FT: Scale of AI private company valuations dwarfs dot-com boom

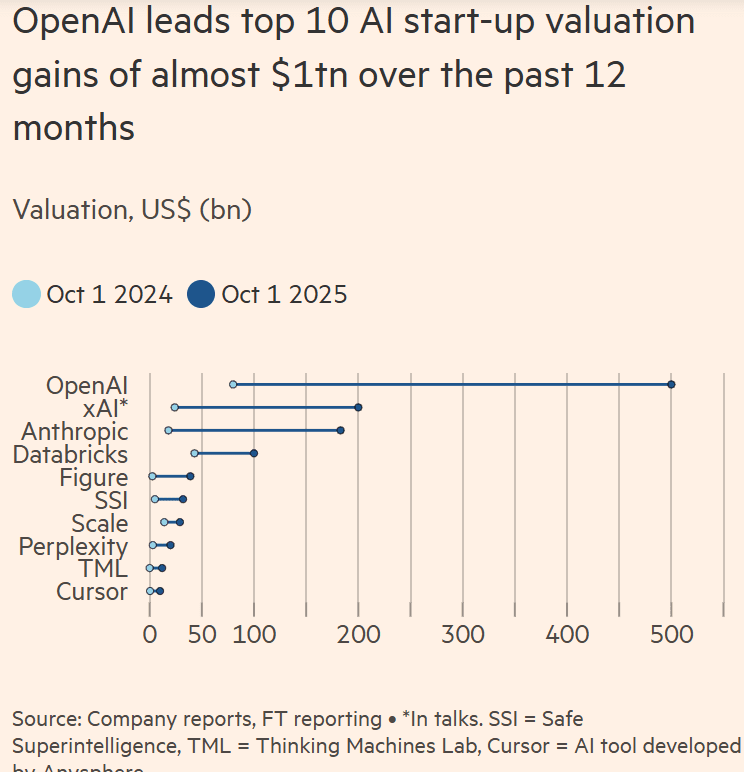

The Financial Times reports that ten loss making artificial intelligence (AI) start-ups have gained close to $1 trillion in private market valuation in the past 12 months, fuelling fears about a bubble in private markets that is much greater than the dot com bubble at the end of the 20th century. OpenAI leads the pack with a $500 billion valuation, but Anthropic and xAI have also seen their values march higher amid a mad scramble to buy into emerging AI companies. Smaller firms building AI applications have also surged, while more established businesses, like Databricks, have soared after embracing the technology.

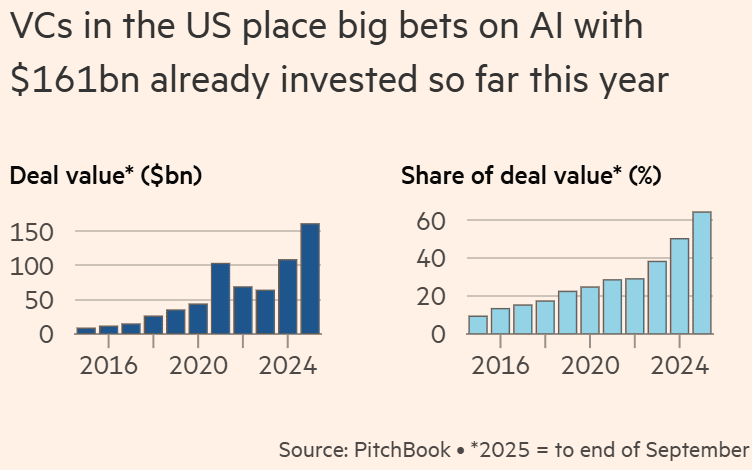

U.S. venture capitalists (VCs) have poured $161 billion into artificial intelligence startups this year — roughly two-thirds of all venture spending, according to PitchBook — even as the technology’s commercial payoff remains elusive. VCs are on track to spend well over $200bn on AI companies this year.

Most of that money has gone to just 10 companies, including OpenAI, Anthropic, Databricks, xAI, Perplexity, Scale AI, and Figure AI, whose combined valuations have swelled by nearly $1 trillion, Financial Times calculations show. Those AI start-ups are all burning cash with no profits forecasted for many years.

Start-ups with about $5mn in annual recurring revenue, a metric used by fast-growing young businesses to provide a snapshot of their earnings, are seeking valuations of more than $500mn, according to a senior Silicon Valley venture capitalist.

Valuing unproven businesses at 100 times their earnings or more dwarfs the excesses of 2021, he added: “Even during peak Zirp [zero-interest rate policies], these would have been $250mn-$300mn valuations.”

“The market is investing as if all these companies are outliers. That’s generally not the way it works out,” he said. VCs typically expect to lose money on most of their bets, but see one or two pay the rest off many times over.

“There will be casualties. Just like there always will be, just like there always is in the tech industry,” said Marc Benioff, co-founder and chief executive of Salesforce, which has invested heavily in AI. He estimates $1tn of investment on AI might be wasted, but that the technology will ultimately yield 10 times that in new value.

“The only way we know how to build great technology is to throw as much against the wall as possible, see what sticks, and then focus on the winners,” he added.

“Of course there’s a bubble,” said Hemant Taneja, chief executive of General Catalyst, which raised an $8 billion fund last year and has backed Anthropic and Mistral. “Bubbles align capital and talent around new trends. There’s always some destruction, but they also produce lasting innovation.”

Venture investors have weathered cycles of boom and bust before — from the dot-com crash in 2000 to the software downturn in 2022 — but the current wave of AI funding is unprecedented. In 2000, VCs invested $10.5 billion in internet startups; in 2021, they deployed $135 billion into software firms. This year, they are on pace to exceed $200 billion in AI. “We’ve gone from the doldrums to full-on FOMO,” said one investment executive.

OpenAI and its start-up peers are competing with Meta, Google, Microsoft, Amazon, IBM, and others in a hugely capital-intensive race to train ever-better models, meaning the path to profitability is also likely to be longer than for previous generations of start-ups.

Backers are betting that AI will open multi-trillion-dollar markets, from automated coding to AI friends or companionship. Yet some valuations are testing credulity. Startups generating about $5 million in annual recurring revenue are seeking valuations above $500 million, a Silicon Valley investor said — 100 times revenue, surpassing even the excesses of 2021. “The market is behaving as if every company will be an outlier,” he said. “That’s rarely how it works.”

The enthusiasm has spilled into public markets. Shares of Nvidia, AMD, Broadcom, and Oracle have collectively gained hundreds of billions in market value from their ties to OpenAI. But those gains could unwind quickly if questions about the startup’s mounting losses and financial sustainability persist.

Sebastian Mallaby, author of The Power Law, summed it up beautifully:

“The logic among investors is simple — if we get AGI (Artificial General Intelligence, which would match or exceed human thinking), it’s all worth it. If we don’t, it isn’t…. “It comes down to these articles of faith about Sam’s (Sam Altman of OpenAI) ability to work it out.”

References:

https://www.ft.com/content/59baba74-c039-4fa7-9d63-b14f8b2bb9e2

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Can the debt fueling the new wave of AI infrastructure buildouts ever be repaid?

Amazon’s Jeff Bezos at Italian Tech Week: “AI is a kind of industrial bubble”

Gartner: AI spending >$2 trillion in 2026 driven by hyperscalers data center investments

AI Data Center Boom Carries Huge Default and Demand Risks

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

Since 2024, private investors have spent $259B funding AI start-ups, according to Crunchbase. OpenAI is making an early bid to become a colossus in the AI age, but many of these new companies may not yet be on anyone’s radar, and some might not even exist. There are long-term risk tied to OpenAI, which underlies Oracle’s growth.

There’s still no clear answer as to where OpenAI will get the money for its Oracle cloud contract. Or how Oracle itself will finance the capital expenditures required to fulfill its end of the bargain. Perhaps most complicated: Where will the companies find the electricity to power these data centers?

Oracle’s long-term value relies on answers to these thorny questions.

https://www.barrons.com/articles/nobel-prize-ai-innovation-disruption-7cd620ce