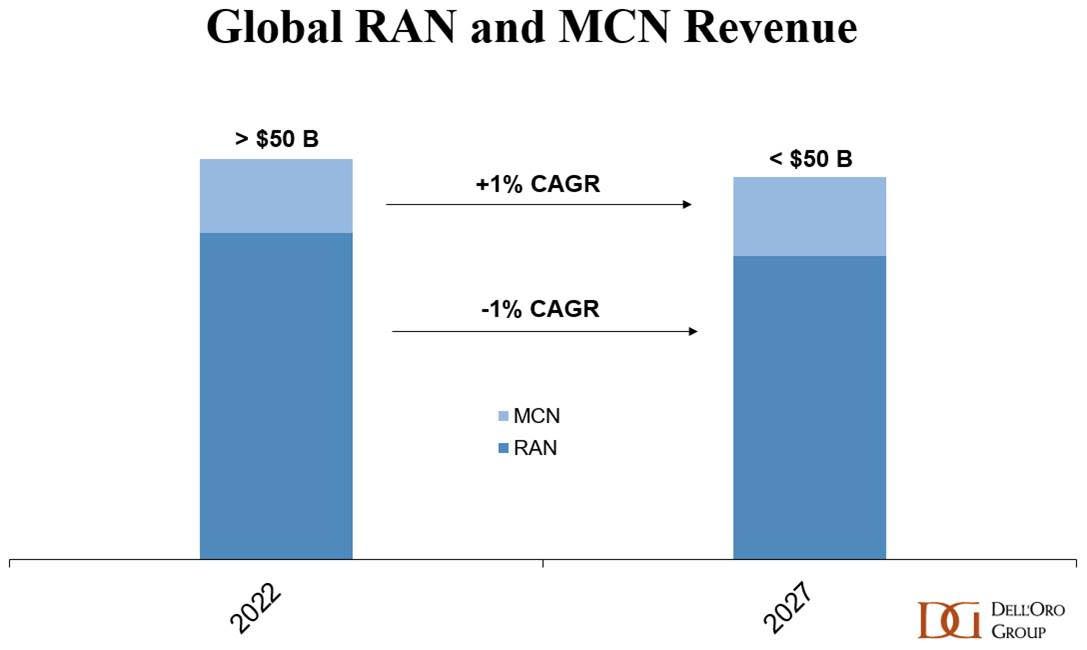

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

According to a newly published forecast report by Dell’Oro Group,the Radio Access Network (RAN) market is done expanding for now. Following the 40% to 50% ascent between 2017 and 2021, RAN revenues flattened out in 2022 and these trends extended to 1Q 2023.

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak,” said Stefan Pongratz, Vice President at Dell’Oro Group.

“Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?” Pongratz added.

Additional highlights from the Mobile RAN 5-Year July 2023 Forecast Report:

- Global RAN is projected to decline at a 1 percent CAGR over the next five years.

- The less advanced 5G regions are expected to perform better while the more developed 5G regions, such as North America and China, are projected to record steeper declines.

- LTE is still handling the majority of the mobile data traffic, but the focus when it comes to new RAN investments is clearly on 5G. Even with the more challenging comparisons, 5G is projected to grow another 20 percent to 30 percent by 2027, which will not be enough to offset steep declines in LTE.

- With mmWave comprising a low single-digit share of the RAN market and skepticism growing about the MBB business case, it is worth noting that our position has not changed. We still envision that the mmWave spectrum will play a pivotal role in the long-term capacity roadmap.

……………………………………………………………………………………………………………………….

Separately, Dell’Oro again lowered its forecasts for the Mobile Core Network market (which is now 5G SA core network), this time citing a slowdown in customer growth. It now predicts that the worldwide market for mobile core networks will expand at a CAGR of 1% over the next five years, having previously forecast a 2% CAGR as recently as January.

“We have reduced our forecast for the third consecutive time, primarily caused, this time, by an expected slowdown in subscriber growth,” said Dave Bolan, Research Director at Dell’Oro Group.

Dave said that Dell’Oro has reduced its expectations for the Multi-Access Edge Computing (MEC) market (which requires 5G SA core network). It now anticipates MEC will have a CAGR of 31%, noting that commercially-viable enterprise applications are taking much longer to come to fruition than many had hoped.

“Mobile Network Operators (MNOs) are concerned about inflation, a possible recession, and political conflicts. They are therefore being restrained in their capital expenditures, another factor weighing in on a more conservative forecast,” said Bolan. “As we continue refining our count of MNOs that have launched 5G Standalone (5G SA) eMMB networks, we note that only 4 MNOs have commercially deployed new 5G SA networks compared to six in the first half of 2022,” he added.

Additional highlights from the Mobile Core Network & Multi-Access Edge Computing 5-Year July 2023 Forecast Report:

- Year-over-year MCN revenue growth rates are projected to be flat in 2026 and turn negative in 2027.

- The North America and China regions are expected to have negative CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific excluding China regions are expected to have the highest positive CAGRs.

Vodafone became one of those first-half 2023 launches, when it brought 5G Ultra to market in the UK in late June. In its latest Mobility Report, published around the same time, Ericsson noted that while around 240 telcos have launched commercial 5G services, only 35 of them have brought standalone 5G to market.

That should bode well for the mobile core market, and indeed it is faring better than the RAN space, in growth potential terms, at least.

Nonetheless, Dell’Oro predicts that year-on-year growth rates in mobile core network revenues will be flat by 2026 and turn negative the following year.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year July Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

RAN Market to Decline at a 1 Percent CAGR Through 2027, According to Dell’Oro Group

Slower Subscriber Growth to Cut Mobile Core Network Market Growth, According to Dell’Oro Group

One thought on “Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR”

Comments are closed.

Earlier this year, a report from Mobile Experts forecast that 5G RAN investments would decline over the next few years before 6G forces another ramp up. Mobile Experts’ new forecast shows how China and the rest of the world have become entirely separate markets. While Chinese operators will work to meet their government’s expectations of 5G development over the next two years, the United States and other countries will experience a decline in 5G investment, the firm stated. “We’ve seen this pattern many times, in 2000, 2008, 2016 and now 2023,” said Mobile Experts chief analyst Joe Madden in a statement. “The second half of every ‘G’ involves significant reductions in base station pricing, as well as shifts in volume. Every ‘G’ migrates from a growth opportunity to a cash-cow opportunity. This time, we have some interesting shifts toward software and private 5G at the same time, which offset the natural decline of the market.” High inflation and increasing interest rates also are affecting carriers’ spending plans. For example, Dish Network, which the U.S. government set up to become the nation’s fourth facilities-based mobile carrier, is taking a pause in its 5G network buildout after having met its June 2023 coverage mandates.

https://www.fiercewireless.com/tech/ran-market-downturn-steeper-expected-delloro https://www.fiercewireless.com/tech/ran-revenue-decline-until-6g-comes-along-report