T-MobileUSA

U.S. Home Internet prices DECLINE amidst fierce competition between wireless carriers and cablecos

Home internet prices in the U.S. are being driven down by fierce competition between mobile carriers offering Fixed Wireless Access (FWA) and cable internet companies offering legacy Hybrid Fiber Coax connections. The increased competition has driven down the cost of home internet service, a welcome break for consumers when prices are rising for many other essential products. The price of home internet service fell 3.1% in May from a year earlier, while the overall consumer-price index rose 2.4%, according to the Labor Department.

The WSJ reports that major home-internet service providers including Verizon VZ, Comcast/Xfinity and T-Mobile launched a flurry of price-lock guarantees, promising steady rates for as long as five years. CableCos Charter, which is acquiring Cox, unveiled a three-year deal last year.

Cable companies have struggled to retain broadband internet subscribers since mobile carriers began offering more affordable 5G fixed-wireless access (FWA) internet service in 2018. FWA, which relies on over the air transmission to cell towers instead of HFC access, brought competition into markets where cable companies had long enjoyed being the only game in town. Now both types of providers are growing more aggressive to attract—and keep—customers.

“The cable companies went from gaining subscribers and raising rates every year to declining subscribers and giving people price locks,” said John Hodulik, a UBS analyst. “They’re seeing churn rise in their broadband subscriber base. And they’re trying to nip that in the bud.” Fixed wireless can sometimes cost half as much as a cable-provided internet plan. Though network congestion and other connectivity issues can be an issue for some users, the lower price point has been luring cable customers away.

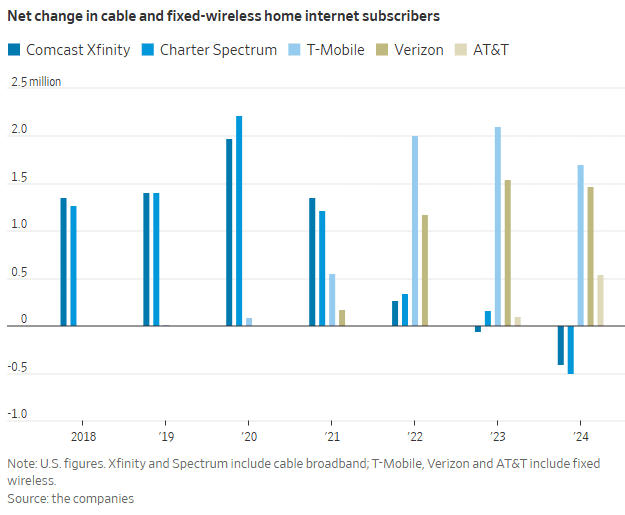

T-Mobile, Verizon and AT&T added a combined 3.7 million FWA customers in 2024. In sharp contrast, Comcast’s Xfinity and Charter’s Spectrum lost more than 900,000 home internet subscribers. That’s depicted in this graph:

“Our pricing wasn’t breaking through in the marketplace,” said Steve Croney, chief operating officer for Comcast’s connectivity and platforms business. He said the company’s five-year price lock, introduced in April, competes well against the telecom companies’ offerings.

Frank Boulben, chief revenue officer at Verizon’s consumer group, said his company has been trying to address the “pain points” customers have with cable companies, such as price hikes. That’s why the telco is emphasizing FWA vs its FiOS fiber to the home based service. Boulben said his company would focus on selling fiber service to customers as it becomes available to them.

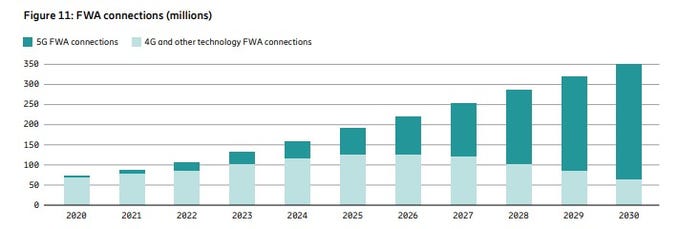

Is FWA the ONLY real killer application for 5G? Even though it was NOT one of the envisioned use cases? Ericsson’s recently released Mobility Report says FWA will account for more than 35% of all new fixed broadband connections, with an expected increase to 350 million by the end of 2030. The report states that more than half of all network service providers (wireless telcos) who offer FWA now do so with “speed-based monetization benefits enhanced by 5G.”

About 80% of the global network operators sampled by Ericsson currently offer FWA, with the most rapid area of growth among CSPs (communications service providers) offering 5G-enabled speed-based tariff plans. These opportunities are about the ability to offer a range of subscriber packages with different downlink and uplink data options with 5G FWA. As with fiber deals, “increasing monetization opportunities for CSPs compared to earlier generations of FWA.” 51% of operators with FWA offerings now include these speed-based options, which is up from 40% on the same period in June 2024 and represents a 27.5% increase. The June 2024 number had grown 50% on the June 2023 equivalent.

Source: Ericsson Mobility Report

…………………………………………………………………………………………………………………………………………………………………..

“We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation,” said Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer. “The recent advancements in 5G standalone (SA) networks, coupled with the progress in 5G-enabled devices, have led to an ecosystem poised to unlock transformative opportunities for connected creativity. Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”

Fixed-wireless doesn’t work everywhere. Besides congestion weak signals can make coverage spotty. If your cell phone doesn’t pick up 5G coverage smoothly, fixed-wireless from the same company probably won’t work either.

Verizon, AT&T and T-Mobile are winning converts to FWA at a faster pace than many anticipated, said Jonathan Chaplin, a managing partner at equity research firm New Street Research. Charter agreed to buy Cox last month for $21.9 billion in equity and assume $12 billion of its outstanding debt, in part to acquire scale to better compete with fixed wireless access. However, fixed-wireless growth can’t last indefinitely. The wireless networks on which they run will eventually hit capacity, limiting how many subscribers they can add. Chaplin estimates the networks can support around 19 million total fixed-wireless subscribers—which he predicts they will reach in about five years, accounting for planned network expansions that the companies have announced. When that limit is reached, cable companies may regain the upper hand and keep growing their fiber customer base, Chaplin said.

The big three wireless carriers (AT&T, Verizon and T-Mobile) have all been investing in fiber-based wired networks via build-outs and acquisitions. AT&T is bringing new customers in via FWA, with the long-term goal to convert them to fiber-based service, said Erin Scarborough, who runs that company’s broadband and connectivity initiatives.

References:

https://www.telecoms.com/5g-6g/ericsson-says-fwa-is-boosting-telco-monetization-opportunities

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.consumeraffairs.com/news/cable-vs-wireless-war-is-driving-prices-down-062525.html

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

Evercore: T-Mobile’s fiber business to boost revenue and achieve 40% penetration rate after 2 years

T-Mobile’s fiber business could serve about 5 million U.S. customers and generate up to $5 billion in revenue during the next five years, according to financial analysts at Evercore. That call is the investment advisor firm’s first take at evaluating the maturation of T-Mobile’s fiber plans. It’s based on the assumption that T-Mobile will close its deal to acquire fiber operator Metronet, following the recent closure of another deal with EQT for fiber operator Lumos. Evercore’s projections do not assume that T-Mobile will make a play for another fiber operator like Lumen Technologies.

“Looking to 2030, we expect 14 million [fiber] passings … and 4.8 million subscribers,” the analysts wrote in a note to investors this week. “Assuming a $75 ARPU [average revenue per user] growing 4% year over year implies ~$5 billion of revenue in 2030. “While it hasn’t shared subscriber targets, [T-Mobile] management has expressed confidence that it would see higher long-term market penetration than typical [fiber] overbuilders (e.g., ~35%) benefitting from its national brand and advertising, digital and retail distribution, ability to take advantage of the waiting list it has for FWA [fixed wireless access] in markets where demand outstrips supply,” the Evercore analysts added.

Evercore assumes that T-Mobile Fiber (see plans below) will be able to capture 10% market share within six months of launch and 20% within a year. After two years, the analysts predict T-Mobile Fiber will command 40% penetration (meaning, 40% of the customers reached by its fiber connections will subscribe to those connections).

T-Mobile Fiber Plans:

- Fiber 500 (500 Mbps): Superfast performance for gaming, streaming, and more.

- Fiber 1 Gig (1000 Mbps): Blistering speeds for every device and user in your home.

- Fiber 2 Gig (2000 Mbps): Our fastest speeds and largest capacity for more devices and users.

……………………………………………………………………………………………………………………………………….

……………………………………………………………………………………………………………………………………….“For now, until there’s greater color from management, we’ve assumed T-Mobile will see 25% EBITDA [earnings before interest, taxes, depreciation and amortization] margins on its Fiber revenue. This could be conservative over time,” the Evercore analysts wrote. They predicted overall EBITDA from T-Mobile Fiber of around $340 million in 2026, growing to $1.24 billion in 2030. And that, they said, would equate to free cash flow of $270 million in 2026, growing to $1 billion by 2030.

“Pricing will evolve as T-Mobile acquires and operates Metronet and Lumos’ subscribers along with the competitive dynamics across the broadband market. T-Mobile has a clear history of being a disruptor, so it could be more aggressive on pricing than we expect, resulting in downside to our ARPU and revenue estimates,” the Evercore analysts warned. They noted that T-Mobile Fiber in some Colorado markets today costs $55 per month for 500 Mbit/s connections. That’s similar to local incumbents Lumen Technologies ($50 for 500 Mbit/s) and Comcast ($55 per month for 600 Mbit/s).

Convergence of mobile and fiber access will provide a tailwind for T-Mobile, potentially driving increased postpaid phone share and revenue. “Despite management’s tone around the benefits of convergence, we believe there will clearly be an opportunity to drive higher postpaid phone share across the growing number of households that ultimately end up taking T-Mobile fiber,” according to the Evercore analysts. They predicted that T-Mobile’s fiber operations would eventually help improve the operator’s postpaid smartphone net customer additions by up to 650,000 per year, and that it will drive the operator’s annual wireless service revenues up by $200 million to $350 million.

An important insight into T-Mobile’s convergence strategy emerged in the wake of its acquisition of Lumos. “New and existing customers will enjoy VIP treatment through Magenta Status, which includes exclusive benefits like discounts on food, gas, entertainment and top brands, plus freebies every Tuesday in the T-Life app. All with T-Mobile’s standard ‘no exploding bills’ pricing structure,” T-Mobile said of its new Lumos customers.

“One app. All the things,” T-Mobile proclaims of the T-Life app it launched roughly a year ago. The app is available to all T-Mobile smartphone customers – and now its new fiber customers.

“Get the latest exclusive perks from T-Mobile Tuesdays, and take advantage of all your Magenta Status benefits,” T-Mobile said of its T-Life app. “You can also pay your bill, add a line to your account, and track orders straight from the app. And you can manage your account, configure your T-Mobile Home Internet gateway, and more. If you need help with anything, customer care is available at the tap of a button.”

The analysts expect T-Mobile’s fixed wireless access business to continue gaining traction, potentially reaching 7% of the total broadband subscriber base by 2025.

Separately, Verizon is now Evercore’s top pick among wireless network operators and is its top value idea.

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://fiber.t-mobile.com/

https://www.lightreading.com/fttx/t-mobile-fiber-could-see-5m-customers-and-5b-in-revenue-by-2030

T‑Mobile and EQT close JV to acquire FTTH network provider Lumos

T-Mobile and EQT (a purpose-driven global investment organization) announced the successful close of their joint venture (JV) to acquire fiber-to-the-home provider Lumos. As part of the transaction, many Lumos customers will soon become T-Mobile Fiber customers and begin enjoying new offers and benefits as they’re welcomed into the Magenta family.

This deal marks a major milestone in T-Mobile’s broadband growth and builds on the Un-carrier’s success in delivering best-in-class connectivity. By bringing more value and choice to the millions of Americans who have previously been underserved, T-Mobile continues to deliver on its mission to change broadband for good. T-Mobile will take full ownership of the customer experience, using its proven brand, nationwide retail footprint, differentiated marketing and customer-first service model to attract new subscribers.

Currently, Lumos operates a 7,500-mile fiber network, providing high-speed connectivity to 475,000 homes across the Mid-Atlantic. The joint venture combines the Un-carrier’s unique assets with EQT’s fiber infrastructure expertise, and Lumos’ scalable build capabilities to drive rapid network expansion, with the goal of reaching 3.5 million homes by the end of 2028. To fuel this growth, T-Mobile invested $950 million into the joint venture, with an additional $500 million planned between 2027 and 2028 to support further expansion. T-Mobile will provide an update to its full year 2025 guidance resulting from this transaction during its Q1 earnings call.

“T-Mobile is already the fastest-growing broadband provider in America, and expanding into fiber helps us take the next big step in delivering what customers truly want – faster, more reliable internet that simply works,” said Mike Katz, T-Mobile President of Marketing, Strategy and Products. “People deserve better when it comes to their home internet: fewer disruptions, more value, and support that actually feels supportive. We’re excited to welcome Lumos customers to the T-Mobile family and bring them the Un-carrier experience – built around their needs, fueled by innovation, and focused on making life easier.”

As Lumos customers continue to enjoy the same high-speed fiber internet they rely on today at low monthly prices, they’ll now also enjoy the value-add benefits they get from simply being a part of the T-Mobile family. They will have access to T-Mobile’s best-in-class customer experience and nationwide retail presence. Every plan also comes with unlimited data plus Wi-Fi equipment and installation included, so customers can enjoy the freedom and flexibility of reliable internet. Additionally, new and existing customers will enjoy VIP treatment through Magenta Status, which includes exclusive benefits like discounts on food, gas, entertainment and top brands, plus freebies every Tuesday in the T-Life app. All with T-Mobile’s standard ‘no exploding bills’ pricing structure.

“We’re excited to begin this joint venture and even more energized about what’s ahead,” said Brian Stading, CEO of Lumos. “Partnering with EQT and T-Mobile, we’re ready to scale faster, deliver cutting-edge fiber technology to more people, and change even more lives. This is about more than just internet – it’s about building the infrastructure of the future and creating lasting opportunity, connection, and impact for communities.”

“We are thrilled to officially embark on this next chapter of growth with Lumos alongside our partners at T-Mobile,” said Nirav Shah, Partner within EQT’s Infrastructure Advisory team. “This joint venture represents a powerful combination of EQT’s digital infrastructure expertise, Lumos’ proven fiber deployment capabilities, and T-Mobile’s customer-first approach and national reach. Together, we are well-positioned to accelerate access to high-quality fiber broadband to millions of underserved Americans and look forward to executing on our plans to deliver the critical connectivity that empowers communities across the country.”

As the fifth-largest and fastest-growing Internet service provider in the U.S., T-Mobile offers 5G Home Internet to 70 million homes, serving more than 6.4 million customers nationwide as of the end of 2024, and has introduced T-Mobile Fiber in parts of 32 U.S. markets. Fiber-to-the-home complements T-Mobile’s successful 5G Home Internet offering, which currently has over 1 million customers on its waitlist. This expansion in fiber opens an additional avenue to meet the growing demand for T-Mobile broadband. Through its strategic fiber partnerships and joint ventures, the Un-carrier expects to reach 12 to 15 million households, or more, with fiber by the end of 2030.

References:

https://www.t-mobile.com/news/business/t-mobile-eqt-close-lumos-fiber-jv

T-Mobile & EQT Joint Venture (JV) to acquire Lumos and build out T-Mobile Fiber footprint

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

AT&T’s leads the pack of U.S. fiber optic network service providers

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

New Zealand telco One NZ has commercially launched its Satellite TXT service to eligible phone customers [1.] enabling them to communicate via Starlin/SpaceX’s network of Low Earth orbit (LEO) satellites at no extra cost as long as they have a clear line of sight to the sky. The initial TXT service will take longer to send and receive TXT messages. In many cases, TXT messages will take 3 minutes. However, at times it may take 10 minutes or longer, especially during the first few months. As the service matures and more satellites are launched, we expect delivery times to improve. The type of eligible phone you are using, where you are in New Zealand and whether a satellite is currently overhead will all have an impact on whether your TXT is sent or received and how long it takes.

Note 1. There are only four handsets that can currently use of Satellite TXT: Samsung’s Galaxy Z Flip6, Z Fold6, and S24 Ultra, plus the OPPO Find X8 Pro. One NZ said the handset line-up will expand during the course of next year (2025).

“We have lift-off! I’m incredibly proud that One NZ is the first telecommunications company globally to launch a nationwide Starlink Direct to Mobile service, and One NZ customers are among the first in the world to begin using this groundbreaking technology,” exclaimed Joe Goddard, experience and commercial director at One NZ. He said coverage is available across the whole of New Zealand including the 40% of the landmass that isn’t covered by terrestrial networks – plus approximately 20 km out to sea. “Right from the start we’ve said we would keep customers updated with our progress to launch in 2024 and as the technology develops. Today is a significant milestone in that journey,” he added.

April 2023’s partnership with Starlink coincided with the beginning of a new era for One NZ, which up until that point had operated under the Vodafone brand. At the time, One NZ tempered expectations by making it clear the service wouldn’t launch until late 2024.

SpaceX in October finally received permission to begin testing Starlink’s direct-to-cell capabilities with One NZ. Later that same month, One NZ reported that its network engineers in Christchurch were successfully sending and receiving text messages over the network. “We continue to test the capabilities of One NZ Satellite TXT, and this is an initial service that will get better. For example, text messages will take longer to send but will get quicker over time,” said Goddard. He also went to some lengths to point out that Satellite TXT “is not a replacement for existing emergency tools, and instead adds another communications option.”

One NZ offered a few tips to help their customers use the service:

- To TXT via satellite, you need a clear line of sight to the sky. Unlike other satellite services, you don’t need to hold your phone up towards the sky.

- Keeping your TXT short will help. You can also prepare your TXT and press send as soon as you see the One NZ SpaceX banner appear on-screen.

- To check if your TXT has been delivered, check the time stamp next to your TXT. On a Samsung or OPPO, tap on the message.

- Remember to charge your phone or take a battery pack if you are out adventuring.

One NZ vs T-Mobile Direct to Cell Service:

New Zealand’s terrain – as varied and at times challenging as it is – can be covered by far fewer LEO satellites than the U.S. where T-Mobile has announced Direct to Cell service using Starlink LEO satellites. T-Mobile was granted FCC approval for the service in November, and is now signing up customers to test the US Starlink beta program “early next year.”

References:

https://one.nz/why-choose-us/spacex/

https://www.telecoms.com/satellite/one-nz-claims-direct-to-cell-bragging-rights-over-t-mobile-us

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

RWA, CWA and EchoStar file FCC petitions against T-Mobile’s acquisition of UScellular

The Rural Wireless Association (RWA), Communications Workers of America (CWA), and EchoStar (owns Dish Network) all filed FCC petitions requesting the agency reject T-Mobile’s proposed acquisition of “substantially all” of UScellular’s wireless operations, including some spectrum.

The proposed transaction would remove UScellular from the U.S. telecom market, thereby eliminating one of the last few remaining regional wireless network operators and strengthening T-Mobile’s position across the 21 states where UScellular maintains operations.

Public interest and consumer groups (include Public Knowledge, New America’s Open Technology Institute and Community Broadband Networks Initiative) also opposed approval. They argued that the proposed merger between T-Mobile and UScellular would “result in the loss of the fifth largest marketplace competitor with a network covering approximately 10 percent of the country’s population, reallocate spectrum resources predominantly to the three top wireless carriers only to make it nearly impossible for a fourth competitor to emerge in the market, and waste valuable funding secured for building out 5G networks.”

The deal is relatively small as telecom mergers go — valued at about $4.4 billion, including $2 billion in assumed debt — but has ignited substantial opposition. UScellular is the nation’s fifth-largest wireless carrier.

“T-Mobile is asking for the commission’s blessing to further entrench its dominance over the wireless voice and broadband markets, making it harder for others (like EchoStar) to compete. The commission should deny this transaction, which threatens to substantially harm competition while offering only illusory public interest benefits,” EchoStar wrote in a new filing to the FCC.

“The merger would substantially lessen competition in local markets where UScellular operates, hurting workers, consumers and other rural carriers. The commission should reject the proposed transaction as currently structured and require specific enforceable measures … to ensure that the merger remains in the public interest,” wrote the Communications Workers of America (CWA), a union that counts thousands of members inside AT&T and Verizon but has struggled to unionize workers in T-Mobile. The Rural Wireless Association also voiced its opposition.

This past May, T-Mobile said it would purchase around 30% of UScellular’s spectrum holdings, all of its 4.5 million customers and its retail stores in a deal worth $4.4 billion. T-Mobile has also said it will make job offers to “a significant number” of UScellular’s employees as part of the transaction. Following T-Mobile’s announcement, both AT&T and Verizon inked deals to acquire roughly $1 billion each worth of UScellular’s spectrum. T-Mobile officials still expect to close the UScellular transaction next year.

“I don’t know how many mergers you’ve heard of in the past that are like, yeah, I can promise you better networks and lower prices right from the get-go, and the company, of course, will benefit from the synergies, and it’s highly accretive. So this is going to be a win all the way around, and I’m confident the government will see it that way as well,” T-Mobile CEO Mike Sievert said this week at an investor event.

However, the U.S. Department of Justice (DoJ) advised a deeper review of T-Mobile’s UScellular proposed acquisition due to T-Mobile’s foreign owner Deutsche Telekom, which indirectly holds 50.42% of T-Mobile’s stock and also holds a proxy agreement that authorizes it to vote additional shares.

Many pundits expect T-Mobile to ultimately close on its purchase of UScellular thanks to the incoming Trump administration, which is expected to be more friendly to acquisitions than the Biden administration has been. As a precedent, Donald Trump’s first administration immediately approved T-Mobile’s $26 billion purchase of Sprint in 2020.

References:

https://www.fcc.gov/ecfs/document/1209299836114/1

https://www.fcc.gov/ecfs/document/120973502037/1

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T‑Mobile achieves record 5G Uplink speed with 5G NR Dual Connectivity

T-Mobile US claims it broke a world record with its 5G standalone (SA) network via a new feature called New Radio Dual Connectivity (5G DC) [1.]. With 5G DC. The so called “Un-carrier” was able to massively increase uplink throughput and capacity, reaching peak speeds of 2.2 Gbps — that’s the fastest recorded anywhere in the world — and demonstrates the technology’s potential to create serious efficiencies in how data is transmitted from devices to the network.

Note 1. New Radio Dual Connectivity (NR-DC) is a dual connectivity configuration that uses the 5G standalone core (specified by 3GPP but not standardized by ITU-R or ITU-T). In this configuration, both the primary and secondary RAN nodes are 5G gNBs. NR-DC was was specified in 3GPP Release 15 along with simultaneous receive (Rx) / transmit (Tx) band combinations for NR CA/DC.

…………………………………………………………………………………………………………………………………..

To put T-Mo’s 2.2 Gbps uplink speed into context, the latest report from connectivity data specialist Ookla puts the median mobile upload speed in the U.S. at 8.41 Mbps, although that’s across networks. T-Mobile is ahead of major rivals AT&T and Verizon with a median upload speed of 12.19 Mbps.

In June Ookla stated that while U.S. network operators have invested heavily in improving 5G download speeds, “5G upload and latency performance need more attention.” Its data at the time showed Verizon and T-Mobile had comparable 5G upload at just above 15 Mbps, while AT&T lagged somewhat at closer to the 10 Mbps mark.

5G DC enables the Un-carrier to aggregate 2.5 GHz and mmWave spectrum, allowing for an insane boost to uplink throughput and capacity. In this test, T-Mobile was able to allocate 60% of the mmWave radio resources for uplink where previous use cases typically allowed up to 20%. Completed on T-Mobile’s 5G SA production network in SoFi Stadium in Southern California with equipment and 5G DC solution from Ericsson and a mobile test smartphone powered by a flagship Snapdragon® X80 5G Modem-RF System from Qualcomm Technologies, Inc., this test changes the game for providers looking to offer customers and businesses the best experience possible at crowded events.

“With 5G DC, T-Mobile is pushing the boundaries of what’s possible to create better experiences in the places that matter most to our customers,” said Ulf Ewaldsson, President of Technology at T-Mobile. “This accomplishment is a testament to the network we’ve built over the last five years and our ability to deliver unparalleled capabilities that extend beyond the devices in our pockets.”

For those in the know, download speeds typically reign as the top network performance metric, but with recent strides in uplink capabilities and increasingly demanding tasks, upload speed is becoming more important than ever, especially for live events, mobile gaming and extended reality applications.

Because of this, SoFi Stadium served as the perfect test site for 5G DC. Every year, millions of people flock to the stadium for the latest football game or to catch their favorite artists in concert. Naturally, all these people want to post, livestream and share their experiences in real-time, which can sometimes be a challenge at crowded events with limited capacity. Not to mention broadcast crews who need to upload high-definition content to production teams in real-time for those watching at home. With 5G DC and T-Mobile, all of this gets done faster than ever, alleviating posting FOMO and production crew headaches.

Mårten Lerner, Head of Product Area Networks at Ericsson, said: “High uplink speeds are essential for delivering immersive experiences and reliable 5G connectivity. This mirrors one of our key objectives with the recent launch of Ericsson 5G Advanced, which is to elevate user experience by enhancing network performance for more interactive applications. This 5G uplink speed milestone, achieved with T-Mobile and Qualcomm, underscores our commitment to taking user experience to unprecedented levels.”

“We are incredibly proud to achieve yet another world record with T-Mobile. This groundbreaking achievement shows what could be possible with 5G DC and how it can bring new, unparalleled experiences to consumers, especially at large events like football games and concerts,” said Sunil Patil, Vice President, Product Management, Qualcomm Technologies, Inc. “We will continue our close collaboration with global innovators like T-Mobile and Ericsson to push the boundaries and unlock the full potential of 5G.”

5G network covers more than 330 million people across two million square miles. More than 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar mid-band 5G offerings from the Un-carrier’s closest competitors.

For more information on T-Mobile’s network, visit T-Mobile.com/coverage.

References:

https://www.t-mobile.com/news/network/t-mobile-shatters-for-5g-uplink-speed

https://www.telecoms.com/5g-6g/t-mobile-us-uses-5g-dc-to-claim-uplink-speed-record

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Samsung-Mediatek 5G uplink trial with 3 transmit antennas

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

BT, Nokia and Qualcomm demonstrate 2CC CA on uplink of a 5G SA network

U.S. Cellular to Sell Spectrum Licenses to Verizon in $1 Billion Deal

The WSJ reports that U.S. Cellular is selling a portion of its retained spectrum licenses to Verizon for $1 billion in cash as it looks to monetize the spectrum that wasn’t included in the proposed sale to T-Mobile. The Chicago-based telco, which caters to a base of mostly rural customers (approximately 4.5 million) across several states, on Friday said the deal includes the sale of 663 million megahertz point-of-presences of its cellular spectrum licenses. The deal is expected to close in mid-2025.

Under the terms of the agreement, U.S. Cellular will also sell 11 million megahertz point-of-presences of its advanced wireless services, and 19 million megahertz point-of-presences of its personal communications services licenses. The company said it has entered into additional agreements with two other mobile operators for the sale of other selected spectrum licenses.

TDS, the majority shareholder of U.S. Cellular, has delivered its written consent to approve the Verizon transaction.

Each transaction is dependent upon the closing of the proposed sale of the company’s cellular wireless operations and select spectrum assets to T-Mobile.

In May, T-Mobile agreed to buy much of U.S. Cellular’s operations which included about 30% of UScellular spectrum holdings, all of its customers and its retail stores in a deal worth $4.4 billion. That deal still requires regulatory approvals. It would give T-Mobile more than four million new customers and a trove of valuable spectrum rights to carry more of their data over the air.

According to the financial analysts at New Street Research, UScellular managed to score a higher-than-expected sale price to Verizon. “We valued these licenses at $812 million, and so this transaction is a 23% premium,” they wrote in a note to investors Friday morning.

Importantly, they argued that, as a result, the low band spectrum owned by EchoStar’s Dish Network might be worth more than they had previously calculated. “If we apply the premium to lowband licenses, based on this new mark, Dish’s 600 MHz portfolio would be worth $16 billion, up from $12 billion currently,” they wrote.

The New Street analysts speculated that UScellular’s remaining spectrum holdings will eventually be sold.

“This spectrum transaction took longer than we expected, and it is for fewer of the licenses than we expected,” they wrote of UScellular’s new deal with Verizon. “The monetization of the remaining [UScellular] spectrum could take time, but it will all be sold eventually.”

They argued that UScellular’s remaining, unsold spectrum holdings – which stretch across lowband holdings like 700MHz as well as mid band spectrum like C-band – could be worth as much as $3.2 billion.

But the analysts cautioned that it can be difficult to extrapolate spectrum values from just one transaction alone. For example, the licenses involved in the transaction between Verizon and UScellular are mostly located in smaller markets and therefore may not be directly comparable to spectrum licenses located in bigger cities. Further, most of the spectrum involved in the deal is low band, and so values might be different for large chunks of mid band spectrum.

References:

https://www.lightreading.com/5g/how-verizon-s-1b-uscellular-spectrum-deal-affects-echostar-s-dish

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

A Mobile World Live webinar on 5G-advanced upgrades identified new opportunities for network operator revenue streams, mostly due to improved network efficiencies and reduced costs. 5G Advanced, the next step in 5G evolution, will be specified in 3GPP Release 18 and 19. There is no work on it in ITU-R which is now focused on IMT-2030 (6G).

Egil Gronstad, T-Mobile senior director-technology development and strategy, said 5G Advanced will present opportunities for new revenue streams: 5G IoT will have lower cost and lower power consumption of endpoint devices (Redcap). Another 5G Advanced capability will be Ambient IoT (coming in Rel 19) which has a lot of opportunities via lower cost and no battery required in IoT devices. A bit further out is Integrated sensing and communications -using the network as a radar system to detect objects of interest. Improved spectrum efficiency will be improved using AI/ML for beam management.

Egil said 3GPP should develop specs for fixed wireless access (FWA). He’s disappointed with 3GPP not pursuing 5G FWA. “We haven’t really done anything in the 3GPP specs to specifically address fixed wireless,” he said. Neither has ITU-R WP 5D, which is responsible for developing all ITU-R recommendations for IMT (3G, 4G, 5G, 6G). FWA was not identified as an ITU use case for 5G and that hasn’t changed with 5G Advanced.

References:

https://www.nokia.com/about-us/newsroom/articles/5g-advanced-explained/

What is 5G Advanced and is it ready for deployment any time soon?

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

FWA a bright spot in otherwise gloomy Internet access market

Parks Associates’ newly launched Broadband Market Tracker, states that U.S. Fixed Wireless Access (FWA) adoption from a mobile network operator hit 7.8 million U.S. residential home internet connections in Q1-2024. That’s in comparison to 106.3 million U.S. households that had home internet service at the end of 2023.

Kristen Hanich, director of research at Parks Associates, told Fierce Network FWA and satellite internet are the “fastest growing” segments of the broadband market, “attracting consumers who were previously unserved or underserved by traditional providers.” She noted for the past several years, the FWA base has grown by 700,000 to 900,000 subscribers per quarter while cable connections have declined.

T-Mobile in Q1-2024 passed the 5 million mark for FWA subscribers and Verizon reported a total FWA tally of 3.4 million subscribers. These figures include both residential and business FWA customers.

Key FWA Findings from OpenSignal:

- 5G FWA has reshaped the U.S. broadband market. It has allowed U.S. mobile operators to rapidly expand their broadband footprints for minimal incremental network investment. This has seen 5G FWA absorb all broadband subscriber growth in the market since mid-2022.

- FWA is the secret sauce for 5G monetization. FWA benefits from lower prices compared to wireline competition, access to existing mobile retail channels and subscribers, and the ability to deliver a “good enough” broadband service.

- U.S. mobile networks have proven to be resilient. Despite adding millions of 5G FWA subs since 2021, 5G speeds on T-Mobile and Verizon’s mobile networks have continued to improve. Their success in managing FWA traffic is due to a variety of factors, including plentiful access to mid-band spectrum, localized load management, and differences in peak usage time of day patterns between mobile and FBB usage.

- Elsewhere, there are mixed results. In India, Jio is seeing no discernible impact from FWA on the mobile experience of its users, while in Saudi Arabia Zain is seeing the additional load on its network from FWA having a greater influence on mobile users’ experience, depending on the time of day or the level of FWA penetration.

“Despite adding more than eight million 5G FWA subs using 400+ GB per month of data since Q1 2021, the overall mobile network experience on T-Mobile and Verizon’s mobile networks has not been compromised,” Opensignal analyst Robert Wyrzykowski wrote in the firm’s new assessment of FWA technology.

In its new report, Opensignal found that areas in the U.S. with a larger number of FWA customers actually showed better networking performance than areas with fewer FWA customers. Meaning, Verizon and T-Mobile offered increasingly speedy connections even in geographic locations with higher concentrations of FWA users.

“We would expect low-FWA penetration areas to see better mobile and FWA performance because of less load on the network. However, our data demonstrates the opposite trend,” Wyrzykowski explained.

Other Opensignal findings:

- Around 6% of urban Internet customers subscribe to FWA; in rural areas that figure is 7%.

- Some 74% of FWA customers pay less than $75 per month for their services.

- 35% of FWA customers are between 18-34 years old, whereas that age range is 25% for cable.

Opensignal’s findings provide an important view into the FWA industry in the US as its subscriber growth begins to slow. For example, T-Mobile added 405,000 FWA customers during the first quarter, far less than the 541,000 FWA customers it added during the fourth quarter of 2023.

“5G FWA services have been on a dramatic growth trajectory in the U.S., absorbing all broadband subscriber growth in the market since mid-2022 and amassing more than 600-700 thousand net adds per quarter,” wrote Opensignal’s Wyrzykowski. “This is despite the USA being a mature broadband market with nearly 97% broadband adoption and modest household growth.”

…………………………………………………………………………………………………………….

U.S. cable companies have recorded historic declines in their core Internet businesses amid the growth of FWA in the U.S. Financial analysts at TD Cowen predict the U.S. cable industry will collectively lose more than half a million customers in the second quarter of this year. They attribute that decline to FWA competition as well as other factors including the end of the U.S. government’s Affordable Connectivity Program (ACP).

The situation for cable might get even worse if FWA providers like T-Mobile and Verizon decide to invest further into their fixed wireless businesses.

“The pain for cable may continue for longer than expected as the ability for cable to return to broadband subscriber growth may take longer (if ever),” wrote the TD Cowen analysts in a recent note to investors.

Others agree. For example, the analysts at S&P Global wrote that cable service providers in general have been losing value to wireless network operators despite cable’s efforts to bundle mobile services into cable offerings.

………………………………………………………………………………………………………

Parks’ Hanich said fiber optic access technology is on an upswing and Parks is seeing “excellent growth in the markets where it is available and high customer satisfaction with the customers who have it.”

“But the numbers are not quite as dramatic as what’s been going on with T-Mobile, Verizon and Starlink,” she said, noting the “growing convergence” of satellite and mobile networks is something else to keep an eye on.

Asked whether the demise of the Affordable Connectivity Program has had any impact on Parks’ findings, Hanich said, “we are concerned that the end of the program will result in households and families needing to disconnect from the internet for financial reasons.”

“For a good percentage of Americans, household budgets have been hit by rising inflation and lower-income families especially are having to cut back,” she said. “Thankfully we are seeing ISPs step up, try and transition people onto other plans and initiatives.”

…………………………………………………………………………………………………………….

Separately, Parks found adoption of mobile virtual network operator (MVNO) services reached over 15 million residential customer mobile lines in the quarter. In an MVNO model, broadband operators lease spectrum capacity from a wireless network to stand up their own mobile offering.

NTIA published some findings from its latest Internet Use Survey. Unsurprisingly, internet usage in the U.S. has gone up, with 13 million more people using the internet in 2023 compared to 2021. However, a lot of that usage is coming from lower-income households. Specifically, internet adoption among households making less than $25,000 per year increased from 69% in 2021 to 73% in 2023.

References:

https://www.fierce-network.com/broadband/fixed-wireless-continues-its-climb-among-us-homes-parks

https://www.lightreading.com/fixed-wireless-access/fwa-in-the-usa-getting-ready-for-phase-2

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon’s 2023 broadband net additions led by FWA at 375K

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

T-Mobile to acquire UScellular’s wireless operations in $4.4 billion deal

T-Mobile will buy almost all of regional carrier UScellular’s wireless operations including customers, stores and 30% of its spectrum assets [1.] in a deal valued at $4.4 billion, the company said on Tuesday. The announcement comes nearly ten months after UScellular and its parent company TDS disclosed that they were undertaking a strategic review of the mobile business, suggesting a possible sale.

Note 1. UScellular stated that it will retain around 70% of its spectrum assets following the T-Mobile deal “and will seek to opportunistically monetize these retained assets.”

The transaction, which is subject to the satisfaction of customary closing conditions and receipt of certain regulatory approvals, is expected to close in mid-2025.

T-Mobile’s 5G SA network will expand to provide millions of UScellular customers, particularly those in underserved rural areas, a superior connectivity experience, moving from a roaming experience outside of the UScellular coverage area to full nationwide access on the country’s largest and fastest 5G network. Additionally, UScellular customers will have the ability to fully participate in the T-Mobile’s industry-leading value-packed plans filled with benefits and perks, and best-in-class customer support with the opportunity to save UScellular customers hundreds of millions of dollars. T-Mobile customers will also get access to UScellular’s network in areas that previously had limited coverage and the benefit of enhanced performance throughout UScellular’s footprint from the addition of the acquired UScellular spectrum to T-Mobile’s network.

“With this deal T-Mobile can extend the superior Un-carrier value and experiences that we’re famous for to millions of UScellular customers and deliver them lower-priced, value-packed plans and better connectivity on our best-in-class nationwide 5G network,” said Mike Sievert, CEO of T-Mobile. “As customers from both companies will get more coverage and more capacity from our combined footprint, our competitors will be forced to keep up – and even more consumers will benefit. The Un-carrier is all about shaking up wireless for the good of consumers and this deal is another way for us to continue doing even more of that.”

“T-Mobile’s purchase and integration of UScellular’s wireless operations will provide best-in-class connectivity to rural Americans through enhanced nationwide coverage and service offerings at more compelling price points,” said Laurent Therivel, CEO of UScellular. “The transaction provides our customers access to better coverage and speeds, as well as unlimited texting in more than 215 countries, content offers, device upgrades and other T-Mobile benefits.”

Best-in-Class Network Experience

The combination of both companies’ spectrum and assets will provide UScellular customers a superior connected experience on T-Mobile’s industry-leading nationwide 5G network that offers best-in-class performance, coverage, and speed. Customers of both companies, particularly those in underserved rural areas, will receive access to faster and more reliable 5G service they would not otherwise have.

Value-Packed Plans

UScellular customers will have the option to stay on their current plans or move to an unlimited T-Mobile plan of their choosing with no switching costs, which include beloved Un-carrier benefits such as streaming and free international data roaming. If UScellular customers choose to switch to T-Mobile, they could save hundreds of millions of dollars combined annually. Some will also have access to plans with increased savings previously not available to them, including T-Mobile’s 5G Unlimited 55+ plans. All customers will be able to take advantage of T-Mobile’s award-winning customer service team, and have better, more accessible in-person and digital retail support.

More Choice and Increased Competition

This transaction will create a much-needed choice for wireless in areas with expensive and limited plans from AT&T and Verizon, and for those that have been limited to one or no options for home broadband connectivity. By tapping into the additional capacity and coverage created through the combined spectrum and wireless assets, T-Mobile will spur competition and expand its fast-growing home broadband offering and fixed wireless products to communities without competitive broadband options, further bridging the digital divide for hundreds of thousands of customers in UScellular’s footprint.

Proven Un-carrier Playbook

T-Mobile has a proven industry-leading track record of bringing companies together in the name of enhanced connectivity, choice, and value for consumers. The integrations of MetroPCS in 2013 and Sprint in 2020 have been noted as two of the most successful merger combinations in wireless history that resulted in competition-enhancing shifts benefiting millions of consumers. Leveraging its tried-and-true playbook for successful integrations, T-Mobile will continue to deliver exceptional value and experiences to more people across the country, while forcing others to follow suit, for the good of customers.

Transaction Details and Financial Profile

T-Mobile will pay approximately $4.4 billion for the assets being acquired from UScellular in the transaction in a combination of cash and up to $2.0 billion of debt to be assumed by T-Mobile through an exchange offer to be made to certain UScellular debtholders prior to closing. To the extent any debtholders do not participate in the exchange, their bonds will continue as obligations of UScellular and the cash portion of the purchase price will be correspondingly increased. Following the closing of the transaction, UScellular will retain ownership of its other spectrum as well as its towers, with T-Mobile entering into a long-term arrangement to lease space on at least 2,100 additional towers being retained.

T-Mobile does not expect the transaction to impact the company’s 2024 guidance or 2024 authorized shareholder return program. T-Mobile expects this transaction will yield approximately $1.0 billion in effective total opex and capex annual run rate cost synergies upon integration, with total cost to achieve the integration currently estimated at between $2.2 billion to $2.6 billion. The company plans to reinvest a portion of synergies toward enhancing consumer choice, quality and competition in the wireless industry.

References:

https://www.t-mobile.com/news/business/uscellular-acquisition-operations-assets

https://finance.yahoo.com/news/t-mobile-buy-uscellulars-wireless-114507766.html

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states