Non Terrestrial Network (NTN

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

Backgrounder:

Non-terrestrial networks (NTN) are networks or segments of networks that use either Uncrewed Aircraft Systems (UAS) operating typically between 8 and 50km altitudes, including High Altitude Platforms (HAPs) or satellites in different constellations to carry a transmission equipment relay node or a base station:

- LEO (Low Earth Orbit): Circular orbit in altitudes of typ. 500-2.000km (lower delay and better link budget but larger number of satellites needed for coverage)

- MEO (Medium Earth Orbit): Circular orbit in altitudes of typ. 8.000-20.000km

- GEO (Geostationary Earth Orbit): Circular orbit 35.786 km above the Earth’s equator (Note: Due to gravitational forces a GEO satellite is still moving within a range of a few km around its nominal orbital position).

- HEO (Highly Elliptical Orbiting): Elliptical orbit around the earth.

Figure 1: Illustration of the classes of orbits of satellites [source: TR 22.822]

……………………………………………………………………………………………………………………………………

Future ITU-R NTN standard – Recommendation ITU-R M.[IMT-2020-SAT.SPECS]:

ITU-R SG04 Circular 134 invited proposal submissions for candidate radio interface technologies for the satellite component of the radio interface(s) for IMT-2020 (ITU-R M.2150 recommendation) and invitation to participate in their subsequent evaluation. Acting on behalf of 3GPP (which it is a member of), ATIS recently submitted three 3GPP documents to ITU-R WP’s 5B and 5D for consideration. The submitted material consists of 3GPP Releases 17 and 18 and it is provided in the following documents:

1. 3GPP 5G-NTN: RIT

o NR-NTN

2. 3GPP 5G-NTN: SRIT

o Component RIT: NR-NTN

o Component RIT: IoT-NTN

Legend:

NTN=Non Terrestrial Network

RIT: Radio Interface Technology

SRIT: Set of Radio Interface Technologies

…………………………………………………………………………………………………………………………………………………………..

3GPP looks forward to the continuous collaboration with ITU-R WP 4B for the finalization of Recommendation ITU-R M.[IMT-2020-SAT.SPECS], which will be the official standard for 5G satellite to ground communications.

…………………………………………………………………………………………………………………………………………………………..

-

Release 17:

- Foundation for 5G NTN: Established the foundation for integrating 5G with non-terrestrial networks (NTNs), enabling satellite connectivity for 5G services.

- Focus on Transparent Architecture: Rel-17 NTN was based on a transparent (bent-pipe) architecture, where the satellite acts as a radio repeater, limiting payload complexity and enabling early deployment.

- Initial Standardization: 3GPP pursued a range of solutions for 5G non-terrestrial networking (NTN) based on options for the type of non-terrestrial platform and the use cases supported.

- IoT-NTN: Introduced IoT-NTN, enabling satellite connectivity for Internet of Things devices.

- Frequency Bands: Focused on L-band and S-band in FR1 for NTN.

- Foundation for 5G NTN: Established the foundation for integrating 5G with non-terrestrial networks (NTNs), enabling satellite connectivity for 5G services.

-

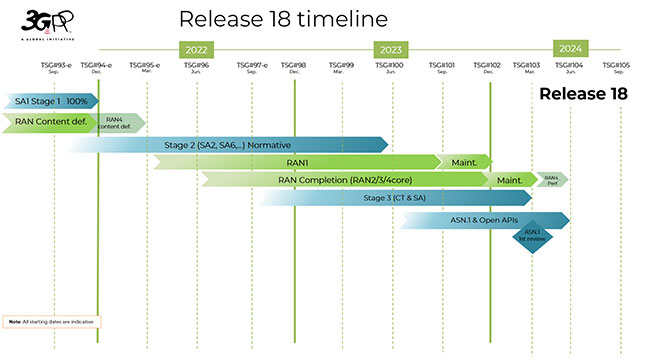

Release 18 (5G-Advanced):

- NTN-IoT Enhancements: Further optimized NTN for IoT, including enhancements for Machine-Type Communication (MTC).

- New Service and Traffic Models: Introduced new service and traffic models to better support NTN applications.

- New Frequency Bands: Expanded frequency support to include Frequency Range 2 (FR2), spanning 17,300 MHz to 30,000 MHz.

- Focus on Ka-band: Prioritized the use of Ka-band for NR NTN deployment.

- Uplink Coverage and Mobility Enhancements: Improved uplink coverage and mobility/service continuity between NTN and terrestrial networks (NTN-TN) and between NTN networks (NTN-NTN).

- Network Verified UE Location: Enabled the network to verify UE location as per regulatory requirements.

- RedCap Enhancements: RedCap solutions were further optimized to reduce device cost and power consumption.

- Support for Store & Forward (S&F) operation based on regenerative payload: Release 18 and beyond will support Store & Forward operation based on regenerative payload, including the support of feeder link switchover.

- NTN-IoT Enhancements: Further optimized NTN for IoT, including enhancements for Machine-Type Communication (MTC).

References:

2 ATIS contributions to ITU-R WP 5D and 5B (only available to ITU TIES account members)

https://www.3gpp.org/technologies/ntn-overview

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Momentum builds for wireless telco- satellite operator engagements

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

China Telecom and China Mobile invest in LEO satellite companies

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

China Telecom and China Mobile invest in LEO satellite companies

Two of China’s state-owned telcos have taken stakes in new LEO satellite companies.

- China Telecom has set up a new fully owned subsidiary, Tiantong Satellite Technology Co., registered in Shenzhen with 1 billion Chinese yuan (US$138 million) paid-in capital. China Telecom, which is currently the only operator with a mobile satellite license, operates three Tiantong Geo orbit satellites, launched between 2016 and 2021, covering China, the western Pacific and its neighbors.

- In April China Mobile took a 20% stake in a new RMB4 billion ($551 million) state-owned company, China Shikong Xinxi Co., registered in Xiongan. China Satellite Network Group, the company behind Starnet, China’s biggest LEOsat project, will own 55%, and aerospace contractor Norinco, a 25% shareholder.

China Telecom will shutter its legacy satellite subsidiary, established in 2009, and transfer the assets into the new company.

The other new business, China Shikong, lists its scope as satellite communication, satellite navigation and remote sensing services.

The two investments come as China Starnet is readying to launch its first satellites in the second half of the year. It is aiming to build a constellation of 13,000, with the first 1,300 going into operation over the next five years, local media has reported.

In addition to Starnet, two other mass constellations are planned – the state-owned G60 and a private operator, Shanghai Hongqing. Neither has set a timetable. They will be playing catch up with western operators like Starlink and OneWeb, which are already operating thousands of commercial satellites.

Since foreign operators are forbidden from selling into China, it is not yet clear how China is going to structure its LEO satellite industry and what role precisely the new operators are going to play.

References:

Chinese telcos tip cash into satellite (lightreading.com)

China Mobile launches LEO satellites to test 5G and 6G – Developing Telecoms

Very low-earth orbit satellite market set to reach new heights | TelecomTV

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

LEO operator Sateliot joins GSMA; global roaming agreements to extend NB-IoT coverage

Momentum builds for wireless telco- satellite operator engagements

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Overview and Backgrounder:

Exolaunch, a global leader in launch mission management, integration, and satellite deployment services, today announced a new launch and deployment services agreement with Sateliot [1.], which claims to be the first company to operate a low Earth orbit (LEO) 5G NB-IoT satellite constellation. It’s the first collaboration between the two companies.

Note 1. Sateliot is based in Barcelona, Spain and San Diego, CA. The start-up company is backed by strong investors such as Evonexus (investment arm of Qualcomm and Verizon among others), Banco Santander, CELLNEX and INDRA, and partners of the GSMA and the ESA (European Space Agency).

Sateliot claims to be a “trailblazer in facilitating connectivity for all current narrowband IoT (NB-IoT) devices via satellite through its constellation.”

Sateliot is building a constellation of 250 unique satellites enabling 5G NB-IoT connectivity from space, revolutionizing connectivity solutions globally. Under the terms of this agreement, Sateliot is set to deploy four additional satellites to join its growing 5G IoT constellation, utilizing Exolaunch’s industry-leading services and hardware.

The constellation of LEO satellites will enable Sateliot to offer services at comparable costs to those of terrestrial cellular networks, a significant stride towards widespread adoption of IoT in previously inaccessible regions.

Sateliot’s four 6U satellites, named Sateliot_1, Sateliot_2, Sateliot_3, and Sateliot_4, are manifested via Exolaunch on the Transporter-11 Rideshare mission with SpaceX, which is slated to launch in mid-2024. Sateliot will benefit from Exolaunch’s renowned mission management services and integration support, and will leverage Exolaunch’s innovative and flight-proven containerized satellite separation system, the EXOpod Nova, for the deployment of its satellites.

………………………………………………………………………………………………………..

About Sateliot’s Technology:

Sateliot’s solution is based on 5G NB-IoT in 3GPP Rel 17 NTN (Non Terrestrial Network). The company says that is “a clear minimum workable solution under 5G ecosystem.” The claim “5G from space,” is based on the use of LEO satellites for connectivity- not HAPS or other NTN types.

While 3GPP Rel 19 (to be completed December 2025) will provide a complete solution, Sateliot says that is not needed now to offer a minimum workable solution, via 3GPP Rel 17 NTN. This minimum workable Rel 17 NTN solution is related to NB-IoT only, so, there is no need to wait for Rel 18 or Rel 19. Sateliot has already found a commercially available chipset and RF module from its main vendor.

………………………………………………………………………………………………………………..

Non-Terrestrial Networks (NTN) for Internet of Things (IoT) Phase 3:

With IoT-NTN specified in 3GPP RAN Rel-17, with optimizations following in Rel-18, commercial deployments are now ongoing. Now, further evolution of IoT-NTN is underway with a dedicated Rel-19 work item, focusing in on three areas:

- Support of Store & Forward (S&F) operation based on regenerative payload, including the support of feeder link switchover.

- Uplink capacity enhancements.

3GPP R19 is part of the 3GPP’s “5G Advanced” releases, which are intended to improve network performance and support new applications and use cases.

…………………………………………………………………………………………………………..

Quotes:

“Partnering with Exolaunch marks a significant milestone for Sateliot as we continue our mission to revolutionize 5G IoT connectivity from space. With Exolaunch’s expertise and industry-leading services, we are confident in the successful launch and deployment of our next four satellites, further advancing our vision of ubiquitous IoT connectivity,” remarked Jaume Sanpera, chief executive officer at Sateliot.

“We are delighted to welcome Sateliot as our newest customer and partner,” said Pablo Lobo, mission manager at Exolaunch. “This agreement highlights Exolaunch’s dedication to facilitating the growth and success of innovative European companies like Sateliot. Exolaunch is proud to provide our industry-leading services and technology to support Sateliot’s vision of advancing 5G IoT connectivity from space. With the launch campaign underway, our team’s excitement for this mission is palpable and we look forward to a smooth and successful deployment of these satellites later this year.”

……………………………………………………………………………………………………

References:

https://www.3gpp.org/news-events/3gpp-news/5g-ntn

LEO operator Sateliot joins GSMA; global roaming agreements to extend NB-IoT coverage

Momentum builds for wireless telco- satellite operator engagements

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Momentum builds for wireless telco- satellite operator engagements

Over the past two years, the wireless telco-satellite market has seen significant industry-wide growth, driven by the integration of Non-Terrestrial Networks (NTN) in 5G New Radio as part of 3GPP Release 17. GSMA Intelligence reports that 91 network operators, representing about 5 billion global connections (60% of the total mobile market), have partnered with satellite operators. Although the regulatory landscape and policy will influence the commercial launch of these services in various regions, the primary objective is to achieve ubiquitous connectivity through a blend of terrestrial and non-terrestrial networks.

Recent developments include:

- AT&T and AST SpaceMobile have signed a definitive agreement extending until 2030 to create the first fully space-based broadband network for mobile phones. This summer, AST SpaceMobile plans to deliver its first commercial satellites to Cape Canaveral for launch into low Earth orbit. These initial five satellites will help enable commercial service that was previously demonstrated with several key milestones. These industry first moments during 2023 include the first voice call, text and video call via space between everyday smartphones. The two companies have been on this path together since 2018. AT&T will continue to be a critical collaborator in this innovative connectivity solution. Chris Sambar, Head of Network for AT&T, will soon be appointed to AST SpaceMobile’s board of directors. AT&T will continue to work directly with AST SpaceMobile on developing, testing, and troubleshooting this technology to help make continental U.S. satellite coverage possible.

- SpaceX owned Starlink has officially launched its commercial satellite-based internet service in Indonesia and received approvals to offer the service in Malaysia and the Philippines. Starlink is already available in Southeast Asia in Malaysia and the Philippines. Indonesia, the world’s largest archipelago with more than 17,000 islands, faces an urban-rural connectivity divide where millions of people living in rural areas have limited or no access to internet services. Starlink secured VSAT and ISP business permits earlier in May, first targeting underdeveloped regions in remote locations.Jakarta Globe reported the service costs IDR750,000 ($46.95) per month, twice the average spent in the country on internet service. Customers need a VSAT (very small aperture terminal) device or signal receiver station to use the solution.Internet penetration in Indonesia neared 80% at the end of 2023, data from Indonesian Internet Service Providers Association showed. With about 277 million people, Indonesia has the fourth largest population in the world. The nation is made up of 17,000 islands, which creates challenges in deploying mobile and fixed-line internet nationwide.Starlink also in received approvals to offer the service in Malaysia and the Philippines. The company aims to enable SMS messaging directly from a network of low Earth orbit satellites this year followed by voice and data starting in 2025. In early January, parent SpaceX launched the first of six satellites to deliver mobile coverage.

- Space X filed a petition with the FCC stating that it “looks forward to launching commercial direct-to-cellular service in the United States this fall.” That will presumably be only for text messages, because the company has stated that ONLY text will available in 2024 via Starlink. Voice and data won’t be operational until 2025. Importantly, SpaceX did not identify the telco who would provide Direct-to Cell satellite service this fall.

In August 2022, T-Mobile and SpaceX announced their plans to expand cellular service in the US using low-orbit satellites. The service aims to provide direct-to-cell services in hard-to-reach and underserved areas such as national parks, uninhabited areas such as deserts and mountain ranges, and even territorial waters. Traditional land-based cell towers cannot cover most of these regions.

- SpaceX said that “supplemental coverage from space (“SCS”) will enable ubiquitous mobile coverage for consumers and first responders and will set a strong example for other countries to follow.” Furthermore, SpaceX said the “FCC should reconsider a single number in the SCS Order—namely, the one-size-fits-all aggregate out-of-band power flux-density (“PFD”) limit of -120 dBW/m2 /MHz that it adopted in the new Section 25.202(k) for all supplemental coverage operations regardless of frequency band.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AT&T, AST SpaceMobile draw closer to sat-to-phone launch

Starlink sat-service launches in Indonesia

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

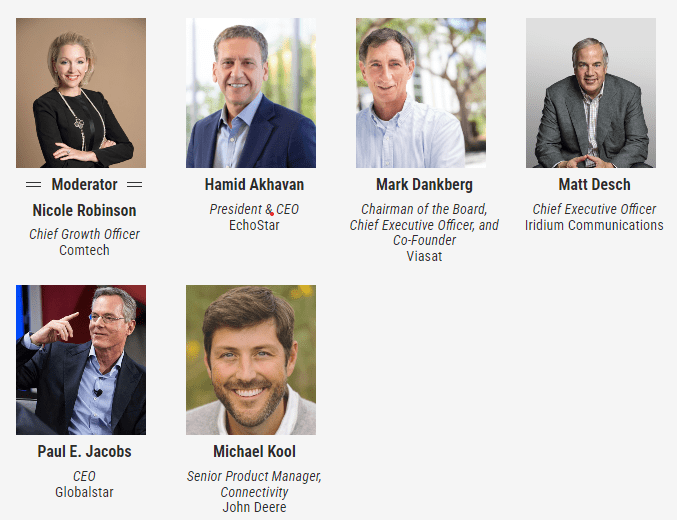

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Satellite Communications (SatCom) market services will include fixed broadband Internet access, satellite Internet of Things (IoT), and Non-Terrestrial Network (NTN) mobile (satellite-to-cell services). These services will experience growth due to more satellite players launching networks in Low Earth Orbit (LEO), alongside an increasing interest in terrestrial and satellite network convergence.

The market is expanding rapidly and major players are quickly recognizing its potential. While satellite networks are experiencing rapid changes due to innovations in small satellites and nanosatellites, Software-Defined Networking (SDN) applications, High Throughput Satellites (HTS), and inter-satellite links, terminals on the ground continue to see growth, with Very Small Aperture Terminals (VSAT) SatCom solutions maintaining dominance in the market.

According to Research & Markets, the SATCOM equipment market is valued at $22.6 billion in 2023 and is projected to reach $38.7 billion by 2028, at a CAGR of 11.3% from 2023 to 2028. Based on frequency, the multiband frequency is projected to register the highest during the forecast period 2023-2028.

………………………………………………………………………………………………………………………………..

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

WP 4B has a working document which is a preliminary draft new Report ITU-R M.[SAT IOT] – Technical and operational aspects of satellite Internet of Things (IoT) applications, a work plan and working document on Work plan for development of a preliminary draft new Report ITU-R M.[DEVELOPMENT AND TECHNOLOGY TRENDS FOR THE SATELLITE COMPONENT OF INTERNATIONAL MOBILE TELECOMMUNICATIONS]. WP5D last meeting was July 2023, but the following meeting won’t be till April 29 to May 5, 2024!

Yet the real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN:

3GPP Release 17 introduced new network topologies that are based on High-Altitude Platforms (HAPs) and LEO and Geostationary Orbit (GEO) satellites. Crucially, these laid out the foundation for satellite IoT and NTN mobile as Release 17 extended the cellular IoT protocols, LTE-M and Narrowband (NB)-IoT for satellites. This enabled two new standards for satellite networks, IoT-NTN and New Radio-NTN (NR-NTN). SatCom with individual mobile devices will close gaps in the terrestrial cellular networks to provide global connectivity. It will target issues like unreachability and service continuity in underserved regions and improve network resilience around the world.

The discussion items in the upcoming 3GPP Release 18 are expected to enhance NTN Mobile and Satellite IoT as key satellite enabled services. While Release 17 established the standards for IoT-NTN and NR-NTN, Release 18 will evolve both those specifications for IoT and satellite-to-mobile broadband connectivity. For NR-NTN, there are plans to run NR-NTN on Radio Frequency (RF) spectrum above 10 Gigahertz (GHz) to serve the aerospace and maritime industry, alongside businesses and buildings (with building-mounted devices). Release 18 is also expected to include enhancements in satellite backhaul, specifically the dedication of more spectrum for Mobile Satellite Services (MSS), with approximately 80 Megahertz (MHz) of uplink in the L-band and downlink in the S-band.

At the same time, improvements targeted toward Fixed Satellite Services (FSS) will be brought about by Release 18 as well, with the consideration of more bands in the Ka frequency bands for downlink (17.7 – 20.2 GHz) and uplink (27.5 – 30 GHz). While the specifics of 3GPP Release 18 are still in development, 3GPP has already established the boundaries of Release 18 that will benefit the SatCom market. Furthermore, with the recent mergers of Eutelsat and OneWeb in 2022 and Viasat and Inmarsat in 2023, in addition to the launch of Infrastructure for Resilience, Interconnectivity and Security by Satellite (IRIS2), a project endorsed by the European Union (EU) in 2022 to enhance connectivity throughout the EU, more partnerships and agreements are expected to arise ahead of the official launch of 3GPP Release 18 in 2024.

ABI Research says that 3GPP Release 18 aims to unlock new capabilities toward the evolution of 5G-Advanced and establish new regulatory requirements, along with new bands, while optimizing satellite access performance. The market research firm forecasts the market value for worldwide SatCom to be US$94.9 billion by 2027 (MD-SATCC-102). The growth of NTN mobile, in addition to broadband, will drive the market moving forward, with special mention of NTN mobile revenue likely to shoot from 0.2% of the total revenue in 2023 to 8.8% of the overall SatCom revenue by 2027. ABI Research recognizes that greater value has been placed on the protocols, such as 3GPP Release 18 and beyond, that will develop and nurture the SatCom space.

Strategic partnerships between terrestrial and NTN operators, solution providers/Communication Service Providers (CSPs), and wireless end-user equipment vendors are currently on the rise and will be critical in expanding the ecosystem and market toward 2027. For instance, MediaTek and Qualcomm have partnered with Inmarsat and Iridium, respectively, to target the NTN mobile market.

Meanwhile, AST SpaceMobile has agreements with AT&T, Rakuten Mobile, and several other mobile network operators. Where satellite IoT is concerned, CSPs like Deutsche Telekom have established partnerships with Intelsat and Skylo, whereas Telefónica and Sateliot are working together to trial satellite IoT connectivity. While partnerships are a good indicator of SatCom’s market potential, it is important that operators consider differentiated and unique product offerings for clients.

The value proposition that SatCom players can offer their target market will be essential for this process. Some examples might include integrated end-to-end IoT solutions for maritime, offshore connectivity, or end-to-end NTN mobile solutions that marry NTN hardware and software for satellite connectivity. Nonetheless, the creation of new value added services will benefit from 3GPP Release 18, in addition to driving the overall momentum and agenda of the Satellite Communications market.

References:

https://www.itu.int/en/ITU-R/study-groups/rsg4/rwp4b/Pages/default.aspx

ABI Research’s Highlights & Developments in the SatCom NTN Market (PT-2740)

https://finance.yahoo.com/news/global-satellite-communication-satcom-equipment-214500758.html

https://www.3gpp.org/specifications-technologies/releases/release-18

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025