Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

The U.S. is at the forefront of fixed wireless access (FWA) deployments, with many major wireless carriers, including T-Mobile, Verizon, AT&T and UScellular targeting expansion.

T-Mobile has built up a lead in terms of 5G fixed-wireless market share, with Verizon following closely, and AT&T recently launching a new FWA service – AT&T Internet Air. We examined Ookla Speedtest data to understand how FWA performance is evolving in the U.S., and how it is impacting churn in the market.

Key Points:

- T-Mobile & Verizon 5G FWA performance holding up well nationally. Despite strong customer growth, both T-Mobile and Verizon have maintained performance levels over the past year according to Speedtest data. Both ISPs recorded similar median download speeds in Q3 2023, although T-Mobile maintains an edge on median upload performance. Despite this, there are significant differences in performance at a State-level, and for urban versus rural locations.

- Cable & DSL providers bear the brunt of user churn. The FWA value proposition is clearly resonating most with existing cable and DSL customers, which make up the vast bulk of churners to both T-Mobile’s and Verizon’s FWA services. It’s not one-way traffic however, with T-Mobile’s larger user base in particular showing some attrition to cable providers. In rural locations where options are more limited, FWA services are increasingly going head to head, with over 10% of users joining Verizon’s FWA service coming from T-Mobile.

- Clear signs that download performance could be a key contributor to churn in the market. Our analysis of the customers of major ISPs in the US that have churned to T-Mobile’s FWA service shows that their median download performance before churning was below the median performance of all customers of these ISPs, indicating a performance short-fall that is likely contributing towards churn.

- Further C-band spectrum will serve to strengthen FWA’s case. The release and deployment of additional C-band spectrum for all three national cellular carriers, and AT&T’s new FWA service will drive further performance gains, and further competitive pressure in 2024.

T-Mobile and Verizon FWA scaling strongly and national performance holding up well:

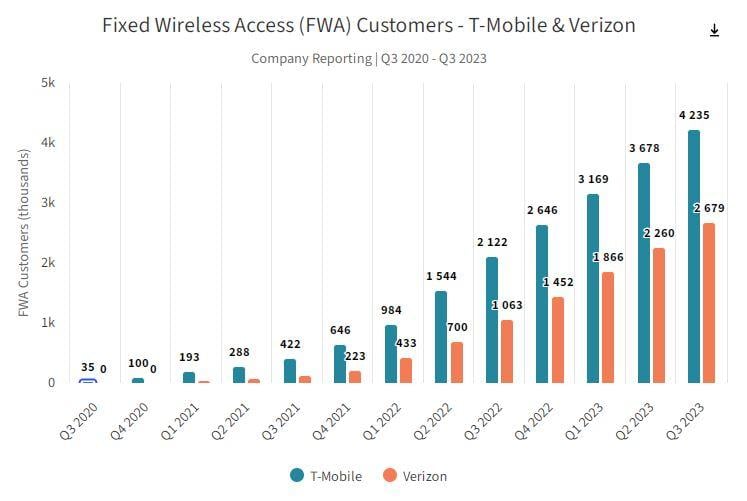

Launched during the COVID-19 pandemic, FWA services from T-Mobile and Verizon have seen strong growth over the past three years. Aided by disruptive pricing strategies, no annual contracts, and ease of installation (self-install), net additions remain strong for both ISPs. T-Mobile’s current FWA plan retails for $50/month, but that falls to $30/month for customers subscribing to its Magenta MAX mobile plan. Verizon prices at a slight premium to T-Mobile, with its FWA service currently retailing for $60/month, but falling to $35/month with select 5G mobile plans. On the back of their success we’ve also recently seen AT&T update its FWA strategy, launching AT&T Internet Air in August 2023, with a similar pricing strategy.

Utilizing the same 5G spectrum that its mobile customer base accesses, both T-Mobile and Verizon have been at pains to point out how they manage the on-boarding of new FWA customers, in order to limit any negative impact on performance for both cellular and FWA customers. The release and rollout of additional C-band spectrum for all three operators will provide extra headroom and the potential for improved 5G FWA performance, while T-Mobile has begun testing 5G Standalone mmWave, and has indicated that this could be utilized for 5G FWA in the future.

Performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs. The median download speed across the US for all fixed providers combined in Q3 2023 was 207.42 Mbps. T-Mobile has recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, down from 19.76 Mbps in Q4 2022, to 17.09 Mbps in Q3 2023. Verizon on the other hand improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps.

Ookla’s Speedtest data was used to identify the number of churned users since Q2 2022, when FWA services really started to scale and impact the rest of the market. The bulk of churn for both T-Mobile’s and Verizon’s 5G FWA services are coming from cable and DSL providers, confirming what the service providers have said.

The market research firm said that performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs.

Ookla clocked the median download speed across the U.S. for all fixed providers combined in Q3 2023 at 207.42 Mbps. T-Mobile recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, from 19.76 Mbps in Q4 2022 to 17.09 Mbps in Q3 2023.

Meanwhile, Verizon improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps, Ookla said.

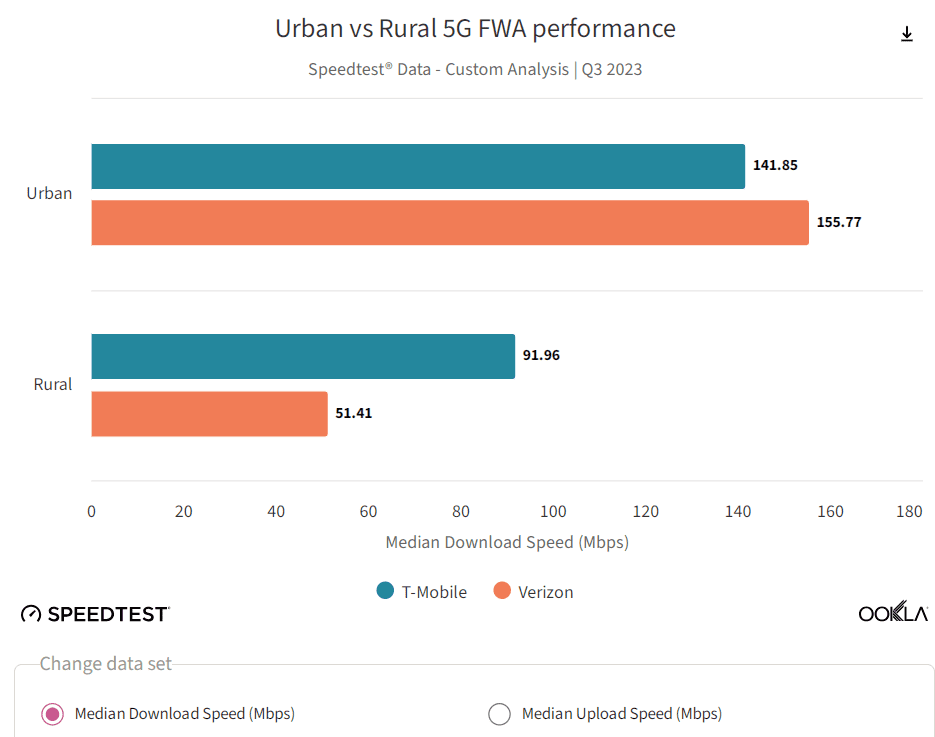

While median performance has remained fairly steady for both operators over the past year, Ookla said it’s a different story when it comes to regional performance and between urban and rural regions.

Rural locations – predictably – fared worse than urban locations for both T-Mobile and Verizon 5G FWA service, given differences in spectrum availability and distance from cell sites, although the difference was starker for Verizon’s FWA service, Ookla said. Verizon’s FWA service recorded a median of 155.77 Mbps in urban locations during Q3 2023, but only 51.41 Mbps in rural locations.

T-Mobile increased rural FWA performance, from 82.20 Mbps in Q4 of 2022 to 91.96 Mbps in Q3 2023. Verizon’s performance in urban locations improved, with the 155.77 Mbps it achieved in Q3 2023 representing a sizable increase on the 125.55 Mbps it recorded in Q4 2022.

All of the big mobile operators, including AT&T with Internet Air, will see improved 5G FWA performance with additional C-band spectrum, and T-Mobile could potentially use millimeter wave on its 5G standalone (SA) network for FWA, Ookla noted.

References:

https://www.ookla.com/articles/fixed-wireless-access-us-q3-2023

https://www.fiercewireless.com/wireless/t-mobile-verizon-5g-fwa-performance-holds-ookla