Daryl Schoolar: 5G mmWave still in the doldrums!

In November Recon Analytics completed a survey of 100 communication service providers (CSP) as part of its “Global Communication Service Provider Pulse” research practice. The survey included questions around the current state of their 5G networks, and their thoughts on 5G Advanced and 6G. Three of those questions are as follows:

- What has been the biggest benefit of deploying 5G?

- In the next phase of 5G’s development, also known as 5G-Advanced, several technological enhancements are under study or being developed. From the list below, which three possible 5G-Advanced technology areas do you think are the most important?

- What are the most important technology areas that you think 6G should focus on?

The most common answers to all three of those questions had to do with increasing network capacity and gaining access to new spectrum. And this is where having lots of water but nothing to drink comes into play. There are mobile operators today who already have large swaths of fallow spectrum in the form of mmWave.

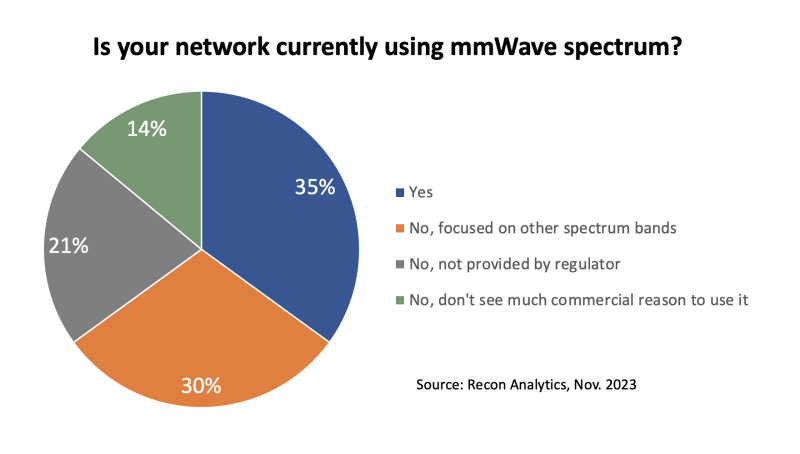

mmWave [1.] provides mobile operators with thousands of megahertz of new capacity, but the majority of 5G operators (with the exception of Verizon) have not started to use it. The limited deployment reflects the coverage and in-building penetration challenges that come with mmWave. Our survey findings underscore this reality. Recon asked mobile operators who currently have a commercial 5G network if they were using mmWave spectrum, below are the responses we got back.

Note 1. 5G mmWave is a set of 5G frequencies that can provide ultra-fast speeds over short distances. It operates on wavelengths between 30 GHz and 300 GHz, which is higher than 4G LTE’s wavelengths of under 6 GHz.

Of the 100 operators we surveyed 66% have a commercial 5G network. Of that group, 35% say they have deployed 5G for mmWave. 44% of the respondents have mmWave spectrum but are either focused on building their network in other spectrum bands, or don’t currently see a commercial reason to use mmWave. The ongoing underutilization of 5G mmWave seems to be impacting the current outlook for future 6G spectrum as well.

When asking mobile network operators about what they thought were the most important areas 6G should focus on, the most common answer given was more capacity through new spectrum. Originally, industry discussions on new 6G spectrum bands were focused on terahertz, which would be even more challenging to work with than mmWave. In the last year there has been a shift. 6G spectrum discussions have moved to the possibility of using bands in the 7 GHz to 24 GHz range. While these bands still have their difficulties when it comes to coverage and in-door penetration, they are not as problematic as terahertz or in many cases mmWave. However, this change in thinking around 6G spectrum does not change the challenges mobile operators must deal with today when it comes to mmWave.

That is where companies like Pivotal Commware and ZTE can be of assistance. Pivotal Commware has pioneered 5G mmWave repeaters that allow a mobile network operator to improve signal range and coverage at a fraction of the cost of an additional mmWave radio. This helps to improve the economics of using mmWave for 5G. Verizon has publicly acknowledged that it is working with the vendor in the U.S. In Asia, ZTE has been working on a solution of its own to overcome line of sight issues with mmWave that it calls RIS 2.0. AIS (Thailand) has trialed RIS 2.0.

Mobile operators’ desire for more capacity is not going away, especially with the emergence of fixed wireless access. The challenge is finding new ways to meet those capacity needs. Operators can continue to milk lower bands and squeeze capacity improvements out of them, but that will only take them so far. mmWave and other higher spectrum bands are well suited to meet growing capacity requirements, but it will require the development of repeaters and reflective services to make those higher bands easier to use for 5G and eventually 6G. It doesn’t help operators to be surrounded by a spectrum they cannot effectively employ, like sailors at sea with no drinkable water in sight.

Daryl Schoolar is a director and analyst at Recon Analytics where he focuses on telecommunication service providers and companies that provide networking communication solutions to those service providers. Some of the topics he covers are digital transformation, 5G, 6G, cloud networking, and telecom service strategies.

UAE network operator “etisalat by e&” achieves 5G mmWave distance milestone

Saudi Arabia’s Stc Achieves 10 Gbps Speeds in 5G mmWave Trials

Verizon Point-To-Multipoint network architecture using mmWave Spectrum

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

Nokia achieves extended range mmWave 5G speed record in Finland

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia