Cogent Communications

T-Mobile sells Sprint wireline business to Cogent for $1

T-Mobile will sell its wireline business, acquired from Sprint, to Cogent Communications Holdings Inc for $1, while taking a $1 billion charge on the transaction. The deal includes a $700 million contract under which Cogent will provide transit services to T-Mobile for 4-1/2 years after the deal closes. Cogent and T-Mobile expect to close the deal in or prior to December 2023.

T-Mobile has been turning its attention away from the wireline business that includes assets from its $26 billion acquisition of Sprint Corp in 2020. The decline of Sprint’s wireline business has been astounding to this author. For years, Sprint was the leader in wireline technologies like X.25, Primary Rate ISDN, Frame Relay, ATM, Carrier Ethernet and MPLS. Their optical network was second to none and was used as a backbone network for many carriers, including AT&T.

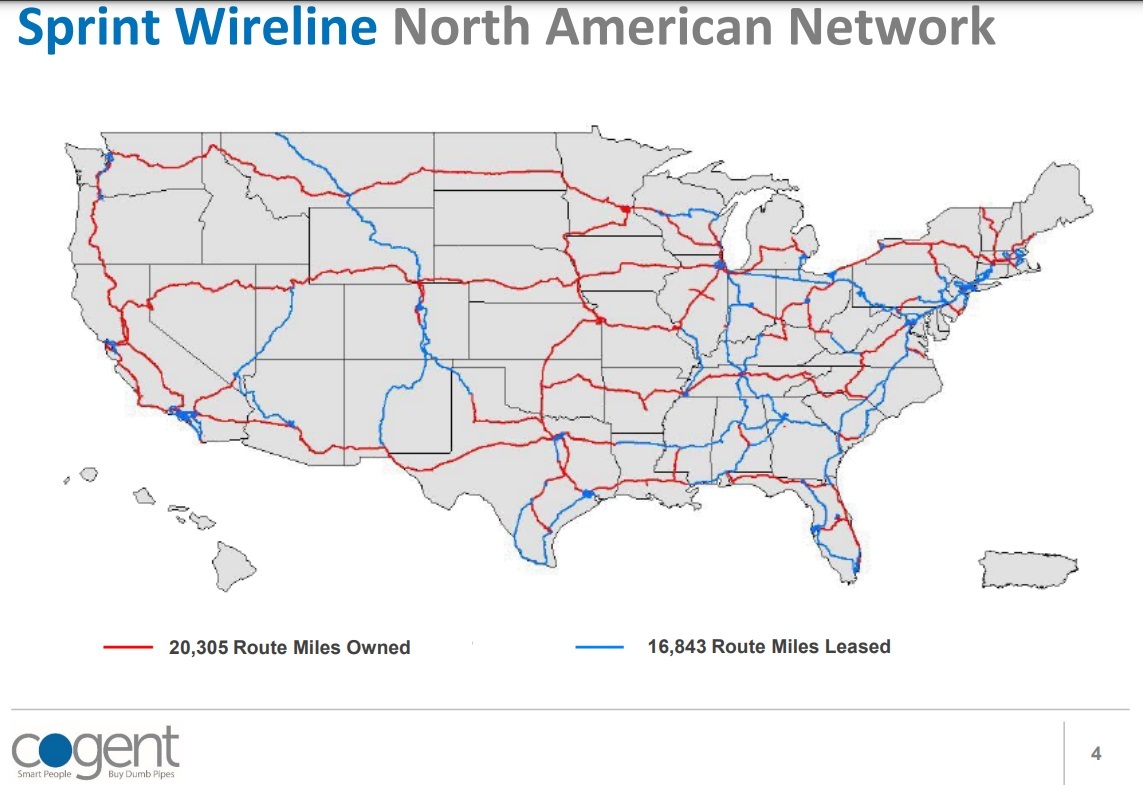

The deal for the Sprint wireline assets, a unit formerly known as Sprint Global Markets Group, provides a range of services, including MPLS (Cogent plans to convert those to VPLS and WAN), DIA (dedicated Internet access) and transit, wavelength and colocation services. The unit generated roughly $560 million in revenues in 2021 and has about 1,300 employees. In North America, the unit operates approximately 19,000 long-haul route miles, 1,300 metro route miles, and some 16,800 route miles of leased dark fiber. Total wireline business revenue was $739 million last year, according to Reuters.

In the most recent earnings call, T-Mobile Chief Executive Michael Sievert said the company was no longer using Sprint infrastructure to support its wireless business and that an asset review was underway.

“We think that T-Mobile must be receiving some sort of discount on the IP transit services that they will be buying from Cogent contractually, and they will save on the costs that they’d otherwise have to keep, maintain and improve (the infrastructure),” said Michael Ashley Schulman, partner and chief investment officer at Running Point Capital Advisors.

For Cogent, the deal provides a U.S. long-haul network that could eventually replace its current leased network and help expand the company’s product set to consumers and enterprises.

Cogent expects its revenue base to be about $1.1 billion, or 180% of its current $600 million run rate, CEO Dave Schaeffer said on a conference call. He outlined several strategic benefits from the deal, noting it will increase its fiber footprint and boost scale in the DIA, transit, virtual private networks and colocation/data centers markets.

The deal also paves the way for Cogent to enter the North American market for wavelength sales, and compete with market leaders Lumen and Zayo. Cogent, which is also looking to enter the market for dark fiber sales, said it also stands to gain international operating licenses in India and Malaysia, where it has no presence today.

Among other benefits, Cogent will also acquire a legacy Sprint customer base of about 1,400 businesses that, it claims, fall outside Cogent’s typical customer profile.

Cogent expects to offer customers the ability to migrate from their legacy MPLS VPN solutions to modern Ethernet / VPLS or SD-WAN / DIA solutions for their corporate needs. Cogent also expects to facilitate the migration of netcentric internet access customers from the T-Mobile Wireline Business (legacy Sprint) AS1239 to Cogent’s AS174.

Cogent expects its revenue base, post-close, to be $1.1 billion, or 180% of its current $600 million run-rate. Cogent likewise expects its multi-year revenue growth post-close will be 5% to 7% annually, with targeted aggregate revenue of over $1.5 billion by 2028.

A newly formed direct subsidiary of Cogent will consummate the acquisition. Cogent does not plan to issue new debt or equity in order to finance the acquisition, and the transaction is not expected to be dilutive to Cogent’s existing stockholders. Cogent plans to maintain its current dividend per share, which is expected to continue to increase over time.

Morgan Stanley served as the financial adviser for Cogent, while Houlihan Lokey was T-Mobile’s financial adviser.

References:

https://www.cogentco.com/en/about-cogent/events/3565-cogent-investor-call

Cogent Communications service revenues and connections increase; uncertain COVID-19 impact

Backgrounder:

Cogent Communications offers a variety of data communications services which include:

Dedicated Internet Access, Ethernet Point-to-Point, Ethernet VPLS, and Colocation Services to Enterprise customers, Carrier & Service Providers and Application & Content Providers.

For more information about the Cogent, please refer to this IEEE Techblog post.

1Q 2020 Earnings Report:

Today, the company reported first-quarter service revenues up 5.1 percent to $140.9 million for the quarter, up 5.6 percent on a constant currency basis. Total customer connections increased by 5.7% from March 31, 2019 to 87,213 as of March 31, 2020 and increased by 0.8% from December 31, 2019. Gross margins increased to an all time high of 60.5 percent in the quarter, which was a 70 percent YoY increase. Traffic growth was 36 percent YoY.

On-net [1.] revenue was up 6.5 percent to $103.5 million, as the company increased the number of on-net buildings by 117 over the year and 22 since December to 2,823 at end-December. On-net customer connections increased by 5.8% from March 31, 2019 to 75,163 as of March 31, 2020 and increased by 0.8% from December 31, 2019.

Note 1. On-net customers are located in buildings that are physically connected to Cogent’s network by Cogent facilities.

…………………………………………………………………………………………………………………………………

- Off-net customer connections increased by 5.2% from March 31, 2019 to 11,721 as of March 31, 2020 and increased by 0.5% from December 31, 2019.

- Net cash provided by operating activities decreased to $28.5 million for Q1 2020.

- EBITDA decreased by 4.4% from Q4 2019 to $50.4 million for Q1 2020 and increased by 6.0% from Q1 2019 to Q1 2020.

According to Zacks, the current consensus EPS estimate is $0.26 on $145.68 million in revenues for the second quarter and $1.05 on $586.21 million in revenues for the current fiscal year.

…………………………………………………………………………………………………………………………………..

COVID-19 Impact:

During the first quarter, the impact of the Covid-19 pandemic on Cogent was limited, the company said. In the last two weeks of March, it saw a positive impact on net-centric revenue but a slight slowdown in corporate installs. There was also a material increase in traffic on the network. Most of its staff have transitioned to remote working. Field engineers continue to install, maintain and upgrade Cogent’s wireline (mostly fiber) network.

The ultimate impact of COVID-19 is unknown as this time due to uncertainty, said Cogent Communications CEO David Schaeffer on the company’s 1Q-2020 earnings call:

We hope everyone remains safe and healthy during these times. We value our employee safety and take all of the necessary precautions to keep our Cogent colleagues safe in these difficult times. While we believe we are a beneficiary of a stay at home model, we are uncertain about the long-term implications for economies around the world. With the large number of employees staying at home and the increased rate of unemployment globally.

On the previous (4Q 2019) earnings call, Mr. Schaeffer said:

The Cogent Network remains the most interconnected networks in the world, with direct connectivity to 6,950 networks. Less than 30 of these networks that connect to Cogent are settlement free peers with the remaining over 6,920 networks being paying Cogent transit customers. We are currently utilizing approximately 29% of the lit capacity in our network. We routinely augment this capacity, as portions of our network need those augmentations to maintain these low utilization rates.

Cogent’s Network Scope, Scale and Traffic Growth:

On the May 7th (1Q-2020) earnings call, Dave talked about the scope and scale of Cogent’s network:

At quarter end, we had over 961 million square feet of multi-tenant office buildings connected to the Cogent network.

Our network consists of over 36,000 metro fiber miles and over 58,000 intercity route miles of fiber. The Cogent network remains the most interconnected in the world, and we directly connect to over 7,040 networks. Of these networks, less than 30 are settlement-free peers. The remaining networks that we connect to are Cogent customers.

We are currently utilizing approximately 35% of the lit capacity in our network. We routinely augment capacity on parts of our network as we see increases in traffic to maintain these low utilization rates. For the quarter, we achieved sequential traffic growth of 12% and year-over-year traffic growth of 36%. We operate 54 Cogent-controlled data centers with over 606,000 feet of space and those facilities are operating at approximately 33% capacity.

Our business remains completely focused on the Internet and IP connectivity services, as well as data center co-location. Each of these services are a necessary utility for our customer. Our multiyear constant-currency long-term growth target of approximately 10% and our long-term EBITDA margin expansion rate of approximately 200 basis points should continue for the foreseeable future. Our board of directors approved our 31st consecutive increase in our regular quarterly dividend.

During the Q&A, Dave answered a question related to trends in data (non-voice) traffic growth:

We support a number of key applications, video conferencing, audio conferencing, and all of that traffic has materially increased as we’ve gone to a more work from home environment. People will eventually return to their offices, and there will be a reduction, maybe not a complete revert to where we were before, but a reduction in that type of traffic. That traffic is de minimis compared to streaming video traffic, which is the primary driver of unit volume growth.

We see this broad mix of OTT business models, accelerating their displacement of linear television. That is a permanent trend, not a temporary trend. What is temporary as people may be watching more minutes a day of video, but what is permanent is the migration from linear to over the top. And while we saw a material spike up in the rate of acceleration, that rate of acceleration has returned to a more normalized rate of acceleration, but we’re off of a higher base.

And we do expect our rate of traffic growth for the full-year 2020 to be above that of 2019.

……………………………………………………………………………………………………………………………………..

About Cogent Communications

Cogent Communications (NASDAQ: CCOI) is a multinational, Tier 1 facilities-based ISP. Cogent specializes in providing businesses with high-speed Internet access, Ethernet transport, and colocation services. Cogent’s facilities-based, all-optical IP network backbone provides services in over 200 markets globally.

Cogent Communications is headquartered at 2450 N Street, NW, Washington, D.C. 20037. For more information, visit www.cogentco.com. Cogent Communications can be reached in the United States at (202) 295-4200 or via email at [email protected].

…………………………………………………………………………………………………………………………………..

References:

https://www.cogentco.com/en/news/events/1392-cogent-communications-first-quarter-2020-earnings-call

https://www.cogentco.com/files/docs/news/media_kit/cogent_fact_sheet.pdf

Cogent Communications still growing strongly -18 years after the Fiber Optic Bust

Cogent Communications still growing strongly -18 years after the Fiber Optic Bust

Cogent Communications, one of the world’s largest ISPs, is carrying more traffic on its network than most incumbent telcos. During its most recent earnings report, Cogent said its quarterly traffic growth came in at 10%, while year-over-year traffic growth hit 44%. Let’s break that down into on-net and off-net services/customers:

On-net service is provided to customers located in buildings that are physically connected to Cogent’s network by Cogent facilities. On-net revenue was $93.0 million for the three months ended June 30, 2018; an increase of 0.7% from the three months ended March 31, 2018 and an increase of 8.7% over the three months ended June 30, 2017. Cogent’s more than 65,000 on-net customer connections and its nearly 2,600 on-net office buildings and carrier-neutral data centers send traffic over its all-IP-over-DWDM network, protected at Layer 3, using Ethernet as its network interface. On-net customers are obviously the most profitable customers for Cogent.

Off-net customers are located in buildings directly connected to Cogent’s network using other carriers’ facilities and services to provide the last mile portion of the link from the customers’ premises to Cogent’s network. Off-net revenue was $36.1 million for the three months ended June 30, 2018; the same amount as the three months ended March 31, 2018 and an increase of 6.3% over the three months ended June 30, 2017.

Total customer connections increased by 13.8% from June 30, 2017 to 76,193 as of June 30, 2018 and increased by 3.1% from March 31, 2018. On-net customer connections increased by 14.1% from June 30, 2017 to 65,407 as of June 30, 2018 and increased by 3.2% from March 31, 2018. Off-net customer connections increased by 12.3% from June 30, 2017 to 10,480 as of June 30, 2018 and increased by 2.3% from March 31, 2018. The number of on-net buildings increased by 161 on-net buildings from June 30, 2017 to 2,599 on-net buildings as of June 30, 2018 and increased by 58 on-net buildings from March 31, 2018.

Cogent classifies all of their customers into two types: NetCentric customers and Corporate customers.

- NetCentric customers buy large amounts of bandwidth from us and carrier neutral data centers and our Corporate customers buy bandwidth from us in large multi-tenant office buildings. Revenue in customer connections by customer type. There were 33,520 NetCentric customer connections on our network at quarter-end, which declined from last quarter due to significant circuit grooming, consolidating multiple 10 gig circuits to fewer 100 gig circuits at the same location from some of our larger NetCentric customers.

- Corporate customer revenue grew sequentially by 2.7% to $83.3 million and grew year-over-year by 11.9%. We had 42,673 Corporate customer connections on our network at quarter-end. Quarterly revenue from our NetCentric customers declined sequentially by 3.4% and grew year-over-year by 1.4%.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

CEO Dave Schaeffer’s Earnings Call Remarks:

The size and scale of our network continues to grow. We have over 927 million square feet of multi-tenant office space on-net in North America. Our network consists of over 31,900 metro fiber miles and over 57,400 intercity route miles of fiber.

Cogent remains the most interconnected network in world, where we are directly connected with over 6,360 networks. Less than 30 of these networks are settlement-free peers. The remaining over 6,330 networks are paying Cogent transit customers.

We are currently utilizing 27% of the lit capacity in our network. We routinely augment capacity in sections of our network to maintain these low utilization rates. For the quarter, we achieved sequential quarterly traffic growth of 10% in what is traditionally a slow seasonal period for traffic growth and we saw a significant improvement in our year-over-year quarterly traffic growth to over 44%.

We operate 52 Cogent-controlled data centers with 587,000 square feet of space and we are operating those facilities at 32% utilization. Our sales force turnover rate in the quarter was 4.8% per month, again better than our long-term average turnover rate of 5.7% per month. And I think a testament to the training and retention programs that we’ve put in place. We ended the quarter with 438 reps selling our services.

Cogent remains the low cost provider of internet access and transit services. Our value proposition to our customers remains unparalleled in the industry. Our business remains entirely focused on the Internet and IP connectivity and data colocation services. Our services provide a necessary utility to our customers. Beginning at the start of Q2 and April 1st, we began selling our SD-WAN services. We do not expect a material contribution from these services for the next several quarters.

We expect our annualized constant currency long-term revenue growth to be consistent with our annualized guidance of 10% to 20%, and our long-term EBITDA margin expansion rates to remain approximately 200 basis points per year for the next several years.

We expect to grow the sales force at between 7% and 10% per year for the next several years, while we expect operational head count growth to be slower at probably 2% to 3%. So the mix will increasingly become more sales-centric. Because of the efficiencies in running our business and the standardization of our products and the systems that we’ve deployed, we can sustain 44% traffic growth, 20% growth in unit number of connections and do that with a increase in operational and overhead employees of only about 2% to 3% per year. The sales force, however, is the engine that will drive accelerating revenue growth. And investing in that sales force has been and continues to be our major focus.

Analysis:

Cogent is trying to provide the most bandwidth at the lowest possible price, which means it’s in a race to run its network at the lowest possible cost, which means it’s in a race to take every advantage of new optical networking and routing technologies, as soon as they’re available.

“We divide the network into four big technology regions — edge routing, core routing, metro transport and long-haul transport,” Schaeffer told Light Reading. “In all of those functional areas we are on our third generation of equipment — we’ve done two complete forklift upgrades in 19 years — and, you know, I’m sure we’ll go to a fourth generation soon,” he added.

Webcast Replays:

The KeyBanc Capital Markets 20th Annual Global Technology Leadership Forum was held at the Sonnenalp in Vail, CO. Dave Schaeffer will be presenting on Monday, August 13th at 10:00 a.m. MT. Investors and other interested parties may access the live webcast of the presentation by visiting the webcast page.

The Oppenheimer 21st Annual Technology, Internet & Communications Conference was held at the Four Seasons Hotel in Boston, MA. Dave Schaeffer will be presenting on Wednesday, August 8th at 1:05 p.m. ET. Investors and other interested parties may access the live webcast of the presentation by visiting the webcast page.

The Cowen 4th Annual Communications Infrastructure Summit was held at the St. Julien Hotel and Spa in Boulder, CO. Dave Schaeffer will be presenting on Tuesday, August 7th at 3:30 p.m. MT. Investors and other interested parties may access the live webcast of the presentation by visiting the webcast page.