Everywhere we put fiber in the ground, we feel good about our ability to win with consumers,” Stankey said.

AT&T shed 286,000 non-fiber subscribers in the quarter, lowering that total to 5.95 million. AT&T also lost another 25,000 DSL subs in the quarter, ending the period with just 259,000.

Source: AT&T

…………………………………………………………………………………………………………………..

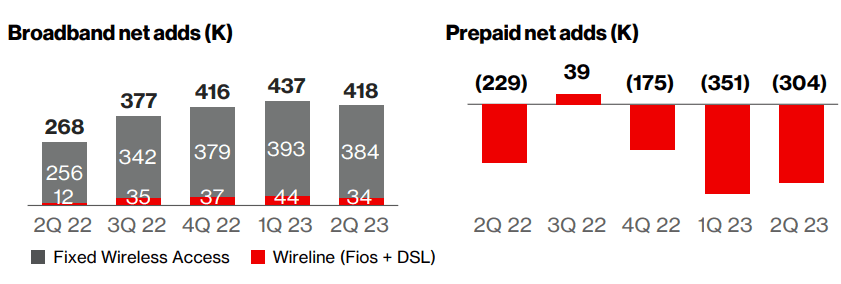

2. While Verizon added 54K FiOS internet subscribers in 2Q-2023 (51K FiOS net adds from Consumer, 3K from Business customers), it had a net loss of 304K wireline broadband subs when the loss of DSL subscribers was factored in.

From Verizon’s 2Q-2023 earnings call presentation:

Source: Verizon

Remarkably, Verizon added a net 384K fixed wireless subscribers, an increase from 256,000 fixed wireless net additions in second-quarter 2022. Verizon now has nearly 2.3 million subscribers on its fixed wireless service.

Due to FWA growth, Verizon reported total broadband net additions of 418,000 in 2Q-2023.

……………………………………………………………………………………………………………………………..

Comcast, the largest U.S. ISP, lost 20,000 residential broadband subscribers, lowering its total to 29.79 million. Comcast’s total broadband subscriber loss of 19,000 (including a gain of 1,000 business broadband customers), was better than the -74,000 expected by Wall Street analysts.

Comcast, which lost 10,000 residential broadband subs in the year-ago quarter, warned in April that it doesn’t expect to see much in the way of broadband subscriber growth gains in the near-term. The company also noted that it expected those numbers to be even lower in Q2 due to a slow housing move market paired with traditional “seasonality” driven by students and retirees returning for the summer.

Dave Watson, president and CEO of Comcast Cable, said on today’s earnings call that he expects Comcast to return to broadband subscriber growth “over time.” One way Comcast is pursuing subscriber growth is through network expansion and edge-outs that will total about 1 million locations in 2023. Comcast, which operates in 39 US states, also intends to participate in the Broadband Equity Access and Deployment (BEAD) program, which recently announced state-by-state funding allocations.

Comcast has cited average revenue per user (ARPU) growth as the key metric of its broadband business. And Comcast’s broadband ARPU grew 4.5% in the quarter, matching the ARPU growth rate it posted in the prior quarter.

……………………………………………………………………………………………………………………..

Here are the top 20 broadband wireline ISPs in the U.S.:

| # | Internet Service Provider | Type | States |

| 1 | Comcast | Cable | National |

| 2 | Charter Communications | Cable | National |

| 3 | AT&T | Fiber | National |

| 4 | Verizon | Fiber | Mid-Atlantic, Northeast |

| 5 | Cox Communications | Cable | National |

| 6 | Altice USA | Cable/Fiber | National |

| 7 | Lumen Technologies | Fiber | West, Florida |

| 8 | Frontier Communications | Fiber | National |

| 9 | Mediacom Communications | Cable | Midwest, Southeast |

| 10 | Astound Broadband | Cable/Fiber | National |

| 11 | Windstream Holdings | Fiber | South, Midwest, Northeast |

| 12 | Brightspeed | Fiber | Midwest, Southeast |

| 13 | Cable One | Cable | West, Midwest, South |

| 14 | Breezeline | Cable/Fiber | East Coast |

| 15 | WideOpenWest (WOW!) | Cable/Fiber | AL, FL, GA, MI, SC, TN |

| 16 | TDS Telecom | Cable/Fiber | National |

| 17 | Midco (Midcontinent Communications) | Cable | MN, ND, SD, WI, KS |

| 18 | Consolidated Communications | Fiber | National (22 states) |

| 19 | Google Fiber | Fiber | National (16 states) |

| 20 | Ziply Fiber | Fiber | WA, OR, ID, MT |

Source: https://dgtlinfra.com/top-internet-providers-us/

……………………………………………………………………………………………………………………………..

References:

https://about.att.com/story/2023/q2-earnings.html

Verizon Point-To-Multipoint network architecture using mmWave Spectrum

Verizon has unveiled a point-to-multipoint solution to expand high-speed internet access across various locations. According to the press release, a successful proof of concept in Texas showcased the company’s approach, leveraging its extensive mmWave spectrum holdings and fiber infrastructure.

Verizon stated that its point-to-multipoint architecture is designed to cater to multi-dwelling units (MDUs) such as apartment buildings and townhomes, as well as distributed enterprise campuses and high rises. Intending to serve multiple end-user connections from a single origination location, Verizon said this solution promises reliable, secure, and efficient connectivity.

The company claims this network architecture is less expensive to build, quicker to deploy, and addresses the unique complexities of distributed end users in a single facility or small area such as a residential unit with a large population.

In this proof of concept, an airlink over licensed mmWave spectrum was established between a centralized, rooftop radio site and a radio atop a simulated multi end-point building. The signal was then transmitted via coaxial cable throughout the building to a data processing unit along with a corresponding modem. From there, the building’s existing wiring transported the signal to end user routers that provided broadband coverage throughout simulated distributed end points. Instead of transmitting the data through Verizon’s 4G and 5G wireless cores, this unique architecture uses a simplified Broadband Network Gateway to direct the traffic to and from the internet over Verizon’s public IP network. This means that data traffic will not add load on Verizon’s current wireless cores while at the same time providing excellent capacity and latency.

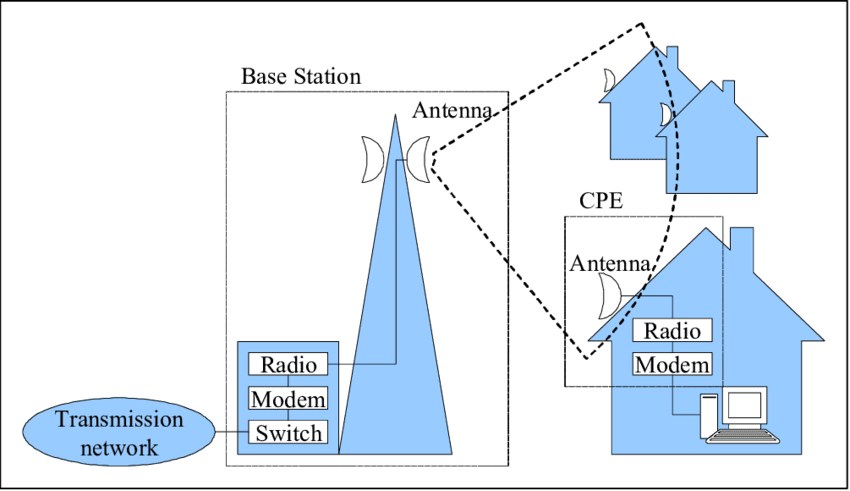

Source: Research Gate Point-to-multipoint FWA network architecture

………………………………………………………………………………………………………………………………….

“Verizon has been building the infrastructure and assets for years to make this new design possible,” said Adam Koeppe, Senior Vice President of Technology Planning for Verizon. “Leveraging our significant fiber footprint in over 70 major markets nationwide and large amounts of ready-to-use mmWave spectrum, this new architecture means we will be able to provide point-to-multipoint architecture in a cost effective and efficient way.”

Leveraging Verizon’s current mmWave spectrum and fiber assets means this point-to-multipoint technology could reduce the cost of providing broadband to many locations. Depending on the various designs of buildings, office complexes and campuses, running fiber connections to individual buildings and individual units within buildings requires complex licensing, significant capital investments, long lead times and can be disruptive, making air links and established indoor cabling appealing alternatives for delivering services. Applications for this type of point to multipoint mmWave based technology could include distributed enterprise campuses, commerce areas, home broadband for multi dwelling units or other areas where air links could easily connect donor sites in the Radio Access Network to facilities with their own internal infrastructure.

Verizon is completing RFPs for the specialized radio access equipment for the licensed 37-39 GHz spectrum and expects to continue developing this technology throughout the year.

References:

https://www.verizon.com/about/news/verizon-develops-new-point-multi-point-use-case-mmwave-spectrum

https://www.verizon.com/about/our-company/5g/what-millimeter-wave-technology

Leichtman Research Group: Fixed Wireless Services Accounted for 90% of the Broadband Net Adds in 2022!

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 95% of the market – acquired about 3,500,000 net additional broadband Internet subscribers in 2022, compared to a pro forma gain of about 3,725,000 subscribers in 2021.

These top broadband providers account for about 110.5 million subscribers, with top cable companies having 75.6 million broadband subscribers, top wireline phone companies having 30.8 million subscribers, and top fixed wireless services having 4.1 million subscribers.

LRG’s findings for 2022 include:

- Overall, broadband additions in 2022 were 94% of those in 2021.

- The top cable companies added about 515,000 subscribers in 2022 – compared to about 2.8 million net adds in 2021.

- The top wireline phone companies lost about 180,000 total broadband subscribers in 2022 – compared to about 210,000 net adds in 2021.

- Wireline Telcos had about 2.4 million net adds via fiber in 2022, offset by about 2.6 million non-fiber net losses.

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,170,000 subscribers in 2022 – compared to about 730,000 net adds in 2021.

“Top broadband providers added about 3.5 million subscribers in 2022. Fixed wireless services (FWA) accounted for 90% of the net broadband additions in 2022, compared to 20% of the net adds in 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Total broadband net adds in 2022 were slightly lower than last year, and down from about 5 million in 2020, but were more than in any year from 2012-2019.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

FWA in the Spotlight:

A recent survey of some T-Mobile fixed wireless customers, conducted by the financial analysts at Wolfe Research, “T-Mobile Fixed Wireless Consumer Survey & Broadband Industry Implications,” found that 90% rated their service as “good enough.” The firm surveyed Facebook’s T-Mobile FWA user group, totalling over 15,000 members, in December 2022. Based on the 60 replies it received, 90% said they were mostly satisfied. The firm also found that 42% of respondents previously subscribed to a cable connection, 37% hailed from DSL operators, and 6% previously used fiber. Around 8% had no prior broadband service. Moreover, the financial analysts at Evercore expect T-Mobile to accumulate around 450,000 new fixed wireless customers in the first quarter of 2023, down from the 524,000 the operator reported in the fourth quarter of 2022.

Verizon added 262,000 residential FWA customers in Q4, up from +38,000 in the year-ago period, to end 2022 with 884,000 residential FWA subscribers. The company also signed on 117,000 business FWA subs in the quarter, up from +40,000 in the year-ago period, ending 2022 with 568,000 business FWA customers. About 70% of the consumer fixed wireless gross additions have come from bundling an existing wireless service, while 30% are new to Verizon. Interestingly, the experience is flipped for Verizon Business, where 70% of FWA customers were new to Verizon.

In contrast to the widely-held view that FWA is a “lower quality” service than wired broadband, Verizon says their principal selling point is FWA network’s greater reliability versus wireline alternatives. Cable’s outside plant issues can take days to resolve, a particularly critical issue in B2B, where cablecos (like Comcast Business) have increased their market share.

Image Credit: Verizon

The Wireless Internet Service Providers Association (WISPA) kicked off its annual trade show this week in Louisville, Kentucky, stating that WISPs service a total of 9 million Americans, many of whom live in the hardest to reach and serve parts of the country

According to Fierce Wireless, Cox is using 5G technology to test FWA services near Macon, Georgia; Tucson, Arizona; and Oklahoma City, Oklahoma.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

| Broadband Providers | Subscribers at end of 2022 | Net Adds in 2022 |

| Cable Companies | ||

| Comcast | 32,151,000 | 250,000 |

| Charter | 30,433,000 | 344,000 |

| Cox* | 5,560,000 | 30,000 |

| Altice | 4,282,900 | (103,300) |

| Mediacom* | 1,468,000 | 5,000 |

| Cable One** | 1,060,400 | 14,400 |

| Breezeline** | 693,781 | (22,997) |

| Total Top Cable | 75,649,081 | 517,103 |

| Wireline Phone Companies | ||

| AT&T | 15,386,000 | (118,000) |

| Verizon | 7,484,000 | 119,000 |

| Lumen^ | 3,037,000 | (253,000) |

| Frontier | 2,839,000 | 40,000 |

| Windstream* | 1,175,000 | 10,300 |

| TDS | 510,000 | 19,700 |

| Consolidated** | 367,458 | 724 |

| Total Top Wireline Phone | 30,798,458 | (181,276) |

| Fixed Wireless Services | ||

| T-Mobile | 2,646,000 | 2,000,000 |

| Verizon | 1,452,000 | 1,171,000 |

| Total Top Fixed Wireless | 4,098,000 | 3,171,000 |

| Total Top Broadband | 110,545,539 | 3,506,827 |

* LRG estimate

** Includes LRG estimate of pro forma net adds

^ Includes the impact of a divestiture completed in October 2022

- TDS residential subscribers, includes 305,200 wireline subscribers and 204,800 cable subscribers

- Company subscriber counts may not solely represent residential households – about 6.5% of the total are non-residential

- Top broadband providers represent approximately 95% of all subscribers

- Net additions reflect pro forma results from system sales and acquisitions, reporting adjustments, and the addition of new providers to the list – therefore, comparing totals in this release to prior releases will not produce accurate findings

About Leichtman Research Group, Inc:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com

References:

https://wispa.org/news_manager.php?page=29725

https://www.verizon.com/about/blog/fixed-wireless-access

Verizon deploys Private 5G at Wichita Smart Factory; 5G Radio’s an Issue?

Executive Summary:

Verizon Business announced that its private 5G wireless network is live at The Smart Factory at Wichita, a new immersive, industry experience centre convened by Deloitte. Verizon collaborates with Deloitte and other companies in the Smart Factory ecosystem to advance smart manufacturing deployment and allow manufacturers to quickly adopt cutting-edge Industry 4.0 solutions and technologies that support new business models that improve quality, productivity, and sustainability.

Verizon, as a builder-level collaborator in The Smart Factory at Wichita ecosystem of 20 leading global companies, intends to use this network of companies to help customers from various industries to innovate their approach to better connectivity and use of data to improve real-time coordination between people and assets. Verizon’s private 5G wireless network provides features that will help drive select use cases at The Smart Factory in Wichita, which include:

Select Use Cases at The Smart Factory:

- Improved shop floor visibility: Using predictive maintenance analytics on assets can improve uptime and productivity by addressing up to approximately 50% of the root causes of downtime.

- Improved quality assurance and reduced defects: Detection of potential defects in manufactured products or services before they reach customers, thereby improving the customer experience and reducing waste.

- Material handling automation: Orchestration and management of AGV and AMR fleets can improve the reliability, consistency, safety, and accuracy of moving material across the plant.

- Workplace safety: Reduces human error and manual workloads to minimize injury and productivity loss.

Commenting on the Private 5G Network Deployment, Jennifer Artley, SVP, 5G Acceleration, Verizon Business, said: “The Smart Factory at Wichita is a microcosm of industry 4.0 itself, with a wide range of enterprise partners, suppliers, researchers, and complementary technologies coming together in one ecosystem to make a supercharged impact. 5G brings massive bandwidth and incredibly fast data speeds to the equation to help make these impacts replicable in a plethora of business applications at virtually any scale — customers have the flexibility to dream big and start small.”

“5G is the backbone of Industry 4.0, and we’re so excited to bring it to Deloitte’s The Smart Factory at Wichita to help catalyze scalable, collaborative innovation,” added Jennifer Artley.

The Smart Factory in Wichita:

The Smart Factory at Wichita assists firms through their most difficult manufacturing challenges by showcasing modern manufacturing techniques in a variety of applications on a shop floor. The Factory, located on the Innovation Campus at Wichita State University, includes a fully operational production line and experiential labs for creating and researching smart manufacturing technology and strategy.

Visitors to the facility can explore smart manufacturing concepts that combine the Internet of Things (IoT), cloud, artificial intelligence (AI), computer vision, and more to create interconnected systems that use data to drive real-time, intelligent decision-making.

Verizon Private 5G:

By utilizing Verizon 5G and edge computing to create applications and solutions that drive both the manufacturing and retail industries, this work with Deloitte at The Smart Factory at Wichita strengthens the commitment between the two businesses to co-innovate.

Verizon Business announced that its private 5G wireless network is live at The Smart Factory at Wichita, a new immersive, industry experience centre convened by Deloitte. Verizon collaborates with Deloitte and other companies in the Smart Factory ecosystem to advance smart manufacturing deployment and allow manufacturers to quickly adopt cutting-edge Industry 4.0 solutions and technologies that support new business models that improve quality, productivity, and sustainability.

Commenting on the Private 5G Network Deployment, Jennifer Artley, SVP, 5G Acceleration, Verizon Business, said: “The Smart Factory at Wichita is a microcosm of industry 4.0 itself, with a wide range of enterprise partners, suppliers, researchers, and complementary technologies coming together in one ecosystem to make a supercharged impact. 5G brings massive bandwidth and incredibly fast data speeds to the equation to help make these impacts replicable in a plethora of business applications at virtually any scale — customers have the flexibility to dream big and start small.”

“5G is the backbone of Industry 4.0, and we’re so excited to bring it to Deloitte’s The Smart Factory at Wichita to help catalyze scalable, collaborative innovation,” added Jennifer Artley.

Could 5G Radios be a Problem for Private 5G?

CEO Hans Vestberg told a Citi investor conference this week:

“We need certain radio base stations for private networks, different price ranges. We need modems for certain things. You need more than the handset and the macro sites that is now in there,” Vestberg said at Citi’s 2023 Communications, Media, and Entertainment Conference. “We would now have offerings for cheaper private 5G networks with certain suppliers and more high level, high quality. We didn’t have this optionality, and that’s why we’re now sort of seeing that we’re actually meeting the customer demands of building private 5G networks.”

Vestberg added that the carrier now has “the ecosystem for radios so we are fully committed. We strongly believe in private 5G networks, and that’s a revenue stream we don’t have today because we’re not into Wi-Fi networks and optimization of a manufacturing site. We’re not into that today.”

Verizon Business CEO Sowmyanarayan Sampath during an investor conference in November said it had dozens of private networks already deployed, with accelerating momentum.

“On the private networks, we are very bullish on that opportunity and I think things have gotten a little faster in the last 90 days than they’ve gotten in the last year or so,” Sampath said, adding most of Verizon’s initial private network deals have resulted in incremental spending by customers.

“For example, if we are providing wireline network services – I’ll call it more broadly network services – to 10,000 stores, and if the realtor wants 100 sites or 200 sites of private network, they’re going to come to us because we are already integrated into their service stack, we are integrated into their day-two operating model, we are integrated into their operating system, so when a ticket happens they know what to do and vice versa,” Sampath said. “It’s a very logical extension to our business when you’re managing large portions of the infrastructure to manage their private network piece to it.”

References:

https://www.fiercewireless.com/private-wireless/verizons-arvin-singh-discusses-private-5g

https://www.verizon.com/about/news/verizon-private-5g-network-aircraft-hangar