Big Tech

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Tech companies have been consistently laying off employees since late 2022. As of April 25th, some 266 tech companies have laid off nearly 75,000 workers in 2024, according to the independent layoff-tracking site layoffs.fyi. A total of 262,682 workers in tech lost their jobs in 2023 compared with 164,969 in 2022. The volume of layoffs in 2023 — a total of 1,186 companies — also surpassed 2022, when 1,061 companies in tech laid off workers — and that total was more than in 2020 and 2021 combined.

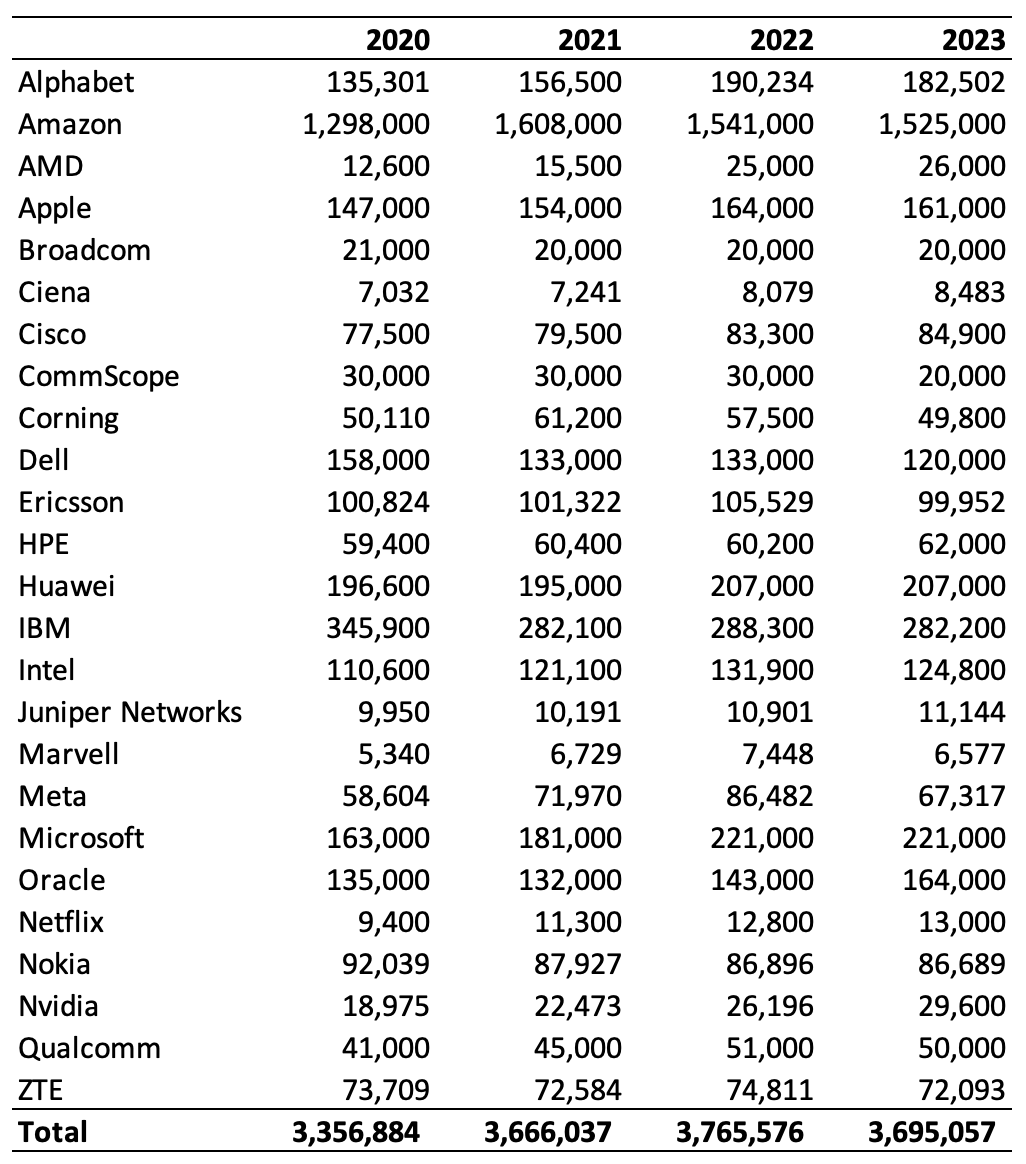

Big Tech companies Alphabet (Google’s parent), Amazon, Apple, Meta, Microsoft and Netflix, collectively cut nearly 45,500 jobs in their most recent full fiscal year. Since 2020, however, they have added more than 358,500, bringing total headcount to nearly 2,170,000. Excluding Amazon, which accounts for 70% of that figure, job numbers fell by around 29,700 last year but have grown by 131,500 since 2020 (data from earnings reports and SEC filings – see chart below).

- Today, Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. Operating income soared more than 200% in the period to $15.3 billion, far outpacing revenue growth, the latest sign that the company’s cost-cutting measures and focus on efficiency is bolstering its bottom line. AWS accounted for 62% of total operating profit. Net income also more than tripled to $10.4 billion, or 98 cents a share, from $3.17 billion, or 31 cents a share, a year ago. Sales increased 13% from $127.4 billion a year earlier.

- Google parent Alphabet also posted robust profits, with net income in the latest quarter soaring 57% to $23.7 billion while revenue grew 15% in the quarter. That’s despite job cuts of 12,115 and net headcount reduction of ~8,000 in 2023.

- Microsoft last week managed 20% year-over-year growth in third-quarter net income, to around $21.9 billion, on 17% growth in sales, to $61.9 billion. The number of Microsoft employees was unchanged in 2023 from the previous year, despite the company laying off 11,158 employees. Future headcount reductions may be necessary to help pay for Microsoft’s multi-billion-dollar splurge on AI and the data centers needed to train the Large Language Models and associated generative AI technology. But few expect job cuts to slow Microsoft down.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

As expected, telecom vendors, which have many fewer employees, than Big Tech had a higher percentage of job reductions. CommScope, Corning, Dell, Ericsson, and Nokia, suppliers to some of the world’s biggest telcos, shed nearly 36,500 jobs last year as large IT customers spent less on new equipment.

The following table shows the total number of jobs per year for many vendors/cloud service providers.

Source: Light Reading & company reports/SEC filings

Huawei was the exception to the telecom vendor layoff craze (even ZTE reduced its workforce in 2023). Despite U.S. sanctions and a European backlash against the company, Huawei gained 12,000 employees in 2022, giving it a workforce of 207,000 that year. The number was unchanged in 2023, according to its recently published annual report. Restrictions have not been as effective at hindering Huawei’s progress as the U.S. had hoped.

On the semiconductor side, Intel experienced a net workforce reduction of 7,100 jobs. Profits have tanked because of market share losses, a downturn in customer spending on equipment (explained partly by the earlier build-up of inventory that happened after the pandemic) and investments in new foundries designed to challenge the Asian giants of TSMC and Samsung. Big Tech moves to build in-house AI augmented processor chips that can substitute for Intel’s microprocessors are among the problems the company faces. Intel’s profits have collapsed, just as they have at the mobile networks business group of silicon customer Nokia, and it is at risk of displacement by chip rivals in important markets.

These big tech layoffs are a peculiar outlier in an otherwise strong employment environment: The unemployment rate has hovered between 3.4% and 3.8% since Feb. 2022, bureau data shows. And quit rates, which reflect a lack of worker confidence, this year are consistently at some of the highest levels in more than 20 years, according to the Federal Reserve Bank of St. Louis.

In summary, Big Tech companies continue to thrive financially, but they are also making strategic adjustments, including job cuts, as they navigate the evolving landscape of technology and generative AI. The emphasis on AI development, large language models, and cloud services remains a key driver for their growth and profitability. Telecom vendors are facing tremendous pain due to continued reduction in telco CAPEX which may persists for many years.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.nerdwallet.com/article/finance/tech-layoffs

US cable and telecom network operators feel the pain

Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

High Tech Layoffs Explained: The End of the Free Money Party

Reuters: Majority of EU countries against network fee levy on Big Tech firms but 10 countries for it

Europe’s major telecommunications operators faced resistance from a majority of EU countries in their efforts to compel Big Tech companies to contribute to the funding of 5G and broadband deployment across the region, Reuters reported on Friday. At a meeting with EU industry chief Thierry Breton in Luxembourg on Thursday, telecoms ministers from 18 European countries either rejected the proposed network fee levy on tech firms, or demanded a study into the need and impact of such a measure, the sources said. That echoed comments made last month by EU telecoms regulators’ group BEREC.

European network operators including Deutsche Telekom, Orange, Telefonica and Telecom Italia want Big Tech to shoulder part of the network costs on the grounds that their data and content makes up a large part of network traffic. They have found a receptive ear in the European Commission’s industry chief Breton, a former chief executive of France Telecom and French IT consulting firm Atos.

Alphabet Inc’s Google, Apple Inc, Facebook parent Meta Platforms Inc, Netflix Inc, Amazon.com Inc and Microsoft Corp have rejected the idea of a levy, saying they already invest in the digital ecosystem.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KMQKW6GCVVMPTGTGJ22KNYCMPQ.jpg)

European Union flags fly outside the European Commission headquarters in Brussels, Belgium, March 1, 2023. REUTERS/Johanna Geron

……………………………………………………………………………………………………………………………………………………………………………….

The European telecom ministers cited the lack of an analysis on the effects of a network levy, the absence of an investment shortfall, and the risk of Big Tech passing on the extra cost to consumers, the people said. They also warned about the potential violation of EU “net neutrality” rules, which require all users to be treated equally, as well as possible barriers to innovation, and a lower quality of products.

- Critics of a network levy included Austria, Belgium, Czech Republic, Denmark, Finland, Germany, Ireland, Lithuania, Malta and the Netherlands, the people said.

- On the other hand, France, Greece, Hungary, Italy, Spain and Cyprus were among 10 countries which backed the idea, one of the people said.

- Poland, Portugal and Romania either took a neutral stance or had not adopted a position, the people said, but another person said they favoured a network fee.

Breton is expected to issue a report by the end of June with a summary of feedback provided by Big Tech, telecoms providers and others, which will help decide his next steps. Any legislative proposal needs to be negotiated with EU countries and EU lawmakers before it can become law.

References:

High Tech Layoffs Explained: The End of the Free Money Party

Thanks to the Federal Reserve Board’s “free money party” (aka Quantitative Easing/QE and Zero Interest Rate Policy/ZIRP) from 2009-March 2022, investors desperate for returns sent their money to Silicon Valley, which pumped it into a wide range of start-ups that might not have received any funding in other times. Extreme valuations of both public and private companies made it easy to issue stock or take on loans to expand aggressively or to offer sweet deals to potential customers that quickly boosted market share.

“The whole tech industry of the last 15 years was built by cheap money,” said Sam Abuelsamid, principal analyst with Guidehouse Insights. “Now they’re getting hit by a new reality, and they will pay the price.”

Cheap money funded many of the tech acquisitions that were a substitute for internal growth. Two years ago, as the pandemic raged and many office workers were confined to their homes, Salesforce bought the office communications tool Slack for $28 billion, a sum that some analysts thought was way too high. Salesforce borrowed $10 billion to do that deal. This month, Salesforce said it’s laying off 8,000 employees, about 10% of its staff, many of them from Slack.

More than 46,000 workers in U.S.-based tech companies have been laid off in mass job cuts so far in 2023, according to a Crunchbase News tally. Last year, more than 107,000 jobs were slashed from public and private tech companies Here are just a few:

- Amazon is laying off 18,000 office workers and shuttering operations that are not financially viable. More below.

- Google parent Alphabet is cutting 12,000 jobs.

- Microsoft, which has been riding high on cloud revenues for years, is eliminating 10,000 jobs.

- Cisco plans to cut 5% of workforce – approximately 4,100 people will lose their jobs.

- Facebook parent Meta announced in November that it plans to eliminate 13% of its staff, which amounts to more than 11,000 employees.

- Shortly after closing his $44 billion purchase of Twitter in late October, new owner Elon Musk cut around 3,700 Twitter employees.

- IBM said today it would eliminate about 1.5% of its global workforce, which amounts to a “ballpark” figure of 3,900 job cuts.

The easy money era (which started shortly after the Lehman Brothers bankruptcy in September 2008) had been well established when Amazon decided it had mastered e-commerce enough to take on the physical world. Its plans to expand into bookstores was a rumor for years and finally happened in 2015. The media went wild. According to one well-circulated story, the retailer planned to open as many as 400 bookstores. Instead, the eRetail and cloud computing leader closed 68 stores last March, including not only bookstores but also pop-ups and so-called four-star stores. It continues to operate its Whole Foods grocery subsidiary, which has 500 U.S. locations, and other food stores. Amazon said in a statement that it was “committed to building great, long-term physical retail experiences and technologies.”

“High rates are painful for almost everyone, but they are particularly painful for Silicon Valley,” said Kairong Xiao, an associate professor of finance at Columbia Business School. “I expect more layoffs and investment cuts unless the Fed reverses its tightening.”

Addendum (Feb 26, 2023):

Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, according to a memo sent to employees and seen by Reuters. “The way headcount reductions will be managed will differ depending on local country practice,” Chief Executive Borje Ekholm wrote in the memo. “In several countries the headcount reductions have already been communicated this week,” he said. “It is our obligation to take this cost out to remain competitive,” Ekholm said in the memo. “Our biggest enemy right now may be complacency.”

Ericsson to lay off 8,500 employees as part of cost cutting plan

References:

https://news.crunchbase.com/startups/tech-layoffs/

The Rise of New Tech Companies – Fiendbear Unicorns, FANGs, and the Nifty Nine

Telco business models must change as Big Tech generates the majority of internet traffic

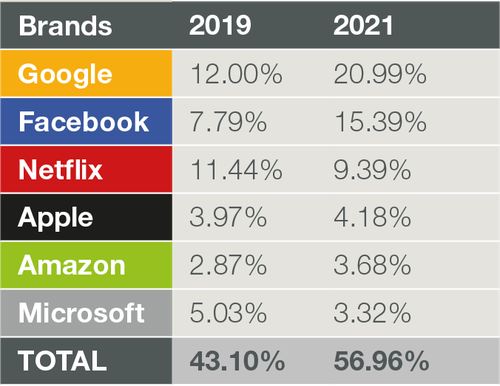

In a blog post today, network intelligence firm Sandvine states that Google, Facebook, and other ‘top-6’ digital brands generate more than 56% of global network traffic. The company’s upcoming 2022 “Global Internet Phenomenon Report,” takes this a step further by showing that the top-6 – Google, Facebook, Netflix, Amazon, Microsoft, and Apple – are generating more than 56% of global network traffic.

For the first time, the biggest digital players account for more traffic than everyone else (telcos, MSOs/cablecos, satellite internet, state & local governments, municipalities, etc), combined! And that trend is likely to continue to increase. as OpenVault recently reported that average monthly home internet data consumption in the U.S. rose to 434.9 GBytes in the third quarter of 2021, up 13% over the same period in 2020.

The chart below shows the percentage of traffic that the six biggest Internet companies generated across global networks.

Source: Sandvine

For Communications service providers (CSPs), this is a watershed moment: they must deliver the benefits of 5G (are there any?), cloud, the IoT, AR/VR, AI, the metaverse (?), etc. and they must assure a good QoE (Quality of Experience) for the current and next generation of apps.

Sandvine believes the shift to more mission-critical enterprise and industry services will trigger a need for flawless connectivity (ultra high reliability/availability) and optimal performance for manufacturing robotics, remote healthcare, autonomous driving, public safety, and other critical services.

Recently, the CEOs of Deutsche Telekom, Telefonica, Vodafone, and 11 other influential service providers published an open letter stating that “a large and increasing part of network traffic is generated and monetized by Big Tech platforms.”

They cited the fact that it is the telecommunications sector that is bearing the “continuous, intensive network investment and planning” that ultimately drives the unprecedented profitability of the biggest tech brands.

“A large and increasing part of network traffic is generated and monetized by Big Tech platforms, but it requires continuous, intensive network investment and planning by the telecommunications sector,” the CEOs said in the joint statement seen by Reuters.

In other words, telcos are subsidizing Big Tech who reap the benefits of those same telco networks. MSOs/cablecos broadband internet providers, like Comcast, Charter, and Cox Communications, could likely make the same argument.

The CEOs did not mention any big tech firms by name, but Reuters understands that U.S.-listed giants such as Netflix and Facebook are companies they have in mind.

According to Reuters, the investments in Europe’s telco sector rose to 52.5 billion euros ($59.4 billion) last year, a six-year high. Those investments include the networks, 5G trials, licenses, planning, and deployment that fuel app QoE. In return, the European telcos received modest usage fees from subscribers.

In addition to wanting a fair ROI for their substantial investments, CSPs also want to protect their networks and brands. The recent Facebook, AWS, and Tesla outages demonstrated how pronounced and far reaching the impacts on networks can be now that apps and services are far more intertwined and interdependent than ever before. QoE for both related and unrelated apps and services were affected.

Source: Sandvine

Sandvine says CSPs need predictive insights that help identify macro trends across their millions of subscribers, billions of devices, and thousands of applications to answer key questions that can drive business actions and outcomes.

Here are a few such questions CSPs should address, according to Sandvine:

- Which apps are consuming and generating the most traffic, downstream and upstream?

- What’s the impact of app complexity in terms of mashups, embedded video, payments, chat, and other features?

- How are QUIC (a new multiplexed transport built on top of UDP), HTTP/3, iCloud Private Relay, and encryption affecting the network?

- Who are the “heavy users” in the upgrade from 4G to 5G?

The above questions are just some that Sandvine will explore in detail in their upcoming “Global Internet Phenomenon Report.”

………………………………………………………………………………………………………………………………..

Meanwhile, a growing number of professionals are calling for “Big Tech” to contribute to the Universal Service Fund (USF). The FCC instituted the USF in 1997 to help fund the construction of broadband networks in rural and unserved areas of the country, and to help low-income Americans afford telecom services. But the primary sources of funding for the USF are network operators (which redirect the USF fees paid by their customers each month).

FCC Commissioner Brendan Carr said that the best way to fund the FCC’s Universal Service Fund advanced communications subsidies is to make Big Tech pay the freight. Citing a new study from economist Hal Singer and Ted Tatos, Carr said that the current method of assessing dwindling traditional telecom services is unsustainable, and that shifting to assessing wireless broadband would continue to hit consumers in the pocketbook–the USF fees are passed on by telecoms onto their customers’ bills.

Car argues that the FCC should make Big Tech companies like Google and Facebook pay the USF fees, which would be very difficult for them to pass on to consumers and which would, “significantly reduce consumers’ costs, properly align incentives, and unlike assessing wireline broadband revenues, would not raise consumers’ monthly bill for internet services,” Carr said citing the study,

References:

https://www.sandvine.com/blog/telco-business-models-reaching-tipping-point-in-digital-era

https://www.nexttv.com/news/fccs-carr-make-big-tech-pay-for-usf-subsidies