From LPWAN to Hybrid Networks: Satellite and NTN as Enablers of Enterprise IoT – Part 2

By Afnan Khan (ML Engineer) and Mehsam Bin Tahir (Data Engineer)

Introduction:

This is the second of two articles on the impact of the Internet of Things (IoT) on the UK Telecom industry. The first is at

Enterprise IoT and the Transformation of UK Telecom Business Models – Part 1

Executive Summary:

Early Internet of Things (IoT) deployments relied heavily on low power wide area networks (LPWANs) to deliver low-cost connectivity for distributed devices. While these technologies enabled initial IoT adoption, they struggled to deliver sustainable commercial returns for telecom operators. In response, attention has shifted towards hybrid terrestrial–satellite connectivity models that integrate Non-Terrestrial Networks (NTN) directly into mobile network architectures. In 2026, satellite connectivity is increasingly positioned not as a universal coverage solution but as a resilience and continuity layer for enterprise IoT services (Ofcom, 2025).

The Commercial Limits of LPWAN-Based IoT:

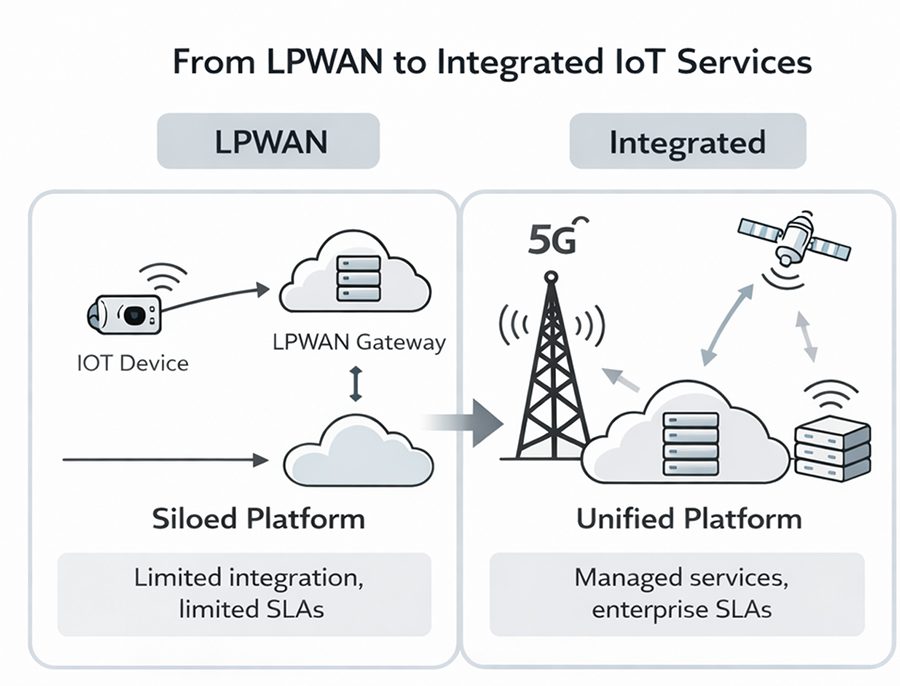

LPWAN technologies enabled low-cost connectivity for specific IoT use cases but were typically deployed outside mobile core architectures. This limited their ability to support quality of service guarantees, enterprise-grade security and integrated billing models. As a result, LPWAN deployments often remained fragmented and failed to scale into durable enterprise business models, restricting their long-term commercial value for telecom operators (Ofcom, 2025).

Satellite and NTN as Integrated Mobile Extensions:

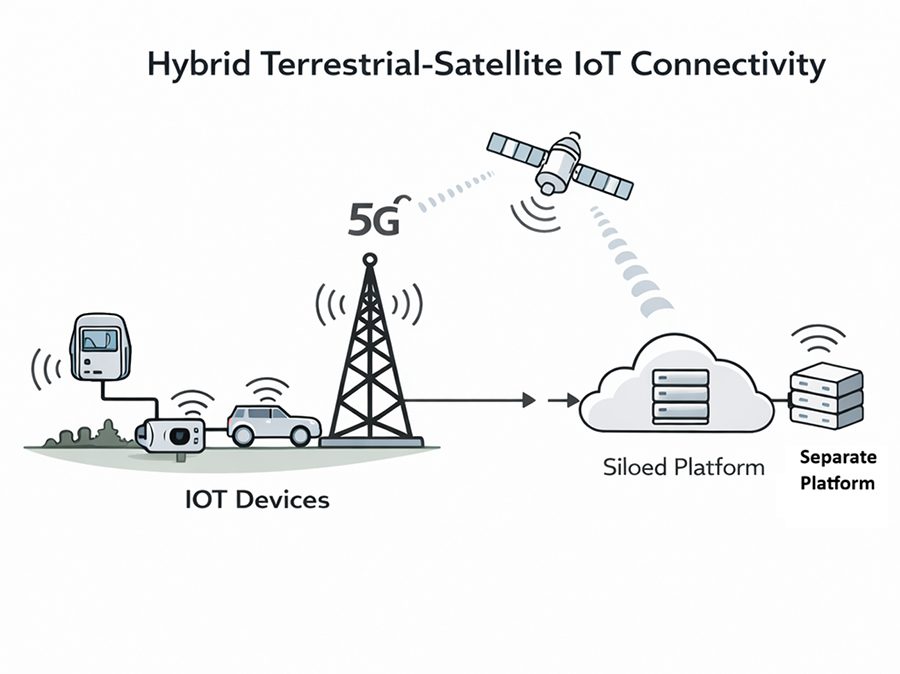

In contrast, satellite and NTN connectivity extends existing mobile networks rather than operating as a parallel IoT layer. When non-terrestrial connectivity is integrated into 5G core infrastructure, telecom operators are able to deliver managed IoT services with consistent security, performance and billing models across both terrestrial and remote environments. This architectural shift allows satellite connectivity to be packaged as part of a unified enterprise service rather than sold as a standalone or niche connectivity product (3GPP, 2023). Figure 1 illustrates this hybrid terrestrial–satellite model, showing how satellite connectivity functions as an extension of mobile networks to support continuous IoT services across urban, rural and remote environments.

Figure 1: Hybrid terrestrial–satellite connectivity supporting continuous IoT services across urban, rural and remote environments.

Industrial Use Cases and Hybrid Connectivity

In sectors such as offshore energy, agriculture, logistics and remote infrastructure monitoring, IoT deployments prioritise coverage continuity and service resilience over peak data throughput. Hybrid terrestrial–satellite connectivity enables operators to offer coverage guarantees and service level agreements that LPWAN-based models could not reliably support. In 2026, Virgin Media O2 launched satellite-enabled services aimed at supporting rural connectivity and improving resilience for IoT-dependent applications, reflecting a broader operator strategy to monetise non-terrestrial coverage where reliability is a core requirement (Real Wireless, 2025).

The commercial implications of this transition are further illustrated in Figure 2, which contrasts siloed LPWAN deployments with integrated mobile and satellite IoT services delivered through a unified network core.

Figure 2: Transition from siloed LPWAN deployments to integrated mobile and satellite IoT services delivered through a unified network core.

Satellite Connectivity and Enterprise IoT at Scale:

The UK Space Agency has identified hybrid terrestrial–satellite connectivity as an enabling layer for remote industrial operations, environmental monitoring and agricultural IoT systems. UK-based firms such as Open Cosmos are contributing to this model by integrating Low Earth Orbit satellite connectivity with existing mobile core networks. This approach allows telecom operators to deliver end-to-end managed connectivity for enterprise customers without deploying separate IoT network stacks, converting coverage limitations from a cost burden into chargeable, service-based revenue opportunities (Open Cosmos, 2024; UK Space Agency, 2025).

Conclusion

In 2026, IoT is reshaping the UK telecom sector primarily by enabling new revenue models rather than by driving incremental network expansion. Following the limited commercial success of LPWAN-based IoT strategies, satellite and Non-Terrestrial Network integration is increasingly deployed as an extension of mobile networks to provide coverage continuity and service guarantees for industrial and remote use cases. When integrated into 5G core architectures, satellite connectivity enables telecom operators to monetise resilience and reliability as part of managed enterprise services rather than offering standalone connectivity. Taken together, these developments show that satellite and NTN integration has become a critical enabler of scalable, enterprise-led IoT business models in the UK (Ofcom-2025; 3GPP-2023).

…………………………………………………………………………………………………………………………………………………………………………

References:

Ofcom. (2025). Connected Nations UK report.

https://www.ofcom.org.uk

Real Wireless. (2025). Satellite to mobile connectivity and the UK market.

https://real-wireless.com

UK Space Agency. (2025). Connectivity and space infrastructure briefing

https://www.gov.uk/government/organisations/uk-space-agency

Open Cosmos. (2024). Satellite solutions for IoT and Earth observation.

https://open-cosmos.com

3GPP. (2023). Non-Terrestrial Networks (NTN) support in 5G systems.

https://www.3gpp.org/news-events/ntn

Non-Terrestrial Networks (NTNs): market, specifications & standards in 3GPP and ITU-R

Keysight Technologies Demonstrates 3GPP Rel-19 NR-NTN Connectivity in Band n252 (using Samsung modem chip set)

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

China ITU filing to put ~200K satellites in low earth orbit while FCC authorizes 7.5K additional Starlink LEO satellites

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU