AT&T and Verizon cut jobs another 6% last year; AI investments continue to increase

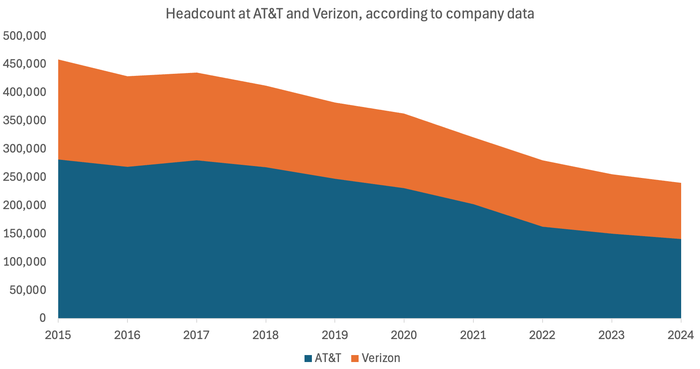

In 2018, after AT&T acquired Time Warner, the enlarged AT&T had approximately 230,000 employees and annual revenues of about $172 billion. Both figures have declined subsequently, but headcount has been reduced at a much sharper rate. Data published this week, after AT&T reported full-year sales of $122.3 billion, shows another 9,500 jobs were cut in 2024, decreasing the total to 141,000 workers. Back in 2017, counting the Time Warner business it was then trying to buy, AT&T had as many as 280,000 employees. Is AI being used to replace jettisoned employees at AT&T?

During Monday’s earnings call, AT&T’s CEO John Stankey said AI is already powering a variety of functions at the telco. “What we’ve been able to do in our call centers and how we operate within our customer base, a lot of that has been driven by AI tool applications. And it’s not that we’re necessarily exclusively replacing individuals with the technology, but we’re making them a lot more effective and efficient,” Stankey said, adding that AT&T is also using AI to develop its computer code. “We’re spending less right now to develop new code internally … and it’s through the application of AI and technology.”

Stankey added that AT&T plans to invest more heavily in AI this year, including by using its customer data to more effectively target customers with promotions and other offerings. “If I were to say I had a goal for 2025, I would like to … be talking about good momentum we’ve received in business as a result of executing on some of those things moving forward.”

AI was also highlighted during recent calls about financial results as something that would help to sharpen the axe. Those updates came after AT&T said in December 2024 that its latest aim was to slash another $3 billion in annual costs by the end of 2027. “In 2025, we will make progress on this goal by further integrating AI throughout our operations,” said Stankey this week. AT&T has also put AI to use on writing code and adapting the capabilities of the mobile network based on analysis of traffic patterns.

AT&T officials have previously discussed the possibility that AT&T central offices could host AI capabilities. During a recent analyst event, AT&T CTO Jeremy Legg said that some of the company’s central offices could be used for AI, but that the company would have to address the power requirements for those AI computing functions.

……………………………………………………………………………………………………………………………………………………………………………………….

Job cuts at Verizon have also been dramatic. Under CEO Hans Vestberg, it has managed to grow sales while axing jobs. Annual revenues at the company rose by $6.5 billion between 2020 and 2024, to about $134.8 billion, just as 32,600 jobs were slashed over this period. Workforce shrinkage left Verizon with fewer than 100,000 employees at the end of 2024. The rate of Verizon job cuts was relatively low in 2024, when fewer than 6,000 positions were eliminated, down from the nearly 12,000 that were scrapped in 2023. Yet Verizon employs about 78,000 fewer people today than it did ten years ago, and there has been no sign the trend might go into reverse.

At Verizon, “driving down costs in our operations” is part of a “three-pronged strategy for AI,” Vestberg told analysts. AI Connect, which should be the most exciting prong, positions AI in the same way edge computing was positioned years ago. The idea is to host the resources needed for AI applications in the network facilities that dot the US – some 16,000 “near net” enterprise locations, according to Verizon, along with between 100 and 200 acres of land partially “zoned” for data center build – and then charge for the privilege.

“If you think about where we are on generative AI today, it’s where large language modules are trained at large data centers and that require enormous capacities. Over time, that will, of course, come much closer to the edge of the network,” Verizon CEO Hans Vestberg explained on the operator’s quarterly conference call.

Kyle Malady, head of Verizon Business and the executive leading the operator’s AI efforts, offered more details: “Power, space and cooling are the currencies that are in demand right now, and we have all three,” he said in discussing the AI sector. “As we look across our assets, take inventory and compare against other players in the market, we believe that we are in a leadership position when it comes to usable power and space. We have facilities across the United States that either have spare power, space and cooling, or can be retrofitted. As we sit here today, we have 2-10+ megawatts of usable power across many of our sites. … In addition, we have between 100 and 200 acres of undeveloped land, some currently zoned for data center builds, and much of it in prime, data center-friendly areas.” Malady added that Verizon would deploy Vultr’s GPU-as-a-Service (GPUaaS) in its data centers in order to support the AI computing applications that require those kinds of high-performance graphical processing units (GPUs).

Malady added that Verizon sees a total addressable market (TAM) of $40 billion or more in this new area.

……………………………………………………………………………………………………………………………………………………………………………………………………

CEO’s Stankey and Vestberg have made cost cutting a priority, but most of the attendant layoffs so far are not due to the impact of AI. Stankey said, “It’s not that we’re necessarily exclusively replacing individuals with the technology, but we’re making them a lot more effective and efficient in how they handle customer needs and then complementing that with customer-supported AI.”

If AI does create new types of job, as many AI cheerleaders say, they have clearly not increased the headcount at AT&T or Verizon. A key take-away is that over the last few years, telcos were able to operate a business of roughly the same size with just a fraction of the workforce they previously employed. Average revenues per employee rose 6% at Verizon last year, to about $1.35 million, and have soared from less than $717,000 a decade ago. At AT&T, they grew 7% in 2024, to nearly $868,000, and are up from less than $544,000 in 2014.

References:

https://www.lightreading.com/ai-machine-learning/at-t-and-verizon-cut-another-15-3k-jobs-in-2024-as-ai-advanced

Verizon and AT&T cut 5,100 more jobs with a combined 214,350 fewer employees than 2015

https://www.verizon.com/about/news/verizon-unveils-ai-strategy-power-next-gen-ai-demands

https://www.lightreading.com/the-edge-network/at-t-and-verizon-are-pivoting-into-the-landlord-biz-for-ai

AT&T to deploy Fujitsu and Mavenir radio’s in crowded urban areas

AT&T’s leads the pack of U.S. fiber optic network service providers

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

U.S. Cellular to Sell Spectrum Licenses to Verizon in $1 Billion Deal

Verizon to buy Frontier Communications

Verizon Business sees escalating risks in mobile and IoT security

5 thoughts on “AT&T and Verizon cut jobs another 6% last year; AI investments continue to increase”

Comments are closed.

T-Mobile CEO Mike Sievert hinted at some of the un-carrier’s opportunities and strategies during T-Mobile’s quarterly conference call on Wednesday: AI, network slicing and satellites. Each of those technologies represents an opportunity for T-Mobile to make more money, according to Sievert.

1. “AI growth and AI workloads are going to be a way for us to increasingly showcase that [network] differentiation, especially as AI begins to make the leap from textual interfaces to much more video, audio, imagery,” he said. “It’s early days, but I think this is a nice tailwind for our business, because it’s going to be important that we’re able to showcase these advantages.” However, Sievert didn’t say anything about selling AI services directly to end users, like SK Telecom hopes to do.

2. 5G network slicing, which requires a 5G standalone (SA) systems, allows T-Mobile to dedicate a chunk of its network capacity to a specific customer. The operator first put network slicing to use in its T-Priority service for first responders.

“We waited a long time before starting to talk about all this stuff, because we wanted to see a real business model develop around it,” Sievert explained. “But the moment’s kind of arriving, and T-Priority’s certainly an expression of it.”

Sievert said network slicing will create a direct revenue opportunity from customers paying for the service, as well as a “share taking opportunity” among customers who shift their phones to T-Mobile because of its advanced offerings

3. Sievert said that T-Mobile recently launched a beta test of its direct-to-device (D2D) service with SpaceX. That offering connects T-Mobile customers directly to SpaceX Starlink satellites when they’re outside of T-Mobile’s 5G coverage area.

“We see things coming together pretty quickly,” Sievert said, hinting that a commercial launch would happen relatively soon. He did not provide a firm launch date. Nonetheless, Sievert explained that T-Mobile will make money from those satellite connections by offering the service only on its most expensive plans. That, he said, will encourage customers to upgrade to those more expensive plans.

But Sievert also held out the possibility that T-Mobile would charge for SpaceX connections on an a la carte basis. “For those that don’t have the plans that include it, and lots of other customers, there may be opportunities there,” he said, without providing details.

……………………………………………………………………………………………

“To be sure, T-Mobile is still running circles around its competitors,” wrote the financial analysts at MoffettNathanson in a note to investors. “Over the past week, the market celebrated roughly in-line results and tepid guidance from each of AT&T and Verizon. T-Mobile, by contrast, beat on virtually every metric in today’s Q4 report, and their guidance for 2025, at least, promises more of the same.”

…………………………………………………………………………………………..

https://www.lightreading.com/ai-machine-learning/t-mobile-ceo-we-ll-make-money-from-ai-traffic-network-slicing-and-satellites

According to RationalFX.com. at least 11,000 employees in the technology sector have lost their jobs since the beginning of the year. That’s after a staggering 280,991 employees were terminated as the tech industry wrestled with economic uncertainty and shifting market demands. Over half of these layoffs – 157,950 – were announced by U.S. companies, underscoring the country’s significant role in the ongoing workforce reductions. PC maker Dell led the way by cutting 18,500 positions, followed by Intel and Amazon, each eliminating approximately 15,000 jobs.

The redundancies in the U.S., including in many Silicon Valley companies, are a result of over-hiring during the pandemic and high inflation. But there are other factors at play with recession fears and companies’ increased focus on AI being just two of them. Many companies have announced restructuring plans aiming to increase efficiency and profitability. Interestingly, 2023 and 2024 were extremely profitable for many businesses that reported increased revenues, record-high earnings for shareholders, and expansion to new markets.

https://www.rationalfx.com/forex-brokers/the-tech-industrys-workforce-crisis-2024s-layoffs-surpass-280000-and-continue-in-2025/

Intel has also cut jobs in a big way. Since the end of 2022, Intel has shrunk headcount by 23,000 jobs, a figure equal to 17% of the earlier total. Nearly 16,000 of those went last year, leaving the company with a total workforce of 108,900 at the end of 2024. This roughly puts Intel back where it was in 2018, when annual sales were about $18 billion higher. While some of the world’s biggest telcos have shown they can generate as much in sales as they did several years ago with a far smaller workforce, Intel is effectively making less money with as many people.

What’s unclear is where the axe has fallen most heavily within Intel. The company’s annual marketing, general and administrative costs have fallen more than a fifth in the last two years, to about $5.5 billion in 2024. Of greater concern to those already worried about Intel’s technology smarts is the 6% reduction in spending on research and development over the same period, lowering the amount to roughly $16.5 billion last year. As small as that reduction might seem, Nvidia’s spending rose 48% for the first nine months of its 2024 fiscal year, to $9.2 billion, compared with the same period the year before. And it looks more concentrated in one fast-growing area.

https://www.lightreading.com/semiconductors/intel-has-cut-23-000-jobs-in-about-two-years.

……………………………………………………………………………………………………………………………..

Intel’s network and edge group (NEX) reported sales growth of just 1%, to about $5.84 billion, and an operating profit of $931 million. While that was a big improvement on the $203 million Intel managed a year before, it was down from $1.5 billion in 2022, when NEX also had revenues of $8.4 billion. In 5G, moreover, Intel complained that customers had still been “tempering purchases to reduce existing inventories.”

The small virtual RAN market segment has been monopolized by Intel CPUs. In 2023, analyst firm Omdia, a Light Reading sister company, said virtual RAN accounted for just 1/10 of the total installed worldwide RAN baseband market. Omdia forecasts a doubling of this share by 2028. But that would still leave purpose-built compute with 80% of the baseband market.

https://www.lightreading.com/ai-machine-learning/intel-and-telcos-left-in-virtual-ran-limbo-by-rise-of-ai-ran

During Orange’s FY 2024 earnings call Orange Group CEO Christel Heydemann highlighted the potential for operational savings from AI but stressed that it isn’t replacing the human workforce anytime soon. Asked during the Q&A portion of the call about the headcount requirements in the medium term and the impact of AI, she said that “at this stage, the technology is really far from replacing humans,” adding that she thinks “it will never actually replace humans, or it should not replace humans.”

The technology is driving efficiency for pre-sales, developer and customer services teams, she said, but stressed it will in her view enrich rather than replace employees.

Her remarks seem to contrast somewhat with those made by Deutsche Telekom executives, who seemed blunter about the technology’s capacity to slash the workforce. https://www.lightreading.com/ai-machine-learning/artificial-intelligence-to-eat-jobs-at-deutsche-telekom

AI is expected to generate over €300 million ($312 million) in “operational efficiencies,” meaning revenue uplift, opex and capex gross savings, in 2025 as the company is on track in its plan to save €600 million ($624 million) by the end of this year.

AI was one of the big themes during the presentation, which came only a day after the group announced a partnership with Mistral AI, through which both parties seek to design an optimal network infrastructure for AI, assessing the impact of AI on networks.

It will also see Mistral’s applications, such as Le Chat Pro and Codestral, integrated into Orange’s product suite. Moreover, Mistral products will be part of Orange Business’ Live Intelligence offer.

https://www.lightreading.com/ai-machine-learning/orange-ceo-hails-ai-efficiencies-but-stresses-it-shouldn-t-replace-humans

How worried should people be about the threat of AI to their jobs?

Blackrock’s Tony Kim: Of the roughly $100 trillion of global gross domestic product, 55% is labor and 5% is tech spending. Even if you took just 5% out of labor, you would double all of tech spend. If that were to happen, there are two big implications: You wouldn’t have enough compute in the world to do this, which should limit its progression. And there are societal implications.

Where is the net new revenue or growth in gross domestic product, versus the cost takeout? That’s a bigger question mark for me. Everyone is talking about productivity on the cost side. But what about creating net new GDP? It isn’t obvious to me. But if it happens, there isn’t enough compute in the world.

https://www.barrons.com/articles/ai-technology-stocks-roundtable-90300149?mod=hp_SP_A_1_1