Wireless equipment market

TÉRAL Research: Sharp declines in Wireless Infrastructure Market 1Q-2024

The global wireless infrastructure market, including 2G/3G/4G/5G RAN and core networks, experienced significant declines both sequentially (-31%) and YoY (-26%) in 1Q-2024. However, these declines are not unprecedented.

“Such decline has happened before in 2002 and 2003 due to a sharp decrease in TDMA and PDC systems shipments, as well as in the post-LTE peak era from 2016 to 2019, when each year’s first quarter posted a 20%+ YoY decline. And that’s not all, looking at bellwether Ericsson’s networks sales historical data, 1Q was also down 20%+ sequentially during the 5G boom,” said Stéphane Téral, Founder and Chief Analyst at TÉRAL RESEARCH.

Huawei continues to be the largest wireless network infrastructure vendor, Nokia and ZTE Corporation’s lost market share, while Samsung Networks position was steady.

Téral states that 2024 marks the third consecutive year of a wireless disinvestment cycle yet the market is poised for a slight rebound in 2H2024 driven by open RAN and 5G upgrades.

………………………………………………………………………………………………………………..

Stéphane attended Oracle’s Applications & Industries Analyst Summit at the Oracle Conference Center in Redwood Shores, California. This two-day event showcased how Oracle is integrating Generative AI into its Fusion Data Intelligence Platform, enhancing ERP, EPM, SCM, HCM, and CX applications with AI-powered updates. Oracle’s industry verticals, particularly their 5G CSP monetization and digital experience strategies, promise to end the 5G monetization drought. With Oracle migrating databases to its cloud and leveraging AI, CSPs can expect increased efficiency and growth.

References:

https://www.linkedin.com/pulse/whats-new-t%C3%A9ral-research-t-ral-research-qsmec/

https://www.teralresearch.com/resources

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

What is 5G Advanced and is it ready for deployment any time soon?

Téral Research: global wireless infrastructure market sank 9% YoY in 2023; will decline 6% in 2024

|

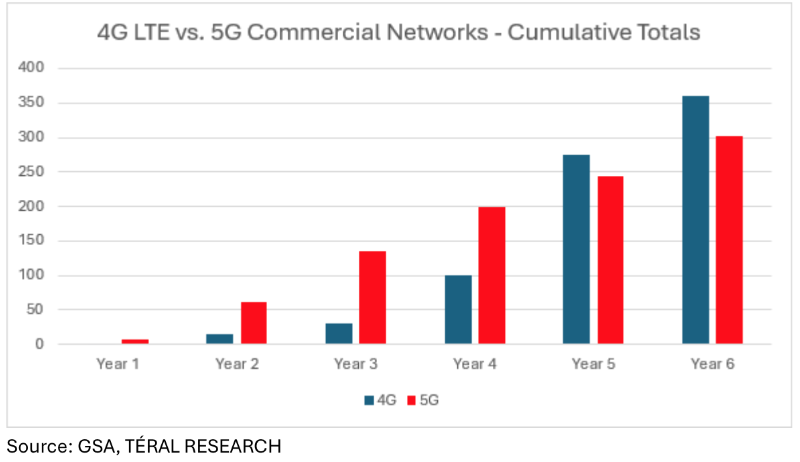

As expected, the global wireless infrastructure market comprised of all RAN and core networks sank 9% YoY despite a strong China-driven 4Q23 that was not enough to offset 3 consecutive quarters of sales declines. 2023 will be remembered by the U.S. market posting its steepest drop in history, the strong 5G rollouts in China which is way ahead of its government-set target, and India’s fast 5G rollout led by Bharti Airtel and Reliance Jio. Meanwhile, 5G core—mostly fueled by China again, and 5G RAN showed some steam in 4Q23. In this environment, for 2023, Huawei kept its lead over Ericsson in global market share, followed by Nokia and ZTE, both managed to increase their market share. Samsung remained #5 but lost shares. We are now entering the third year of this disinvestment cycle. The 5G investment cycle that started in 2019 and ended in 2021 was driven by hundreds of communications service providers (CSPs), including the ones with the world’s largest cellular footprints (i.e., China), and led to a total of 302 commercial 5G networks launched as of December 31, 2023. But the pace is quickly slowing down: by comparison, 2023 was Year 6 for 5G rollouts, at that stage, 360 4G LTE networks were live. |

|

|

At this point, the global Wireless Infrastructure market will be characterized by much smaller footprints that have yet to be upgraded to 5G as well as 5G-Advanced upgrades for the early 5G adopters, and an open RAN ramp up driven by Tier 1 CSPs. In addition, the slow 5G monetization, the normalization after the 5G surge in China and India and the rise of the secondhand equipment market are chief inhibitors that contribute to the declining pattern. Nonetheless, there is no new wave in the horizon and as a result, this year, we expect the market to decline 6% compared to 2023, despite an AT&T-induced pickup expected in 2H24 in the U.S. market. In the long run, our CSP 20-year wireless infrastructure footprint pattern analysis points to a 2023-2029 CAGR of -3% characterized by steady declines through 2026, which appears to be the bottom leading to flatness. In fact, we expect 5G to slightly pick up in 2027, driven by 5G-Advanced and other upgrades needed to prepare networks for 6G. Given the ongoing 6G activity, we believe something labeled 6G will be deployed in 2028. |

References:

Téral Research :: February 2024 Wireless Infrastructure 4Q23 & FY23 (teralresearch.com)

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

LightCounting: Wireless infrastructure market down in 2Q-23 (no surprise)

LightCounting: Wireless infrastructure market dropped both YoY and sequentially in 1Q23

LightCounting: Wireless infrastructure market down in 2Q-23 (no surprise)

| Historical data accounts for sales of the following vendors: | |||

| Vendor | Segments | Source of Information | |

| Altran | vRAN | Estimates | |

| Amdocs | 5GC | Estimates | |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates | |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates | |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates | |

| Corning | vRAN | Estimates | |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Enea | 5GC | Estimates | |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates | |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Fujitsu | RAN | Survey data and estimates | |

| HPE | 2G/3G core, 5GC | Estimates | |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| JMA Wireless | vRAN | Estimates | |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates | |

| Microsoft (acquired Metaswitch and Affirmed Networks, 2020) | 5GC, vEPC and 2G/3G core | Estimates | |

| Movandi | RAN/vRAN (RU/repeater) | Estimates | |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Node-H | vRAN (small cells) | Estimates | |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| NEC (including Blue Danube Systems, January 2022) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates | |

| Oracle | 5GC | Estimates | |

| Parallel Wireless | vRAN (CU, DU) | Estimates | |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates | |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Qucell | RAN, vRAN | Estimates | |

| Rakuten Symphony (acquired Altiostar, August 2021) | vRAN (CU, DU) | Estimates | |

| Ribbon Communications | 2G/3G core | Survey data and estimates | |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates | |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors | |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates | |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

LightCounting: Wireless infrastructure market dropped both YoY and sequentially in 1Q23

In the 1stQ2023, the global wireless infrastructure market declined 3% YoY and 17% sequentially, according to LightCounting. Starting a new year with a sequential decline is typical but a YoY drop is abnormal and suggests a declining pattern is in the making. This trend confirms that we have entered the post-peak era.

While the U.S. market posted its steepest drop, the strong 5G rollouts in India and a 5G rebound in Japan, along with stable and sustained activity in EMEA and China, respectively, were not enough to keep the wireless infrastructure market out of the decline. On the open vRAN front, DISH in the U.S., Rakuten Mobile in Japan, and a few Rakuten Symphony customers kept the market flat YoY and produced double digit sequential growth.

Despite a weak quarter, Huawei retook its lead at the expense of Ericsson, which reported weak 1Q23 results that led to a market share loss. In the meantime, Nokia benefited from the 2 leaders’ market share loss and gained 1% point. ZTE also gained share at the expense of Huawei and Ericsson while Samsung’s share remained stable.

“We have passed the 5G peak and have entered the second year of a disinvestment cycle. The 5G investment cycle that started in 2019 and ended in 2021 was driven by hundreds of communications service providers (CSPs), including the world’s largest cellular footprints (i.e., China). At the moment, India’s massive 5G rollout is preventing the situation from getting worse but this will end soon,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

As a result, this year, LightCounting expects the wireless infrastructure market to slightly decline in 2023 (compared to 2022) with India in the lead. In the long run, our service provider 20-year wireless infrastructure footprint pattern analysis points to a 2022-2028 CAGR of -3% characterized by low single-digit declines through 2027, which appears to be the bottom leading to flatness or slight growth in 2028. In fact, we expect 5G to slightly pick up in 2027, driven by upgrades needed to prepare networks for 6G. Given the ongoing 6G activity, we believe something labeled 6G will be deployed in 2028.

Highlights from Dell’Oro’s 1Q 2023 RAN report:

- Top 5 RAN 1Q 2023 RAN suppliers include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Top 4 RAN 1Q 2023 RAN suppliers outside of China include Ericsson, Nokia, Huawei, and Samsung.

- Nokia recorded the highest growth rate among the top 5 suppliers, while Ericsson and Samsung both lost some ground in the first quarter.

- The report also shows that Nokia’s RAN revenue share outside of China has been trending upward over the past five quarters.

- The Asia Pacific RAN market has been revised upward to reflect the higher baseline in India.

Open RAN and vRAN highlights from Dell’Oro’s 1Q 2023 RAN report:

- After more than doubling in 2022, Open RAN revenue growth was in the 10 to 20 percent range in the first quarter while the vRAN market advanced 20 to 30 percent.

- Positive developments in the Asia Pacific region were dragged down by more challenging comparisons in the North America region.

- Short-term projections remain unchanged – Open RAN is still projected to account for 6 to 10 percent of the 2023 RAN market.

- Top 5 Open RAN suppliers by revenue for the 2Q 2022 to 1Q 2023 period include Samsung, NEC, Fujitsu, Rakuten Symphony, and Mavenir.

| Historical data accounts for sales of the following vendors: | ||

| Vendor | Segments | Source of Information |

| Affirmed Networks (acquired by Microsoft, April 2020) | vEPC, 5GC | Estimates |

| Altran | vRAN | Estimates |

| Altiostar | vRAN (CU, DU) | Estimates |

| Amdocs | 5GC | Estimates |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates |

| Corning | vRAN | Estimates |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Enea | 5GC | Estimates |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Fujitsu | RAN | Survey data and estimates |

| HPE | 2G/3G core, 5GC | Estimates |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

| JMA Wireless | vRAN | Estimates |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates |

| Metaswitch (acquired by Microsoft, May 2020) | 5GC, vEPC and 2G/3G core | Estimates |

| Movandi | RAN/vRAN (RU/repeater) | Estimates |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Node-H | vRAN (small cells) | Estimates |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

| NEC (including Blue Danube) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates |

| Oracle | 5GC | Estimates |

| Parallel Wireless | vRAN (CU, DU) | Estimates |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Qucell | RAN, vRAN | Estimates |

| Ribbon Communications | 2G/3G core | Survey data and estimates |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

LightCounting: 1H-2022 Wireless Infrastructure softness lingered in 3Q-2022

by Stéphane Téral, Chief Analyst at LightCounting Market Research

3Q22 was almost a carbon copy of 2Q22, which signals that the 5G-driven wireless infrastructure market is reaching its peak as the first wave of 5G rollouts wane.

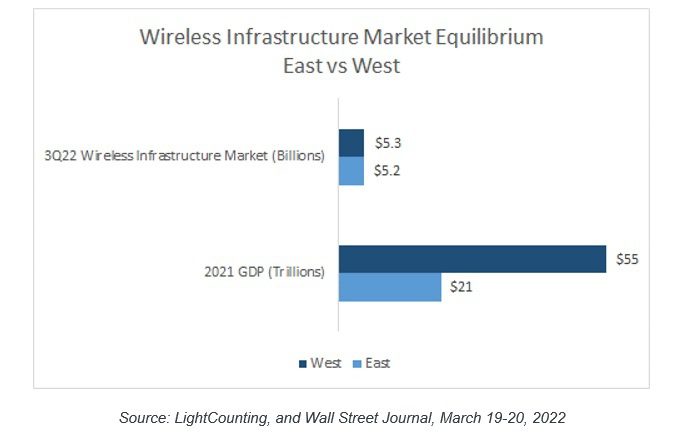

Global uncertainties, lingering supply chain constraints, and forex headwinds contributed to another soft 3Q22 that followed an already sluggish 1H22. In the meantime, the wireless infrastructure market continued to operate at its equilibrium reached in 2021: the 2 opposite spheres of influence, the East led by China versus the West defined as the U.S. and its allies, are becoming more balanced.

We found that the West accounted for 50.5% of the global wireless infrastructure market while the East made up for the rest, with China accounting for more than 80% of the East.

| Historical data accounts for sales of the following vendors: | |||

| Vendor | Segments | Source of Information | |

| Affirmed Networks (acquired by Microsoft, April 2020) | vEPC, 5GC | Estimates | |

| Altran | vRAN | Estimates | |

| Altiostar | vRAN (CU, DU) | Estimates | |

| Amdocs | 5GC | Estimates | |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates | |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates | |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates | |

| Corning | vRAN | Estimates | |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Enea | 5GC | Estimates | |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates | |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Fujitsu | RAN | Survey data and estimates | |

| HPE | 2G/3G core, 5GC | Estimates | |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| JMA Wireless | vRAN | Estimates | |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates | |

| Metaswitch (acquired by Microsoft, May 2020) | 5GC, vEPC and 2G/3G core | Estimates | |

| Movandi | RAN/vRAN (RU/repeater) | Estimates | |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Node-H | vRAN (small cells) | Estimates | |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| NEC (including Blue Danube) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates | |

| Oracle | 5GC | Estimates | |

| Parallel Wireless | vRAN (CU, DU) | Estimates | |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates | |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Qucell | RAN, vRAN | Estimates | |

| Ribbon Communications | 2G/3G core | Survey data and estimates | |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates | |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors | |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates | |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

References:

https://www.lightcounting.com/report/december-2022-wireless-infrastructure-3q22-177

LightCounting: Wireless Infrastructure Market to Grow at 5% in 2021; 8% in 2Q-2021

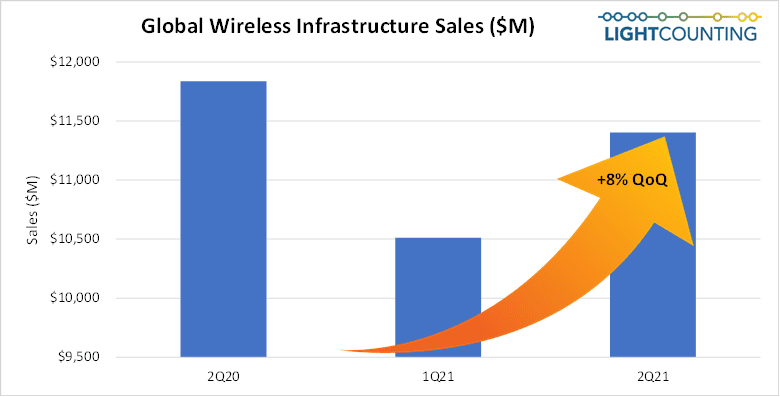

LightCounting says the 2nd quarter of 2021 was robust for the wireless infrastructure market, as a second quarter typically is, but below 2Q20 that was revved up by China’s 5G catch-up after a massive COVID-19 lockdown. The 5G rollout momentum seen in North America, and Northeast Asia reported in 2H-2020 and 1Q-2021 continued in 2Q-2021 and was augmented by strong activity in Europe, and 4G expansion in India.

As a result, the global wireless infrastructure market grew sequentially, driven by RAN, open vRAN—again mostly fueled by Rakuten Mobile’s 5G network buildout, and 5G and 4G core network elements.

“2Q21 was somewhat reminiscent of the golden GSM era and I could not find anyone malcontent as sales of all 4G and 5G network nodes performed magnificently. Regarding the vendors’ market shares, the gradual rise of Ericsson and Nokia was most immediately induced by the fall of Huawei.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

LightCounting once again had to increase their North American forecast to reflect a strong start in C-band activity and Ericsson’s 5-year $8B 5G contract with Verizon and decrease their Asia Pacific’s 5G forecast due to uncertainties in China and India. As a result, the global wireless infrastructure market’s growth stayed intact at 5% over 2020.

In the long run, factoring in the strong North American 5G activity which is expected to last until 2025 our model’s market peak has moved by a year to 2023. Our service-provider 20-year wireless infrastructure footprint pattern analysis points to a 2020-2026 CAGR of 1% characterized by low single-digit growth through 2023, followed by a 1% decline in 2024, flatness in 2025, and a 4% drop in 2026. This lumpy pattern reflects the differences in regional and national agendas.

About the report:

2Q21 Wireless Infrastructure Market Size, Share, and Forecast report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2020, quarterly market size and vendor market shares, and a detailed market forecast through 2026 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America). The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

More information on the report is available at:

https://www.lightcounting.com/report/august-2021-wireless-infrastructure-2q21-116