T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile US today reported a 4% year-over-year YoY) increase in service revenues, to about $16.4 billion, for the recent second quarter. Total sales increased 3%, to almost $19.8 billion. The un-carrier’s profitability metrics were even better. Adjusted earnings (before interest, tax, depreciation and amortization) rose 9%, to nearly $8.1 billion. T-Mobile’s adjusted free cash flow rocketed 54%, to about $4.4 billion. There were also several positive changes to full-year guidance, which included raising the outlook for free cash flow by $150 million (at the midpoint), to $16.8 billion.

“It was another industry-leading quarter for T-Mobile as our continued focus on delivering customers more value and a superior network experience enabled us to outperform our peers in the marketplace and translated into outsized financial growth,” said Mike Sievert, CEO of T-Mobile. “Our formula is continuing to work and we’ve got a lot of room to run including pursuing new growth opportunities that bring the Un-carrier experience to more customers and new markets. This incredible momentum makes us even more excited for what’s next for T-Mobile, and our confidence is reflected in our raised guidance for the full year ahead.”

Peter Osvaldik, T-Mobile’s chief financial officer, boasted “unmatched capital efficiency” on today’s call with analysts. “While our longer-term expectations continue to be in the $9 to $10 billion range annually, as we discussed before, 2024 is a bit lower given certain capital-efficient network activities such as spectrum re-farming and deploying additional 2.5GHz licenses from Auction 108, benefiting from the significant 5G radio deployments during our merger integration,” he said, referring to a previous frequency sale and the $26 billion merger with Sprint in 2020. Site upgrades and build activity is planned in the fourth quarter, he said.

Other T-Mo Highlights:

Industry-Leading Customer Growth Fueled by Best Network and Best Value Combination (1)

- Postpaid net account additions of 301 thousand, best in industry

- Postpaid net customer additions of 1.3 million, best in industry, crossed 100 million postpaid customers milestone

- Postpaid phone net customer additions of 777 thousand, best in industry, highest Q2 in company history, and postpaid phone churn of 0.80%

- High Speed Internet net customer additions of 406 thousand, best in industry, highest share of industry net additions ever

Translating Industry-Leading Customer Growth Into Industry-Leading Financial Performance

- Service revenues of $16.4 billion grew 4% year-over-year, best in industry growth

- Postpaid service revenues of $12.9 billion grew 7% year-over-year, best in industry growth

- Net income of $2.9 billion grew 32% year-over-year, best in industry growth

- Diluted earnings per share (“EPS”) of $2.49 grew 34% year-over-year, best in industry growth

- Core Adjusted EBITDA (2) of $8.0 billion grew 9% year-over-year, best in industry growth

- Net cash provided by operating activities of $5.5 billion, record high and grew 27% year-over-year

- Adjusted Free Cash Flow (2) of $4.4 billion, record high and grew 54% year-over-year

- Returned $3.0 billion to stockholders in Q2 2024, including repurchases of $2.3 billion of common stock and a quarterly dividend payment of $759 million

Overall Network Leader with Largest, Fastest and Most Advanced 5G Network:

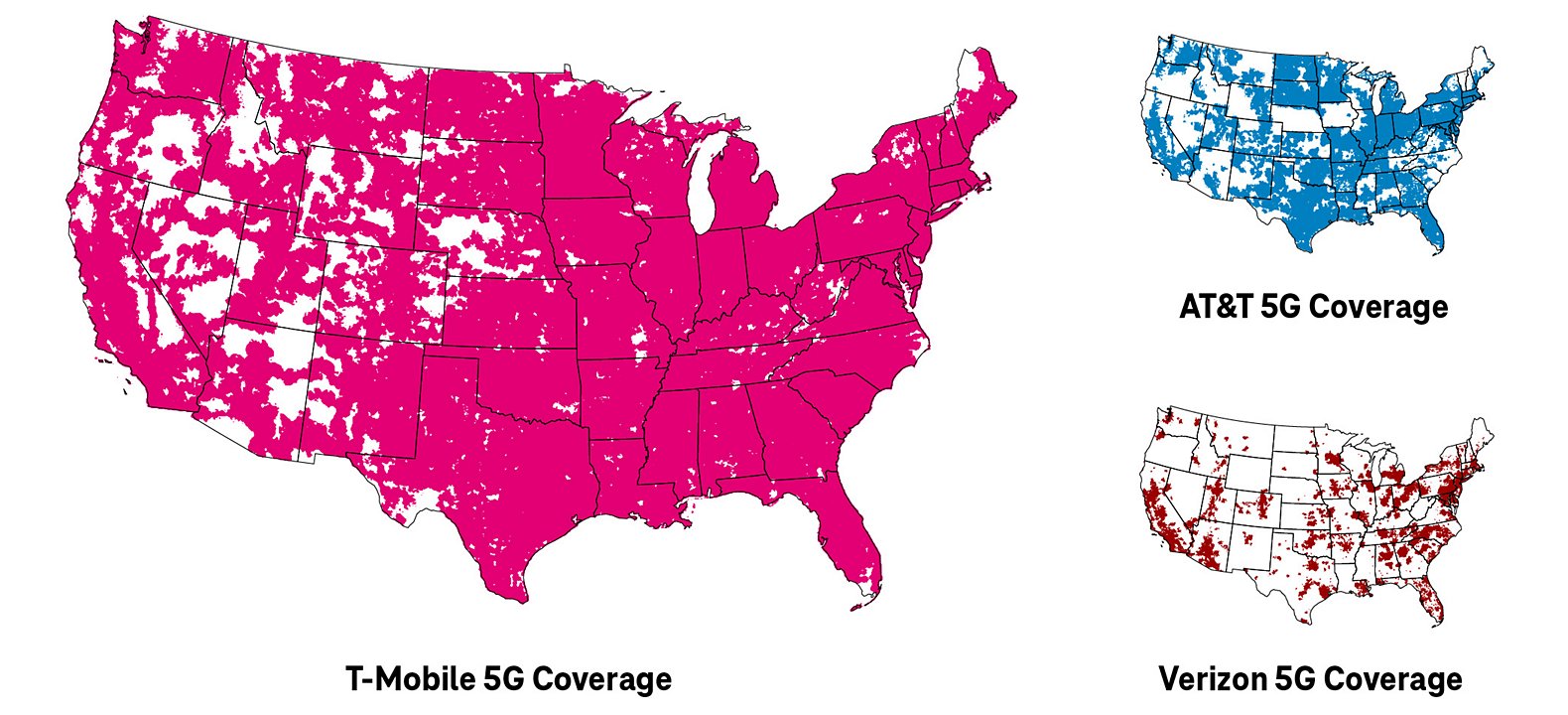

T-Mobile’s network breadth, depth and technology leadership is expected to keep the company years ahead of the competition with total 5G and Ultra Capacity 5G coverage area that continues to far exceed that of the next closest competitor. The company’s unique multi-layer approach to 5G, with dedicated standalone 5G deployed nationwide across 600MHz, 1.9GHz, and 2.5GHz, delivers customers a consistently strong experience and 87% of 5G traffic is on sites with all three spectrum bands deployed.

T-Mobile’s 5G leadership has translated into overall network leadership, with the company continuing to earn third-party recognition for its overall network performance:

- Ookla: In its Speedtest Connectivity United States 1H 2024 report, T-Mobile ranked as the top network performer in seven categories, including wins for fastest overall and 5G network and most consistent overall network, along with best overall and 5G mobile video experience, best gaming experience and highest ranking consumer sentiment.

- Opensignal: In its latest USA Mobile Network Experience report, T-Mobile ranked first for all overall network experience metrics while also earning additional wins for 5G with the fastest 5G download speeds, best 5G coverage experience and best 5G availability.

|

Notes: See 5G device, coverage, and access details at T-Mobile.com. Ookla awards: Based on analysis by Ookla® of Speedtest Intelligence® data for the U.S., 1H 2024. Ookla trademarks used under license and reprinted with permission. Opensignal Awards: USA: Mobile Network Experience Report July 2024, based on independent analysis of mobile measurements recorded during the period March 1 – May 29, 2024. © 2024 Opensignal Limited. |

- The 5G availability gap between T-Mobile and its competitors measures “what proportion of time people have a network connection, in places they most commonly frequent.” T-Mobile scored 67.9% on average. AT&T managed only 11.8%, while Verizon was on a lousy 7.7%. That gap between one player and the other two on such a seemingly important metric may concern investors in AT&T and Verizon.

- 87% of T-Mo’s 5G traffic is now carried at sites where equipment supports all three of the 600MHz, 1.9GHz and 2.5GHz spectrum bands. AT&T and Verizon, by contrast, rely partly on airwaves in much higher ranges, including frequencies in and around the 3.5GHz band. Often described as a sweet spot for 5G, combining decent propagation with sufficient capacity, this “C-band” has come in for heavy criticism from Moffett. “Put simply, C-band isn’t very good spectrum,” he said in a research note issued earlier this month.

- T-Mo’s CAPEX had decreased and likely will continue to do so. That’s partly why free cash flow is high and rising. Capital expenditure fell from $14 billion in 2022, to $9.8 billion last year, and a dip below the $9 billion mark is now forecast for 2024.

- Net postpaid phone additions were up 777,000 in the second quarter, which resulted in T-Mobile having more than 77.2 million postpaid subs in total. For comparison, AT&T has 88 million postpaid subscribers and 19.3 million prepaid subscribers. Verizon has 94 million wireless retail +30.2 million business postpaid connections for a total of 124.2 million postpaid subs.

………………………………………………………………………………………………………………………………………………………..

Fiber Optic Network Opportunity:

Historically a pure-play wireless company, T-Mobile is on a fiber binge. In April, it announced intentions to acquire Lumos through a joint venture with investment firm EQT. More recently, it’s teaming with KKR to invest $4.9 billion for a 50% equity stake in Metronet in a joint venture with KKR. When combined, these deals position T-Mobile to reach about 10 million homes with fiber by the end of 2030. That’s on top of the fiber foray it’s doing with open access network operators like Intrepid Fiber, SiFi Networks and Tillman FiberCo.

T-Mo’s fiber appetite is an adjunct to its fixed wireless access (FWA) service. That’s its high-speed internet service that uses extra capacity on its mobile network. T-Mobile ended Q2 with 5.6 million high-speed internet customers. “We sell fixed wireless access in places in the network where we have excess capacity that won’t be consumed either now or in the future by normal mobile usage,” said T-Mobile Marketing President Mike Katz on the earnings call.

“That’s where we sell fixed wireless. In places where we deploy fiber, there’s an opportunity for us take some of the demand that we’re seeing in fixed wireless where those excess capacity pockets don’t exist and move them to fiber, so there’s really a bunch of complementary features to it,” he continued.

“One thing we feel very strongly about is that these (fiber optic network) transactions are not defensive of our mobile business,” CEO Sievert said. “We believe that our mobile business stands strongly alone. Consumer choice has been made very clear that wireless is a deeply considered sale. It’s the primary purchase decision in a connected life and that people will choose the wireless company that is right for them and we believe we will compete effectively as a pure play wireless company regardless of our simultaneous participation in broadband.”

Put together with its 5G broadband service, T-Mobile’s expanding web of physical fiber lines could help the company reach more than 17 million homes by 2030, according to New Street Research. That would trail AT&T and Verizon, which could respectively cover 38 million and 25 million homes with a fixed-line or wireless broadband offering, the research firm says.

“Because they’re in the game, they’re closing the gap with Verizon and AT&T, but they’re well behind,” New Street analyst Jonathan Chaplin said of T-Mobile. “If they really want to build a business the size of AT&T, they’d have to buy a Comcast or a Charter [Communications].”

“It’s kind of a land grab,” said BNP Paribas telecom analyst Sam McHugh, adding that telecom companies are rushing into neighborhoods where residents aren’t happy with their cable provider and don’t yet have fiber-optic service available. “Investors are worried that the more they invest in fiber, the more they become like AT&T and Verizon both in terms of financial profile and business mix,” McHugh said. Any aggressive moves could also drive up the prices of potential deal targets.

“If the whole fiber industry realizes, ‘Hey we have this big monster coming in and buying up fiber,’ it’s probably not the word they want on the street,” said Armand Musey, president of telecom advisory firm Summit Ridge Group. “Suddenly, all the sellers would have their antennas up.”

………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/t-mobile-results-pile-5g-humiliation-onto-at-t-and-verizon

https://www.verizon.com/about/sites/default/files/Verizon_Fact_Sheet.pdf

https://www.t-mobile.com/news/network/t-mobile-kkr-joint-venture-to-acquire-metronet

https://www.wsj.com/business/telecom/t-mobile-fiber-optic-internet-connection-380957ef

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

3 thoughts on “T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business”

Comments are closed.

From Seeking Alpha: AT&T’s Earnings Highlights Continued Recovery Potential Aug 1, 2024 AT&T refocused its portfolio by spinning off unrelated assets like DirecTV and TimeWarner, leading to a new business model for stronger shareholder returns. The company’s priorities include growing 5G, reducing debt to maintain a 6% dividend yield, and achieving the long-term net debt-to-adjusted EBITDA target by 2025. AT&T has seen YoY growth in all business segments, particularly in its fiber business, with strong revenue and EBITDA margin growth.

AT&T made the classic mistake of attempting to become a mega conglomerate. The company invested in wholly unrelated assets such as DirecTV and TimeWarner, both of which it was forced to spin-off. The company’s recent earnings highlight the strength of its new business model, which will help shareholder returns.

The company has a number of business priorities we’d like to see it focus on with its refocused portfolio. The first goal is to grow 5G, now that the major investment and spectrum purchase cycles are done. The company will hopefully be able to grow revenue and keep expenses low. The company is combining this with run-rate cost savings expected to be in the billions, and synergies between its infrastructure.

AT&T has been punished by the market for a long time by its debt load. The company expects to achieve its long-term net debt-to-adjusted EBITDA target of 2.5x in 1H 2025. That will enable the company to maintain its dividend of almost 6% and drive overall shareholder returns. AT&T YoY Growth The company has seen strong quantifiable YoY growth among all of its business segments. AT&T reported postpaid phone subscribers increase by 2% along with a similar 2% growth in ARPU. That growth lines up with inflation for ARPU, but it shows the company’s ability to continue getting subscribers in a saturated market. This enabled the company to both grow its revenue and EBITDA margin.

The company’s fiber business has also remained incredibly strong, with fiber revenues growing almost 18% YoY. That led to strong top line EBITDA and EBITDA margin growth.

The company has managed to grow to 8.8 million total fiber subscribers, as average fiber revenue has gone up to almost $2 billion quarterly. As someone who’s anecdotally used both AT&T fiber and major competitor Comcast fiber, AT&T is substantially more reliable, offers symmetric up and down bandwidth, and has no data caps. That makes it a much more pleasing experience. The company has worked to chase synergies with its AT&T mobility business, with not only fiber subscriptions growing, but the % of customers with AT&T mobility has grown as well. That ratio is now almost 40% for the company. The company’s focus in both these segments will help long-term revenue growth. AT&T Financial Performance The company had reasonably strong performance through the quarter, even though CFFO declined.

Financially, the company’s overall business remained strong. The company’s revenue remained roughly flat, however, the company’s EBITDA margin grew by 1% to more than $11.3 billion in adjusted EBITDA. The company benefited from strength across the board. EPS of $0.57 declined slightly YoY, but most of the impact was from various depreciation and retirement costs. The company’s FCF remains strong, and the company continues to generate strong FCF from DirecTV despite the business’ declining nature. The company’s FCF yield annualized is ~15% which will enable massive shareholder returns. AT&T Capital Allocation The company’s capital allocation continues to be supported by FCF and its ability to turn that into shareholder returns. This is versus the company’s modest $135 billion market capitalization. AT&T Investor Presentation AT&T Investor Presentation The company has continued to manage its investing while betting on its future and growth. The company spent $4.9 billion in capital investment, annualized at almost $20 billion. The company expects $21.5 billion in capital investment for 2024, with lower vendor financing payments. That enables the company to invest more directly into its business. The company has managed to reduce net debt by $5.1 billion while growing its EBITDA. The company remains on track to hit 2.5x in the next year. This has come with reduced vendor and financing obligations as well, and the company’s average interest is a mere 4.2%. That means the company is paying only ~$5.5 billion in annual interest, well below market rates, and it’s something it can comfortably afford. The company’s cash flow enables strong continued shareholder returns.

AT&T Shareholder Returns

The company’s 2024 guidance shows the company’s ability to continue driving shareholder returns. Even if the large company isn’t growing like crazy, it’s still growing. The company is seeing 3% adjusted EBITDA growth and continued revenue strength. Capital investment is remaining hefty as the company is continuing to invest in its business for the long term. The company’s adjusted EPS puts it in the solid single-digit P/E ratio range, and the company’s Free Cash Flow (FCF) is $17.5 billion. That’s FCF that can comfortably cover the company’s almost 6% dividend yield and support share buybacks and other forms of returns as well. For patient investors, we expect shareholder returns to continue growing. Thesis Risk The largest risk to our thesis is AT&T management’s history of lofty ambitions and spending on poor investments. The company has worked hard to clean up its portfolio of assets and drive future returns, however, there’s no guarantee that management doesn’t get carried away in the future and make more poor decisions.

Conclusion: AT&T has recovered by 40% from its 52-week lows set last August. Despite that massive recovery, the company has room to grow as investors accept what we’ve argued for a while. The company’s debt is not a concern, with its long-term duration and 4.2% average weighted rate. That, combined with growing EBITDA, can enable the debt to be paid down easily. At the same time, the company is continuing to generate strong FCF. It’s maintaining its dividend yield of almost 6%, and it has the ability to drive hefty shareholder returns through repurchases, debt pay down, and dividends. All of that together helps make the company a valuable long-term investment opportunity.

T-Mobile CEO Mike Sievert hinted at some of the un-carrier’s opportunities and strategies during T-Mobile’s quarterly conference call on Wednesday: AI, network slicing and satellites. Each of those technologies represents an opportunity for T-Mobile to make more money, according to Sievert.

1. “AI growth and AI workloads are going to be a way for us to increasingly showcase that [network] differentiation, especially as AI begins to make the leap from textual interfaces to much more video, audio, imagery,” he said. “It’s early days, but I think this is a nice tailwind for our business, because it’s going to be important that we’re able to showcase these advantages.” However, Sievert didn’t say anything about selling AI services directly to end users, like SK Telecom hopes to do.

2. 5G network slicing, which requires a 5G standalone (SA) systems, allows T-Mobile to dedicate a chunk of its network capacity to a specific customer. The operator first put network slicing to use in its T-Priority service for first responders.

“We waited a long time before starting to talk about all this stuff, because we wanted to see a real business model develop around it,” Sievert explained. “But the moment’s kind of arriving, and T-Priority’s certainly an expression of it.”

Sievert said network slicing will create a direct revenue opportunity from customers paying for the service, as well as a “share taking opportunity” among customers who shift their phones to T-Mobile because of its advanced offerings

3. Sievert said that T-Mobile recently launched a beta test of its direct-to-device (D2D) service with SpaceX. That offering connects T-Mobile customers directly to SpaceX Starlink satellites when they’re outside of T-Mobile’s 5G coverage area.

“We see things coming together pretty quickly,” Sievert said, hinting that a commercial launch would happen relatively soon. He did not provide a firm launch date. Nonetheless, Sievert explained that T-Mobile will make money from those satellite connections by offering the service only on its most expensive plans. That, he said, will encourage customers to upgrade to those more expensive plans.

But Sievert also held out the possibility that T-Mobile would charge for SpaceX connections on an a la carte basis. “For those that don’t have the plans that include it, and lots of other customers, there may be opportunities there,” he said, without providing details.

……………………………………………………………………………………………

“To be sure, T-Mobile is still running circles around its competitors,” wrote the financial analysts at MoffettNathanson in a note to investors. “Over the past week, the market celebrated roughly in-line results and tepid guidance from each of AT&T and Verizon. T-Mobile, by contrast, beat on virtually every metric in today’s Q4 report, and their guidance for 2025, at least, promises more of the same.”

…………………………………………………………………………………………..

https://www.lightreading.com/ai-machine-learning/t-mobile-ceo-we-ll-make-money-from-ai-traffic-network-slicing-and-satellites

T-Mobile CEO Mike Sievert hinted at some of the un-carrier’s opportunities and strategies during T-Mobile’s quarterly conference call on Wednesday: AI, network slicing and satellites. Each of those technologies represents an opportunity for T-Mobile to make more money, according to Sievert.

1. “AI growth and AI workloads are going to be a way for us to increasingly showcase that [network] differentiation, especially as AI begins to make the leap from textual interfaces to much more video, audio, imagery,” he said. “It’s early days, but I think this is a nice tailwind for our business, because it’s going to be important that we’re able to showcase these advantages.” However, Sievert didn’t say anything about selling AI services directly to end users, like SK Telecom hopes to do.

2. 5G network slicing, which requires a 5G standalone (SA) systems, allows T-Mobile to dedicate a chunk of its network capacity to a specific customer. The operator first put network slicing to use in its T-Priority service for first responders.

“We waited a long time before starting to talk about all this stuff, because we wanted to see a real business model develop around it,” Sievert explained. “But the moment’s kind of arriving, and T-Priority’s certainly an expression of it.”

Sievert said network slicing will create a direct revenue opportunity from customers paying for the service, as well as a “share taking opportunity” among customers who shift their phones to T-Mobile because of its advanced offerings

3. Sievert said that T-Mobile recently launched a beta test of its direct-to-device (D2D) service with SpaceX. That offering connects T-Mobile customers directly to SpaceX Starlink satellites when they’re outside of T-Mobile’s 5G coverage area.

“We see things coming together pretty quickly,” Sievert said, hinting that a commercial launch would happen relatively soon. He did not provide a firm launch date. Nonetheless, Sievert explained that T-Mobile will make money from those satellite connections by offering the service only on its most expensive plans. That, he said, will encourage customers to upgrade to those more expensive plans.

But Sievert also held out the possibility that T-Mobile would charge for SpaceX connections on an a la carte basis. “For those that don’t have the plans that include it, and lots of other customers, there may be opportunities there,” he said, without providing details.

……………………………………………………………………………………………

“To be sure, T-Mobile is still running circles around its competitors,” wrote the financial analysts at MoffettNathanson in a note to investors. “Over the past week, the market celebrated roughly in-line results and tepid guidance from each of AT&T and Verizon. T-Mobile, by contrast, beat on virtually every metric in today’s Q4 report, and their guidance for 2025, at least, promises more of the same.”

…………………………………………………………………………………………..

https://www.lightreading.com/ai-machine-learning/t-mobile-ceo-we-ll-make-money-from-ai-traffic-network-slicing-and-satellites