Téral Research: global wireless infrastructure market sank 9% YoY in 2023; will decline 6% in 2024

|

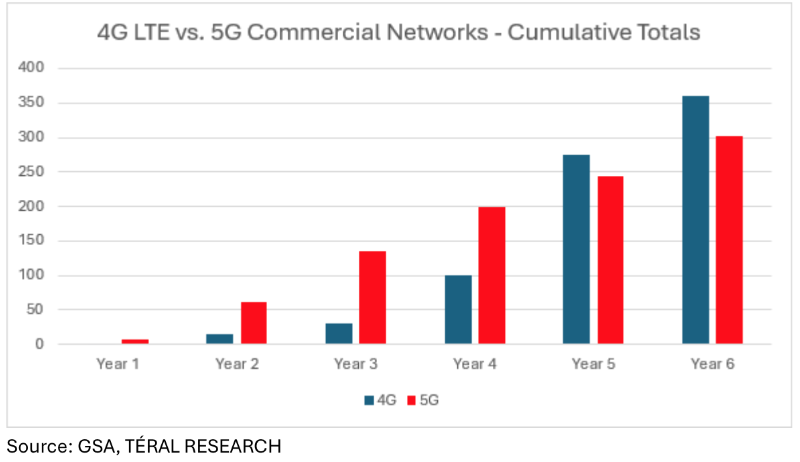

As expected, the global wireless infrastructure market comprised of all RAN and core networks sank 9% YoY despite a strong China-driven 4Q23 that was not enough to offset 3 consecutive quarters of sales declines. 2023 will be remembered by the U.S. market posting its steepest drop in history, the strong 5G rollouts in China which is way ahead of its government-set target, and India’s fast 5G rollout led by Bharti Airtel and Reliance Jio. Meanwhile, 5G core—mostly fueled by China again, and 5G RAN showed some steam in 4Q23. In this environment, for 2023, Huawei kept its lead over Ericsson in global market share, followed by Nokia and ZTE, both managed to increase their market share. Samsung remained #5 but lost shares. We are now entering the third year of this disinvestment cycle. The 5G investment cycle that started in 2019 and ended in 2021 was driven by hundreds of communications service providers (CSPs), including the ones with the world’s largest cellular footprints (i.e., China), and led to a total of 302 commercial 5G networks launched as of December 31, 2023. But the pace is quickly slowing down: by comparison, 2023 was Year 6 for 5G rollouts, at that stage, 360 4G LTE networks were live. |

|

|

At this point, the global Wireless Infrastructure market will be characterized by much smaller footprints that have yet to be upgraded to 5G as well as 5G-Advanced upgrades for the early 5G adopters, and an open RAN ramp up driven by Tier 1 CSPs. In addition, the slow 5G monetization, the normalization after the 5G surge in China and India and the rise of the secondhand equipment market are chief inhibitors that contribute to the declining pattern. Nonetheless, there is no new wave in the horizon and as a result, this year, we expect the market to decline 6% compared to 2023, despite an AT&T-induced pickup expected in 2H24 in the U.S. market. In the long run, our CSP 20-year wireless infrastructure footprint pattern analysis points to a 2023-2029 CAGR of -3% characterized by steady declines through 2026, which appears to be the bottom leading to flatness. In fact, we expect 5G to slightly pick up in 2027, driven by 5G-Advanced and other upgrades needed to prepare networks for 6G. Given the ongoing 6G activity, we believe something labeled 6G will be deployed in 2028. |

References:

Téral Research :: February 2024 Wireless Infrastructure 4Q23 & FY23 (teralresearch.com)