Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

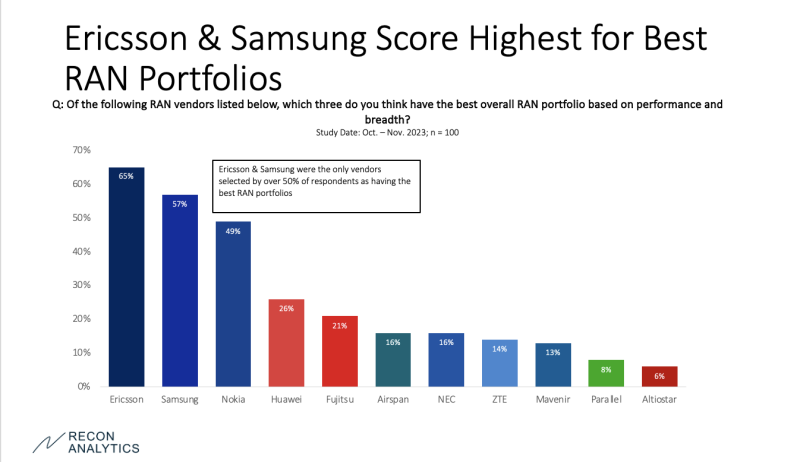

A Recon Analytics on-line survey results show that Ericsson, Nokia and Samsung are the top RAN vendors not including China. When the same global operators were asked which vendor had the best overall radio access network (RAN) portfolios, over 50% of respondents named Ericsson and Samsung as the top two. One would’ve expected Nokia to be #2, but the Finland based vendor ended 2023 on a negative trajectory when AT&T announced that it would work with Ericsson to deploy Open RAN equipment in its 5G network and exclude Nokia.

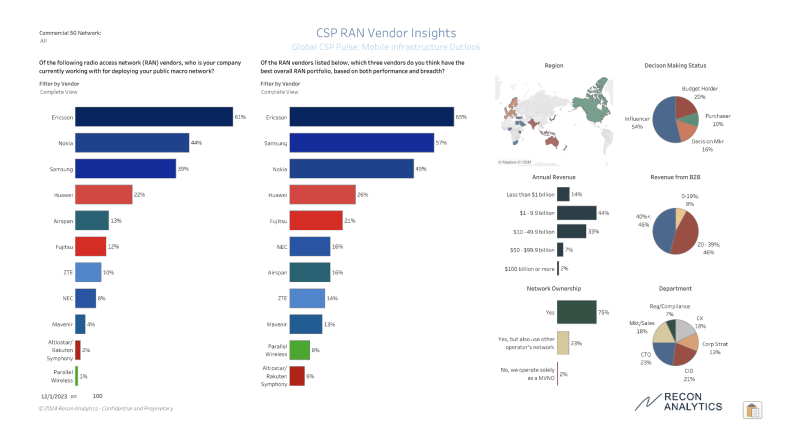

The survey was conducted in October and November, 2023 with 100 global network operators. Each respondent worked at a service provider that sells mobile services. Only one response per operator per country was allowed. Although a multinational operator like Orange France and Orange Belgium would count as two separate responses.

All respondents were required to have one of the following roles when it came to selecting network partners – influencer, budget holder, decision maker or purchaser.

Recon Analytics estimates there are only about 710 live commercial mobile networks in the world. The 100 network operators captured in its survey, represent the meaningful part of the world, according to Roger Entner, founder of Recon Analytics. However, the relatively low sample size results in a margin of error of 9.8%. Entner had earlier opined that “FWA was the 5G killer application.” That despite it is a wireles network configuration – not an application – and it is not one of the ITU-R use cases for 5G (aka IMT 2020).

Communication Service Provider RAN Vendor Insights:

When survey respondents were asked which vendors have the best overall RAN portfolio, they named Ericsson, Samsung and Nokia, in that order.

“Ericsson, with the overall highest level of positive responses for being a top three vendor, positions the company well for the future,” said Daryl Schoolar, analyst with Recon Analytics.

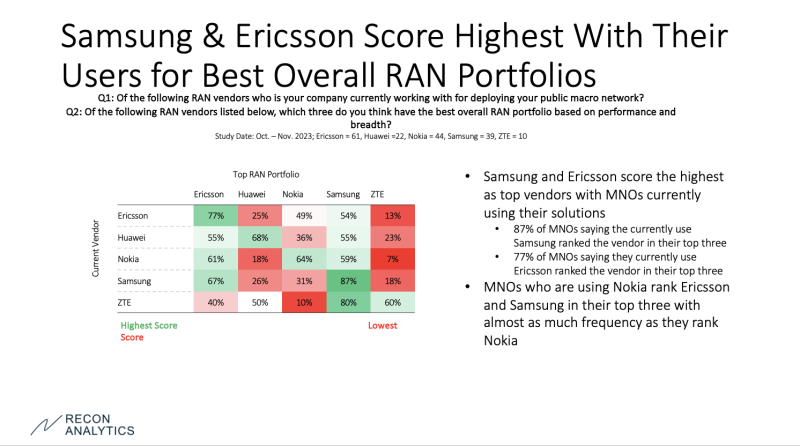

Of respondents who said they were currently using Ericsson equipment, 77% said Ericsson had one of the three best portfolios, followed by Samsung at 54%, and Nokia at 49%. 87% of respondents who say they are using Samsung gear list the Japan based vendor as having a top three portfolio.

“While Ericsson’s users don’t list it in their top three at the same frequency as Samsung, 77% is a strong showing and bodes well for its future,” said Schoolar. “Nokia has reason to be concerned as well. While its current users did select it in top three most often among the five vendors shown here, there was little separation between Nokia versus Ericsson and Samsung,” he added.

Meanwhile, Fujitsu and Mavenir (Open RAN only vendor) also scored well as vendors that operators are interested in for the future. Samsung’s top three status is 18 percentage points over its currently used status; Fujitsu’s top three status is 9 percentage points over currently used; and Mavenir’s top three status is 9 percentage points over currently used.

References:

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

LightCounting: Open RAN/vRAN market is pausing and regrouping

3 thoughts on “Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors”

Comments are closed.

From Light Reading:

“We expect the decline to continue in 2024, but to be less pronounced than in 2023, and the RAN market size to reach between $37 billion and $40 billion in 2024,” said Remy Pascal, a principal analyst with Omdia (owned by Informa which also owns Light Reading).

In December, when Omdia last crunched the numbers, it estimated the RAN market would generate sales of about $40.2 billion for 2023, down from about $45.2 billion the year before. In the worst-case scenario, then, sales could drop another 8% this year. The decline has been heavily blamed on a sharp contraction in North America, where big telcos have slashed capital expenditure on network equipment after a splurge in previous years.

The consistent message from the Nordic vendors has been that a rising tide of data traffic on mobile networks will eventually force operators to build additional capacity.

“[The] high-paced mobile data growth, further spurred by new use cases, is the underlying driver for the market to recover to a more normal level,” said Börje Ekholm, Ericsson’s CEO, in the introduction to the company’s third-quarter report. “We are also relatively early in the 5G upgrade cycle with 75% of all radio base station sites, outside China, not yet updated with 5G mid-band.”

Unfortunately, networks seem to be coping better with this traffic growth than equipment vendors would like. Nor have telcos seen much 5G-generated uplift in sales, despite Ericsson’s attempts to correlate 5G rollout with an improvement in average revenue per user. There is still no mobile application that demands a 5G as opposed to a 4G connection. Even if there were, it is doubtful this would boost consumer spending on telecom services. A likelier scenario is that money would flow to application developers.

Vendors are understandably worried, realizing their customers must grow if they are to sell much more equipment in future. It explains last year’s chatter about “network exposure.” Consumers might not spend more to receive a higher-speed, lower-latency connection, or for other network features. But application developers might. Through an initiative called CAMARA, the industry is trying to standardize the “northbound” application programming interfaces (APIs) between the 5G network and the services that sit on it. Developers would then pay for access to those APIs, using them to produce 5G-tailored applications. Or such is the hope.

Since last year’s Mobile World Congress (Feb 2023), when the GSM Association made a fuss about its “Open Gateway” APIs initiative, there has been little sign of commercial progress. Ericsson, meanwhile, has written down Vonage, the company it bought for about $6.2 billion to support these API-related efforts, by nearly $3 billion. Investors are not persuaded Ericsson is on the verge of big things. Since July 2022, when it bought Vonage, its share price has fallen by 22%.

Despite telco efforts to inject competition via “open” RAN, the market remains “concentrated,” said Dell’Oro. The top eight vendors – Huawei, Ericsson, Nokia, ZTE, Samsung, NEC, Fujitsu and Datang Mobile – accounted for 98% of the global market during the first nine months of 2023, Dell’Oro’s data shows, leaving a 2% sliver of sales split between the bottom 30 companies.

Regardless of open RAN, “more suppliers increasingly accept and realize that the traditional macro MBB [mobile broadband] market is extremely challenging to enter using the feature parity and pricing approach,” said Dell’Oro. That acceptance is prompting a “pivot” to segments where there is a greater chance of success, it reckons, including fixed wireless access, private wireless, neutral host and mobile broadband in rural and low-income markets.

Open RAN, though, is projected to account for between 7% and 10% of the RAN market this year. The concept was supposed to be about combining products from various specialists at the same mobile site, instead of buying an entire system from one vendor. Yet the biggest deal hailed as an open RAN one so far has gone to Ericsson. Under its $14 billion contract with AT&T, announced in December, it will initially stump up purpose-built baseband, RAN software and radios, the giant US telco has confirmed. For virtualization enthusiasts and smaller players, deals like that do not bode well.

https://www.lightreading.com/5g/ericsson-and-nokia-face-another-mobile-squeeze-in-2024

From Light Reading:

Outside China and India, big operators have slammed the brakes on network investment in response to inventory build-ups, inflationary pressure and flat revenues. For Ericsson, the world’s biggest western vendor of 5G equipment, the consequence last year was a 10% drop in sales on a constant-currency basis and a renewed focus on costs. Reported revenues fell 3%, to 263.4 billion Swedish kronor (US$25.2 billion), and Ericsson’s closely monitored gross margin shrank from 41.7% to 38.6%. After impairment charges affecting Vonage, the software company Ericsson bought for $6.2 billion in July 2022, the Swedish vendor went from a SEK19.1 billion ($1.8 billion) net profit the year before to a SEK26.1 billion ($2.5 billion) loss.

Ericsson is effectively camped out with its kiosk of goodies, waiting for the hunger pangs to overcome prospective customers reluctant to indulge. “It is important to note that, looking historically, large declines in the mobile network market are followed by a rebound,” said Börje Ekholm, Ericsson’s CEO, on his usual quarterly call with analysts. “Operators can sweat the assets up to a point but eventually will need to invest to manage the data traffic growth, cost, energy usage and, of course, network quality, and give the customer the experience that the customer demands.”

Sweating the assets, though, is what many will continue to do this year. In December, Omdia, a sister company to Light Reading, expected the market for radio access network products (RAN) to generate sales of about $40.2 billion in 2023, down from $45.2 billion the year before. Its latest ballpark estimate is that revenues will dip further in 2024, to between $37 billion and $40 billion. Dell’Oro, another market research firm, thinks RAN revenues will drop from about $40 billion in 2022 to roughly $35 billion this year.

“As we look ahead, 2024 will be a difficult year and market conditions will prevail, and so we currently expect the market outside China to further decline as our customers remain cautious and the investment pace normalizes in India,” said Ekholm. A speedy rollout of 5G in the huge Asian country slowed down massively in the final quarter, explaining why Ericsson’s network sales in India fell sequentially by as much as 40%.

Paring back

With no rebound likely this year, Ericsson has warned of further cuts and even a narrowing of its activities. Previous efforts to slash annual costs by SEK12 billion ($1.2 billion) have claimed about 9,000 jobs across what Ekholm described as “internal and external headcount.” In its latest quarterly report, Ericsson recorded staff numbers of 99,952 at the end of December, down from 105,529 a year before. But the figure seems likely to continue falling after this week’s update.

Preparing for a “challenging market” this year, Ekholm told analysts he would “focus on taking costs out where appropriate” and “really pare back some of the investment areas we’ve had.” The overarching goal is “to be as lean as possible,” he said. Further details were not forthcoming, but this will inevitably fuel speculation about a possible retreat from some activities. Research and development (R&D) spending fell by SEK200 million ($19 million) year-over-year for the fourth quarter, to about SEK13 billion ($1.2 billion), after cuts at both the networks and the cloud software and services units, although it grew 7% for the full year, to SEK50.7 billion ($4.9 billion).

Ericsson also remains hopeful that Vonage can bring about a recovery. Along with other parts of the industry, it has been working to standardize the application programming interfaces (APIs) between the 5G network and the apps it would support. The idea is that a software developer would be able to write better 5G apps after paying for access to the Vonage platform where these network features are exposed. Money would trickle down to operators and they, in turn, would be more inclined to invest in network upgrades.

Today, however, it all seems very convoluted, and there have been few signs of commercial progress on network APIs in the last year. Vonage’s sales rose just 2% year-over-year for the fourth quarter, amounting to SEK4.1 billion ($390 million) in Ericsson’s report. And revenues of SEK6.6 billion ($630 million) at the broader enterprise segment housing Vonage represented just 9% of the company total. Enterprise also recorded a SEK3.3 billion ($320 million) full-year loss (based on earnings before interest, tax and amortization).

The AT&T affair

Much of the attention later this year will be on a $14 billion networks contract with AT&T, struck at Nokia’s expense. It has been heavily promoted by Ericsson and AT&T as an “open RAN” affair. That should mean products include new interfaces allowing AT&T to pair Ericsson with other vendors when it would previously have had to buy the whole system from Ericsson.

Yet others, including Nokia, which is to be gradually phased out of the AT&T network, have described it as a “one vendor” deal. Although Fujitsu has been named as another supplier of radios, the contract will clearly make AT&T far more dependent on Ericsson than it is today. Even Ericsson acknowledges that its market share will grow in North America later this year thanks to the AT&T win.

Executives seemed wary of going into much detail about the contract on today’s call with analysts, but it is expected to have some impact on revenues in the second half. Ekholm also denied it would lead to “material rehirings” in the US, saying Ericsson is today more dependent on third-party contractors than in-house service engineers.

As for Ericsson’s long-suffering cloud software and services unit, it managed sales growth of 5% for 2023, to SEK63.6 billion ($6.1 billion), and narrowed its loss to just SEK200 million ($19.1 million), from SEK1.6 billion ($150 million) the year before. Efforts to boost profitability continue, and they could include additional pruning of the portfolio, said Carl Mellander, Ericsson’s soon-to-depart chief financial officer. Less parsimonious telcos would undoubtedly help.

https://www.lightreading.com/5g/ericsson-eyes-more-cuts-after-slashing-9-000-jobs-as-outlook-dims

Iain Morris, Light Reading:

This global RAN market dominated by Ericsson, Huawei and Nokia looks increasingly dysfunctional, too. Deemed a security threat by western governments, China’s Huawei can no longer sell 5G products in the UK and other European countries, and it has long been seen as a public enemy by US authorities. In a tit for tat, China has squeezed Ericsson and Nokia to the fringes. And outside China, Nokia looks in desperate shape.

Big US contracts have instead gone to Ericsson and South Korea’s Samsung, a RAN challenger, and other customers have not picked up the slack. What was a lightning-fast rollout of 5G in India last year has now shifted down several gears. While sales at Ericsson have also dwindled, Nokia’s fell dramatically for the recent first quarter. Having recorded an operating profit for 12 consecutive quarters, its mobile networks business group this year slumped to its first-ever loss.

It’s unsettling for telcos such as Vodafone UK, which have had few other choices. “What is the state of Nokia? Not great, from what I read. It’s worrying,” said Andrea Dona, the operator’s chief network officer. “So we need to inject diversity in the network. We need another option. Samsung could be it.”

The South Korean vendor has come to figure prominently in Vodafone UK’s network strategy. Under government orders, Vodafone is stripping out Huawei equipment and software installed at 2,500 RAN sites, a job it must finish by the end of 2027. Using a system called open RAN, it has been replacing those with a mix of vendors. But Samsung is the key. It is not only down to supply many of the radio units (RUs) but also the sole provider of RAN software.

After spending about two years on technology trials at a “golden cluster” of around 20 sites in Devon, a county in southwest England, Vodafone kicked off its commercial deployment last August. Vodafone is not sharing current site numbers, but Dona insists it has now gone significantly beyond that original golden cluster. It has also ticked off some important milestones.

The most recent was the critical pairing of Samsung’s software with RUs supplied by Japan’s NEC. The original goal of open RAN was to find an alternative to CPRI, a fronthaul interface that has required operators to buy software and RUs from the same vendor’s system. With an open fronthaul interface, they would supposedly be able to combine software from one vendor with RUs from another. Yet this remains tricky.

The big problem is an advanced 5G technology called massive MIMO, which crams dozens of transmitters and receivers into antenna units. “Open interfaces does not equal multivendor,” said Ericsson in a guide to massive MIMO published in February. It notes four “fundamental challenges.”

First, new interfaces do not minimize the cost and effort of systems integration, the work a vendor would normally do before bringing a fully integrated product to market. Different vendors also need to coordinate on software releases to maintain interoperability, said Ericsson. Support for technology features is dictated by a “minimum common denominator,” it added, “resulting in performance limitations.” Finally, in the event of problems, identifying the vendor at fault, and therefore responsible for providing a fix, can be difficult.

Much of this seems to echo comments made by Tommi Uitto, the head of Nokia’s mobile business, at Mobile World Congress (MWC). Massive MIMO relies on complex algorithms in both the RU and distributed unit (DU), a server box hosting RAN software, and these need to match, he told Light Reading.

“If I have to connect my DU to someone else’s massive MIMO RU, he will have to make changes to his software, I will have to make changes to my software, or both will,” he said. Falling back on simpler algorithms could make integration easier, but these could also reduce throughput by up to 80%, according to Uitto.

In February, nevertheless, Vodafone showed off its first open RAN site where a massive MIMO NEC radio, featuring 64 transmitters and receivers, was linked to a Samsung DU. “You need to choose your partners and be very specific to your partners about the role they have and the rules of engagement,” said Dona, when asked how it was accomplished.

He insists, too, that performance is not worse than Vodafone would get from a single-vendor product. “There are difficulties to overcome, obviously, but I am not going to compromise, and we’ve worked very hard to ensure parity on the KPIs [key performance indicators],” he said. “I am not going to introduce something that doesn’t perform to at least the same level, if not better.”

Unlike several years ago, when Nokia was hurt by 5G product problems, its current malaise largely reflects the market downturn. Outside China and the US, Nokia’s RAN market share has recently grown, according to independent analysts. It has won plaudits from other commentators on open RAN. AT&T’s decision to replace Nokia across one third of sites with Ericsson, already the supplier to the other two thirds, seems mainly about having a single technology platform and the efficiencies this could bring.

Nevertheless, Nokia’s technology approach does not align with Vodafone UK’s. The open RAN the telco is building will also be entirely virtualized, using technologies that derive from the IT world. This means running the Samsung software on Intel chips in Dell servers and relying on Wind River as the cloud platform. Nokia is unopposed to much of this, but it prefers to keep its Layer 1 software – a resource-hungry part of the RAN – on custom silicon from Marvell Technology. Smart network interface cards (SmartNICs) hosting these Marvell chips can slot directly into servers.

Nokia does not, accordingly, have Layer 1 code that works with Intel’s chips. It has recently taken issue with the marketing of these as “general purpose” central processing units (CPUs), arguing that new Intel generations like Granite Rapids-D feature plenty of customization and embed that in a server. “It’s not a general-purpose processor,” said Uitto at MWC. “And if you build servers with only those CPUs, it would be ridiculous because you’d have all this overhead of hardware acceleration in the product cost and power consumption.”

The Finnish vendor’s earlier criticisms focused on the shortcomings of using general-purpose silicon for Layer 1 functions. Even Ericsson, which uses Intel chips in its virtual RAN products, says custom silicon will remain ahead for some key performance measures. In comments emailed to Light Reading earlier this year, Michael Begley, the head of Ericsson’s RAN compute product line, said that “purpose-built hardware will continue to be the most energy-efficient and compact hardware for radio site deployments going forward.”

But Dona says Vodafone has not seen any drawbacks. “We wouldn’t have gone to mass deployment if we hadn’t met the minimum criteria, but it took a while,” he said, noting that it has been nearly three years since Vodafone UK first announced its open RAN partners.

Vodafone has now taken what Dona calls the same “blueprint” into parts of Romania, where it also needs to replace Huawei under government orders (there is a huge amount of Huawei across Vodafone’s European footprint). And there is a strong hint from Dona that this Samsung-based template will play an even bigger role in future. Margherita Della Valle, Vodafone’s CEO, confirmed on a recent earnings call that suppliers have been invited to pitch for future work across Vodafone’s entire European and African footprint of about 170,000 sites.

The danger for Nokia could be the perception it is in financial trouble and that the market needs alternatives. This gave impetus to the open RAN movement several years ago, when operators were unimpressed by Nokia’s initial 5G products. If decision makers at other telcos share Dona’s view about the “state” of Nokia, and are convinced they must introduce new suppliers, Nokia’s condition may only worsen.

But if it were perilously weakened, operators would simply be substituting one vendor for another, not boosting choice. The consolidation that happened years ago showed that a global RAN market supporting low-cost mobile usage at scale was not big enough for more than a handful of vendors. Last year, it shrank 11%, according to Omdia (a Light Reading sister company).

Omdia forecasts another decline this year of between 4% and 6%. Nokia’s mobile business, meanwhile, has just suffered a first-quarter operating loss of €42 million (US$45 million), after sales dropped 39% year-over-year, to less than €1.6 billion ($1.7 billion). It worryingly suggests there is not enough pie to keep even a few vendors well nourished.

https://www.lightreading.com/open-ran/nokia-plight-shows-need-for-samsung