T-Mobile’s growth trajectory increases: 5G FWA, Metronet acquisition and MVNO deals with Charter & Comcast

T-Mobile US is having a banner year. The “uncarrier” has again increased its annual earnings outlook, supported by the acquisition of fiber network operator Metronet and strong mobile customer growth in Q2. After gaining another 1.73 million postpaid customers in the quarter, T-Mobile now expects total postpaid net additions this year of 6.1-6.4 million, up from its previous guidance of 5.5-6.0 million. Postpaid customer growth strengthened compared to the first quarter and included 830,000 new phone customers and 902,000 other devices, while churn was little changed at 0.90 percent. Prepaid growth was more muted, with just 39,000 net additions. T-Mobile counted 132.778 million mobile customers at the end of June, up by around 1.9 million from a year ago. 5G broadband customers rose by 454,000 in the three months to 7.308 million.

In the three months to June, the company posted service revenues up 6% year-on-year to $17.4 billion, and core adjusted EBITDA (after leases) also was up 6% to $8.5 billion. The net profit rose 10 percent to a record $3.2 billion, and adjusted free cash flow increased 4% to $4.6 billion. Cash CAPEX rose 17.5 percent to $2.4 billion in Q2 and is still expected to reach $9.5 billion over the full year. The company also spent $2.5 billion buying back its own shares in Q2.

“T-Mobile crushed our own growth records with the best-ever total postpaid and postpaid phone nets in a Q2 in our history,” said Mike Sievert, CEO of T-Mobile. “T-Mobile is now America’s Best Network. When you combine that with the incredible value that we have always been famous for, it should surprise no one that customers are switching to the Un-carrier at a record pace. These durable advantages enabled us to once again translate customer growth into financial growth, with the industry’s best service revenue growth by a wide mile and record Q2 Adjusted Free Cash Flow.”

The new forecast includes the expected close of the Metronet acquisition on July 24th (today). The Metronet deal – crafted as a joint venture with KKR – will expand T-Mobile’s fiber reach by about 2 million homes across 17 states. It follows the completion of the deal with EQT to buy fiber operator Lumos.

T-Mobile plans to close the UScellular buyout and “become one team” on August 1st. “The combination gives us an expected 50% or more increase in capacity, in the combined footprint, and our site coverage will expand by a third from 9,000 to 12,000 sites,” CEO Mike Sievert said, noting that this will be in addition to 4,000 greenfield sites planned for this year, of which 1,000 have already been “lit up” to date.

T-Mobile stands at a critical juncture in its history, as it prepares to absorb more wireless and fiber assets, build a fiber network access business and enter a new market with the launch of T-Satellite in collaboration with Elon Musk’s Starlink. T-Mobile has already launched T-Mobile Fiber Home Internet and has forecast 100,000 fiber net customer adds in the second half of 2025 following the Lumos and Metronet deals. Sievert also reiterated that T-Mobile would continue to “keep an open mind” about any further fiber M&A.

T-Mobile is now the market’s fifth-largest ISP. Currently, the operator’s goals are to reach 12 million fixed wireless access subscribers by 2028 and to pass 12 million to 15 million households with fiber by the end of 2030, through both the fiber joint ventures and wholesale partnerships.

COO Srini Gopalan said on the earnings call, “We’re positioned to be a scale player in broadband,” claiming that the combined FWA and fiber targets would be equivalent to 40 million to 45 million homes passed as a broadband player, “and that’s before we go make other investments. As we’ve said before, we’re very open to looking at investments in fiber,” he added.

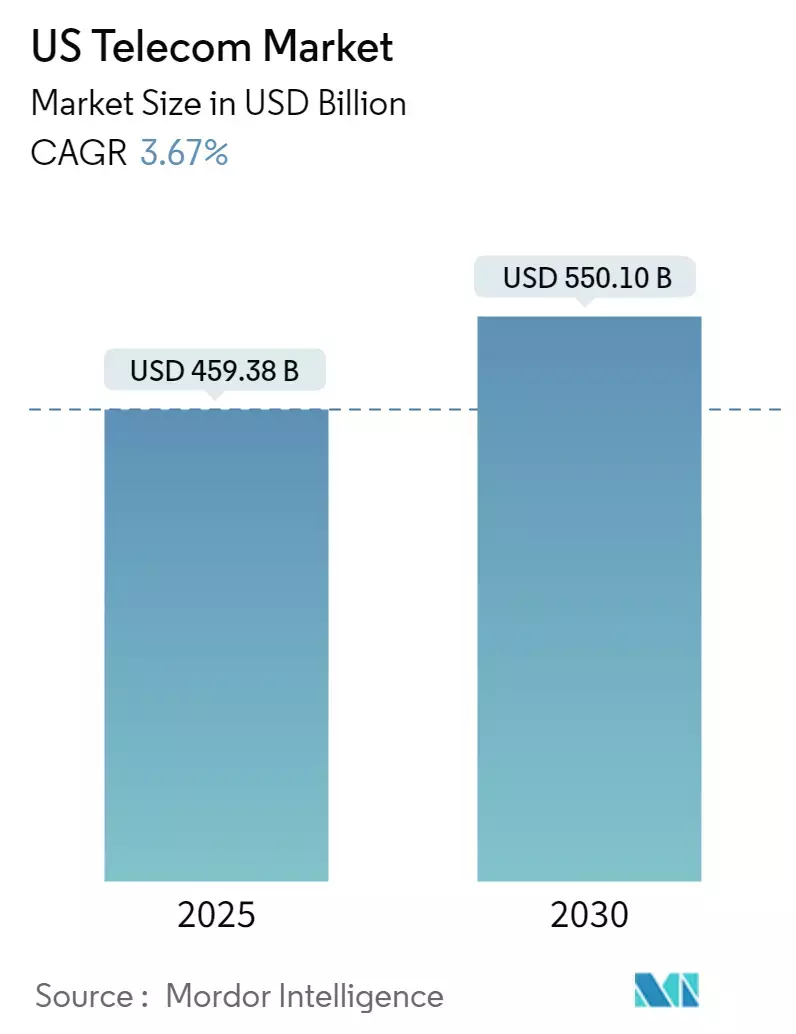

Separately, Charter Communications and Comcast announced Tuesday that they’ve cut a multi-year MVNO agreement with T-Mobile focused on their respective business customers. As the telecom industry growth rate is very low (real growth rate is barely positive), this additional source of revenue will be most welcome by the uncarrier. T-Mobile is expected to generate $850 million in incremental after tax income from its MVNO deals with Charter and Comcast. This revenue is included in the company’s updated guidance, but that guidance excludes the planned acquisition of UScellular assets.

T-Mobile Recognized as Network Leader by Third Parties:

- Ookla awarded T-Mobile as the only carrier in the country to win back-to-back Best Mobile Network awards in the largest, most-comprehensive tests of their kind, each leveraging half a billion real world data points on millions of devices measuring speed and experience

- Recognized by Opensignal for best Overall Experience for the fourth consecutive year and blew away the competition in best download speeds, nearly 200% faster than the nearest competitor, and upload speeds, approximately 65% faster than the nearest competitor

References:

https://www.lightreading.com/fttx/t-mobile-readies-for-the-next-stage-after-a-record-breaking-q2

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

AT&T disputes T-Mobile’s claim: “We’ve got the largest, fastest, most advanced 5G network. With more towers, more bandwidth, and a signal that goes farther—and now we’ve been awarded Best Mobile Network in the U.S. by Ookla® Speedtest®.” https://www.t-mobile.com/coverage/network

AT&T Chief Operating Officer Jeff McElfresh said in a video chat:

“In fact, T-Mobile’s got the smallest network. Over 300,000 square miles smaller than that of AT&T. We own and operate the largest, most reliable wireless network and you know, when you’re working in a in an industry for as long as we are and you’re seeing a competitor who repeatedly is getting corrected by the Better Business Bureau’s advertising watchdog 16 times across four years. That’s one correction per quarter. Enough’s enough. It’s time for somebody to speak out uh on behalf of consumers.”

https://finance.yahoo.com/video/t-coo-attacks-t-mobile-162709015.html